form 37b can be filled in without difficulty. Simply try FormsPal PDF editor to perform the job in a timely fashion. To retain our editor on the leading edge of convenience, we strive to put into operation user-oriented capabilities and improvements regularly. We are routinely looking for feedback - play a vital role in remolding PDF editing. With some simple steps, you may start your PDF journey:

Step 1: Firstly, access the tool by clicking the "Get Form Button" at the top of this site.

Step 2: With this handy PDF file editor, you'll be able to do more than just fill out blanks. Try each of the features and make your docs appear high-quality with customized text put in, or modify the file's original content to excellence - all that accompanied by an ability to incorporate any type of photos and sign the file off.

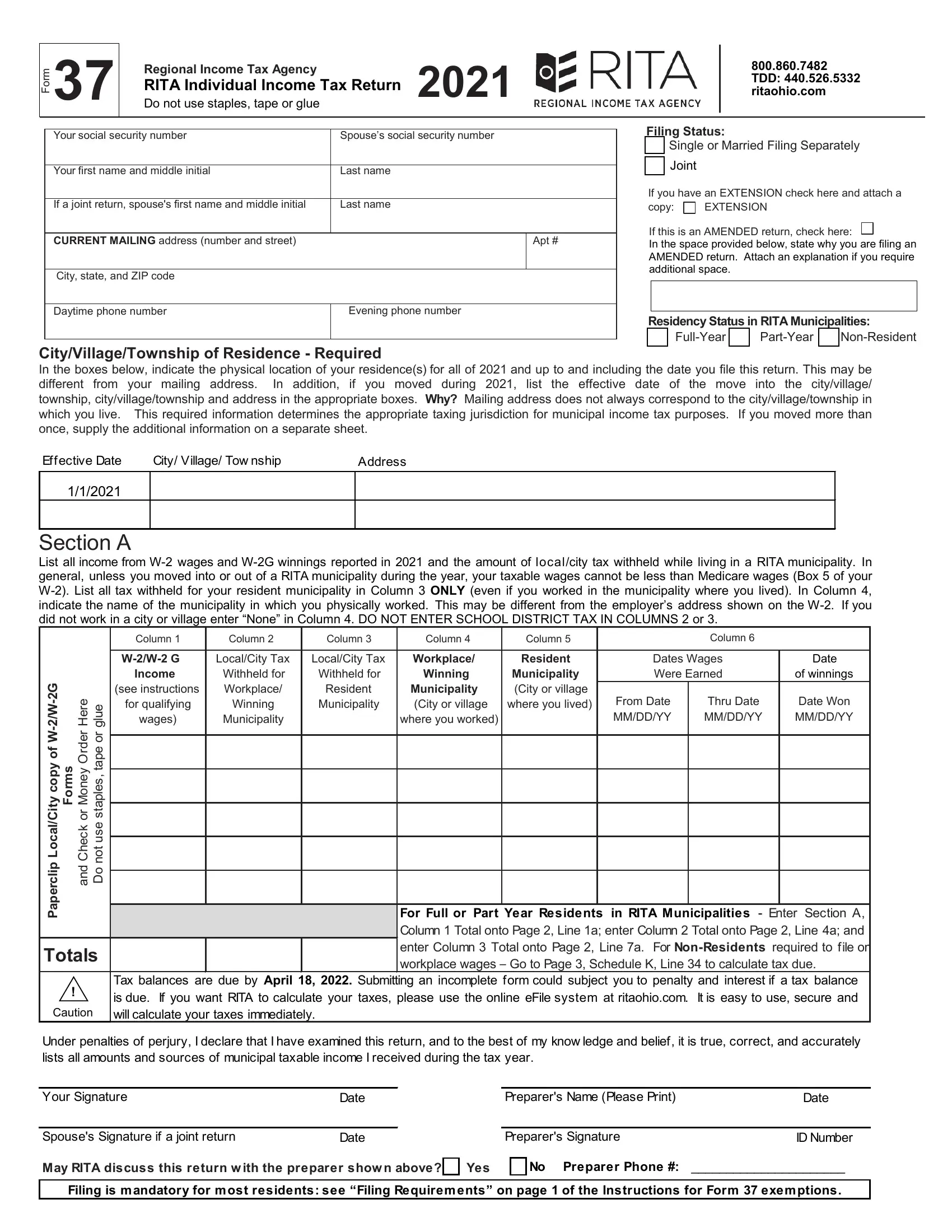

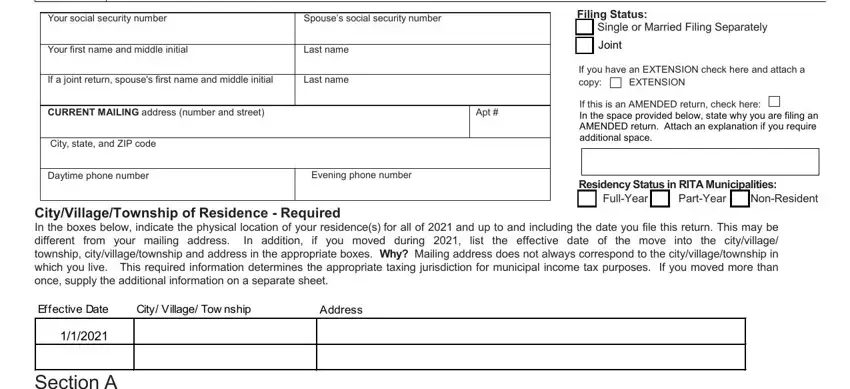

This PDF will require specific details to be entered, so make sure to take whatever time to fill in exactly what is requested:

1. When submitting the form 37b, make sure to include all of the important blank fields in the relevant part. It will help hasten the process, allowing your details to be handled fast and correctly.

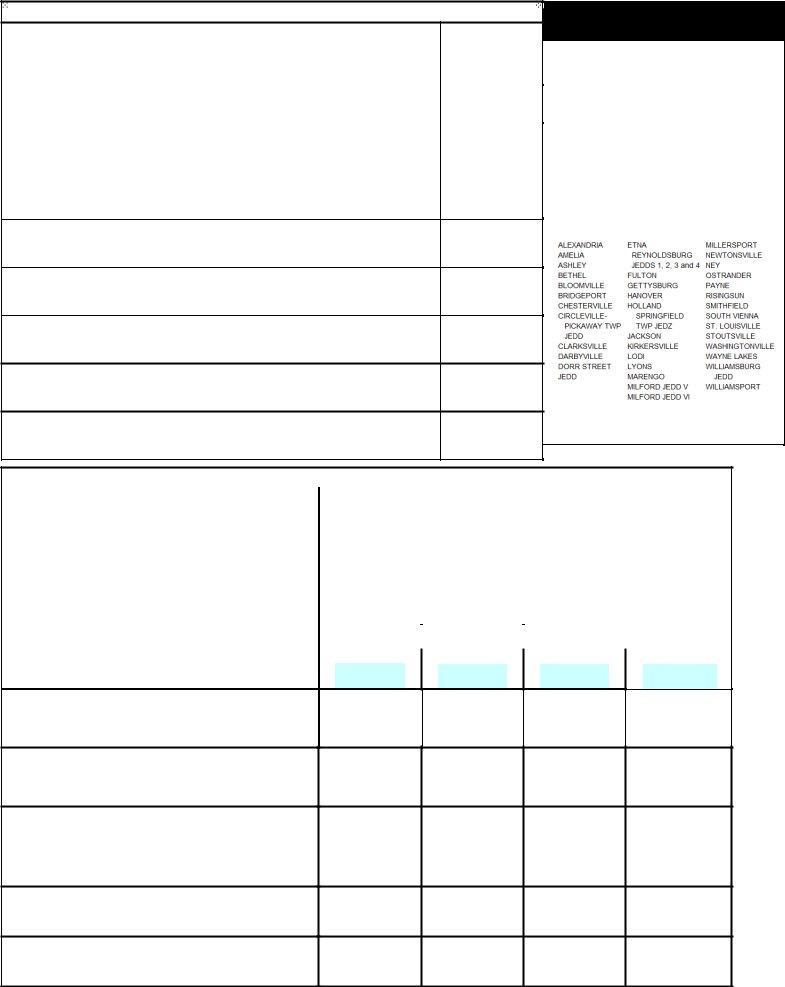

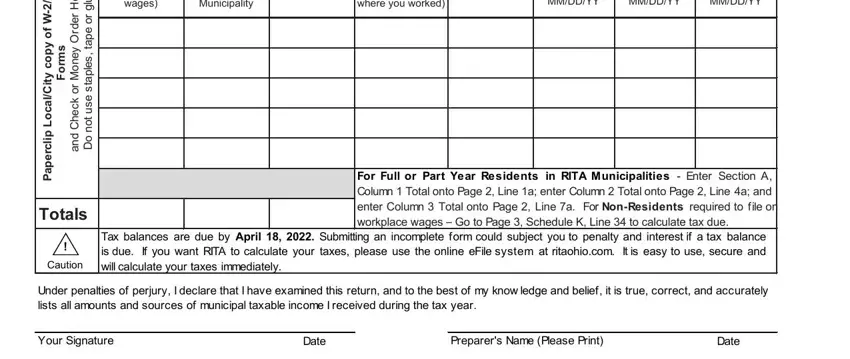

2. Now that the previous array of fields is done, you have to insert the necessary particulars in wages, Municipality, where you worked, From Date MMDDYY, Thru Date MMDDYY, Date Won MMDDYY, For Full or Part Year Residents in, Tax balances are due by April, e r e H, r e d r, O y e n o M, r o, k c e h C d n a, G W W, and f o y p o c y t i in order to progress further.

Always be extremely attentive when filling out For Full or Part Year Residents in and Date Won MMDDYY, because this is the section where most people make some mistakes.

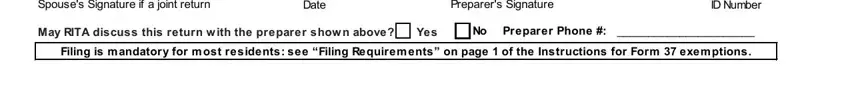

3. The following step is considered fairly straightforward, Spouses Signature if a joint return, Date, Preparers Signature, ID Number, May RITA discuss this return w ith, No Preparer Phone, and Filing is m andatory for m ost - these blanks has to be filled out here.

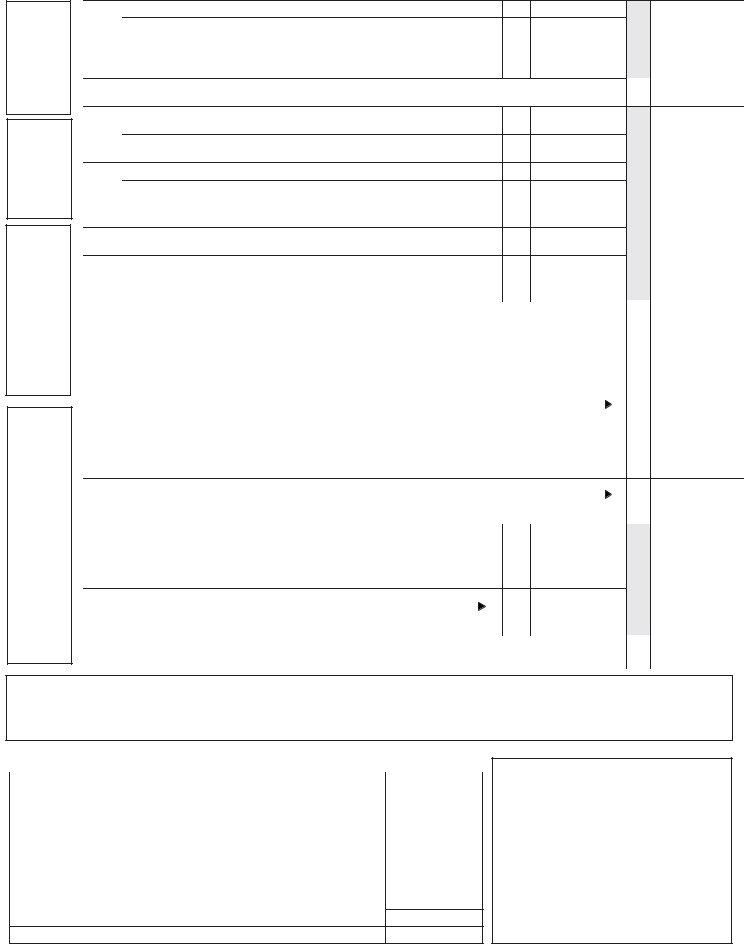

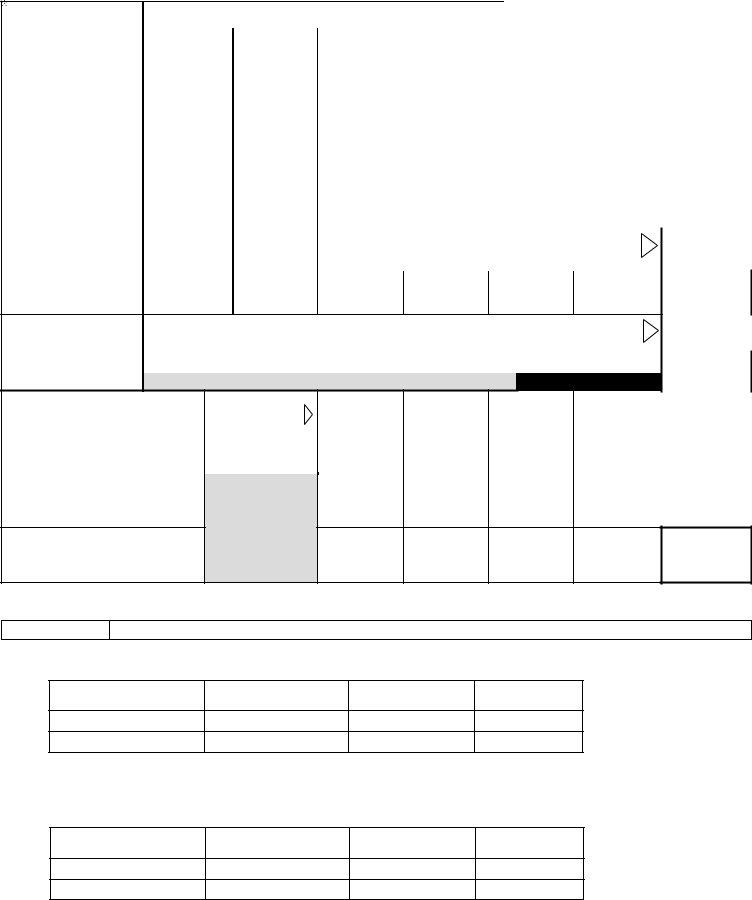

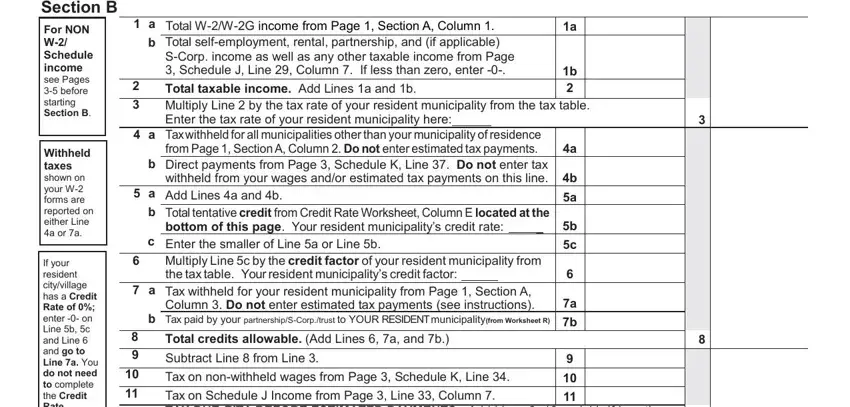

4. To go onward, the next stage requires filling out a few blanks. These comprise of Form Section B, For NON W Schedule income see, Withheld taxes shown on your W, If your resident cityvillage has a, a b, Total WWG income from Page, Subtract Line from Line Tax on, and Tax on Schedule J Income from Page, which you'll find key to going forward with this PDF.

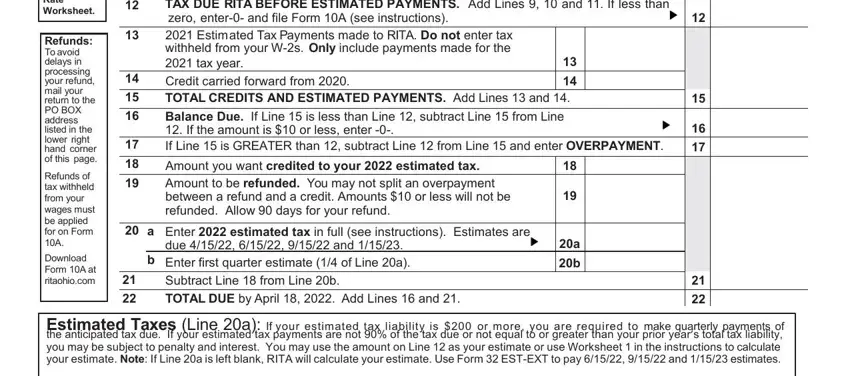

5. The very last notch to finish this form is integral. You must fill in the displayed blanks, consisting of If your resident cityvillage has a, Refunds To avoid delays in, Refunds of tax withheld from your, Download Form A at ritaohiocom, Tax on Schedule J Income from Page, a Enter estimated tax in full, due and b Enter first quarter, Subtract Line from Line b TOTAL, and Estimated Taxes Line a If your, prior to using the pdf. Neglecting to do so could lead to an incomplete and probably nonvalid form!

Step 3: Reread all the details you have typed into the blanks and then press the "Done" button. Sign up with us right now and immediately get access to form 37b, all set for downloading. Each modification you make is handily saved , letting you edit the pdf at a later point anytime. At FormsPal, we aim to make sure that all your information is kept protected.