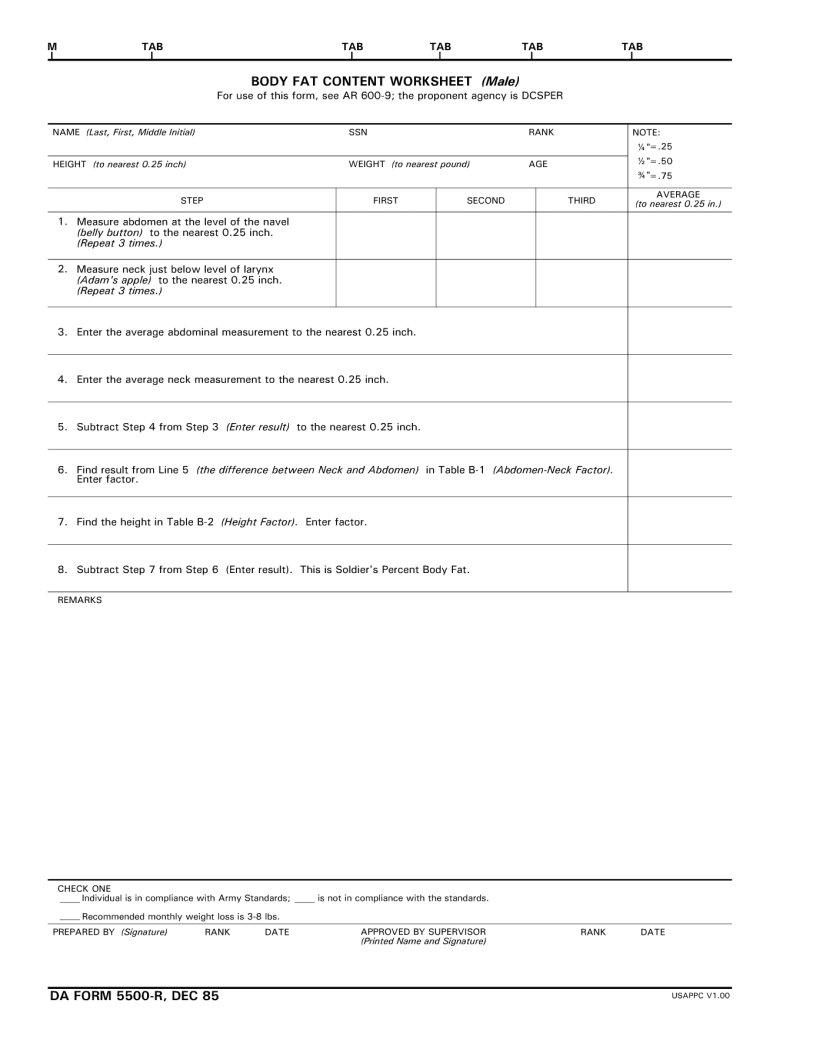

In the 5500 R Worksheet Form, you will report whether or not your retirement plan is a qualified retirement plan. This form is used by the IRS to determine whether or not a particular retirement plan is a qualified retirement plan. If it is not, then certain excise taxes may be assessed. The 5500 R Worksheet Form must be filed annually by all sponsor of qualified plans. The 5500 R Worksheet Form can be confusing for some taxpayers, so make sure to seek help if you are unsure how to complete it. You can find help online or through an accountant or tax specialist. Remember, it is important to file this form accurately and on time in order to avoid any penalties from the IRS.

| Question | Answer |

|---|---|

| Form Name | 5500 R Worksheet Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | da 5500 r form, how to 5500 r form, da form 5500 r, body fat content worksheet |