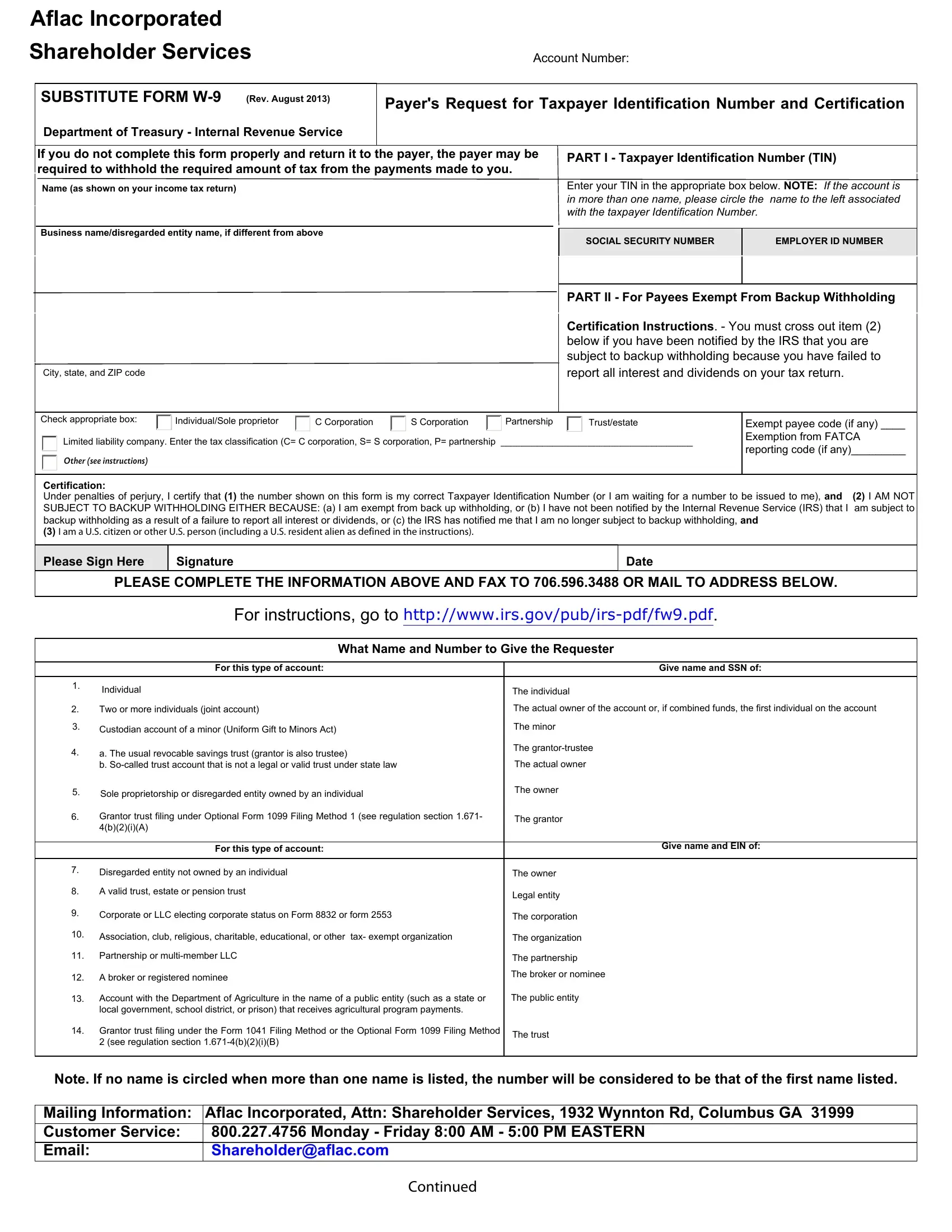

Aflac Incorporated

Shareholder Services

SUBSTITUTE FORM W-9 (Rev. August 2013)

Department of Treasury - Internal Revenue Service

Account Number:

Payer's Request for Taxpayer Identification Number and Certification

If you do not complete this form properly and return it to the payer, the payer may be required to withhold the required amount of tax from the payments made to you.

Name (as shown on your income tax return)

Business name/disregarded entity name, if different from above

PART I - Taxpayer Identification Number (TIN)

Enter your TIN in the appropriate box below. NOTE: If the account is in more than one name, please circle the name to the left associated with the taxpayer Identification Number.

SOCIAL SECURITY NUMBER |

EMPLOYER ID NUMBER |

|

|

City, state, and ZIP code

PART II - For Payees Exempt From Backup Withholding

Certification Instructions. - You must cross out item (2) below if you have been notified by the IRS that you are subject to backup withholding because you have failed to report all interest and dividends on your tax return.

Check appropriate box: |

|

Individual/Sole proprietor |

|

C Corporation |

|

S Corporation |

|

Partnership |

|

Trust/estate |

|

Limited liability company. Enter the tax classification (C= C corporation, S= S corporation, P= partnership |

_____________________________________ |

|

|

OTHER (SEE INSTRUCTIONS) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exempt payee code (if any) ____

Exemption from FATCA reporting code (if any)_________

Certification:

Under penalties of perjury, I certify that (1) the number shown on this form is my correct Taxpayer Identification Number (or I am waiting for a number to be issued to me), and (2) I AM NOT SUBJECT TO BACKUP WITHHOLDING EITHER BECAUSE: (a) I am exempt from back up withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and

(3)I am a U.S. citizen or other U.S. person (including a U.S. resident alien as defined in the instructions).

Please Sign Here |

Signature |

|

|

PLEASE COMPLETE THE INFORMATION ABOVE AND FAX TO 706.596.3488 OR MAIL TO ADDRESS BELOW.

For instructions, go to http://www.irs.gov/pub/irs-pdf/fw9.pdf.

What Name and Number to Give the Requester

|

For this type of account: |

Give name and SSN of: |

|

|

|

1. |

Individual |

The individual |

|

2. |

Two or more individuals (joint account) |

The actual owner of the account or, if combined funds, the first individual on the account |

3. |

Custodian account of a minor (Uniform Gift to Minors Act) |

The minor |

|

|

4. |

a. The usual revocable savings trust (grantor is also trustee) |

The grantor-trustee |

|

|

b. So-called trust account that is not a legal or valid trust under state law |

The actual owner |

5. |

Sole proprietorship or disregarded entity owned by an individual |

The owner |

|

6. |

Grantor trust filing under Optional Form 1099 Filing Method 1 (see regulation section 1.671- |

The grantor |

|

|

|

4(b)(2)(i)(A) |

|

|

|

|

|

For this type of account: |

Give name and EIN of: |

|

|

|

|

|

7. |

Disregarded entity not owned by an individual |

The owner |

|

8. |

A valid trust, estate or pension trust |

Legal entity |

|

|

9. |

Corporate or LLC electing corporate status on Form 8832 or form 2553 |

The corporation |

10. |

Association, club, religious, charitable, educational, or other tax- exempt organization |

The organization |

11. |

Partnership or multi-member LLC |

The partnership |

12. |

A broker or registered nominee |

The broker or nominee |

|

13. |

Account with the Department of Agriculture in the name of a public entity (such as a state or |

The public entity |

|

local government, school district, or prison) that receives agricultural program payments. |

|

14. |

Grantor trust filing under the Form 1041 Filing Method or the Optional Form 1099 Filing Method |

The trust |

|

2 (see regulation section 1.671-4(b)(2)(i)(B) |

|

|

|

|

Note. If no name is circled when more than one name is listed, the number will be considered to be that of the first name listed.

Mailing Information: Aflac Incorporated, Attn: Shareholder Services, 1932 Wynnton Rd, Columbus GA 31999

Customer Service: 800.227.4756 Monday - Friday 8:00 AM - 5:00 PM EASTERN

Email:Shareholder@aflac.com

Continued

EXEMPTION CODES

If you are exempt from backup withholding and/or FATCA reporting, enter in the Exemtions box, any code(s) that may apply to you. See Exempt payee code and Exemption from FATCA reporting codes below.

Exempt payee code. Generally, individuals (including sole proprietors) are not exempt from backup withholding. Corporations are exempt from backup withholding for certain payments, such as interest and dividends. Corporations are not exempt from backup withholding for payments made in settlement of payment card or third party network transactions.

Note. If you are exempt from backup withholding, you should still complete this form to avoid possible erroneous backup withholding.

The following codes identify payees that are exempt from backup withholding:

1 --An organization exempt from tax under section 501(a), any IRA, or a custodial account under section 403(b)(7) if the account satisfies the requirements of section 401(f)(2)

2 --The United States or any of its agencies or instrumentalities

3 --A state, the District of Columbia, a possession of the United States, or any of their political subdivisions or instrumentalities 4 --A foreign government or any of its political subdivisions, agencies, or instrumentalities

5 --A corporation

6 --A dealer in securities or commodities required to register in the United States, the District of Columbia, or a possession of the United States 7 --A futures commission merchant registered with the Commodity Futures Trading Commission

8 --A real estate investment trust

9 --An entity registered at all times during the tax year under the Investment Company Act of 1940 10 --A common trust fund operated by a bank under section 584(a)

11 --A financial institution

12 --A middleman known in the investment community as a nominee or custodian 13 --A trust exempt from tax under section 664 or described in section 4947

Exemption from FATCA reporting code. The following codes identify payees that are exempt from reporting under FATCA. These codes apply to persons submitting this form for accounts maintained outside of the United States by certain foreign financial institutions. Therefore, if you are only submitting this form for an account you hold in the United States, you may leave this field blank. Consult with the person requesting this form if you are uncertain if the financial institution is subject to these requirements.

A --An organization exempt from tax under section 501(a) or any individual retirement plan as defined in section 7701(a)(37) B --The United States or any of its agencies or instrumentalities

C --A state, the District of Columbia, a possession of the United States, or any of their political subdivisions or instrumentalities

D --A corporation the stock of which is regularly traded on one or more established securities markets, as described in Reg. section 1.1472-1(c)(1)(i) E --A corporation that is a member of the same expanded affiliated group as a corporation described in Reg. section 1.1472-1(c)(1)(i)

F --A dealer in securities, commodities, or derivative financial instruments (including notional principal contracts, futures, forwards, and options) that is registered as such under the laws of the United States or any state

G --A real estate investment trust

H --A regulated investment company as defined in section 851 or an entity registered at all times during the tax year under the Investment Company Act of 1940 I --A common trust fund as defined in section 584(a)

J --A bank as defined in section 581

K --A broker

L --A trust exempt from tax under section 664 or described in section 4947(a)(1)

M --A tax exempt trust under a section 403(b) plan or section 457(g) plan