By using the online editor for PDFs by FormsPal, you may fill in or alter CALIFORNIA here. FormsPal is focused on providing you with the perfect experience with our tool by consistently introducing new features and improvements. With these improvements, working with our editor becomes easier than ever! It merely requires several basic steps:

Step 1: First, open the pdf editor by clicking the "Get Form Button" in the top section of this webpage.

Step 2: This editor lets you modify your PDF document in a variety of ways. Change it with customized text, correct original content, and place in a signature - all possible within a few minutes!

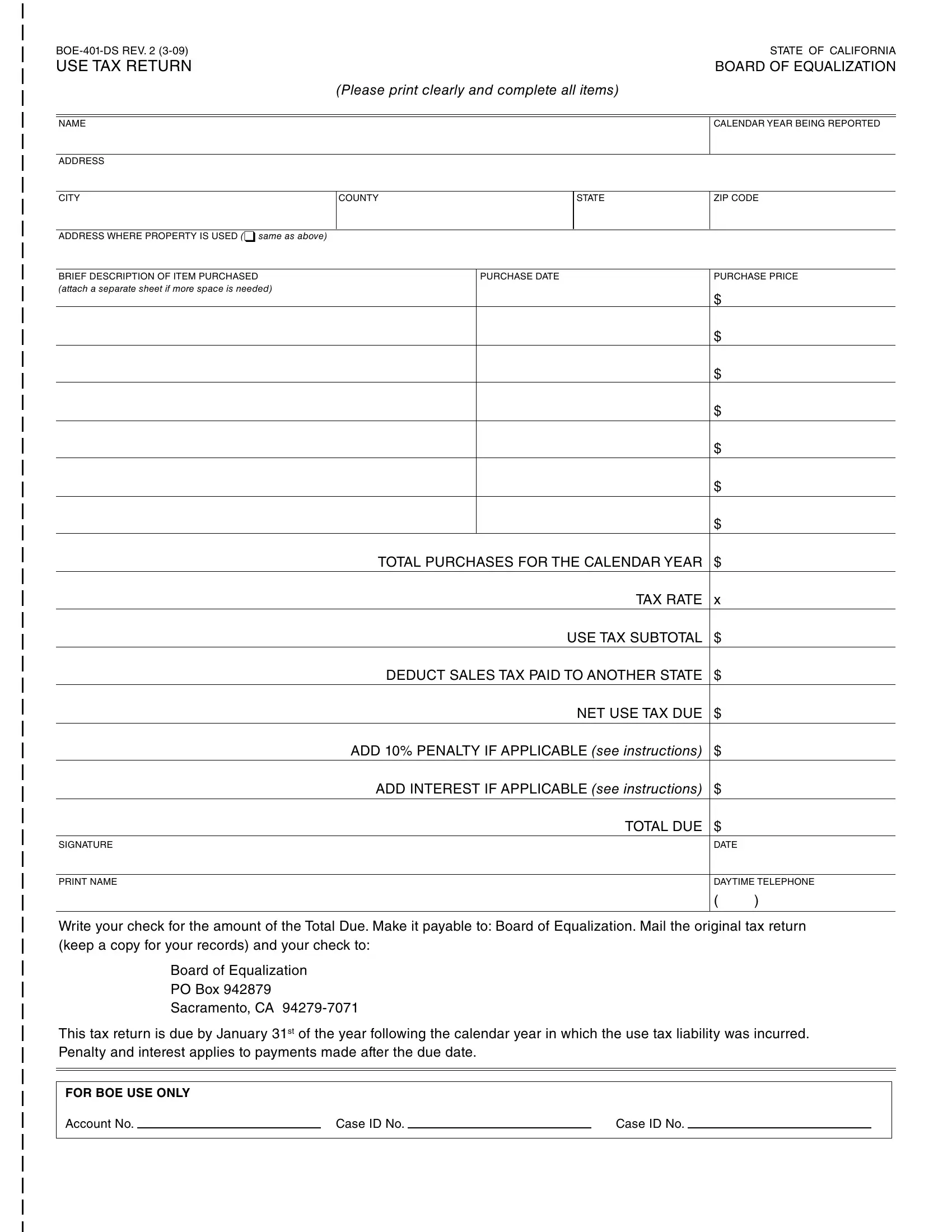

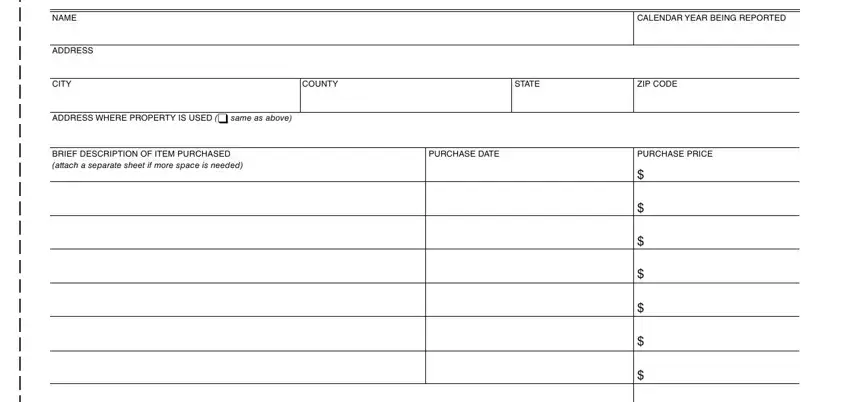

Filling out this document needs thoroughness. Ensure each and every field is filled out accurately.

1. The CALIFORNIA will require specific information to be entered. Be sure that the next fields are finalized:

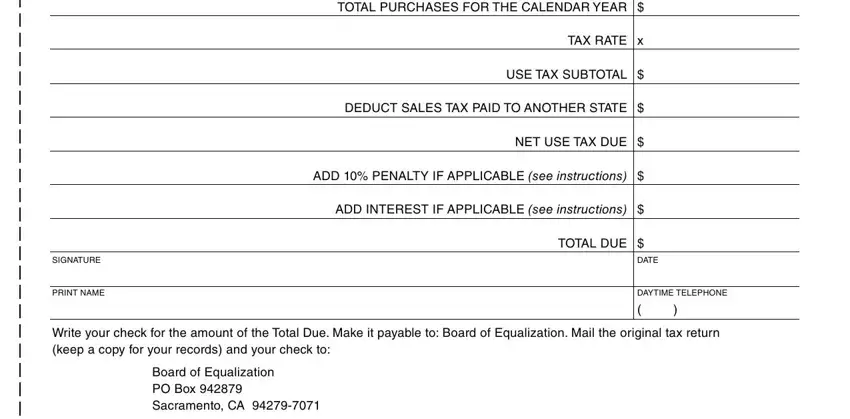

2. The subsequent stage is usually to fill in these blank fields: TOTAL PURCHASES FOR THE CALENDAR, TAX RATE x, USE TAX SUBTOTAL , DEDUCT SALES TAX PAID TO ANOTHER, NET USE TAX DUE , ADD PENALTY IF APPLICABLE see, ADD INTEREST IF APPLICABLE see, SIGNATURE, PRINT NAME, TOTAL DUE , DATE, DAYTIME TELEPHONE, Write your check for the amount of, and Board of Equalization PO Box .

It is possible to get it wrong while filling out the DEDUCT SALES TAX PAID TO ANOTHER, therefore be sure to look again prior to deciding to finalize the form.

3. This next part is focused on How can I tell if I owe use tax, Please note The irst of tangible, How do I report and pay the use, If you have a California sellers, Please note If you sell tangible, regulations forms, and publications from our, website or you may call our, Taxpayer Information, Section to talk to a, Board of Equalization, representative, BOE website and, Board Member contact, and information - complete all these empty form fields.

4. The subsequent subsection will require your input in the subsequent parts: Cigarette and tobacco product, Vehicles vessels and aircraft, efile, BOARD OF EQUALIZATION, BOARD OF EQUALIZATION MEMBERS, RAMON J HIRSIG Executive Director, BETTY T YEE First District San, BILL LEONARD Second District, MICHELLE STEEL Third District, JEROME E HORTON Fourth District, and JOHN CHIANG State Controller. Be sure that you type in all of the requested details to go forward.

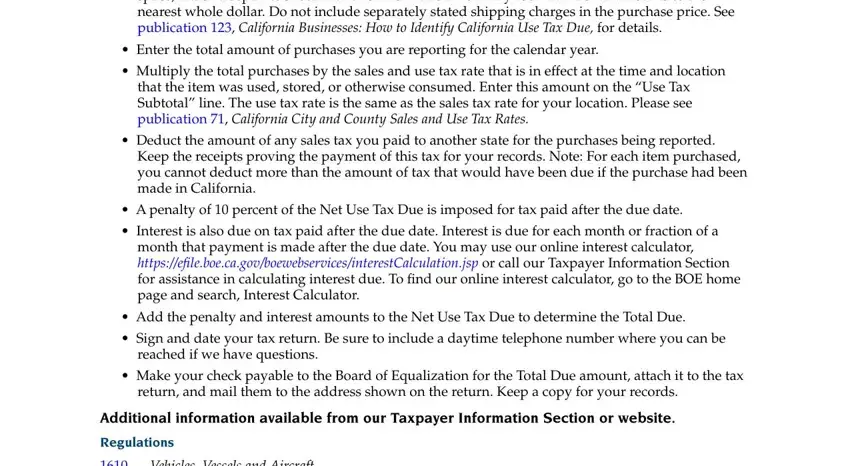

5. The form must be completed by going through this section. Below one can find a comprehensive list of blanks that must be filled out with specific details for your form usage to be accomplished: space attach a separate sheet with, Enter the total amount of, that the item was used stored or, Deduct the amount of any sales, Keep the receipts proving the, A penalty of percent of the Net, month that payment is made after, Add the penalty and interest, reached if we have questions, Make your check payable to the, return and mail them to the, Additional information available, Regulations, and Vehicles Vessels and Aircraft.

Step 3: Prior to moving on, ensure that all blanks are filled in the right way. As soon as you’re satisfied with it, click “Done." Create a free trial subscription at FormsPal and acquire instant access to CALIFORNIA - downloadable, emailable, and editable inside your personal account. At FormsPal.com, we do everything we can to make sure all your details are kept private.