If you are a California taxpayer, you may be eligible for the state's Earned Income Tax Credit (EITC). The EITC is a refundable tax credit that can reduce your tax liability and provide a financial boost to working families. The credit is available to taxpayers with low to moderate incomes, and it can be worth up to $2,719 per year. To claim the credit, you must file Form 51 055A with your tax return. You can find more information about the EITC on the California Franchise Tax Board's website.

| Question | Answer |

|---|---|

| Form Name | California Form 51 055A |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names |

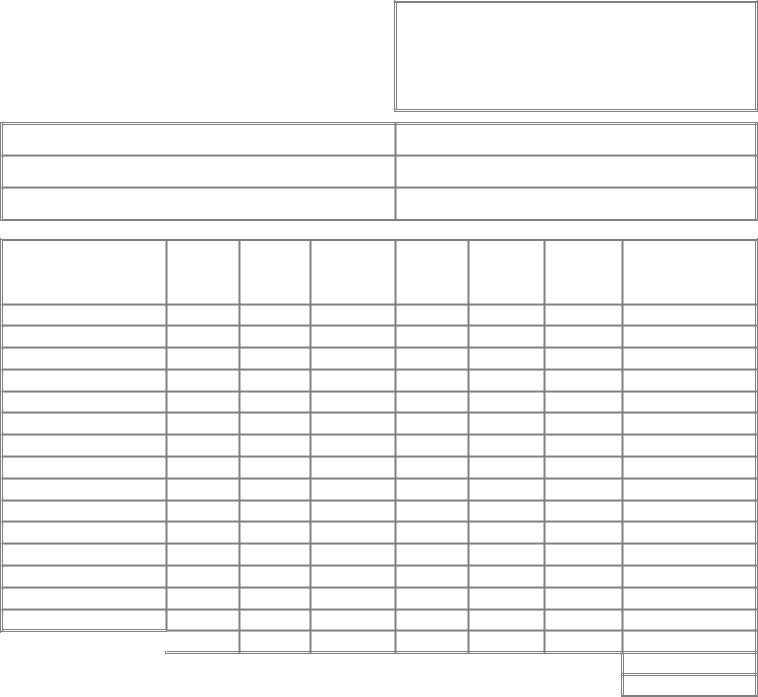

CONFIDENTIAL

STATE OF CALIFORNIA

DEPARTMENT OF FOOD AND AGRICULTURE

Fruit and Vegetable Shipper Monthly Remittance Report/Registration

41101

SEND MONTHLY REMITTANCE

[PAYABLE TO CASHIER] AND THIS FORM TO:

Cashier

Department of Food and Agriculture

1220 N Street, P.O. Box 942872

Sacramento, CA

COMPANY NAME

P.O. BOX/STREET ADDRESS

CITY, STATE, AND ZIP CODE

REGISTRATION NUMBER

AREA CODE AND TELEPHONE NUMBER

DUE DATE: Submit on the last day of the reporting Month

(See # 7 on the reverse side of this form for penalty information)

Check this box if any of the above information has changed

(1)

Commodity

(2) |

(3) |

(4)* |

# of Containers |

# of Containers |

# of Containers |

Shipped |

Shipped |

Valencia Oranges |

(@ $0.001) |

(@ $0.003) |

Shipped |

|

|

(@ $0.0045) |

(5)** |

(6)*** |

# of Containers |

# of Containers |

Navel Oranges |

Lemons |

Shipped |

Shipped |

(@ $0.009) |

(@ $0.004) |

(7)****

#of Containers Mandarin Citrus

Shipped

(@ $0.0045)

(8)

Assessment

Amount

SUBTOTAL

NOTE: If there are no shipments to report, this form must be submitted |

PENALTY |

indicating "No Shipments Made" or "Nothing to Report" |

TOTAL |

|

Last report for the season. Will begin reporting again in ______________________