If you're a business owner in Connecticut, you're required to file Form Ct 6 1 with the Department of Revenue Services (DRS) by April 15th each year. This form is used to report taxable income and identify any tax credits or deductions that may be claimed. Failing to submit this form on time can result in penalties and interest charges, so it's important to make sure you understand what's required and submit your return on time. For more information, please contact the DRS directly. Thank you for your attention to this matter.

| Question | Answer |

|---|---|

| Form Name | Form Ct 6 1 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | ct 6 1 termination election s corporation, pdf of ct 6 1, ct 6 termination s corporation form, nys ct 6 |

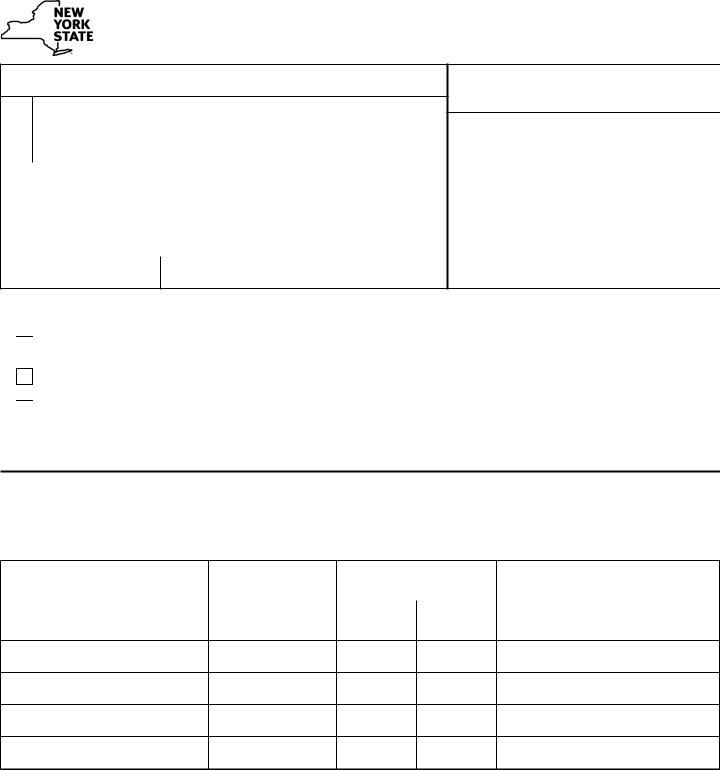

Department of Taxation and Finance |

|

Termination of Election to be Treated |

|

As a New York S Corporation |

(12/19) |

|

Employer identification number

Legal name of corporation

address |

|

|

|

|

DBA or trade name (if any) |

|

|

|

|

|

|

Mailing |

Mailing name (if different from legal name) |

|

|

c/o |

|

|

|

|

|

|

|

|

Number and street or PO box |

|

|

|

|

|

|

|

City |

State |

ZIP code |

|

|

|

|

Business telephone number |

Effective date of termination (see instructions) |

|

|

( )

For office use only

Date received

The corporation is terminating its election to be treated as a New York S corporation under New York State Tax Law, Article 22, section 660(c) for the following reason (mark an X in the appropriate box):

1 Termination of federal S election

2 Revocation of election by shareholders owning more than 50% of the shares of stock of the corporation

3 New shareholder refusal

If you marked box 2, all revoking shareholders must complete the Shareholder individual affirmation. If you marked box 3, only the new shareholder must complete the Shareholder individual affirmation.

Shareholder individual affirmation - By signing below, the shareholder(s) of the above corporation revokes the election to be treated as an S corporation or, in the case of a new shareholder, refuses to consent to the election to be treated as an S corporation under Tax Law, Article 22, section 660(c). The shareholder(s) also certifies that the personal information given below is to the best of the shareholder’s knowledge and belief true, correct, and complete.

See instructions if a continuation sheet or a separate consent statement is needed.

A |

B |

|

C |

D |

|

Name and address |

Social Security |

Stock owned or percentage of |

Shareholder’s signature (see instructions) |

||

of each revoking shareholder |

number or employer |

ownership (see instructions) |

For this termination of election to be valid, all |

||

(include ZIP code) |

identification number |

|

|

revoking shareholders must signify consent by |

|

Number of shares |

Date |

||||

|

|

signing below. |

|||

|

|

or percentage of |

acquired |

|

|

|

|

ownership |

|

|

|

Certification: I certify that this termination of election and any attachments are to the best of my knowledge and belief true, correct, and complete.

|

Printed name of authorized person |

|

Signature of authorized person |

|

|

Official title |

|

||||||

Authorized |

|

|

|

|

|

|

|

|

|

|

|

|

|

person |

Email address of authorized person |

|

|

|

|

Telephone number |

|

|

Date |

|

|||

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

Paid |

Firm’s name (or yours if |

|

|

|

Firm’s |

EIN |

|

|

|

|

Preparer’s PTIN or SSN |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

preparer |

|

|

|

|

|

|

|

|

|

||||

Signature of individual preparing this election |

Address |

|

City |

|

State |

ZIP code |

|||||||

use |

|

|

|

|

|

|

|

|

|

|

|

|

|

only |

|

|

|

|

|

|

|

|

|

|

|||

Email address of individual preparing this election |

|

|

Preparer’s NYTPRIN |

|

or |

Excl. code |

Date |

|

|||||

(see instr.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax form to:

Page 2 of 2 |

Instructions |

||

|

|||

General information |

|

Column C – Enter the number of shares of stock owned and |

|

A corporation that made the election to be treated as a New |

|

the date the shares of stock were acquired by each shareholder |

|

|

listed in column A. An entity without stock, such as a limited |

||

York S corporation on Form |

|

||

|

liability company (LLC), should enter the percentage of |

||

S Corporation to be Treated as a New York S Corporation, |

|

||

|

ownership for each member and date acquired. |

||

must file Form |

|

||

|

|

||

Form |

|

Column D – Each shareholder listed in column A must signify |

|

– the termination of the corporation’s taxation as a New York |

|

consent to the termination or revocation by signing their name |

|

S corporation under Tax Law Article |

|

in column D or by signing their name on a separate consent |

|

– the termination of the shareholder’s election to include his or |

statement, as described in Continuation sheet or separate |

||

consent statement. |

|||

her share of the New York S corporation’s items of income, |

|||

loss, and deductions under the personal income tax law |

|

If a married couple has a community interest in the stock or |

|

(Article 22) or as unrelated business income for Article 13 |

|

the income from it, both spouses must consent. Similarly, each |

|

taxpayers. |

|

tenant in common, joint tenant, or tenant by the entirety must |

|

When termination occurs |

|

also consent. |

|

|

A minor’s consent is made by the minor or the legal guardian. |

||

An election to treat the corporation as a New York S corporation |

|||

If no legal guardian has been appointed, the natural guardian |

|||

will cease to be effective: |

|

||

|

makes the consent (even if a custodian holds the minor’s stock |

||

– on the day the federal election to be treated as an |

|

||

|

under a law patterned after the Uniform Gifts to Minors Act). |

||

S corporation ceases; or |

|

An Article 13 shareholder’s consent is made by an elected |

|

– where shareholders owning more than 50% of the shares of |

|||

officer or other authorized person. |

|||

stock revoke the New York S election, on the date specified |

|||

|

|||

under Revocation of election; or |

|

Signature |

|

– on the day a person who refuses to consent to the New York |

|||

The election must be certified by the president, vice president, |

|||

S corporation treatment becomes a new shareholder. |

|

||

|

treasurer, assistant treasurer, chief accounting officer, or other |

||

|

|

||

Note: When the termination date is other than the first day of a tax |

officer authorized by the taxpayer corporation. |

||

year, the corporation will be considered a New York S corporation |

The election of an association, publicly traded partnership, or |

||

from the first day of the tax year to the day immediately preceding |

|||

business conducted by a trustee or trustees must be signed by |

|||

the termination day and a New York C corporation from the |

|

||

|

a person authorized to act for the association, publicly traded |

||

termination day to the last day of the tax year. |

|

||

|

partnership, or business. |

||

|

|

||

Revocation of election |

|

If an outside individual or firm prepared the election, all |

|

The revocation is effective: |

|

applicable entries in the paid preparer section must be |

|

– on the first day of the tax year, if Form |

completed, including identification numbers (see Paid preparer |

||

identification numbers in Form |

|||

before the fifteenth day of the third month of the tax year; or |

|||

will delay the processing of any refunds and may result in |

|||

– on the first day of the following tax year if Form |

|||

penalties. |

|||

after the fifteenth day of the third month of the tax year; or |

|

|

|

–on the date specified, if Form

Note: In order for the revocation to be valid, the shareholders revoking the New York S election must own more than 50% of the shares of stock in the S corporation on the day the revocation is made.

Specific instructions

Enter the legal name of the corporation exactly as it appears in the records of the New York State Department of State.

Enter the DBA or trade name that appears on the Certificate of Assumed Name filed with the New York State Department of State.

Continuation sheet or separate consent statement – If you need a continuation sheet or use a separate consent statement, attach it to Form

Column A – If this is a revocation, enter the name and address of each shareholder consenting to the revocation who owned shares of stock in the corporation at the time of revocation. If this is a new shareholder refusal, enter the name and address of the new shareholder.

Column B – Enter the Social Security number or employer identification number of each shareholder listed in column A.

How to file

Fax Form

If you are unable to send a fax, mail Form

NYS TAX DEPARTMENT

W A HARRIMAN CAMPUS

ALBANY NY

Private delivery services

See Publication 55, Designated Private Delivery Services.

Need help? and Privacy notification

See Form