Dbpr Form CPA41 is an important form that must be filed with the Division of Banking and Professional Regulation (DBPR) when a change in control or ownership occurs at a licensed professional firm. The form must be filed within 15 days of the change in control or ownership. The information on the form will help DBPR track any changes in ownership or management at licensed firms. Knowing what to expect when filing Dbpr Form CPA41 can help ensure that the process goes smoothly. The Division of Banking and Professional Regulation (DBPR) requires all licensed professional firms to file Dbpr Form CPA41 whenever there is a change in control or ownership. The form must be filed within 15 days of the change taking place

| Question | Answer |

|---|---|

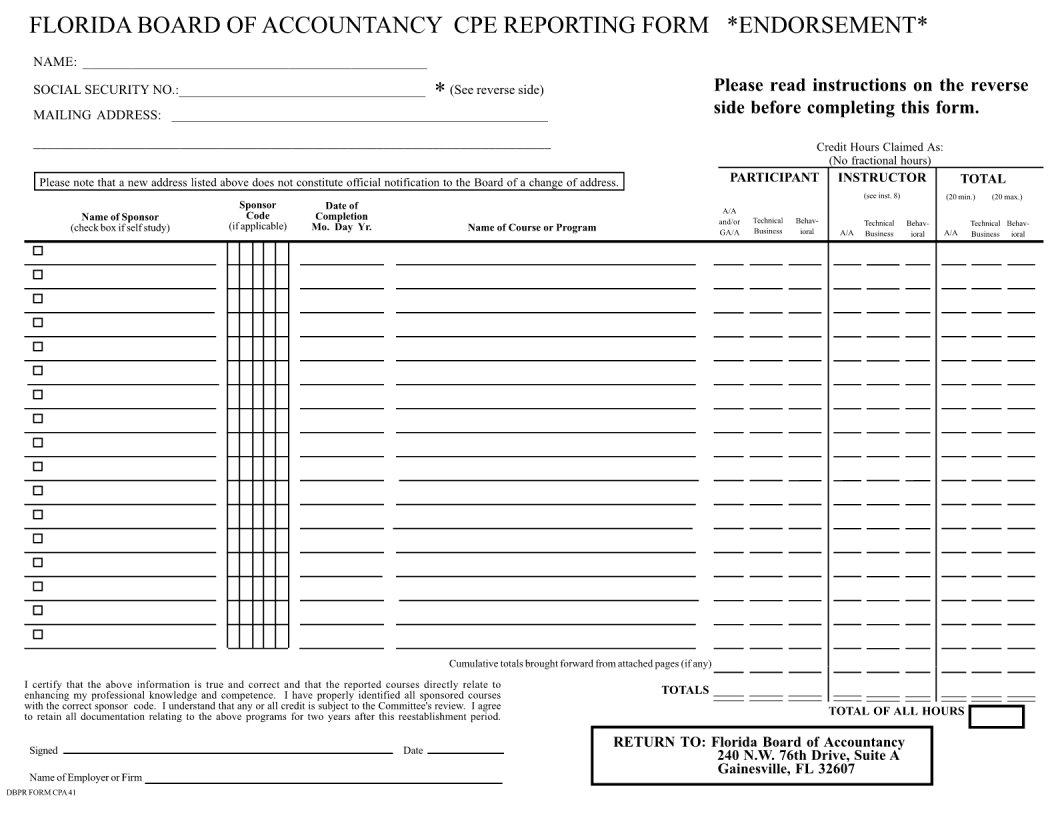

| Form Name | Dbpr Form Cpa41 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | WKH, RU, RI, IRUP |