Form 560 023 E is an information return used to report the federal estate tax liability of estates. This form is used to calculate the value of taxable estate, deduct any allowable credits, and compute the amount of tax owed. The form must be filed by the executor of the estate no later than nine months after the date of death. Penalties may apply for late filing. Form 560 023 E is used to report a taxpayer's federal estate tax liability on an estate. This form is used to calculate the value of taxable estate, deduct any allowable credits, and compute the amount of tax owed. The form must be filed by the executor of an estate no later than nine months after the date of death. Penalties may apply for late filing. Form 560 023 E will help ensure your taxes are filed correctly and on time! As always, consult with a professional if you have any questions about how this form applies to your unique situation. Thanks for reading!

| Question | Answer |

|---|---|

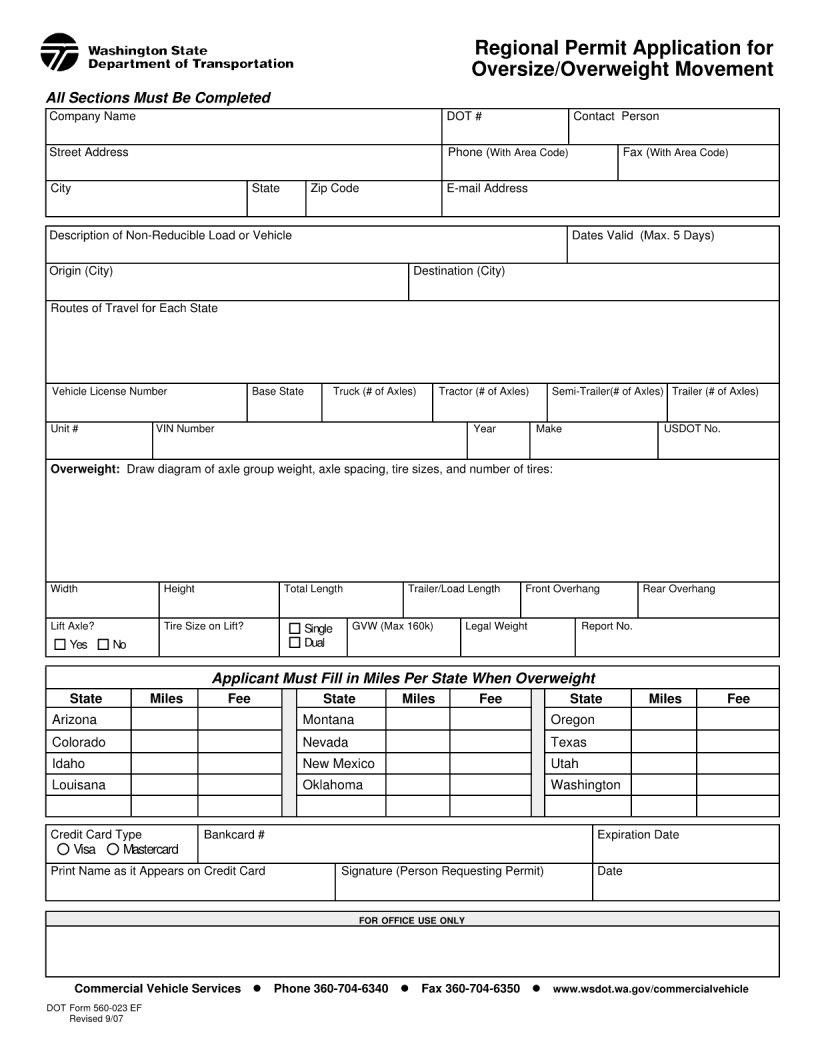

| Form Name | Dot Form 560 023 Ef |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | ago, form, wd, false |