Through the online tool for PDF editing by FormsPal, you are able to complete or modify CT-33-NL right here. To maintain our tool on the forefront of practicality, we aim to adopt user-driven features and improvements on a regular basis. We're always pleased to get feedback - assist us with remolding how we work with PDF forms. Starting is effortless! Everything you should do is follow the following basic steps below:

Step 1: Firstly, access the editor by clicking the "Get Form Button" above on this site.

Step 2: With this handy PDF editing tool, it is possible to do more than merely complete blank form fields. Edit away and make your docs appear high-quality with customized textual content put in, or fine-tune the original content to excellence - all backed up by the capability to insert stunning pictures and sign the PDF off.

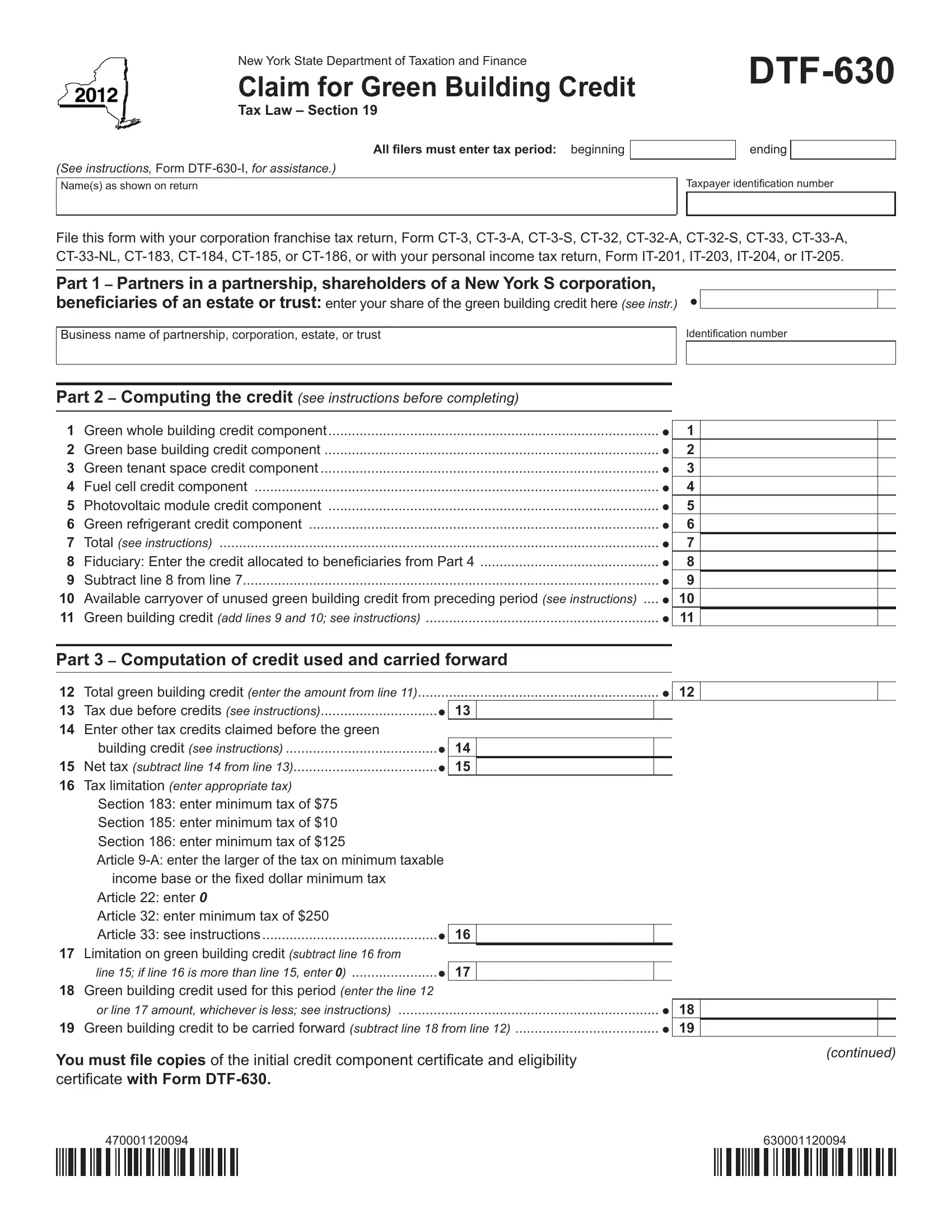

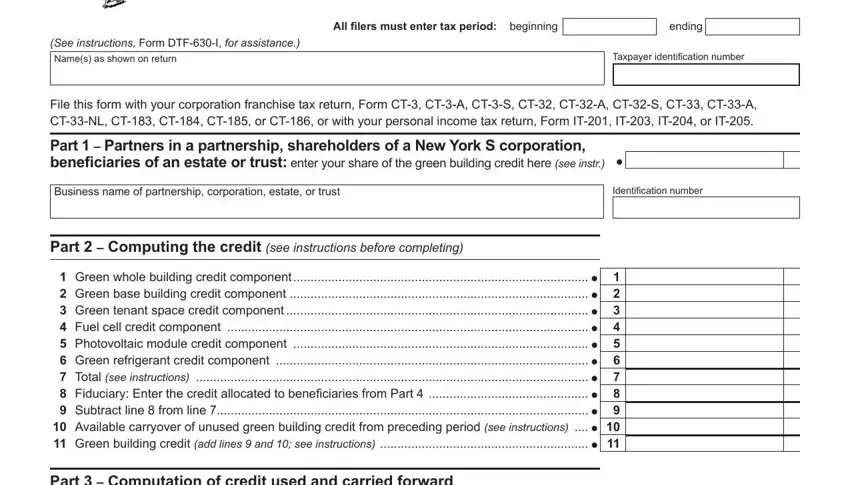

As a way to fill out this form, be sure you provide the information you need in each and every blank:

1. The CT-33-NL involves certain details to be entered. Make certain the following blanks are filled out:

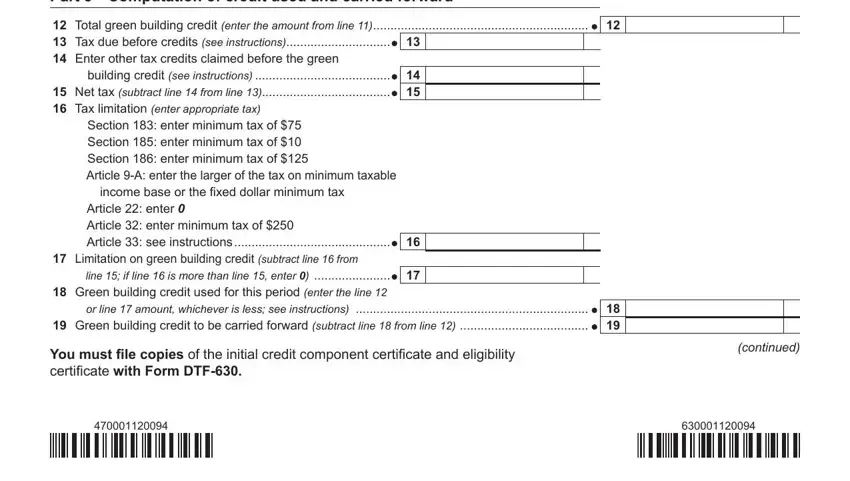

2. Just after finishing the last step, go to the subsequent stage and fill out all required details in these fields - Part Computation of credit used, Total green building credit enter, Section enter minimum tax of, income base or the ixed dollar, line if line is more than line, You must ile copies of the initial, and continued.

3. Completing Total enter the amount from Part, and Fiduciary is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Be really mindful when filling in Fiduciary and Total enter the amount from Part, since this is where a lot of people make errors.

Step 3: Before moving on, make sure that blanks have been filled in properly. When you believe it is all fine, press “Done." Right after creating afree trial account with us, you'll be able to download CT-33-NL or email it promptly. The PDF document will also be readily available through your personal account with all of your modifications. Here at FormsPal.com, we do everything we can to be certain that all your details are kept private.