Deduction Worksheet 106, or DWc form 105, is a tax document used by the Internal Revenue Service to calculate taxable income for individuals and businesses. The form is also used to determine whether a taxpayer is eligible for certain deductions and credits. The IRS released the updated form for the 2018 tax year on January 3, 2019. The updated form includes new lines for the qualified business income deduction and separate limitations for taxpayers filing as heads of households or married couples filing jointly. There are also new lines for the refundable portion of the child tax credit and the American opportunity credit. filers claiming either of these last two credits will need to use Form 8814 to calculate their eligibility. Taxpayers should consult their tax preparer or accountant to ensure they are using the correct form when preparing their taxes this year. Failure to do so could lead to costly mistakes.

| Question | Answer |

|---|---|

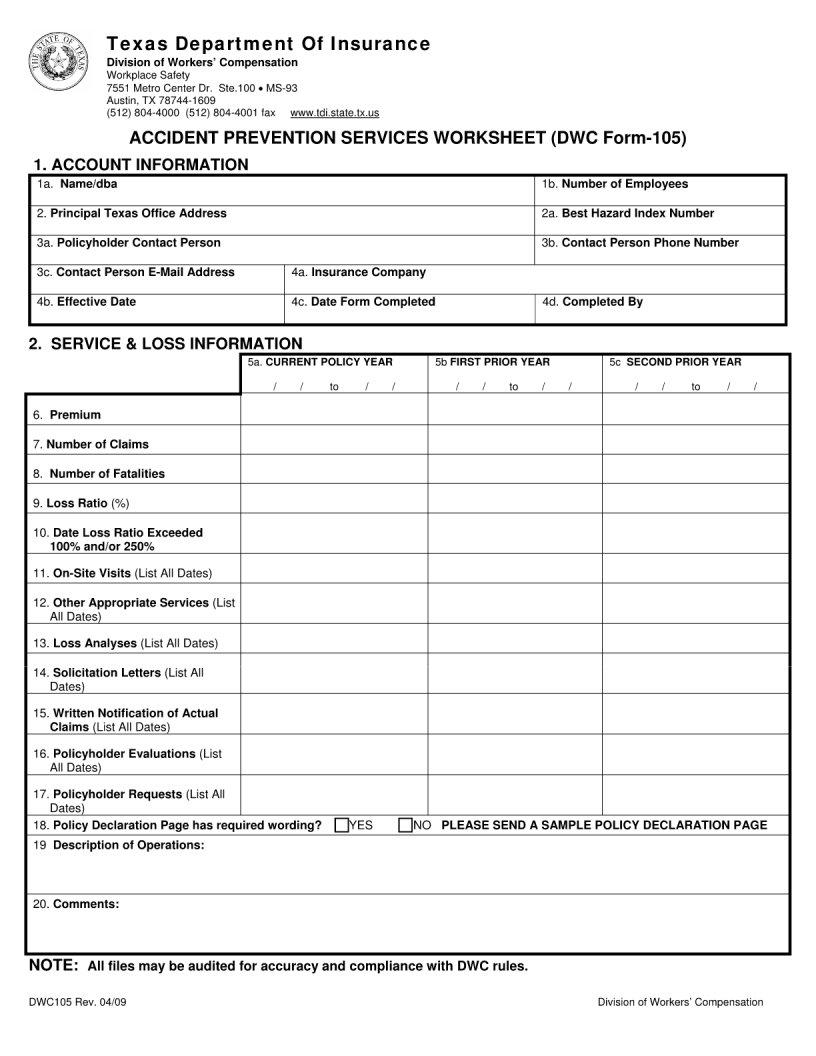

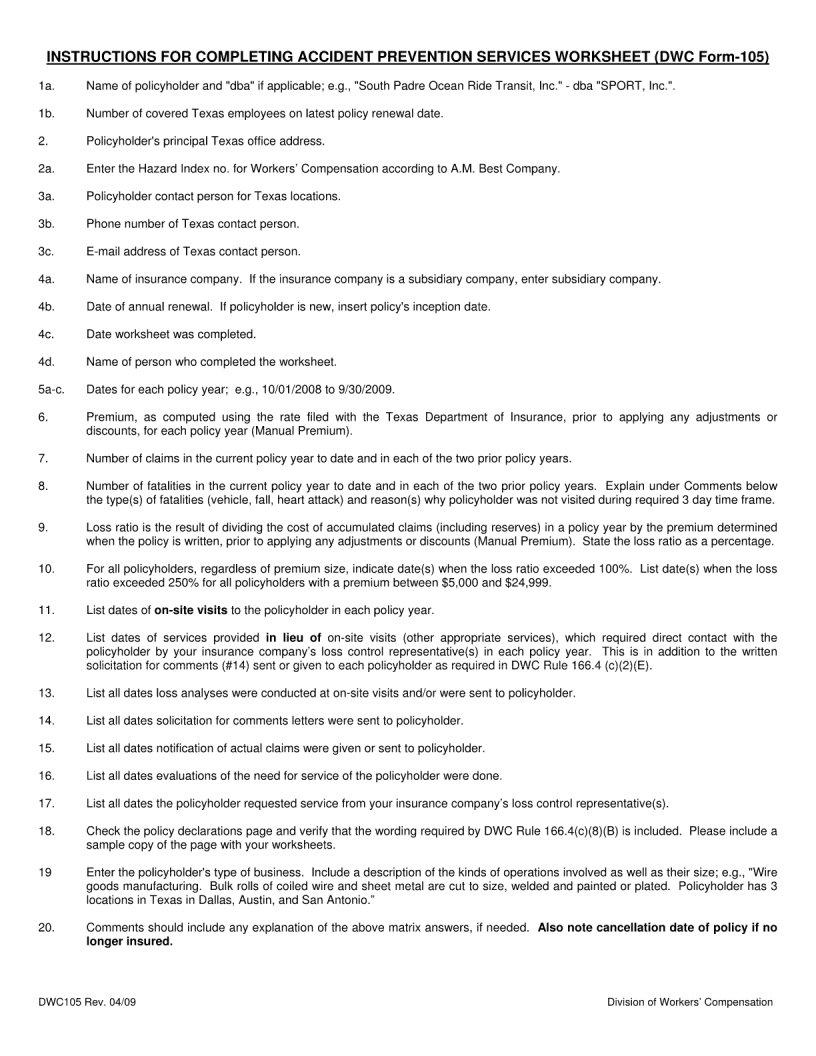

| Form Name | Dwc Form 105 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | dwc105apsw accident prevention worksheets printable form |