Whenever you need to fill out dwc 3, it's not necessary to download and install any sort of programs - just try using our PDF tool. FormsPal is committed to providing you with the perfect experience with our editor by continuously releasing new capabilities and enhancements. With all of these improvements, working with our editor gets easier than ever before! By taking some basic steps, you can begin your PDF journey:

Step 1: Access the PDF in our editor by clicking on the "Get Form Button" at the top of this webpage.

Step 2: The editor will give you the capability to customize your PDF in a variety of ways. Transform it by adding any text, correct original content, and add a signature - all readily available!

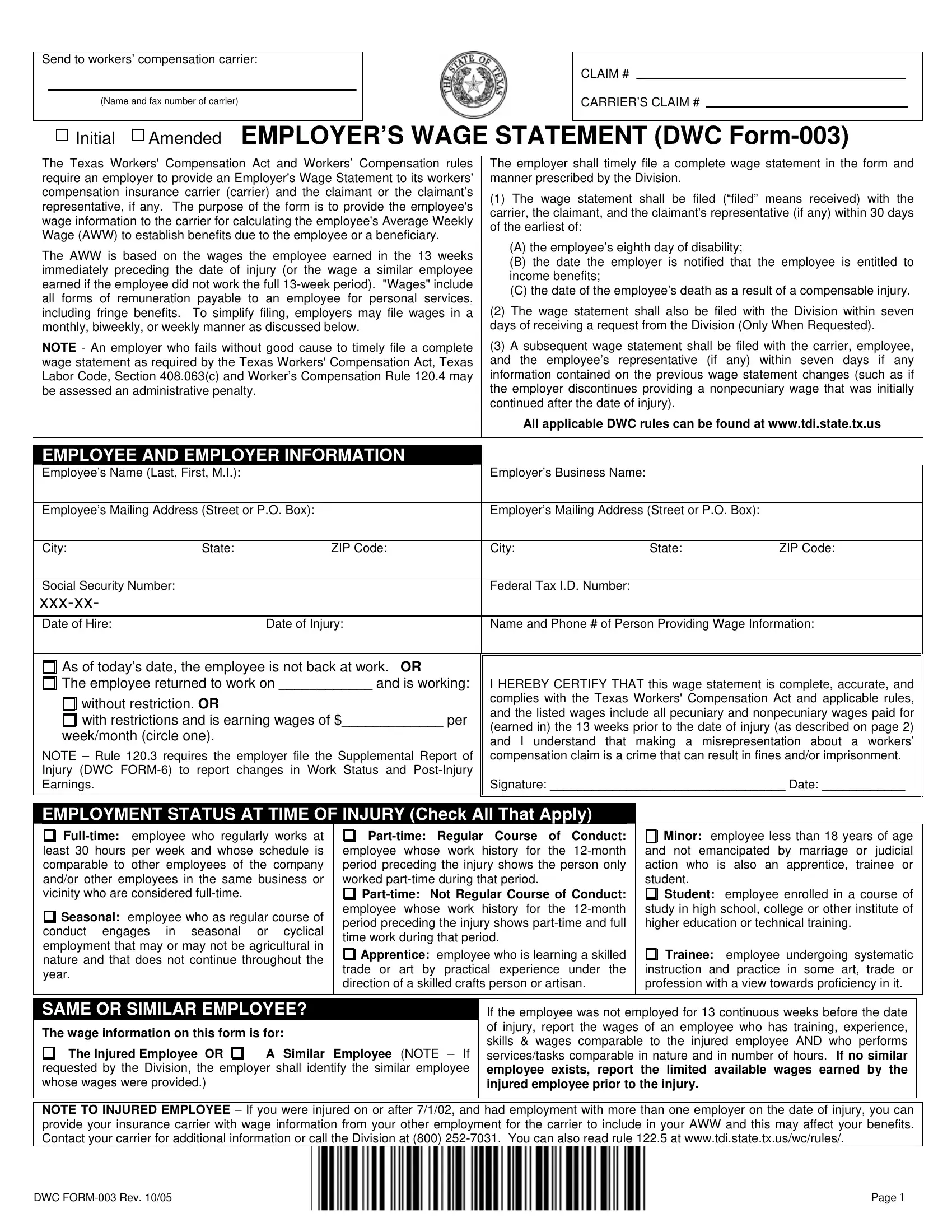

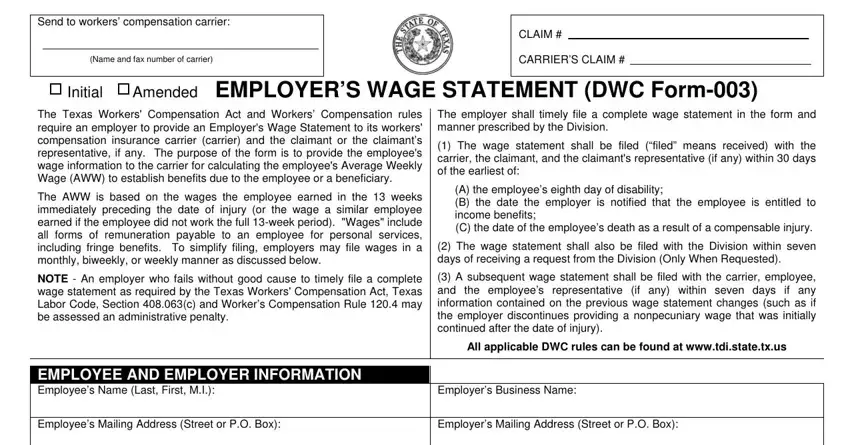

If you want to finalize this PDF form, make certain you provide the information you need in each blank:

1. Start filling out the dwc 3 with a group of major blanks. Get all the required information and ensure not a single thing left out!

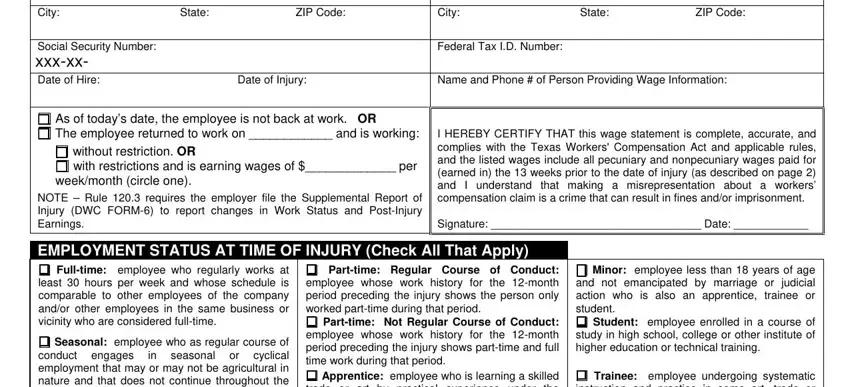

2. Once your current task is complete, take the next step – fill out all of these fields - City State ZIP Code, City State ZIP Code, Social Security Number xxxxx Date, Federal Tax ID Number, Date of Injury, Name and Phone of Person, As of todays date the employee is, without restriction OR with, weekmonth circle one, NOTE Rule requires the employer, I HEREBY CERTIFY THAT this wage, EMPLOYMENT STATUS AT TIME OF, Fulltime employee who regularly, Seasonal employee who as regular, and Parttime Regular Course of Conduct with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

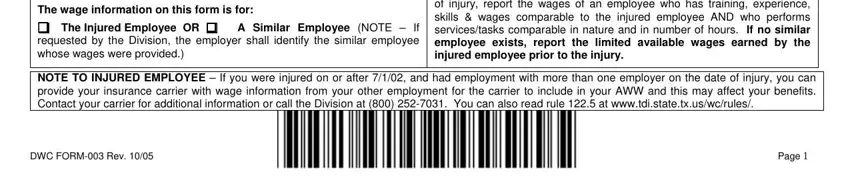

3. Your next part is usually hassle-free - complete all of the fields in The wage information on this form, The Injured Employee OR, A Similar Employee NOTE If, If the employee was not employed, NOTE TO INJURED EMPLOYEE If you, and DWC FORM Rev Page to conclude this part.

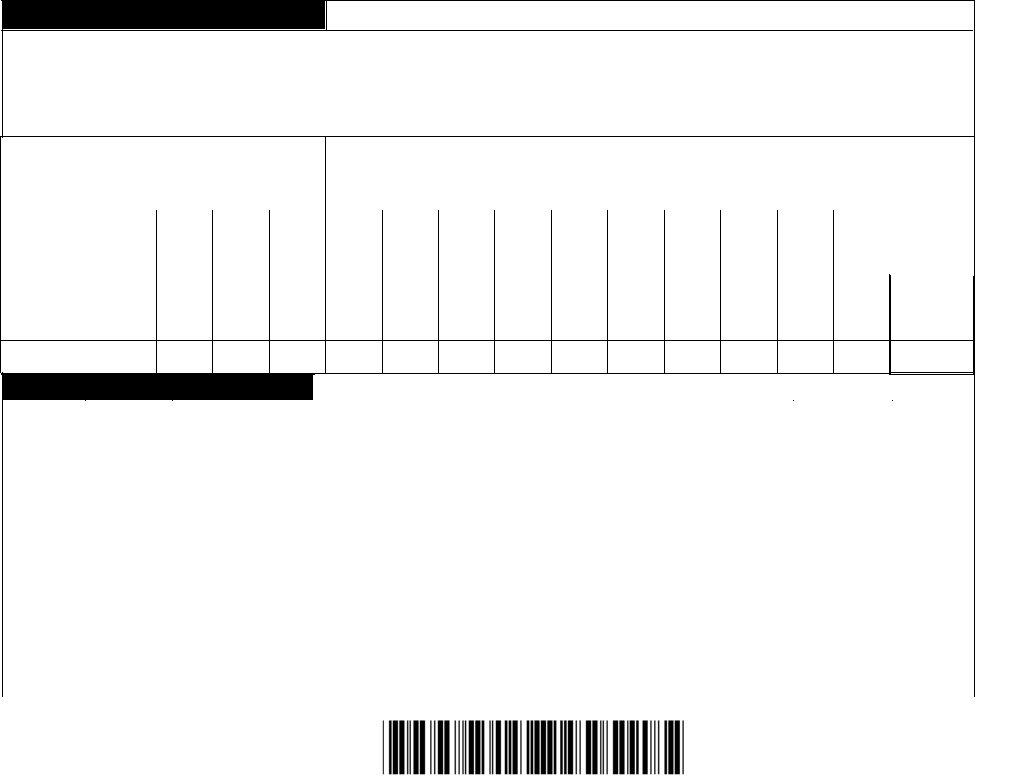

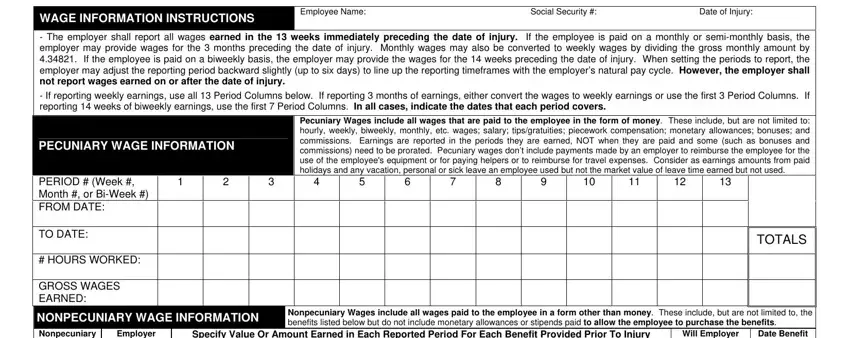

4. To go forward, the next part will require typing in a handful of fields. These comprise of WAGE INFORMATION INSTRUCTIONS, Employee Name Social Security, The employer shall report all, If reporting weekly earnings use, PECUNIARY WAGE INFORMATION, Pecuniary Wages include all wages, TOTALS, NONPECUNIARY WAGE INFORMATION, Nonpecuniary Wages include all, Nonpecuniary, Employer, Specify Value Or Amount Earned in, Will Employer Continue To, Date Benefit Suspended if suspended, and PERIOD Week Month or BiWeek, which are integral to carrying on with this process.

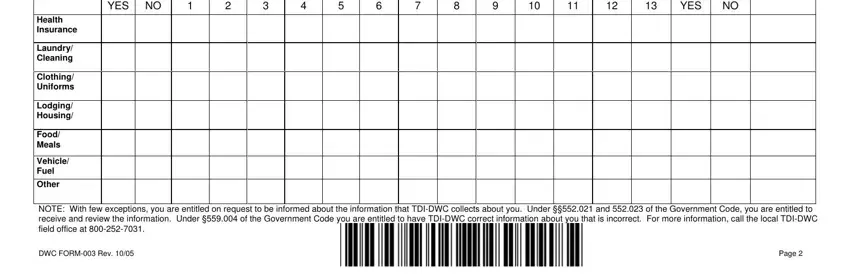

5. While you come close to the end of your file, you'll find a few more requirements that need to be satisfied. Particularly, Health Insurance, Laundry Cleaning, Clothing Uniforms, Lodging Housing, Food Meals, Vehicle Fuel Other, To Injury YES NO, YES, NOTE With few exceptions you are, DWC FORM Rev, and Page must all be filled in.

People who use this document generally get some things incorrect when completing Clothing Uniforms in this part. You need to double-check whatever you enter right here.

Step 3: Revise the details you have inserted in the blanks and then click on the "Done" button. Make a free trial plan at FormsPal and gain direct access to dwc 3 - downloadable, emailable, and editable in your FormsPal cabinet. We don't share or sell any information that you type in when filling out documents at our website.