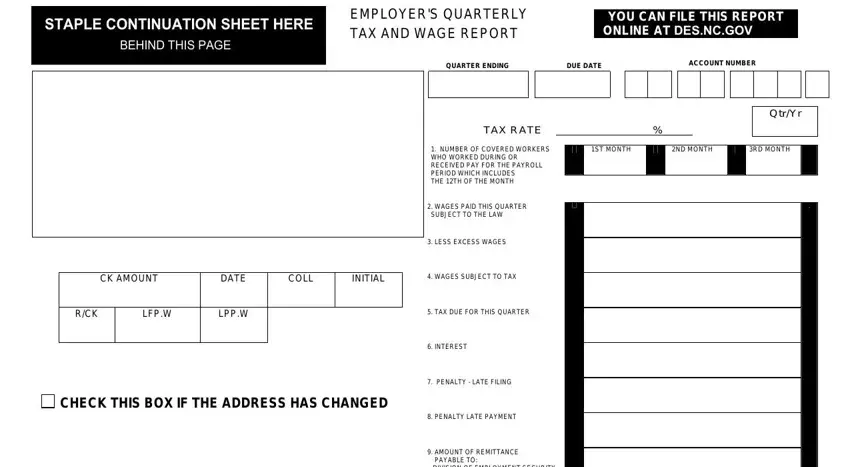

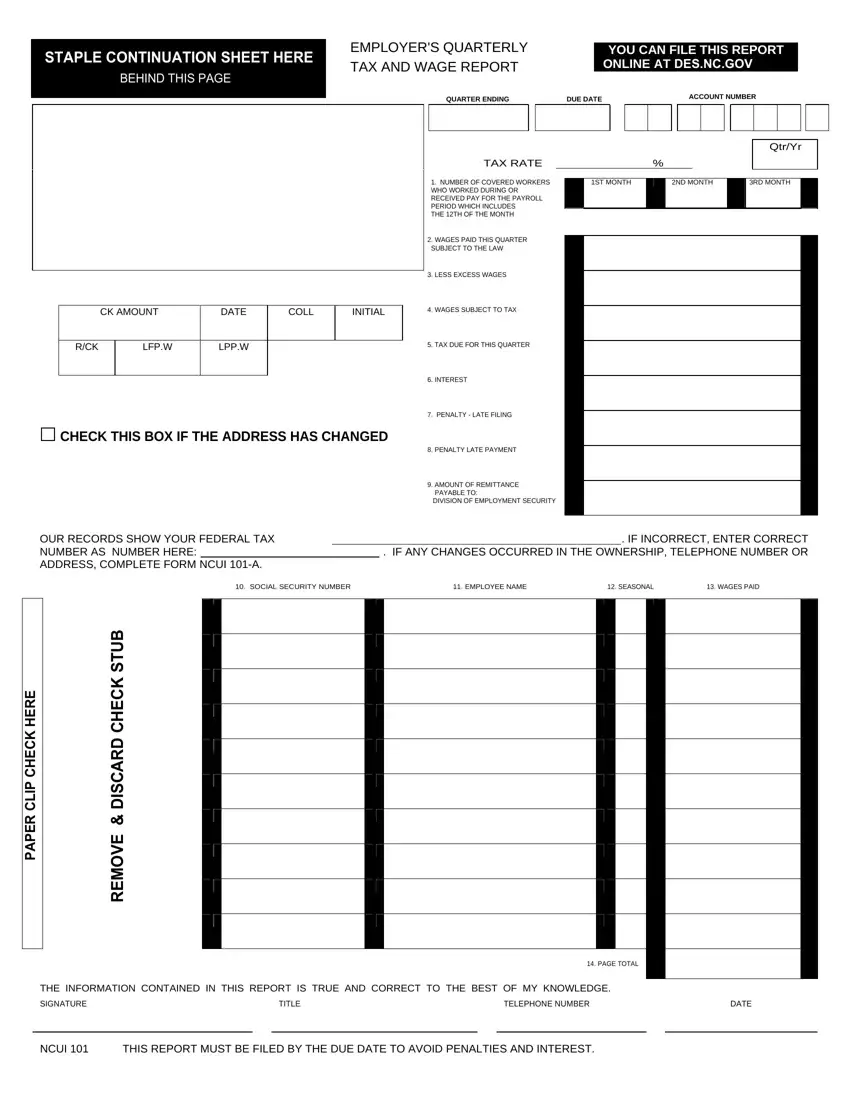

STAPLE CONTINUATION SHEET HERE

BEHIND THIS PAGE

EMPLOYER'S QUARTERLY TAX AND WAGE REPORT

QUARTER ENDING

TAX RATE

YOU CAN FILE THIS REPORT ONLINE AT DES.NC.GOV

Qtr/Yr

%

1. NUMBER OF COVERED WORKERS |

1ST MONTH |

2ND MONTH |

3RD MONTH |

WHO WORKED DURING OR |

|

|

|

RECEIVED PAY FOR THE PAYROLL |

|

|

|

PERIOD WHICH INCLUDES |

|

|

|

THE 12TH OF THE MONTH |

|

|

|

|

CK AMOUNT |

DATE |

COLL |

INITIAL |

R/CK |

LFP.W |

LPP.W |

|

|

CHECK THIS BOX IF THE ADDRESS HAS CHANGED

CHECK THIS BOX IF THE ADDRESS HAS CHANGED

2.WAGES PAID THIS QUARTER SUBJECT TO THE LAW

3.LESS EXCESS WAGES

4.WAGES SUBJECT TO TAX

5.TAX DUE FOR THIS QUARTER

6.INTEREST

7.PENALTY - LATE FILING

8.PENALTY LATE PAYMENT

9.AMOUNT OF REMITTANCE PAYABLE TO:

DIVISION OF EMPLOYMENT SECURITY

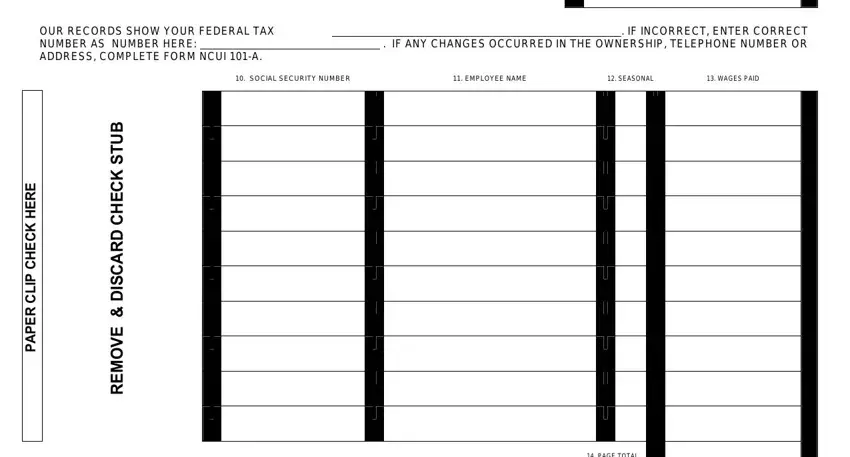

OUR RECORDS SHOW YOUR FEDERAL TAX |

|

|

. IF INCORRECT, ENTER CORRECT |

NUMBER AS NUMBER HERE: |

|

. IF ANY CHANGES OCCURRED IN THE OWNERSHIP, TELEPHONE NUMBER OR |

ADDRESS, COMPLETE FORM |

NCUI 101-A. |

|

|

|

CLIP CHECK HERE |

DISCARD CHECK STUB |

PAPER |

REMOVE & |

|

|

10. SOCIAL SECURITY NUMBER |

11. EMPLOYEE NAME |

12. SEASONAL |

13. WAGES PAID |

|

|

14. PAGE TOTAL |

|

THE INFORMATION CONTAINED IN THIS REPORT IS TRUE AND CORRECT TO THE BEST OF MY KNOWLEDGE.

SIGNATURE |

TITLE |

TELEPHONE NUMBER |

DATE |

NCUI 101 THIS REPORT MUST BE FILED BY THE DUE DATE TO AVOID PENALTIES AND INTEREST.

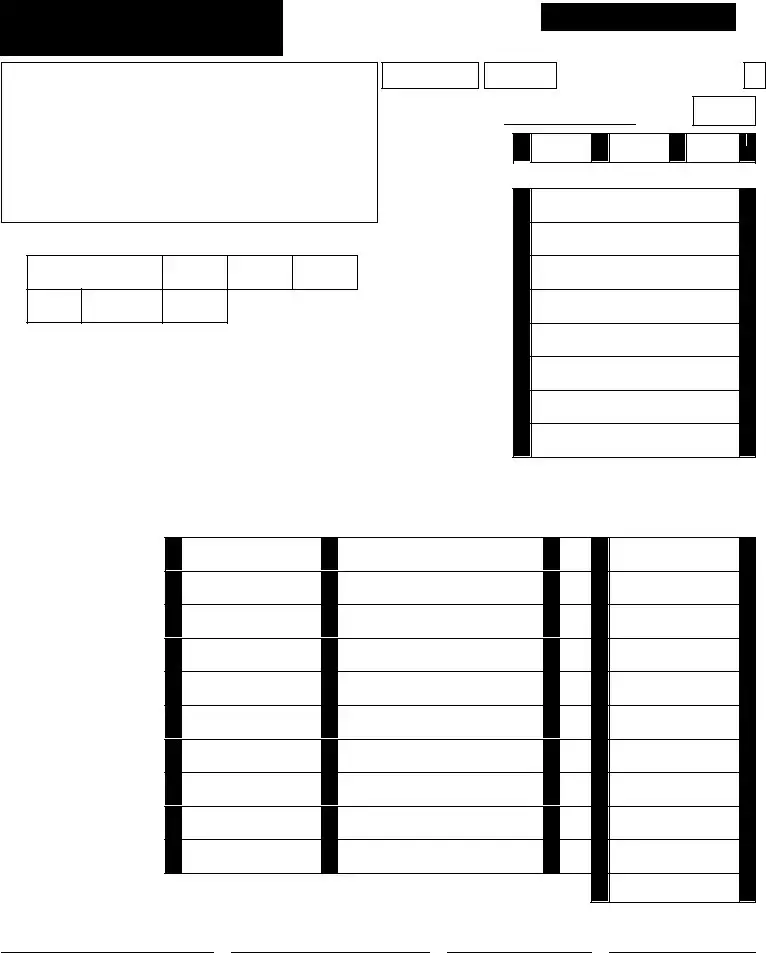

INSTRUCTIONS FOR COMPLETING FORM NCUI 101, EMPLOYER'S QUARTERLY TAX AND WAGE REPORT

ITEM 1: For each month in the calendar quarter, enter the number of all full-time and part-time workers who worked during or received pay for the payroll period which includes the 12th of the month.

ITEM 2: Enter all wages paid to all employees, including part-time and temporary, in this calendar quarter. If the legal business is:

(A)CORPORATION, the wages paid to all employees who performed services in North Carolina should be reported. Corporate officers are employees and their wages and/or draws are reportable.

(B)A PARTNERSHIP, the draws or payments made to general partners should not be reported.

(C)A PROPRIETORSHIP, the draws or payments made to the legal owner of the business (the proprietor) should not be reported. Wage paid to the children of the proprietor under the age of 21 years, as well as wages paid to the spouse or parents of the proprietor, should not be reported.

Special payments given in return for services performed, I.E., commissions, bonuses, fees, prizes, are wages and reportable under the Employment Security Law of North Carolina. These payments (or dollar value of the gifts/prizes) are to be included in the payroll of each employee by the employer for the calendar quarter(s) in which they are given.

If no wages were paid, enter NONE.

ITEM 3: Enter the amount of wages paid during this quarter that is in excess of the applicable North Carolina taxable wage base. This entry cannot be more than item 2.

Example: An employer using the 2012 taxable wage base of $20,400 and reporting one employee, John Doe, earning $6,000 per quarter.

1ST QTR 2ND QTR 3RD QTR 4TH QTR

ITEM 2: |

$6,000.00 |

$6,000.00 |

$6,000.00 |

$6,000.00 |

ITEM 3: |

-0- |

-0- |

-0- |

$3,600.00 |

ITEM 4: |

$6,000.00 |

$6,000.00 |

$6,000.00 |

$2,400.00 |

ITEM 4: Subtract Item 3 from Item 2. THE RESULTS CANNOT BE A NEGATIVE AMOUNT.

ITEM 5: Multiply Item 4 by the tax rate shown on the face of this report. (Example: .012% = .00012) If the tax due is less than $5.00, you do not have to

pay it, but you must file a report.

NOTE: ITEMS 6,7, AND 8 MUST BE COMPUTED ONLY IF THE REPORT IS NOT FILED (POSTMARKED) BY THE DUE DATE.

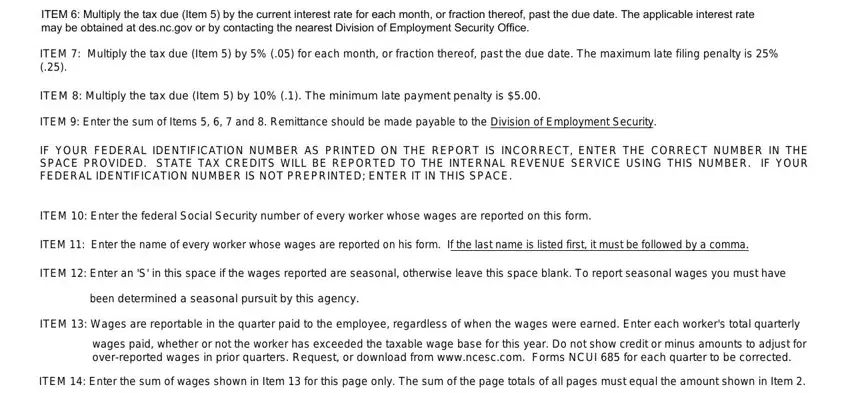

ITEM 6: Multiply the tax due (Item 5) by the current interest rate for each month, or fraction thereof, past the due date. The applicable interest rate may be obtained at des.nc.gov or by contacting the nearest Division of Employment Security Office.

ITEM 7: Multiply the tax due (Item 5) by 5% (.05) for each month, or fraction thereof, past the due date. The maximum late filing penalty is 25% (.25).

ITEM 8: Multiply the tax due (Item 5) by 10% (.1). The minimum late payment penalty is $5.00.

ITEM 9: Enter the sum of Items 5, 6, 7 and 8. Remittance should be made payable to the Division of Employment Security.

IF YOUR FEDERAL IDENTIFICATION NUMBER AS PRINTED ON THE REPORT IS INCORRECT, ENTER THE CORRECT NUMBER IN THE SPACE PROVIDED. STATE TAX CREDITS WILL BE REPORTED TO THE INTERNAL REVENUE SERVICE USING THIS NUMBER. IF YOUR FEDERAL IDENTIFICATION NUMBER IS NOT PREPRINTED; ENTER IT IN THIS SPACE.

ITEM 10: Enter the federal Social Security number of every worker whose wages are reported on this form.

ITEM 11: Enter the name of every worker whose wages are reported on his form. If the last name is listed first, it must be followed by a comma.

ITEM 12: Enter an 'S' in this space if the wages reported are seasonal, otherwise leave this space blank. To report seasonal wages you must have

been determined a seasonal pursuit by this agency.

ITEM 13: Wages are reportable in the quarter paid to the employee, regardless of when the wages were earned. Enter each worker's total quarterly

wages paid, whether or not the worker has exceeded the taxable wage base for this year. Do not show credit or minus amounts to adjust for over-reported wages in prior quarters. Request, or download from www.ncesc.com. Forms NCUI 685 for each quarter to be corrected.

ITEM 14: Enter the sum of wages shown in Item 13 for this page only. The sum of the page totals of all pages must equal the amount shown in Item 2.

Additional information is available at: des.nc.gov

CHECK THIS BOX IF THE ADDRESS HAS CHANGED

CHECK THIS BOX IF THE ADDRESS HAS CHANGED