Working with PDF documents online can be very easy using our PDF tool. You can fill out COLORADO here in a matter of minutes. The tool is consistently improved by our staff, getting new functions and growing to be a lot more convenient. All it takes is a couple of simple steps:

Step 1: First of all, access the pdf editor by pressing the "Get Form Button" in the top section of this site.

Step 2: With the help of our state-of-the-art PDF editing tool, it's possible to do more than just fill in forms. Try all of the features and make your forms appear great with custom textual content added, or tweak the file's original content to perfection - all comes along with the capability to incorporate your own photos and sign the file off.

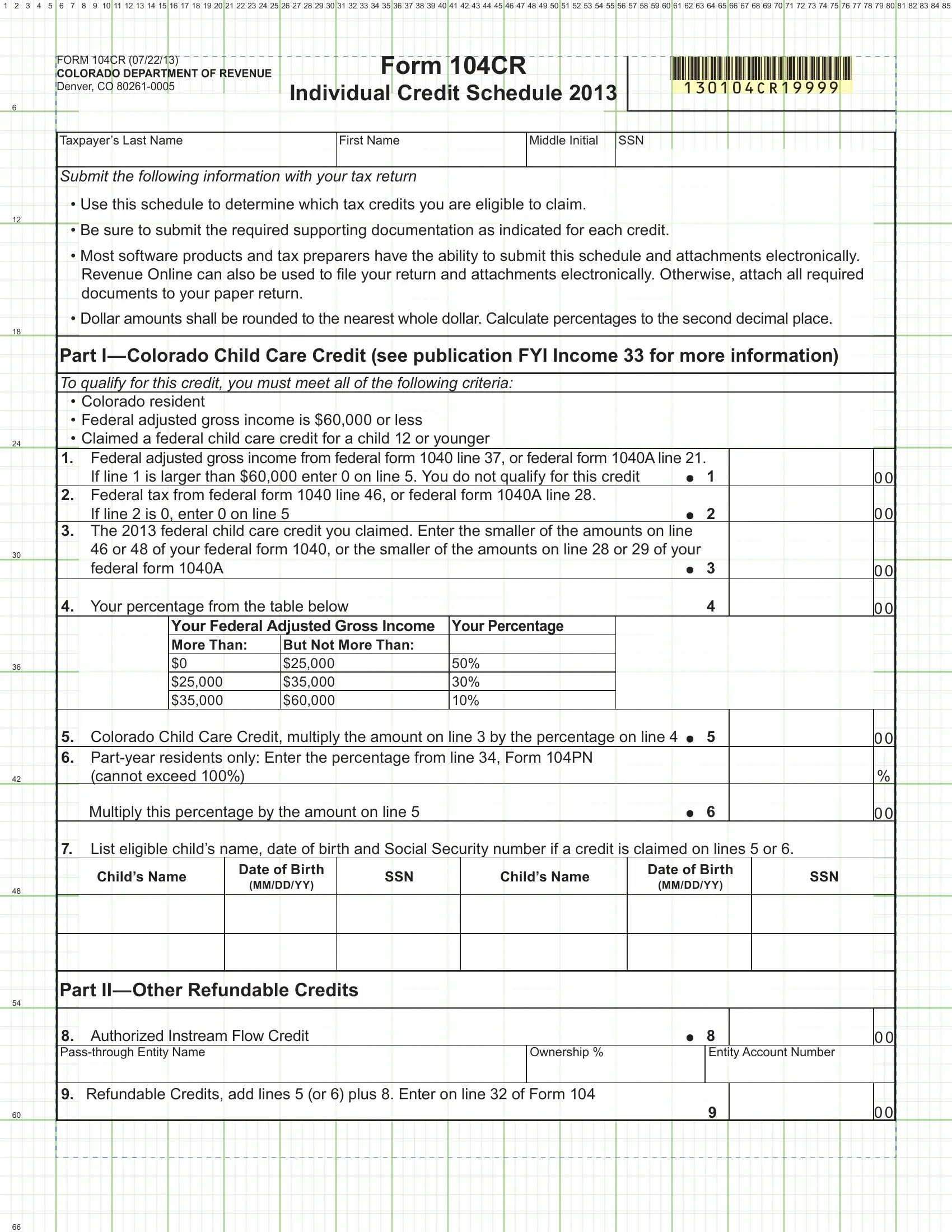

When it comes to fields of this precise form, here's what you should consider:

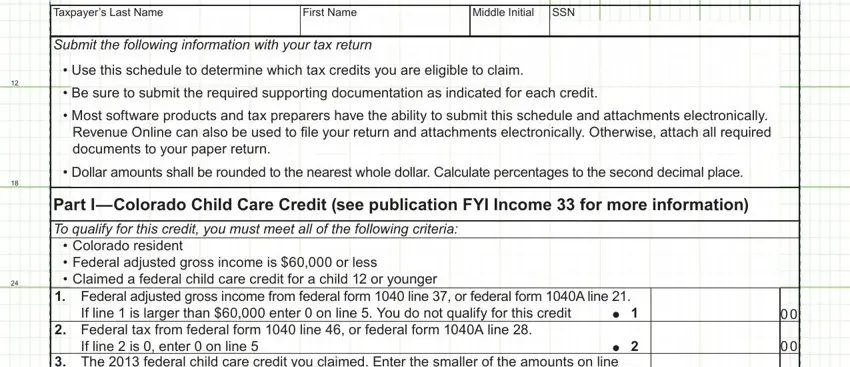

1. Complete your COLORADO with a selection of essential blank fields. Collect all of the information you need and be sure there is nothing left out!

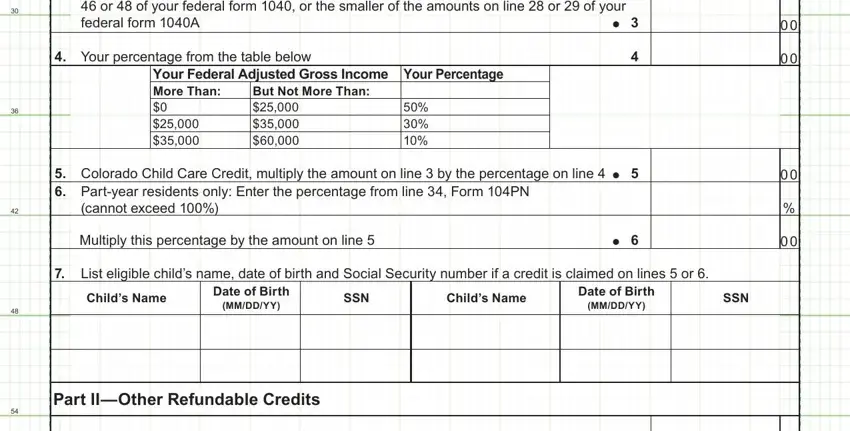

2. Soon after filling in the last part, head on to the subsequent step and fill out the essential details in these blanks - Colorado resident Federal, If line is enter on line The, Your percentage from the table, Your Federal Adjusted Gross Income, But Not More Than, Colorado Child Care Credit, cannot exceed, Multiply this percentage by the, List eligible childs name date of, Childs Name, Date of Birth, MMDDYY, SSN, Childs Name, and Date of Birth.

As for Colorado resident Federal and If line is enter on line The, ensure that you double-check them here. Those two are definitely the most significant fields in the form.

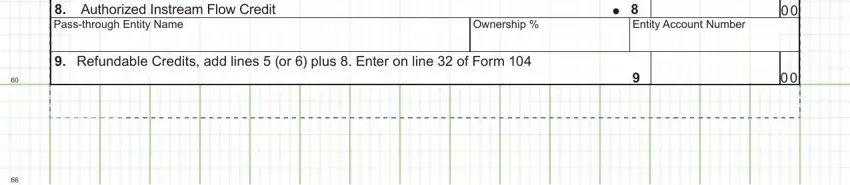

3. Completing Authorized Instream Flow Credit, Ownership, Entity Account Number, Refundable Credits add lines or, and DR Barcode Only Placement is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

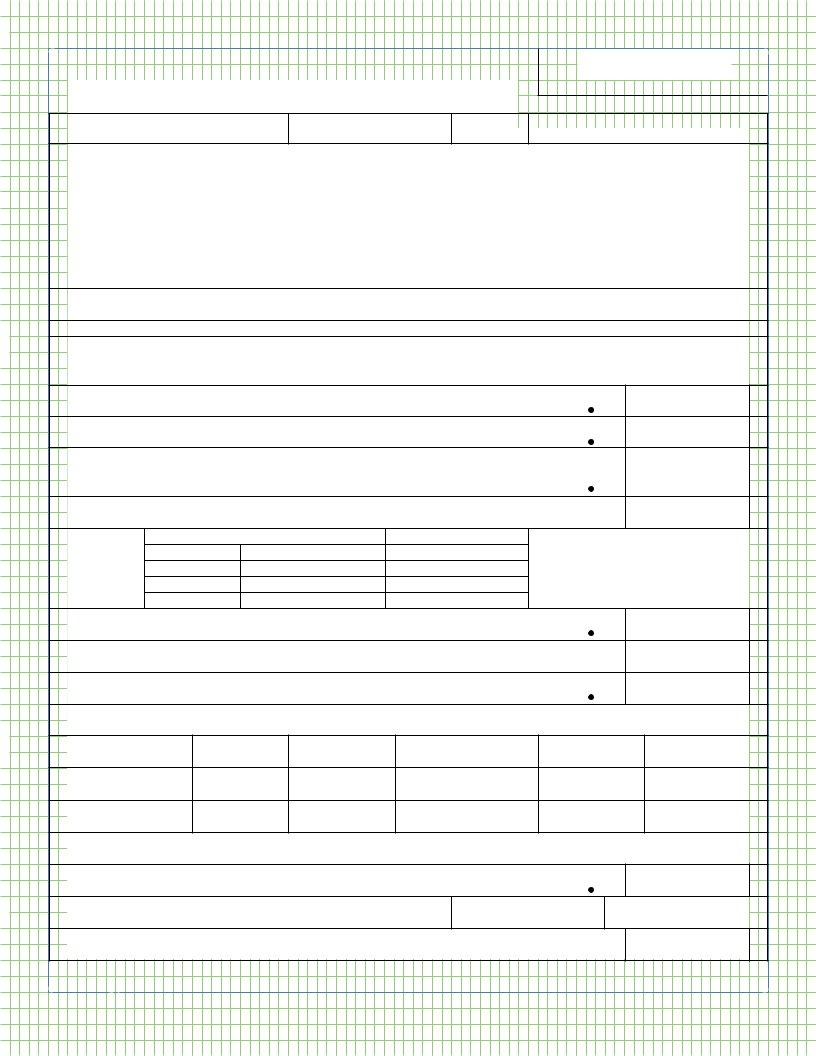

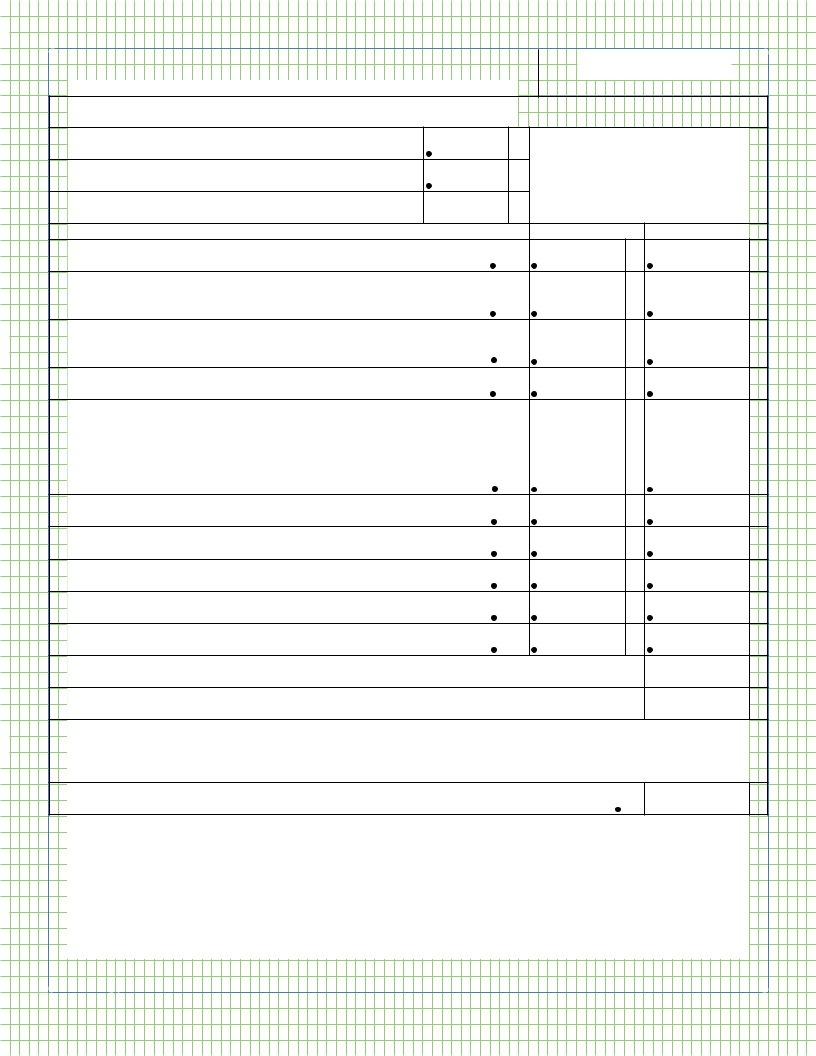

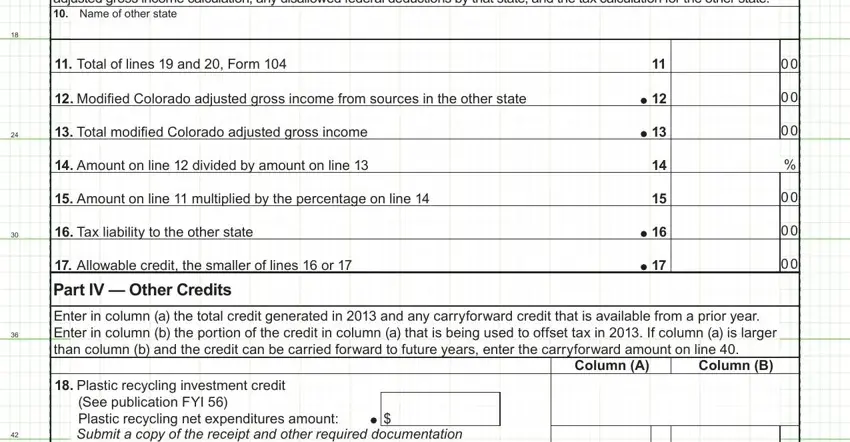

4. Filling in Submit a copy of the tax return, Total of lines and Form, Modiied Colorado adjusted gross, Total modiied Colorado adjusted, Amount on line divided by amount, Amount on line multiplied by the, Tax liability to the other state, Allowable credit the smaller of, Part IV Other Credits, Enter in column a the total credit, Column A, Column B, Plastic recycling investment, and See publication FYI Plastic is crucial in this next step - make certain that you be patient and take a close look at every blank!

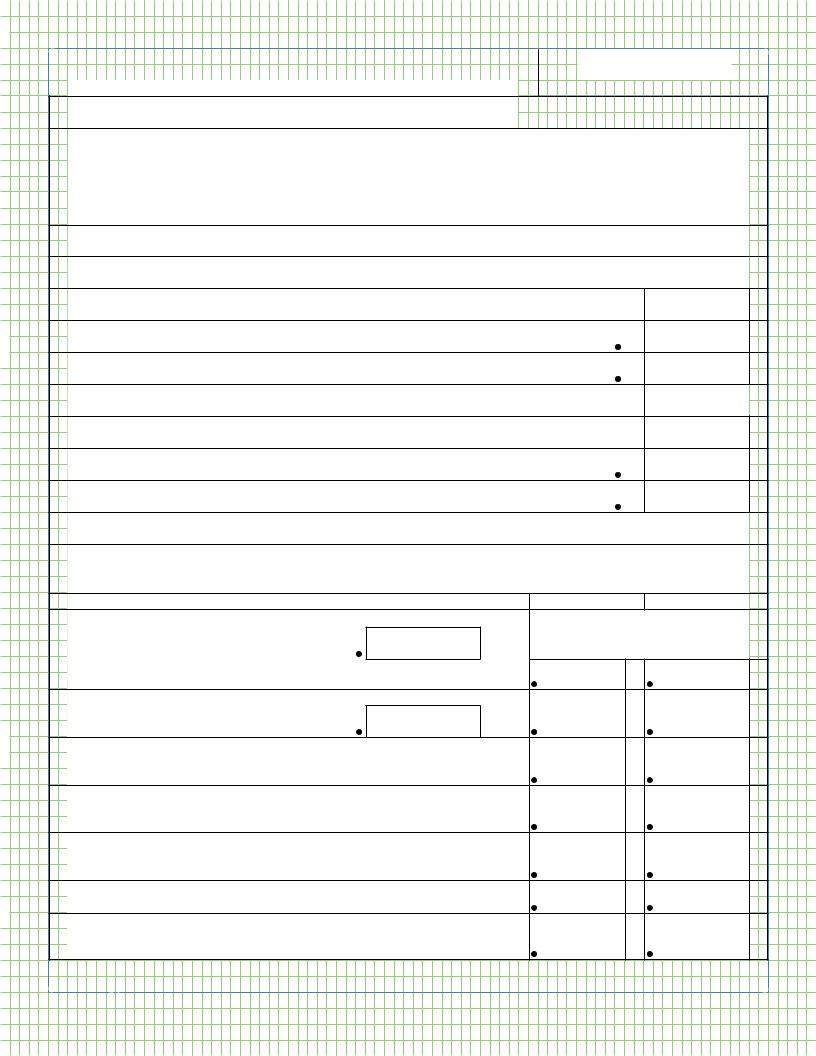

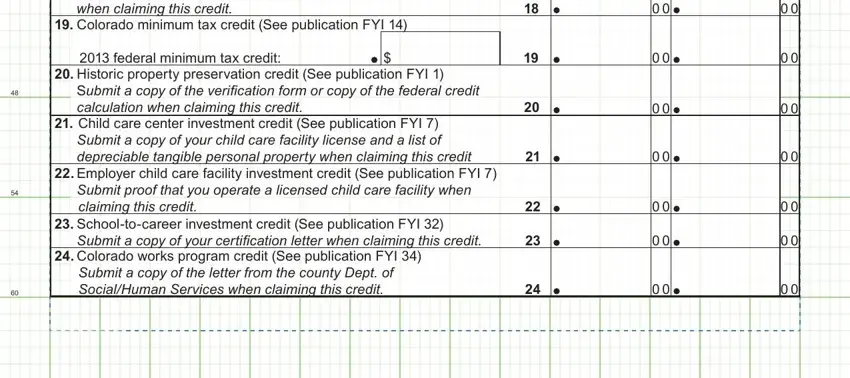

5. Finally, this last subsection is precisely what you will need to wrap up prior to closing the document. The fields at this point include the next: See publication FYI Plastic, Colorado minimum tax credit See, federal minimum tax credit, Submit a copy of the veriication, Child care center investment, Employer child care facility, Submit proof that you operate a, Schooltocareer investment credit, Submit a copy of your certiication, Colorado works program credit See, Submit a copy of the letter from, and DR Barcode Only Placement.

Step 3: As soon as you have reread the information you filled in, click on "Done" to complete your FormsPal process. Join us today and immediately gain access to COLORADO, set for download. All modifications made by you are kept , making it possible to modify the pdf further if necessary. FormsPal guarantees your data privacy with a secure system that in no way records or shares any kind of personal information used in the file. You can relax knowing your docs are kept safe each time you work with our service!