T-4 can be filled out without any problem. Just make use of FormsPal PDF editor to complete the task in a timely fashion. The editor is constantly improved by our team, getting awesome features and becoming better. This is what you'd need to do to start:

Step 1: Open the form in our tool by clicking on the "Get Form Button" at the top of this page.

Step 2: This editor enables you to customize your PDF form in a variety of ways. Improve it by writing your own text, adjust existing content, and add a signature - all within the reach of several mouse clicks!

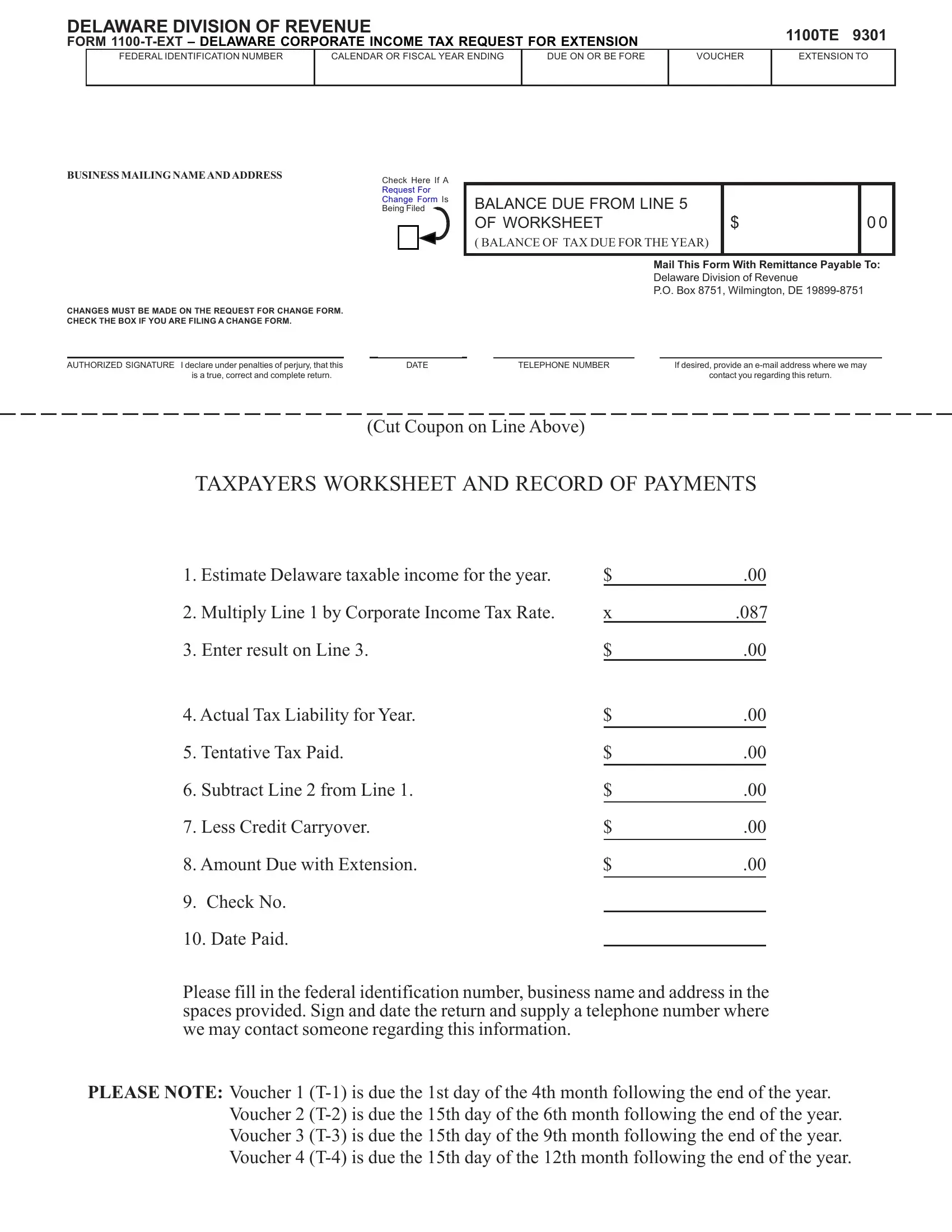

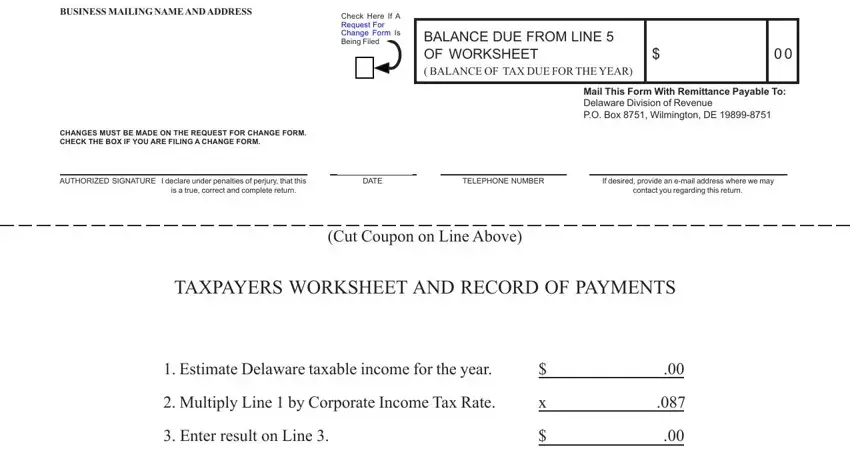

In an effort to complete this document, make sure you provide the necessary information in every single blank:

1. To start with, once completing the T-4, beging with the area that has the following fields:

Step 3: Right after rereading the fields, click "Done" and you're done and dusted! Join FormsPal right now and easily get access to T-4, prepared for downloading. Every edit made is handily preserved , enabling you to modify the document at a later stage if required. We don't share or sell the information that you use while working with forms at FormsPal.