If you need to fill out Form 1100S Ext, you don't have to download any sort of programs - simply make use of our PDF tool. To have our editor on the forefront of efficiency, we work to adopt user-driven features and enhancements regularly. We are routinely looking for feedback - join us in revolutionizing how we work with PDF files. To get started on your journey, take these simple steps:

Step 1: Click on the "Get Form" button at the top of this webpage to access our editor.

Step 2: With the help of this handy PDF editing tool, you'll be able to accomplish more than just complete blank form fields. Try all the features and make your documents look high-quality with custom text added in, or tweak the original content to perfection - all comes with an ability to insert stunning graphics and sign the document off.

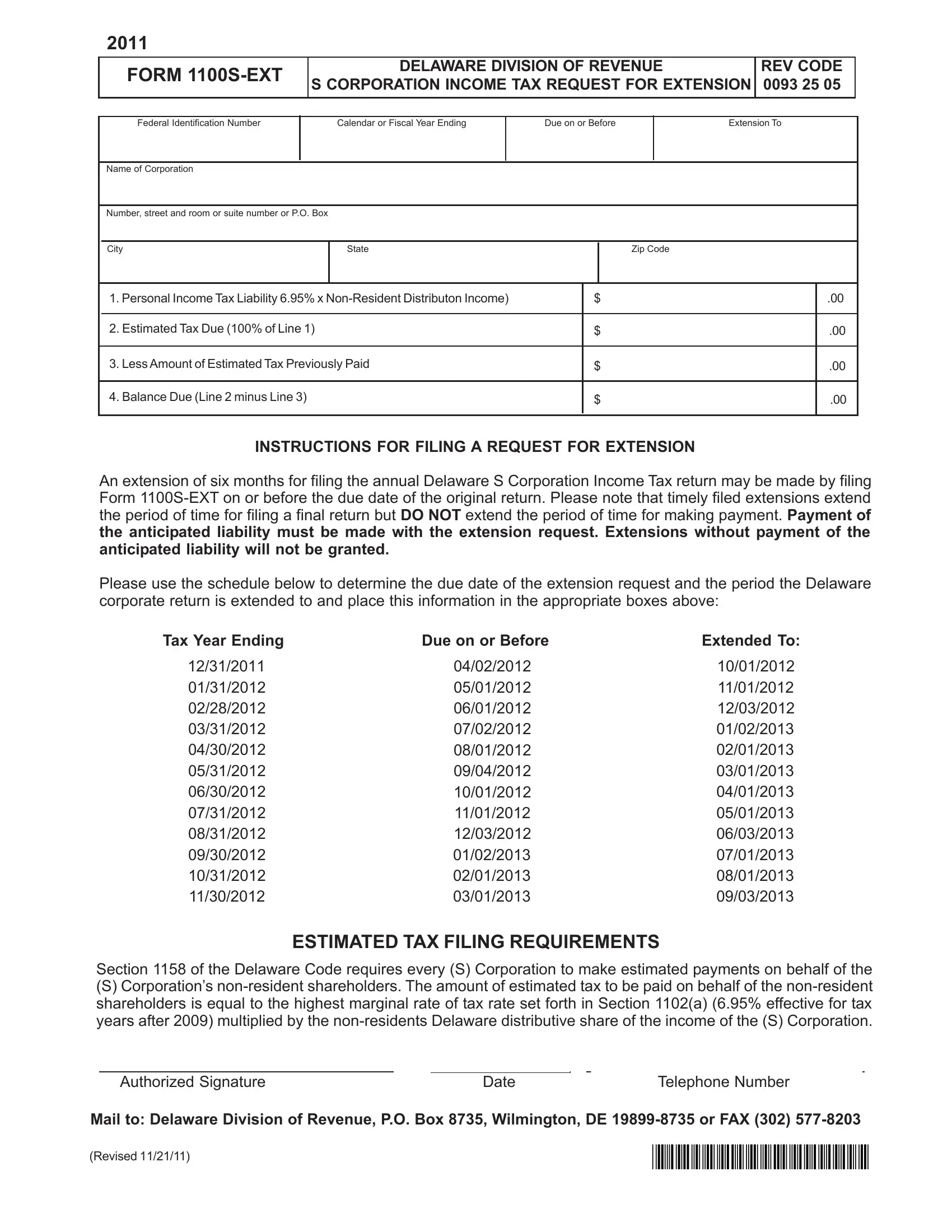

This document will require specific information to be filled in, hence you need to take your time to provide exactly what is expected:

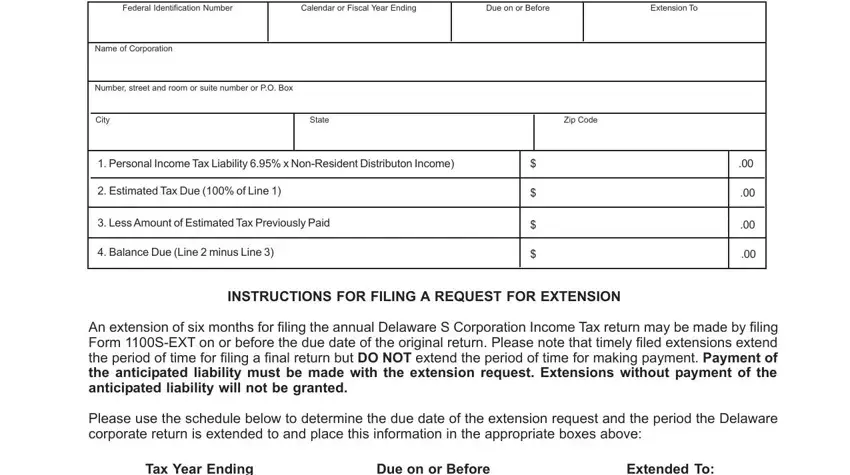

1. Start completing your Form 1100S Ext with a group of essential blank fields. Gather all the necessary information and make certain there's nothing missed!

2. The next step is to submit these blank fields: Section of the Delaware Code, Authorized Signature, Date, Telephone Number, Mail to Delaware Division of, and Revised.

Be extremely attentive when completing Revised and Section of the Delaware Code, because this is where many people make a few mistakes.

Step 3: Revise what you have inserted in the blank fields and then click the "Done" button. Create a free trial subscription at FormsPal and get direct access to Form 1100S Ext - which you'll be able to then begin using as you wish in your personal account page. FormsPal is committed to the confidentiality of all our users; we ensure that all information coming through our editor continues to be protected.