The IRS Form 1139 is used to claim an estate tax deduction for a taxable estate. This form must be filed by the executor of the estate, and it includes information about the value of the taxable estate and the amount of the deduction claimed. There are specific requirements that must be met in order to claim this deduction, so it's important to understand how it works before filing. To learn more about Form 1139 and how to file it, contact an accountant or tax professional.

| Question | Answer |

|---|---|

| Form Name | Form 1139 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | form 1139, completed form 1139 example, form 1139 example, 1139 form |

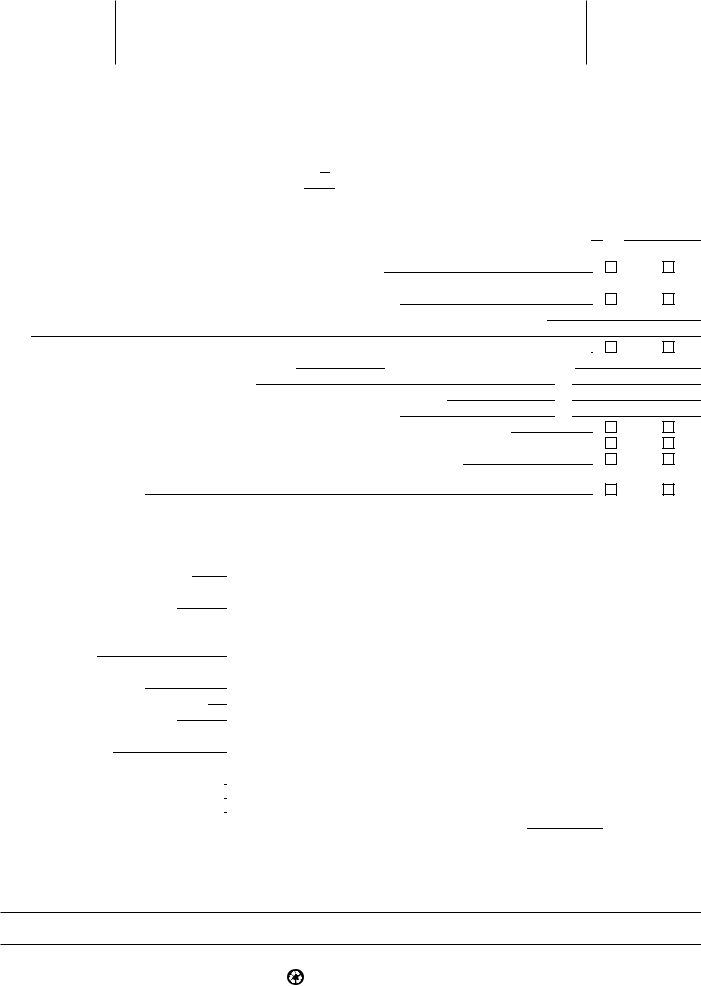

Form 1 1 3 9

(Rev. October 1997)

Department of the Treasury Internal Revenue Service

Corporation Application for Tentative Refund

▶Read the separate instructions before completing this form.

▶Do not attach to the corporation’s income tax

OMB No.

Name |

|

|

|

|

|

|

Employer identification number |

||

|

|

|

|

|

|

||||

Number, street, and room or suite no. (If a P.O. box, see separate instructions.) |

|

Date of incorporation |

|||||||

|

|

|

|

|

|

|

|||

City or town, state, and ZIP code |

|

|

|

Telephone number (optional) |

|||||

|

|

|

|

|

|

|

( |

) |

|

1 |

This application is |

a |

Net operating loss (attach computation) |

▶ |

$ |

c Unused general business |

|

||

|

|

|

|

|

|

|

|||

|

filed to carry back: |

|

|

|

|

|

|

||

|

|

Net capital loss (attach computation) |

|

$ |

$ |

||||

|

b |

▶ |

|

credit (attach computation) ▶ |

|||||

|

|

|

|||||||

2 |

Return for year of loss, unused credit, or |

a Tax year ended |

|

b Date filed |

c Service center where filed |

||||

|

|

|

|

|

|

||||

|

overpayment under section 1341(b)(1) ▶ |

|

|

|

|

|

|

||

3 |

If this application is for an unused credit created by another carryback, enter ending date for the tax year of the first carryback |

▶ |

4Does the net operating loss or net capital loss result in the release of foreign tax credits or the release of other tax

credits because of the release of a foreign tax credit? (see instructions) If “Yes,” you cannot file Form 1139. Instead, use Form 1120X.

5a Was a consolidated return filed for any tax year covered on this application?

bIf “Yes,” identify the year and enter the name of the common parent and its EIN, if different from above ▶

6a |

If Form 1138 has been filed, was an extension of time granted for filing the return for the tax year of the net operating loss? |

||

b |

If “Yes,” give date to which extension was granted ▶ |

c Give date Form 1138 was filed |

▶ |

d |

Unpaid tax for which Form 1138 is in effect |

|

▶ |

7 |

If you changed your accounting period, give date permission to change was granted |

▶ |

|

8 |

If this is an application of a dissolved corporation, enter date of dissolution |

|

▶ |

Yes

Yes

Yes

No

No

No

9Have you filed a petition in Tax Court for the year or years to which the carryback is to be applied?

10Does this carryback include a loss or credit from a tax shelter required to be registered? If “Yes,” attach Form(s) 8271

11a Does the carryback include a specified liability loss that is attributable to a product liability?

bDoes the carryback include a specified liability loss that is attributable to a Federal or state law or to a tort other than product liability?

If the answer to question 11a or 11b is “Yes,” see the instructions and attach a statement.

Yes Yes

Yes

Yes

No No

No

No

|

Computation of |

3rd preceding tax |

|

2nd preceding tax |

|

1st preceding tax |

|

|||

|

year ended ▶ |

|

year ended ▶ |

|

year ended ▶ |

|

||||

|

Decrease in Tax |

|

|

|

|

|

|

|

|

|

|

(a) Before |

|

(b) After |

(c) Before |

|

(d) After |

(e) Before |

|

(f) After |

|

Note: If no entry in 1a or 1b, skip lines |

|

|

|

|||||||

carryback |

|

carryback |

carryback |

|

carryback |

carryback |

|

carryback |

||

12 |

Taxable income from tax return |

|

|

|

|

|

|

|

|

|

13 |

Capital loss carryback (see instructions) |

|

|

|

|

|

|

|

|

|

14 |

Subtract line 13 from line 12 |

|

|

|

|

|

|

|

|

|

15 |

Net operating loss deduction (see inst.) |

|

|

|

|

|

|

|

|

|

16 |

Taxable income (subtract line 15 from line 14) |

|

|

|

|

|

|

|

|

|

17 |

Income tax |

|

|

|

|

|

|

|

|

|

18 |

General business credit (see instructions) |

|

|

|

|

|

|

|

|

|

19 |

Other credits (identify) |

|

|

|

|

|

|

|

|

|

20 |

Total credits (add lines 18 and 19) |

|

|

|

|

|

|

|

|

|

21 |

Subtract line 20 from line 17 |

|

|

|

|

|

|

|

|

|

22 |

Personal holding com pany tax (Sch. PH (Form 1120)) |

|

|

|

|

|

|

|

|

|

23 |

Recapture taxes |

|

|

|

|

|

|

|

|

|

24 |

Alternative m inim um tax and environm ental tax |

|

|

|

|

|

|

|

|

|

25 |

Total tax liability (add lines 21 through 24) |

|

|

|

|

|

|

|

|

|

26 |

Recomputed tax liability (see instructions) |

|

|

|

|

|

|

|

|

|

27 |

Decrease in tax (subtract line 26 from line 25) |

|

|

|

|

|

|

|

|

|

28 |

Overpayment of tax due to a claim of right adjustment under section |

▶ |

|

|

||||||

Sign

Here

Keep a copy of this application for your records.

Under penalties of perjury, I declare that I have examined this application and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete.

▶ |

|

▶ |

|

▶ |

|

Signature of officer |

Date |

Title |

Preparer Other |

Name ▶ |

Than Taxpayer |

Address ▶ |

Date

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 11170F |

Form 1139 (Rev. |