Dealing with PDF files online is definitely very easy with our PDF tool. Anyone can fill out ERC here in a matter of minutes. In order to make our tool better and less complicated to use, we consistently implement new features, with our users' feedback in mind. Here's what you'll need to do to get started:

Step 1: First, open the pdf tool by clicking the "Get Form Button" in the top section of this site.

Step 2: With our state-of-the-art PDF tool, you may accomplish more than just fill out blanks. Express yourself and make your docs appear sublime with customized text incorporated, or tweak the file's original input to excellence - all that comes with the capability to insert stunning images and sign the document off.

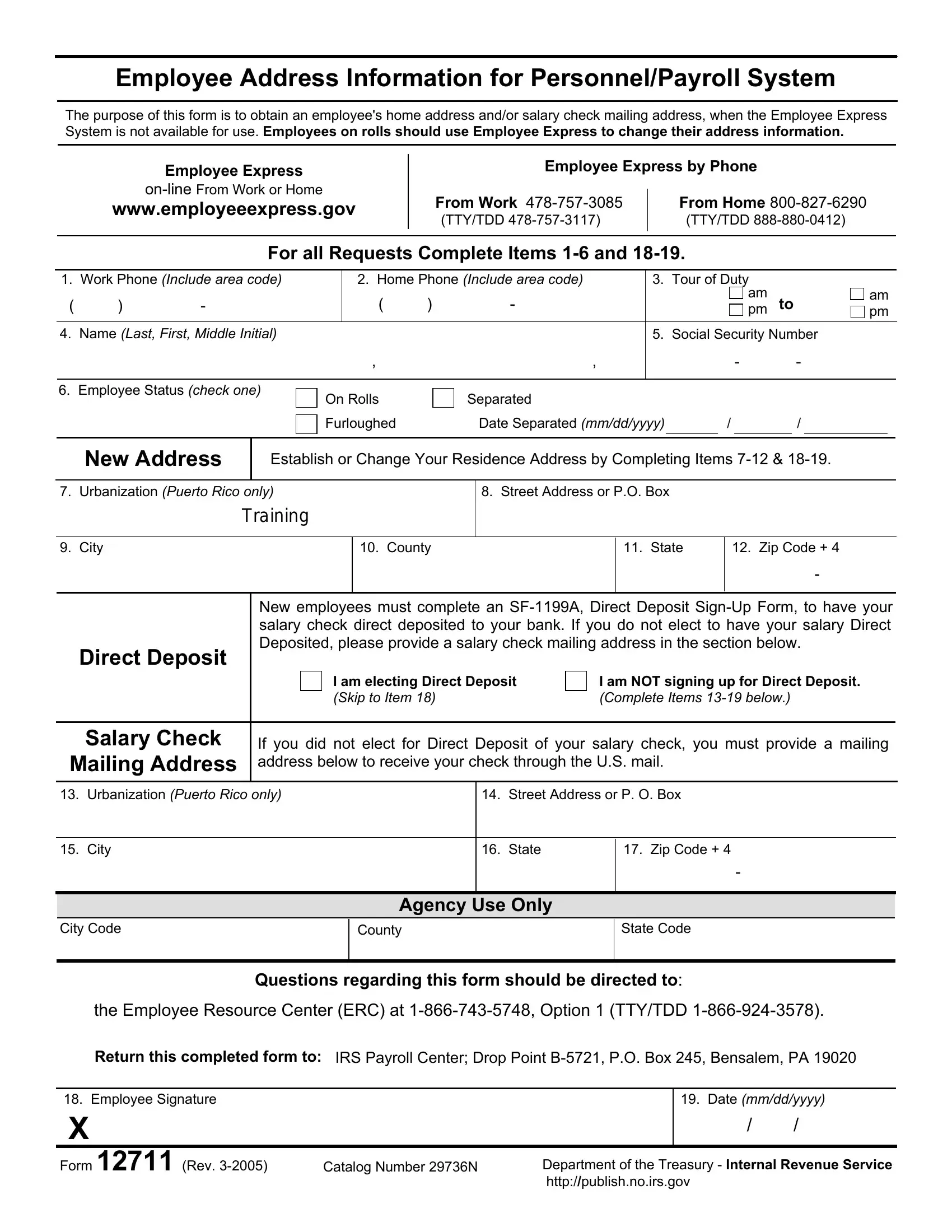

This form will need specific information; to ensure accuracy, please make sure to consider the suggestions further down:

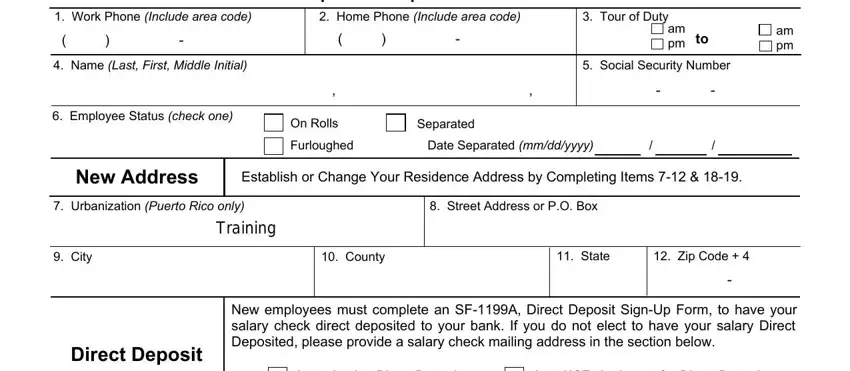

1. When filling out the ERC, be certain to incorporate all of the necessary fields within the associated section. This will help to expedite the work, enabling your details to be handled swiftly and appropriately.

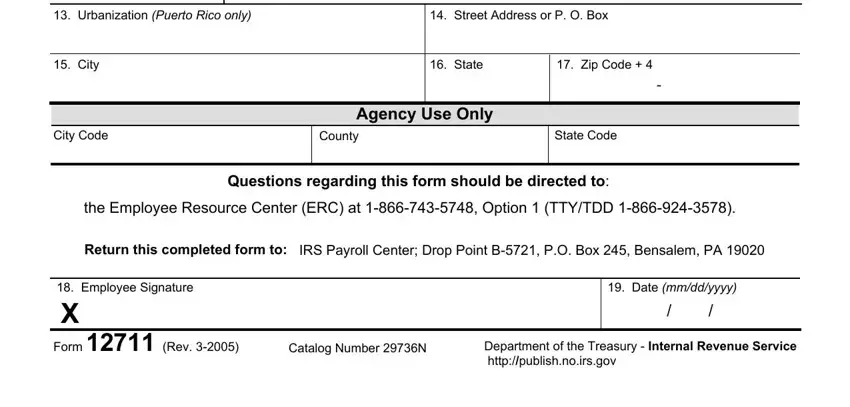

2. Once your current task is complete, take the next step – fill out all of these fields - Urbanization Puerto Rico only, Street Address or P O Box, City, State, Zip Code, City Code, County, State Code, Agency Use Only, Questions regarding this form, the Employee Resource Center ERC, Return this completed form to, IRS Payroll Center Drop Point B PO, Employee Signature, and X Form Rev with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Concerning City and the Employee Resource Center ERC, be sure that you take a second look here. Both of these are thought to be the most significant fields in the document.

Step 3: Before finishing this form, double-check that blank fields have been filled in the correct way. When you are satisfied with it, click “Done." Sign up with us today and instantly obtain ERC, set for downloading. Each modification made is conveniently kept , helping you to change the pdf further if required. FormsPal ensures your information privacy by having a protected system that never records or distributes any private information provided. Feel safe knowing your documents are kept protected each time you use our service!