Using PDF files online is certainly a breeze with this PDF editor. Anyone can fill out EFTPS here and try out a number of other options we offer. Our editor is consistently developing to present the very best user experience achievable, and that's thanks to our commitment to continuous development and listening closely to customer feedback. With some simple steps, it is possible to begin your PDF journey:

Step 1: Simply hit the "Get Form Button" at the top of this page to access our pdf editor. This way, you'll find everything that is necessary to work with your document.

Step 2: As you access the online editor, you will find the form all set to be filled out. Aside from filling in various blanks, you can also do several other actions with the Document, namely putting on custom text, editing the initial text, adding graphics, putting your signature on the PDF, and more.

This PDF doc needs specific details; to ensure accuracy and reliability, take the time to take note of the recommendations below:

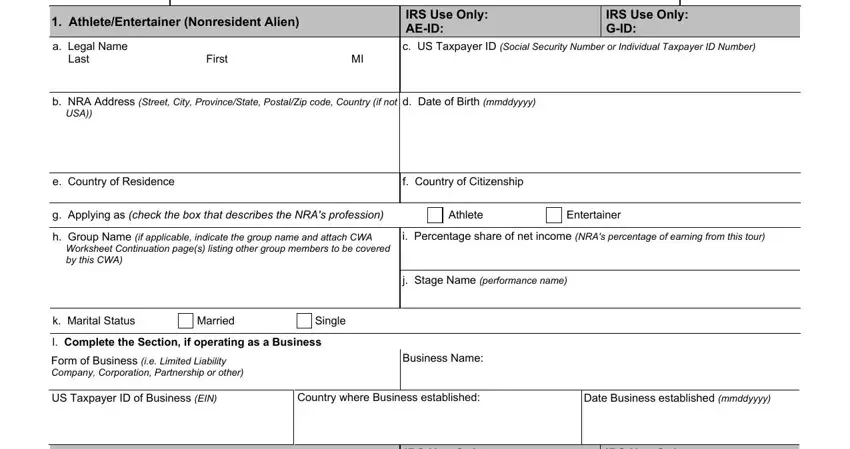

1. To start off, when filling out the EFTPS, start with the section that contains the following blanks:

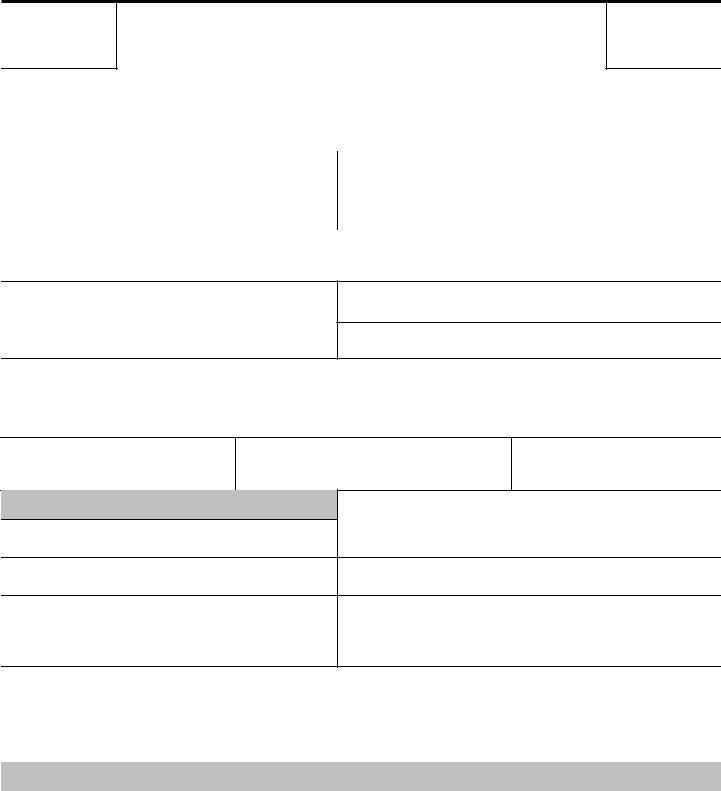

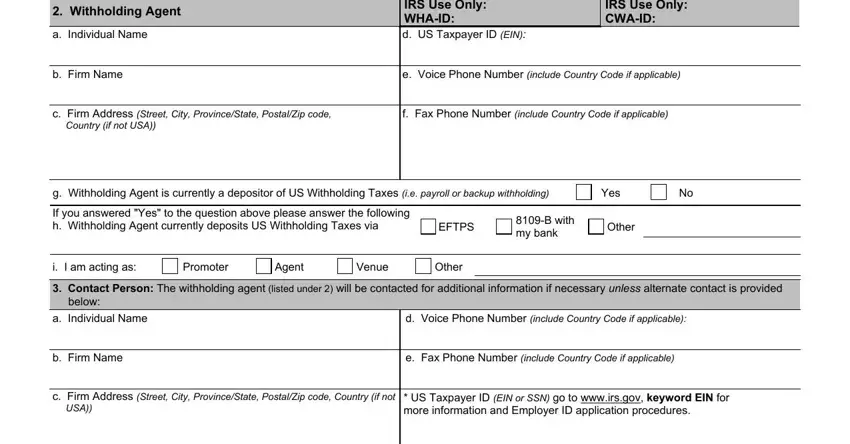

2. Once your current task is complete, take the next step – fill out all of these fields - Withholding Agent, a Individual Name, b Firm Name, IRS Use Only WHAID d US Taxpayer, IRS Use Only CWAID, e Voice Phone Number include, c Firm Address Street City, f Fax Phone Number include Country, Country if not USA, g Withholding Agent is currently a, Yes, If you answered Yes to the, EFTPS, B with my bank, and Other with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

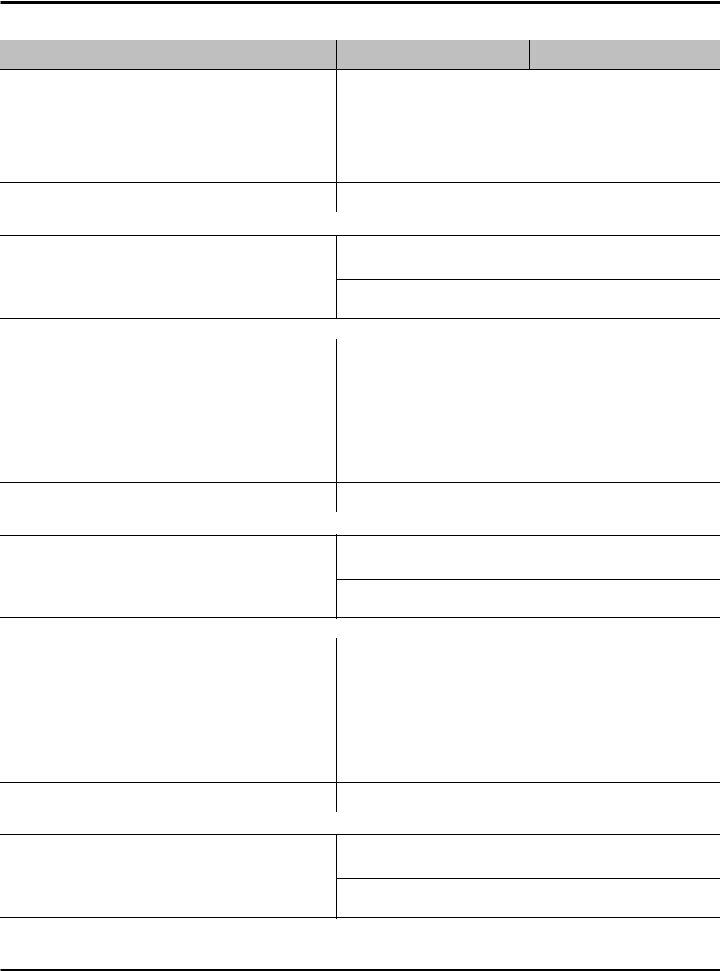

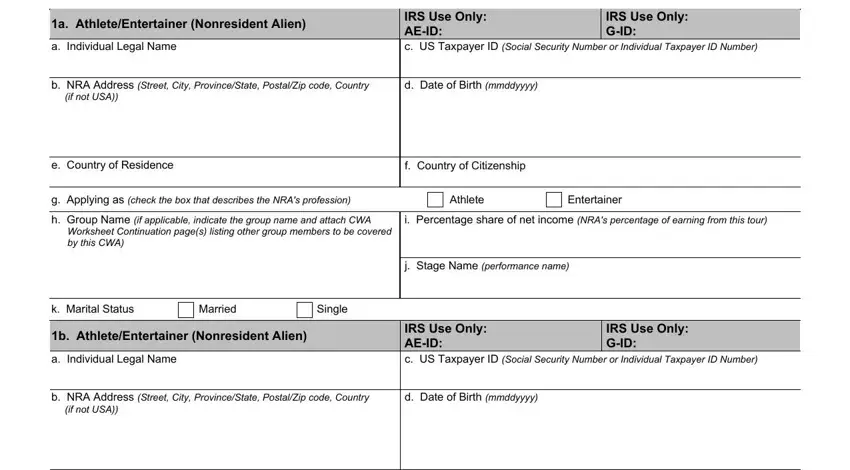

3. This subsequent part should also be rather simple, Continuation Sheet For, a AthleteEntertainer Nonresident, a Individual Legal Name, IRS Use Only AEID c US Taxpayer ID, IRS Use Only GID, b NRA Address Street City, d Date of Birth mmddyyyy, if not USA, e Country of Residence, f Country of Citizenship, g Applying as check the box that, Athlete, Entertainer, h Group Name if applicable, and Worksheet Continuation pages - all of these fields has to be filled in here.

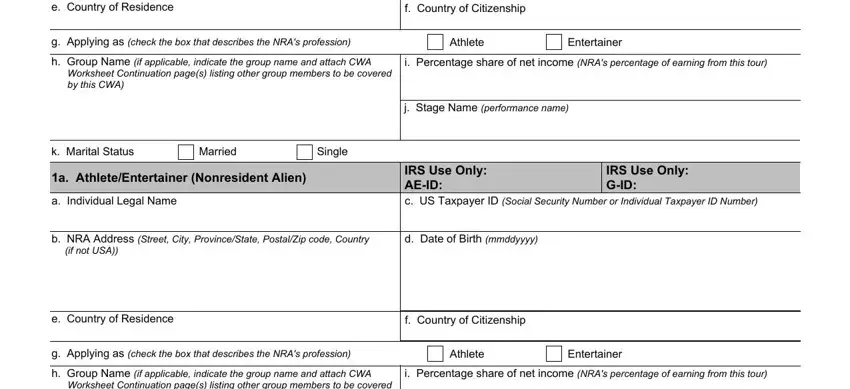

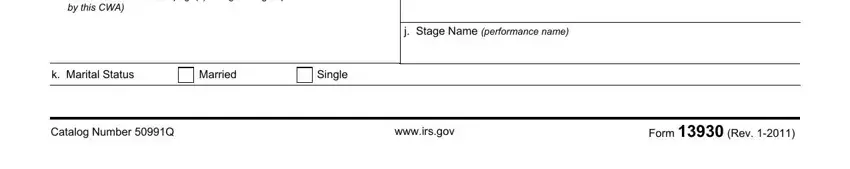

4. This next section requires some additional information. Ensure you complete all the necessary fields - e Country of Residence, f Country of Citizenship, g Applying as check the box that, Athlete, Entertainer, h Group Name if applicable, i Percentage share of net income, Worksheet Continuation pages, j Stage Name performance name, k Marital Status, Married, Single, a AthleteEntertainer Nonresident, a Individual Legal Name, and IRS Use Only AEID c US Taxpayer ID - to proceed further in your process!

A lot of people often make mistakes while filling in a AthleteEntertainer Nonresident in this area. Be sure to re-examine whatever you enter here.

5. To wrap up your document, this final section incorporates a few additional blank fields. Filling in Worksheet Continuation pages, j Stage Name performance name, k Marital Status, Married, Single, Catalog Number Q, wwwirsgov, and Form Rev will certainly finalize everything and you will be done in a flash!

Step 3: Reread what you have inserted in the blank fields and hit the "Done" button. Join FormsPal today and instantly use EFTPS, prepared for download. All modifications you make are saved , which enables you to customize the form later anytime. FormsPal ensures your data privacy with a protected system that in no way records or shares any kind of sensitive information provided. Feel safe knowing your files are kept protected when you use our services!