Through the online tool for PDF editing by FormsPal, it is possible to fill in or modify TAC right here. The editor is continually improved by our staff, receiving useful features and growing to be better. Starting is simple! All you need to do is take these simple steps below:

Step 1: Access the PDF in our editor by clicking the "Get Form Button" in the top section of this page.

Step 2: The editor helps you change nearly all PDF documents in a variety of ways. Modify it by including personalized text, adjust what is already in the document, and add a signature - all manageable in minutes!

Pay close attention while completing this document. Make certain each blank field is filled out properly.

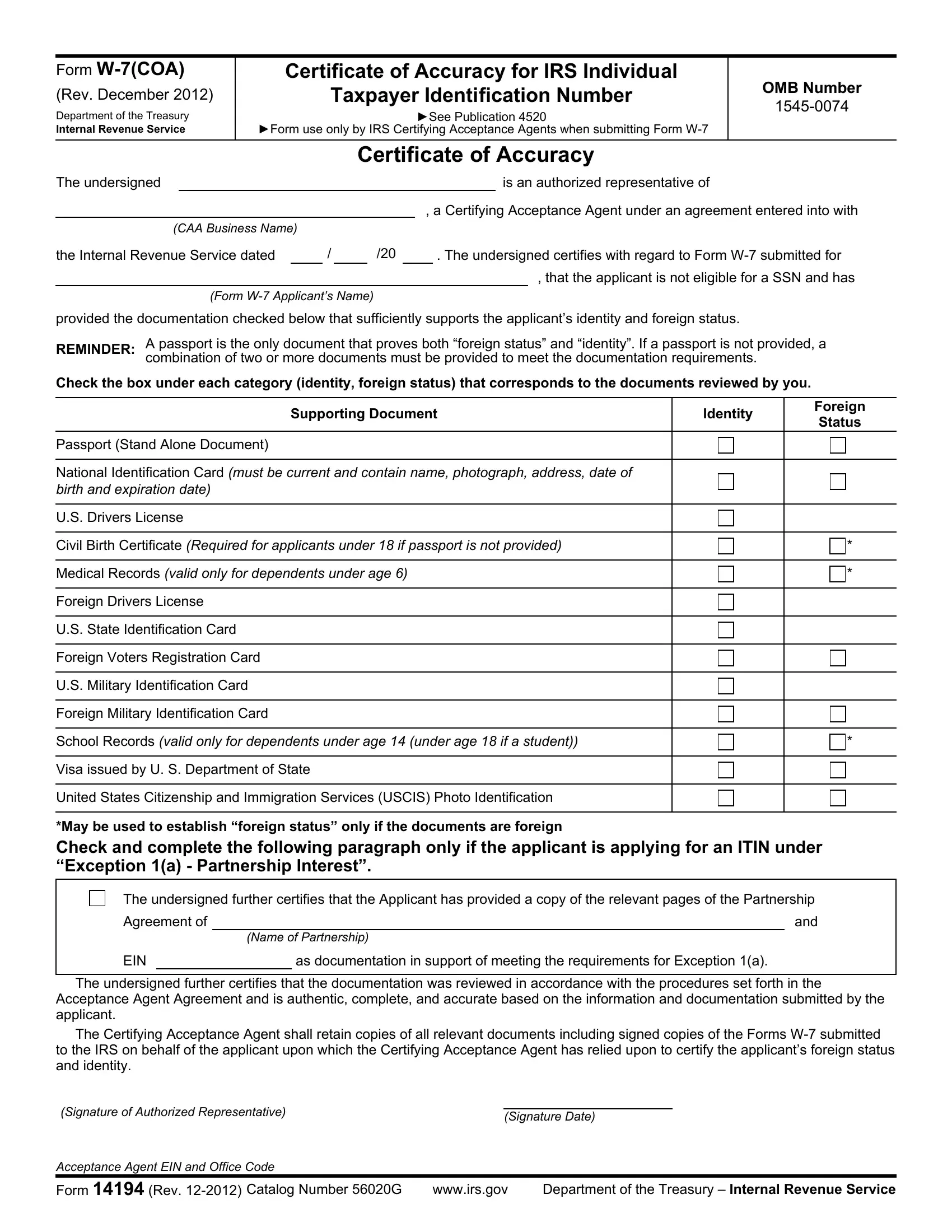

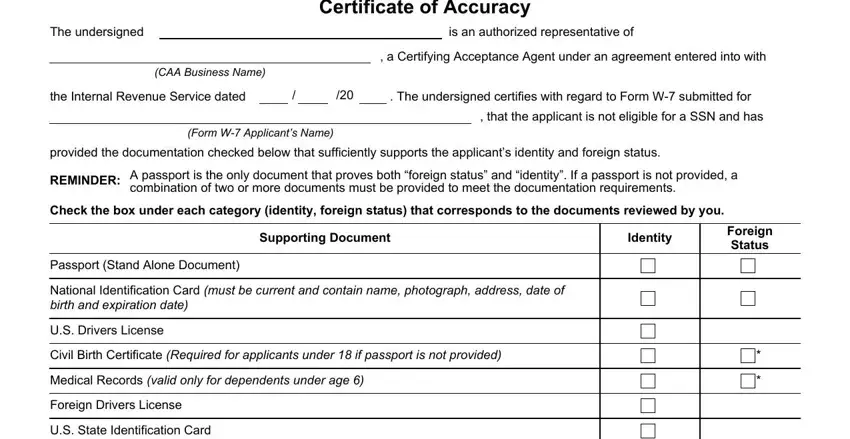

1. It is recommended to fill out the TAC properly, hence be mindful while working with the segments that contain these blanks:

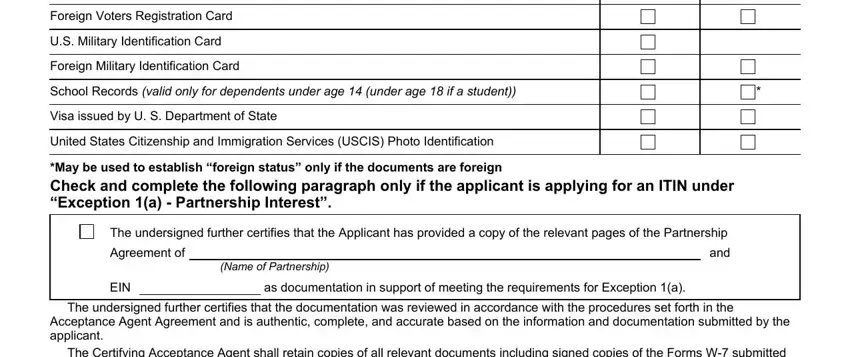

2. After the previous part is complete, you need to put in the essential particulars in Foreign Voters Registration Card, US Military Identification Card, Foreign Military Identification, School Records valid only for, Visa issued by U S Department of, United States Citizenship and, May be used to establish foreign, The undersigned further certifies, Agreement of, Name of Partnership, and, EIN, as documentation in support of, and The undersigned further certifies so you're able to move on to the third stage.

3. Your next part is easy - fill in every one of the fields in The undersigned further certifies, Signature of Authorized, Signature Date, Acceptance Agent EIN and Office, wwwirsgov, and Department of the Treasury in order to complete this process.

4. This paragraph arrives with the following form blanks to look at: The date that the Acceptance, prove the ITIN applicants identity, A statement by the CAA that they, knowledge the authenticity, The signature of the individual, date that it was signed, What is the purpose of Form WCOA, The COA is a certification by the, Who must submit a COA, All IRS ITIN Certifying Acceptance, Where can I find Form WCOA, Form WCOA can be found on the IRS, Supporting Documentation, You should check only the boxes, and Definitions The following chart.

People often make mistakes when filling in The date that the Acceptance in this part. Ensure that you reread what you enter here.

Step 3: Before moving on, ensure that all form fields were filled out properly. The moment you establish that it is fine, click on “Done." Join us now and immediately get TAC, ready for download. Every single modification made is handily kept , enabling you to modify the form at a later stage when required. FormsPal guarantees risk-free form editor with no personal information record-keeping or sharing. Feel comfortable knowing that your data is secure here!