Working with PDF forms online is definitely simple using our PDF tool. You can fill out omb 0960 0527 here painlessly. The tool is continually upgraded by our team, getting new awesome functions and becoming better. If you're seeking to begin, here's what it takes:

Step 1: Click on the "Get Form" button in the top section of this page to access our PDF tool.

Step 2: With our state-of-the-art PDF editing tool, it is easy to accomplish more than just complete blanks. Edit away and make your documents appear perfect with customized textual content added, or tweak the original input to perfection - all that comes with the capability to add your own images and sign the PDF off.

Completing this PDF requires attentiveness. Ensure that all necessary fields are filled in accurately.

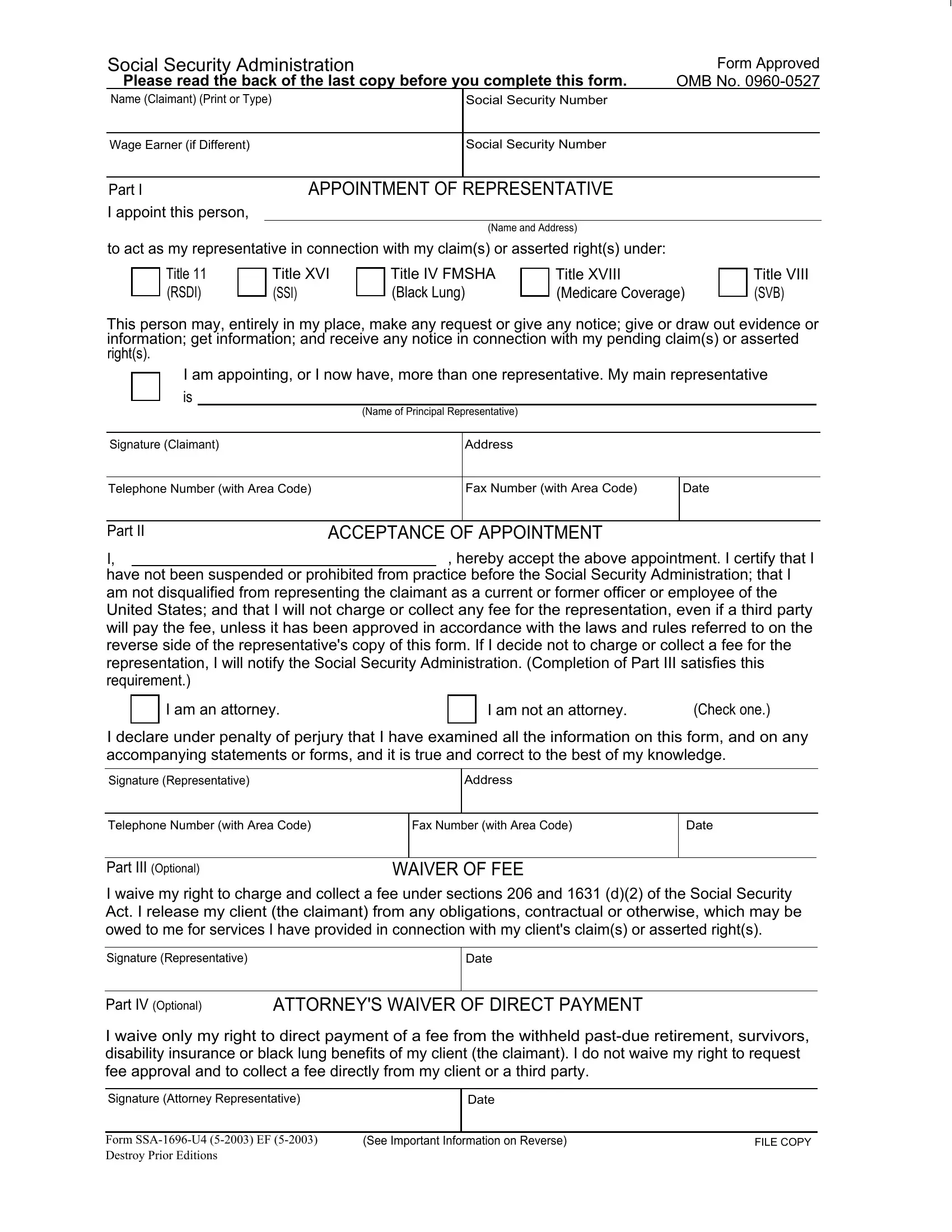

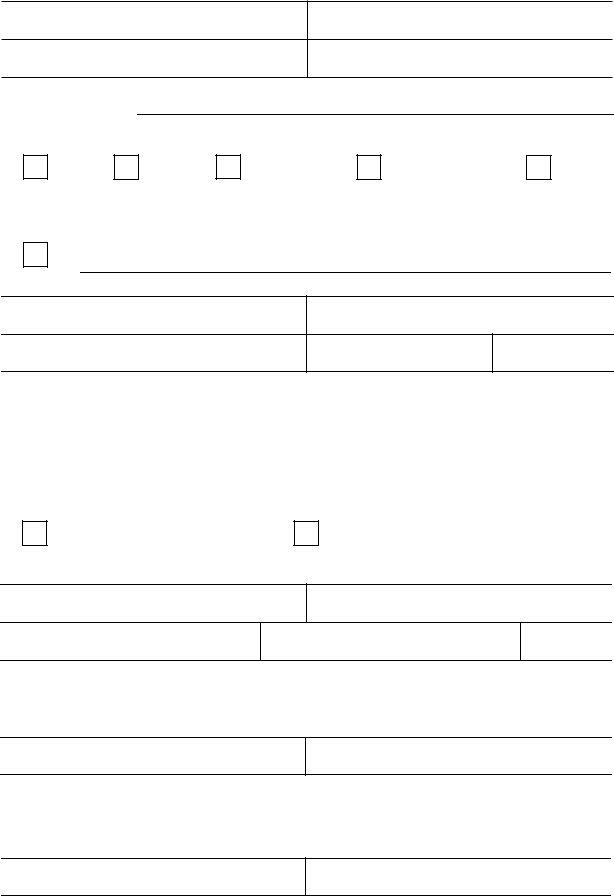

1. It's vital to fill out the omb 0960 0527 correctly, hence be careful when working with the segments containing all of these fields:

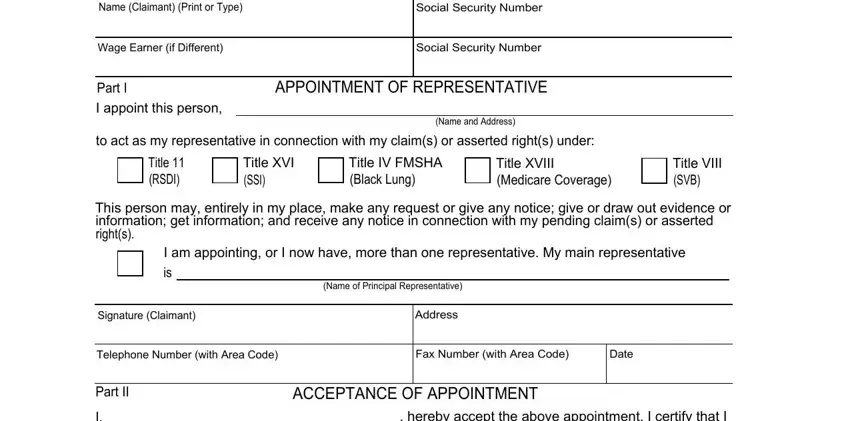

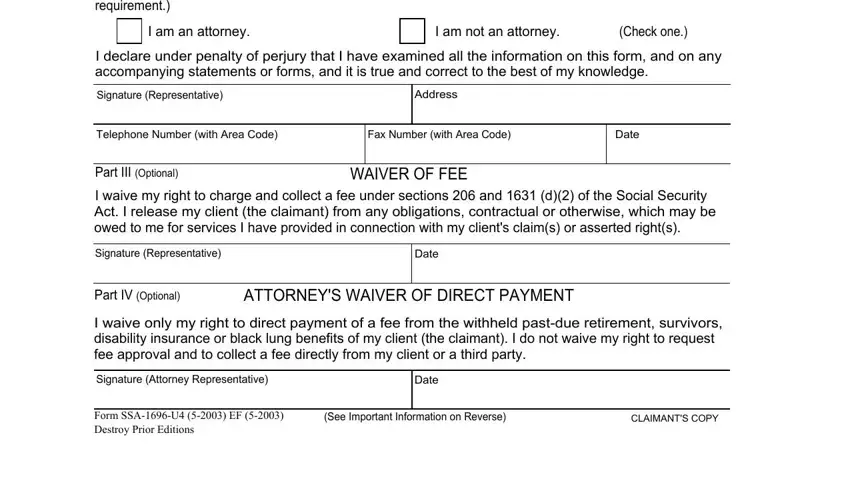

2. Just after filling out the last section, go on to the subsequent stage and fill in the essential particulars in all these blank fields - I have not been suspended or, I am an attorney, I am not an attorney, Check one, I declare under penalty of perjury, Signature Representative, Address, Telephone Number with Area Code, Fax Number with Area Code, Date, Part III Optional, WAIVER OF FEE, I waive my right to charge and, Signature Representative, and Date.

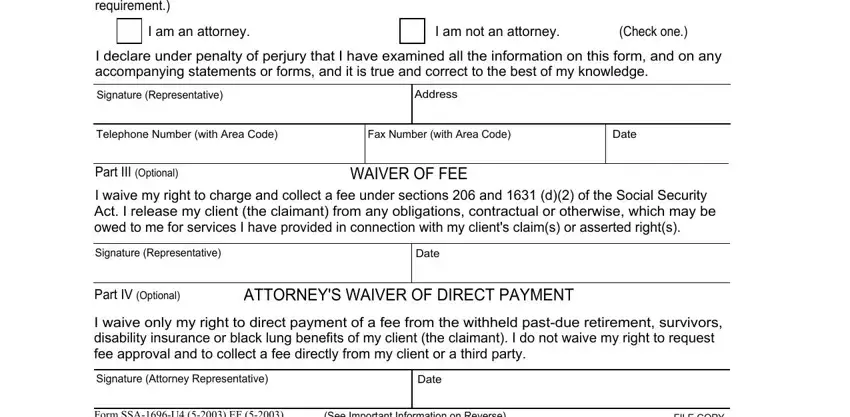

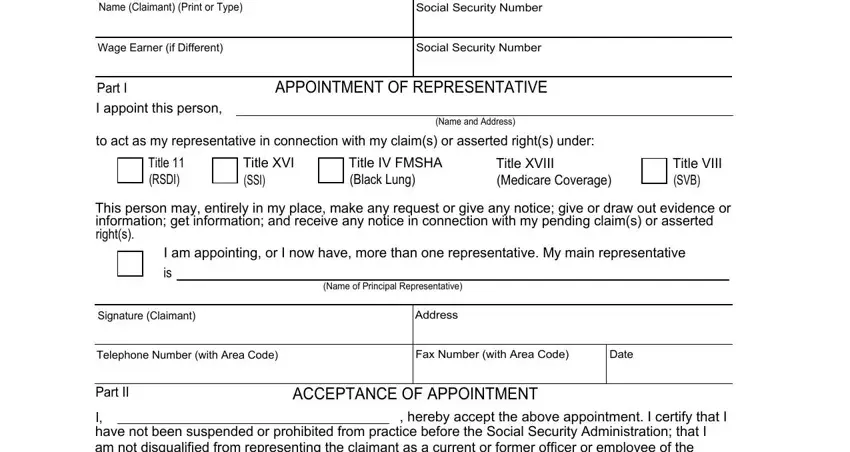

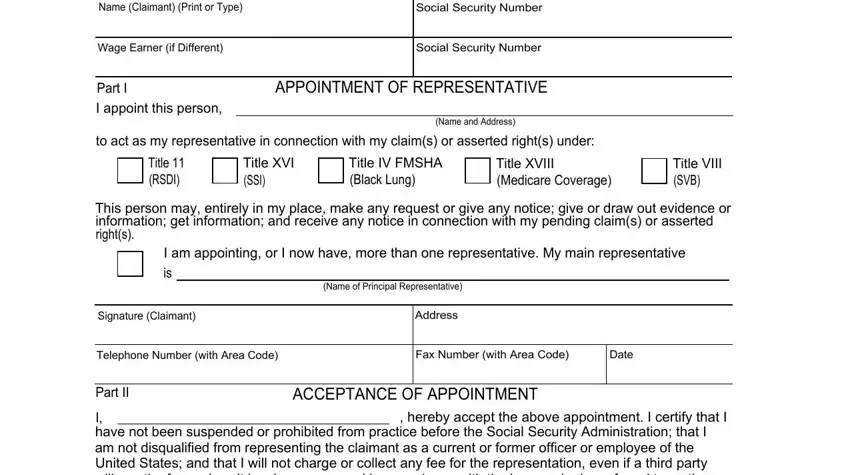

3. Completing Social Security Administration, Social Security Number, Wage Earner if Different, Social Security Number, Part I, I appoint this person, APPOINTMENT OF REPRESENTATIVE, Name and Address, to act as my representative in, Title RSDI, Title XVI SSI, Title IV FMSHA Black Lung, Title XVIII Medicare Coverage, Title VIII SVB, and This person may entirely in my is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

In terms of Social Security Administration and Title XVIII Medicare Coverage, ensure that you don't make any errors in this section. Those two are definitely the most significant ones in the document.

4. This next section requires some additional information. Ensure you complete all the necessary fields - I have not been suspended or, I am an attorney, I am not an attorney, Check one, I declare under penalty of perjury, Signature Representative, Address, Telephone Number with Area Code, Fax Number with Area Code, Date, Part III Optional, WAIVER OF FEE, I waive my right to charge and, Signature Representative, and Date - to proceed further in your process!

5. As you draw near to the completion of the document, there are actually a few extra points to complete. Specifically, Social Security Administration, Social Security Number, Wage Earner if Different, Social Security Number, Part I, I appoint this person, APPOINTMENT OF REPRESENTATIVE, Name and Address, to act as my representative in, Title RSDI, Title XVI SSI, Title IV FMSHA Black Lung, Title XVIII Medicare Coverage, Title VIII SVB, and This person may entirely in my should be filled out.

Step 3: Ensure your details are accurate and then just click "Done" to complete the project. Join FormsPal now and easily get omb 0960 0527, set for downloading. Each change made is conveniently preserved , which means you can change the form further as needed. Here at FormsPal.com, we do everything we can to be certain that your information is maintained secure.