Once you open the online tool for PDF editing by FormsPal, it is possible to fill in or edit Form 20 Ext here and now. FormsPal development team is relentlessly endeavoring to develop the tool and make it even easier for clients with its extensive functions. Enjoy an ever-improving experience today! Here's what you would need to do to start:

Step 1: Access the form inside our tool by clicking on the "Get Form Button" above on this webpage.

Step 2: The editor offers the capability to customize PDF documents in various ways. Transform it by adding any text, adjust what's originally in the document, and add a signature - all manageable within a few minutes!

This PDF form will involve some specific details; in order to ensure accuracy and reliability, please take note of the suggestions down below:

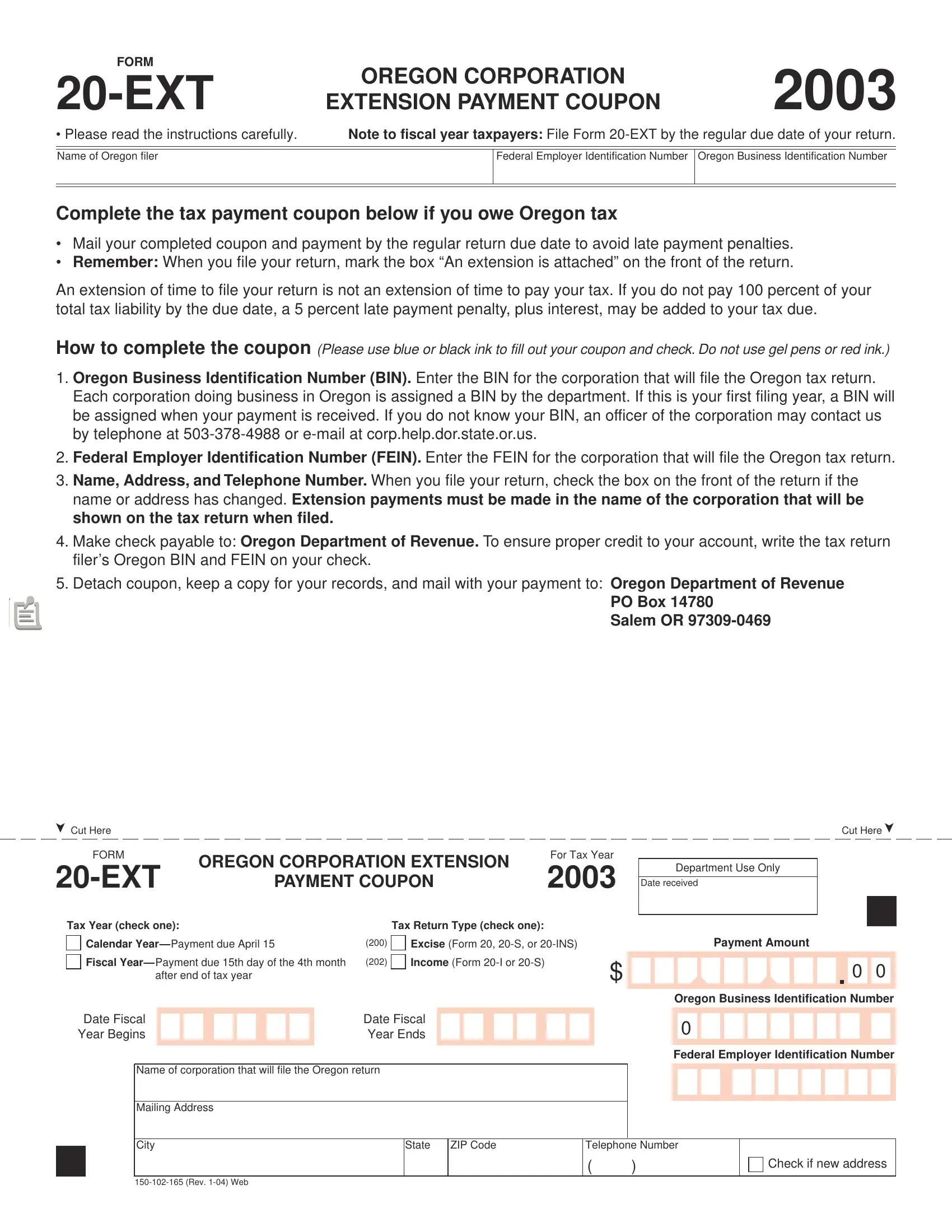

1. Begin filling out the Form 20 Ext with a number of essential blanks. Get all of the required information and make sure not a single thing neglected!

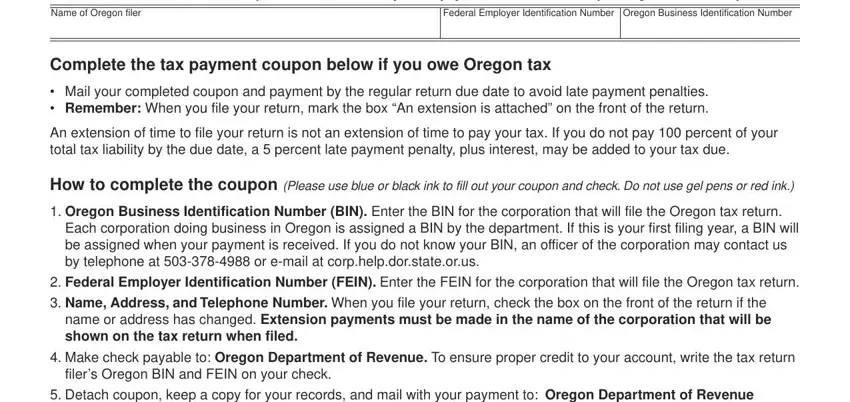

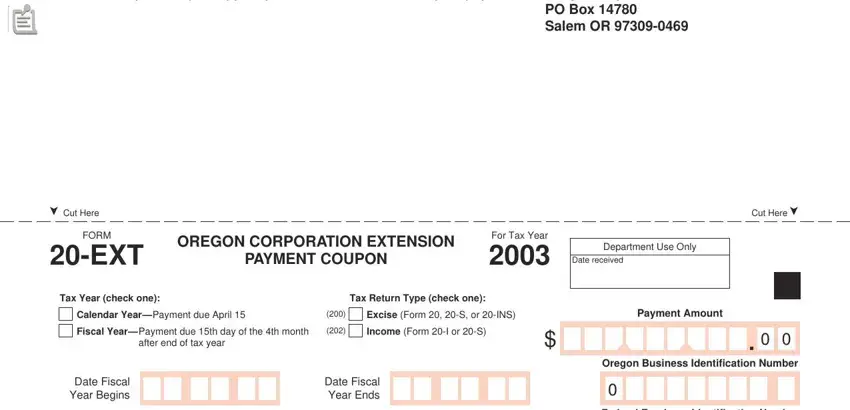

2. The next stage is to fill out the following blank fields: Detach coupon keep a copy for, PO Box Salem OR, Cut Here, FORM, EXT, OREGON CORPORATION EXTENSION, PAYMENT COUPON, For Tax Year, Department Use Only, Date received, Cut Here, Tax Year check one, Calendar YearPayment due April, Fiscal YearPayment due th day of, and after end of tax year.

As for PAYMENT COUPON and Date received, make sure you do everything right in this current part. These are thought to be the key fields in this file.

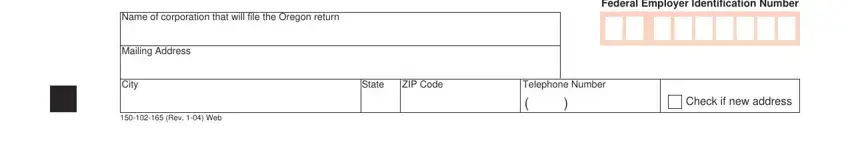

3. This step is usually straightforward - fill out all of the blanks in Name of corporation that will file, Federal Employer Identification, Mailing Address, City, Rev Web, State, ZIP Code, Telephone Number, and Check if new address in order to complete the current step.

Step 3: Always make sure that the details are accurate and click "Done" to finish the process. Obtain the Form 20 Ext once you sign up for a 7-day free trial. Instantly access the form inside your FormsPal account, together with any edits and changes automatically preserved! FormsPal guarantees your data confidentiality by using a protected method that in no way records or distributes any personal data provided. You can relax knowing your files are kept protected whenever you use our tools!