Instructions for Employers

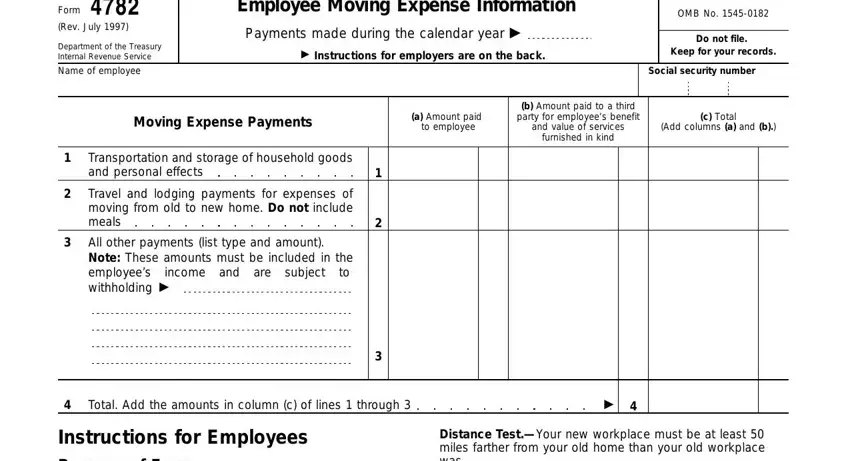

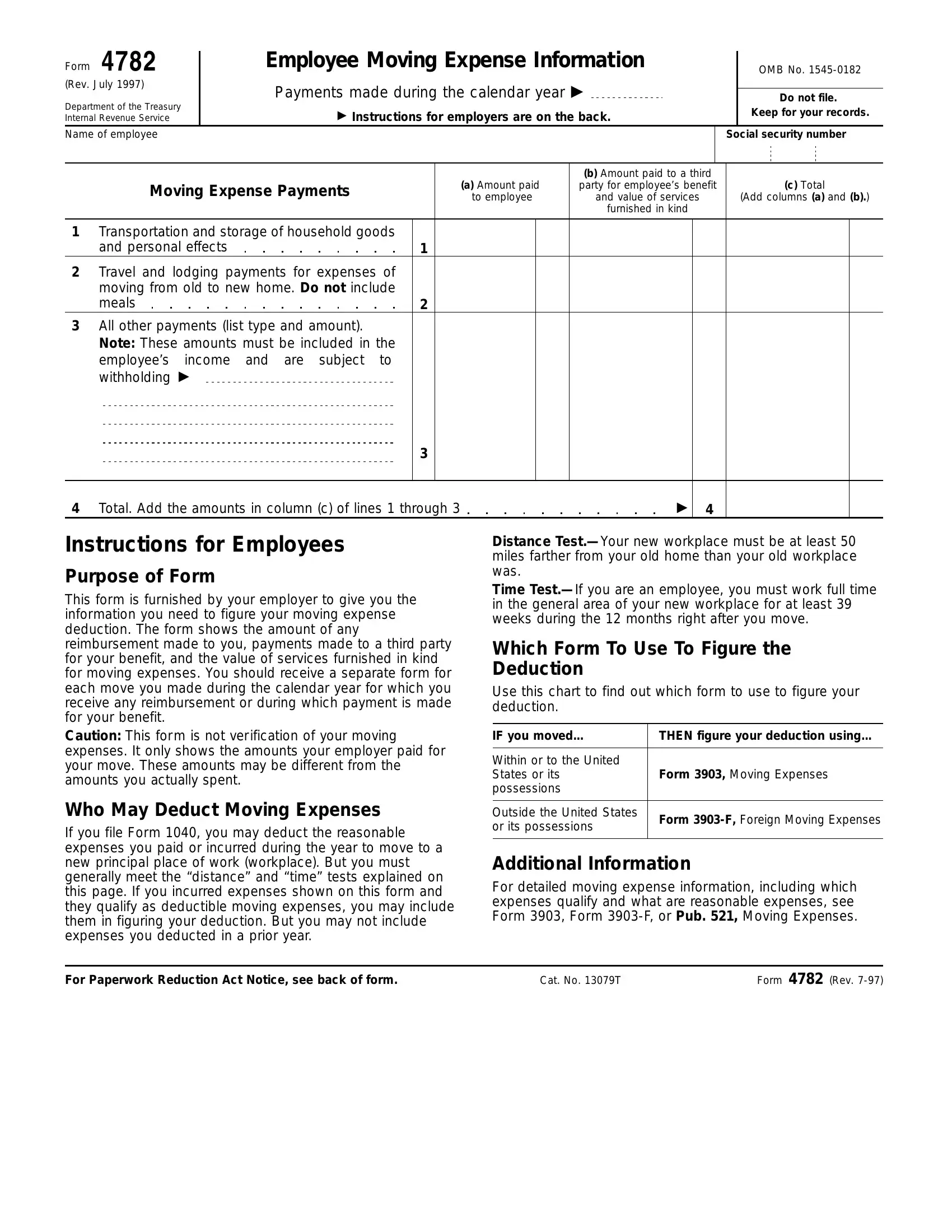

Purpose of Form

You are required to give your employees a statement showing a detailed breakdown of reimbursements or payments of moving expenses. Form 4782 may be used for this purpose or you may use your own form as long as it provides the same information as Form 4782. A separate form is required for each move made by an employee for which reimbursement or payment is made.

When To Give the Information

You must give Form 4782 (or your own form) to your employee by January 31 following the calendar year in which the employee received the reimbursement or payment. However, if the employee stops working for you before December 31 and asks for the form earlier, you must give him or her the completed form within 30 days of the request if the 30-day period ends before the regular January 31 deadline.

Penalty for Not Providing the Information or Providing Incorrect Information

If you fail to give Form 4782 (or your own form) to your employee by the due date or fail to include correct information, you may be subject to a $50 penalty for each failure.

How To Report Payments on Form W-2

Report qualified moving expense payments (see below) in box 13 of the employee’s Form W-2 using code P. Do not include these payments in boxes 1, 3, or 5 of Form W-2. These payments are not subject to withholding.

Other moving expense payments (including the value of any services furnished in kind) are included in wages and must be reported in box 1 of the employee’s Form W-2.

These payments are subject to income tax withholding and social security and Medicare taxes.

Qualified Moving Expense Payments.—Payments (including the value of any services furnished in kind) for an employee’s moving expenses are qualified moving expenses if:

1.The expenses would have been deductible by the employee if he or she had paid them, and

2.The employee did not deduct the expenses in a prior

year.

These payments should be made under rules similar to those of an accountable plan.

Additional Information

For more details on:

●Withholding requirements, see Pub. 15, Circular E, Employer’s Tax Guide.

●Which expenses would be deductible by your employee, see Form 3903, Moving Expenses, Form 3903-F, Foreign Moving Expenses, or Pub. 521, Moving Expenses.

Paperwork Reduction Act Notice.—We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Internal Revenue Code section 6103.

The time needed to complete this form will vary depending on individual circumstances. The estimated average time is: Recordkeeping, 3 hr., 21 min.; Learning about the law or the form, 6 min.; and Preparing the form, 10 min.

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Tax Forms Committee, Western Area Distribution Center, Rancho Cordova, CA 95743-0001. DO NOT send the form to this address. Instead, give it to your employee.