Form 4918 can be filled out effortlessly. Simply try FormsPal PDF editor to get the job done in a timely fashion. Our team is focused on providing you with the ideal experience with our tool by continuously releasing new functions and improvements. Our editor is now even more intuitive as the result of the newest updates! At this point, filling out PDF documents is a lot easier and faster than before. Should you be seeking to get going, here is what it will take:

Step 1: Firstly, open the pdf tool by clicking the "Get Form Button" above on this site.

Step 2: After you access the tool, you'll notice the document made ready to be filled out. Besides filling in various fields, you may also perform several other things with the Document, such as adding any text, editing the initial textual content, adding images, putting your signature on the form, and much more.

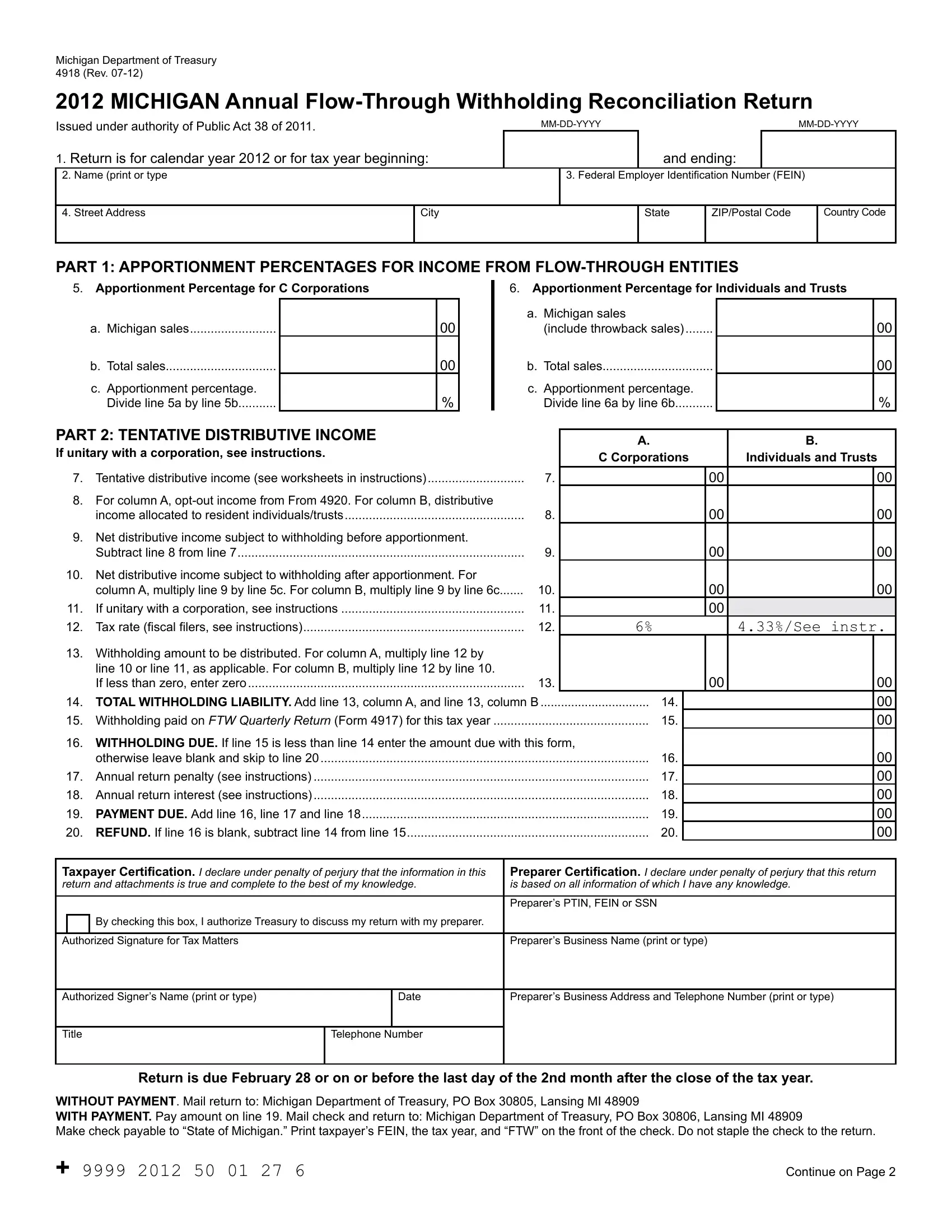

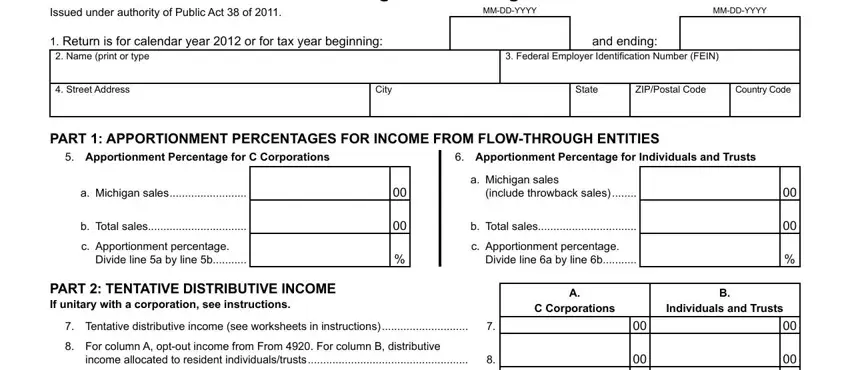

This document will need specific data to be entered, thus be sure you take your time to enter precisely what is asked:

1. It is very important fill out the Form 4918 correctly, therefore be attentive while filling in the sections that contain all these blank fields:

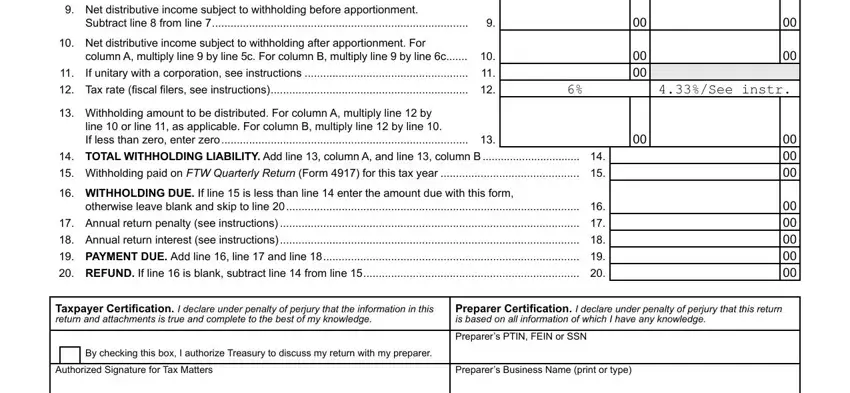

2. After this segment is completed, you're ready to insert the necessary particulars in Net distributive income subject, Subtract line from line, Net distributive income subject, column A multiply line by line c, If unitary with a corporation see, Tax rate iscal ilers see, Withholding amount to be, line or line as applicable For, ToTAl WITHHolDING lIAbIlITy Add, Withholding paid on FTW Quarterly, WITHHolDING Due If line is less, otherwise leave blank and skip to, Annual return penalty see, Annual return interest see, and PAyMeNT Due Add line line and so that you can progress to the 3rd step.

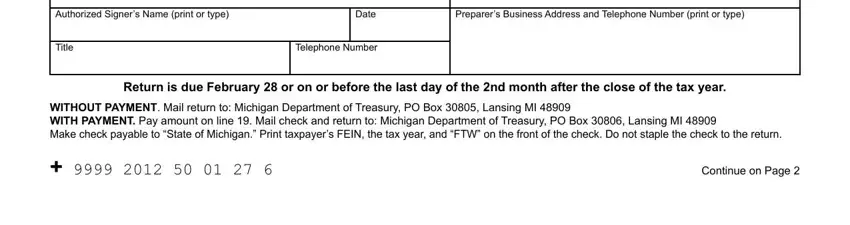

3. In this stage, check out Authorized Signers Name print or, Date, Preparers Business Address and, Title, Telephone Number, Return is due February or on or, WITHouT PAyMeNT Mail return to, and Continue on Page. Each one of these need to be filled in with greatest accuracy.

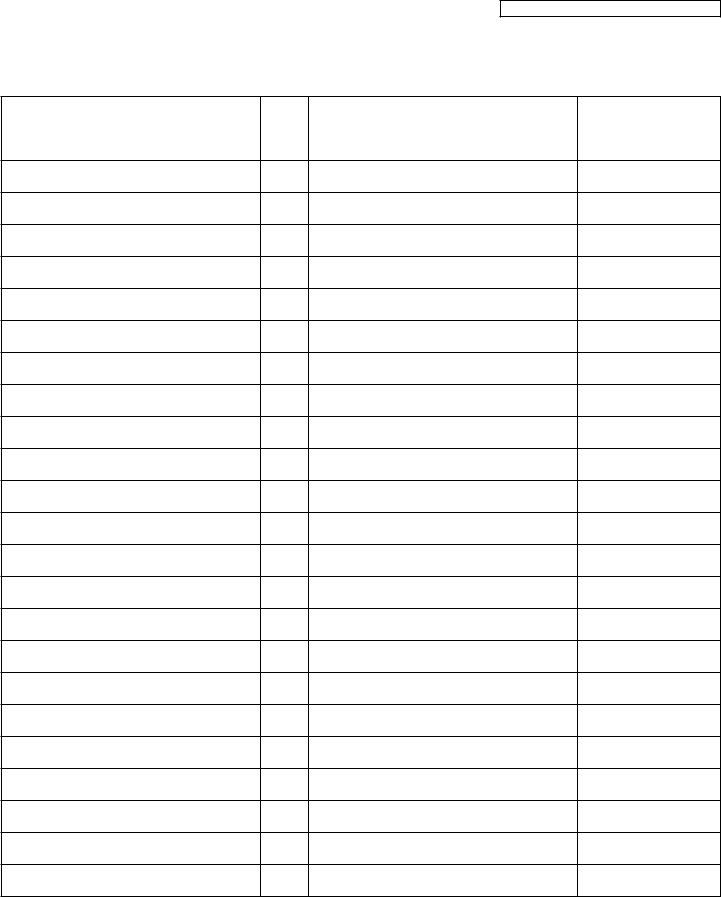

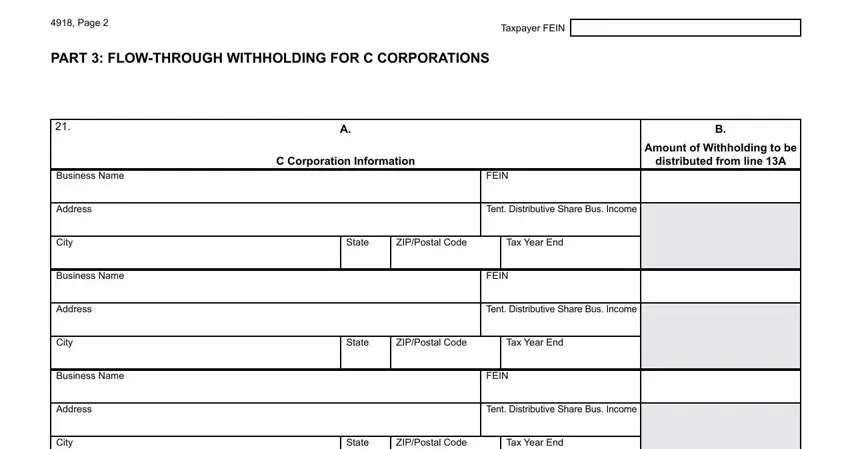

4. It's time to complete this fourth section! In this case you will get all of these Amount of Withholding to be, distributed from line A, Page, Taxpayer FEIN, PART FloWTHRouGH WITHHolDING FoR, Business Name, Address, City, Business Name, Address, City, Business Name, Address, City, and C Corporation Information blanks to fill in.

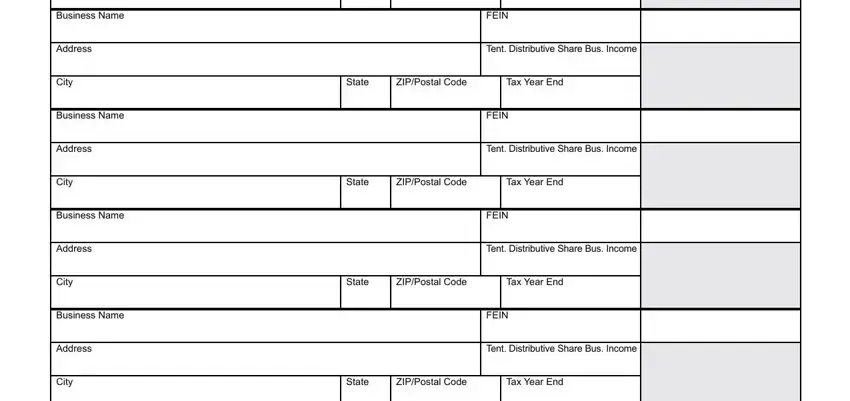

5. While you come near to the final sections of your document, you will find a few extra things to do. Mainly, Business Name, Address, City, Business Name, Address, City, Business Name, Address, City, Business Name, Address, City, FEIN, Tent Distributive Share Bus Income, and State should be done.

A lot of people frequently make errors when filling out Tent Distributive Share Bus Income in this section. Ensure you go over everything you enter here.

Step 3: Look through the information you have inserted in the form fields and then hit the "Done" button. Join FormsPal now and easily access Form 4918, all set for downloading. Every modification made is conveniently kept , letting you edit the document later as needed. Here at FormsPal.com, we strive to make sure your information is kept protected.