missouri gas tax refund form 4925 can be filled out online with ease. Just make use of FormsPal PDF editing tool to accomplish the job in a timely fashion. Our editor is constantly evolving to present the best user experience achievable, and that's due to our commitment to continual enhancement and listening closely to user comments. Here is what you would have to do to get going:

Step 1: Simply click the "Get Form Button" above on this webpage to access our pdf file editor. Here you will find all that is necessary to fill out your file.

Step 2: With our handy PDF editing tool, you could do more than merely fill out blank form fields. Express yourself and make your docs appear sublime with customized text added, or modify the original input to excellence - all that comes with an ability to add any type of photos and sign the document off.

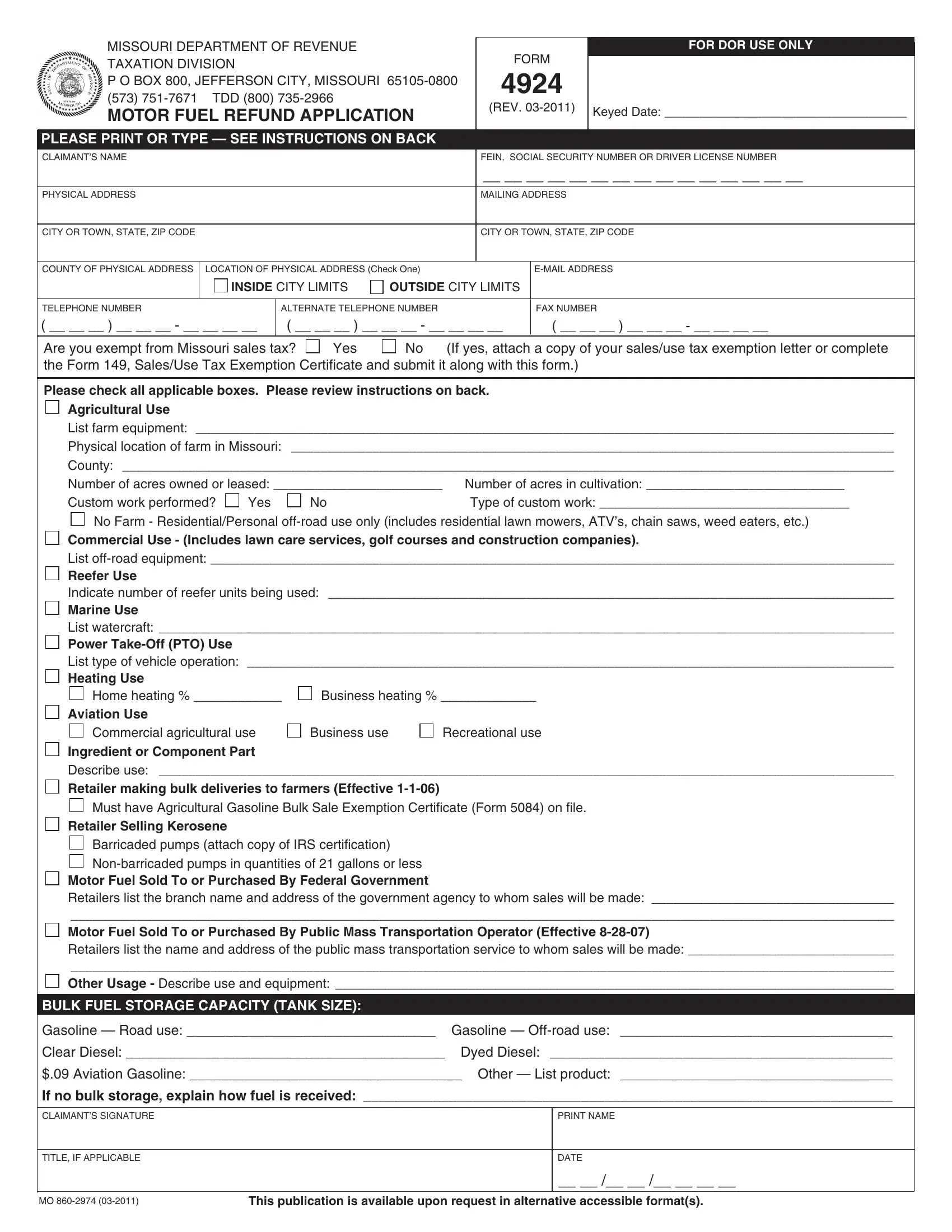

This PDF form will require specific info to be typed in, hence ensure you take the time to provide exactly what is required:

1. Begin filling out the missouri gas tax refund form 4925 with a selection of essential fields. Consider all of the information you need and make certain absolutely nothing is missed!

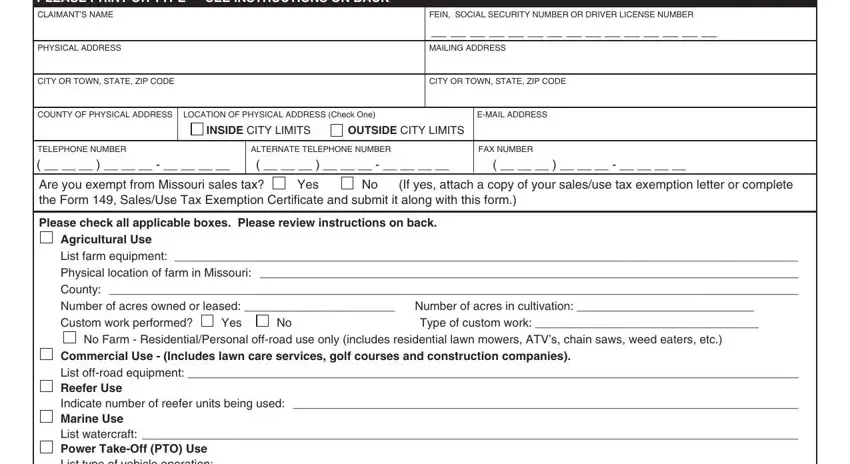

2. Your next part is to fill out all of the following fields: Commercial Use Includes lawn care, Home heating, Business heating, Aviation Use, Commercial agricultural use, Recreational use, Business use, Must have Agricultural Gasoline, Retailer Selling Kerosene, Barricaded pumps attach copy of, BULK FUEL STORAGE CAPACITY TANK, Gasoline Road use Gasoline, and Clear Diesel Dyed Diesel.

Lots of people frequently get some things wrong while completing Recreational use in this section. Don't forget to double-check what you enter here.

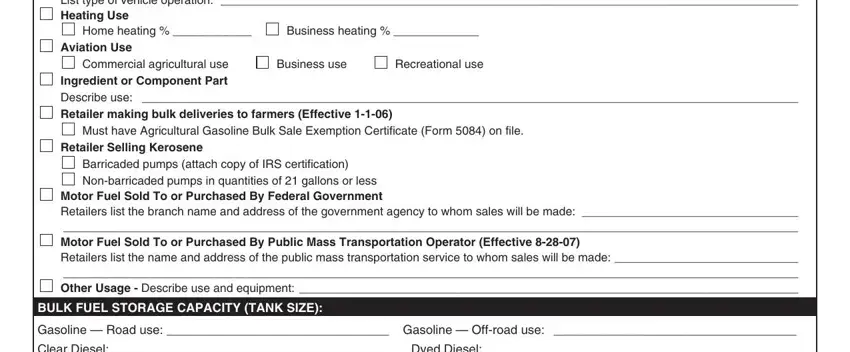

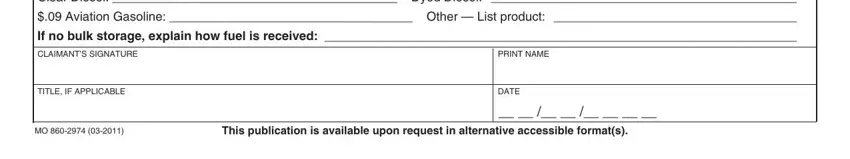

3. This next segment will be focused on Clear Diesel Dyed Diesel, Aviation Gasoline Other List, If no bulk storage explain how, CLAIMANTS SIGNATURE, TITLE IF APPLICABLE, PRINT NAME, DATE, and This publication is available upon - complete every one of these fields.

Step 3: Ensure the information is accurate and click on "Done" to continue further. Join FormsPal now and instantly gain access to missouri gas tax refund form 4925, all set for downloading. Each and every edit you make is conveniently preserved , so that you can change the file at a later time when required. When using FormsPal, you're able to fill out documents without stressing about database incidents or records being distributed. Our protected software helps to ensure that your private information is stored safely.