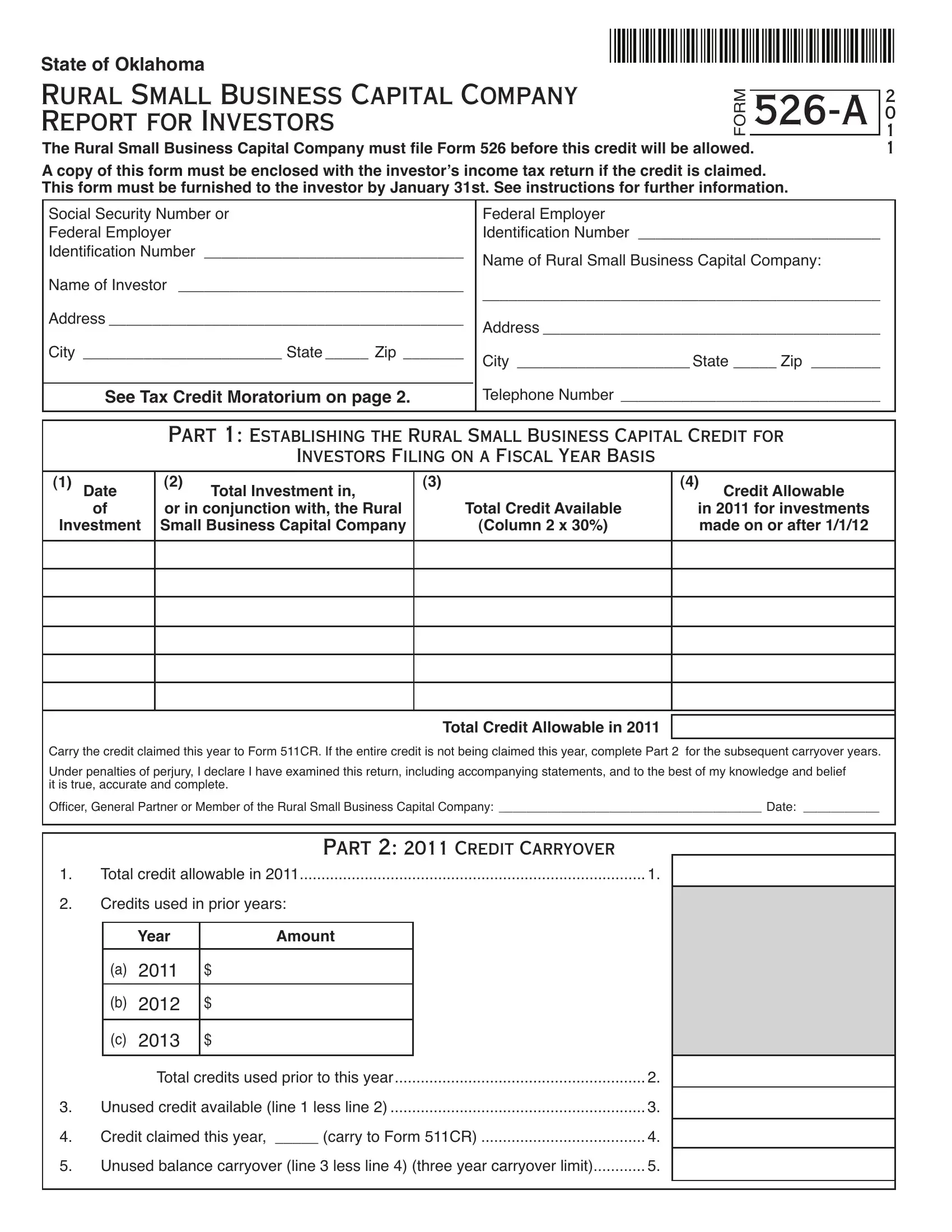

State of Oklahoma

|

RURAL SMALL BUSINESS CAPITAL COMPANY |

|

|

|

FORM |

|

|

|

REPORT FOR INVESTORS |

|

526-A |

|

|

|

The Rural Small Business Capital Company must ile Form 526 before this credit will be allowed.

A copy of this form must be enclosed with the investor’s income tax return if the credit is claimed. This form must be furnished to the investor by January 31st. See instructions for further information.

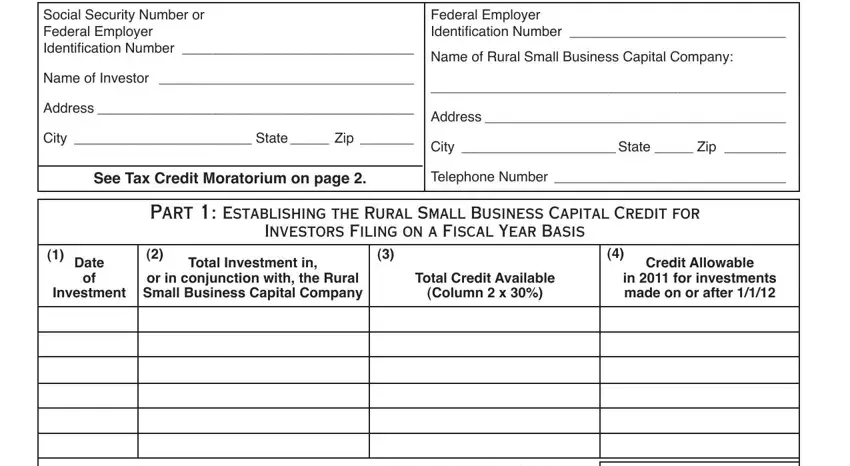

Social Security Number or |

Federal Employer |

Federal Employer |

Identiication Number ____________________________ |

Identiication Number ______________________________ |

Name of Rural Small Business Capital Company: |

Name of Investor _________________________________ |

______________________________________________ |

Address _________________________________________ |

Address _______________________________________ |

City _______________________ State _____ Zip _______ |

City ____________________ State _____ Zip ________ |

|

Telephone Number ______________________________ |

See Tax Credit Moratorium on page 2. |

|

|

PART 1: ESTABLISHING THE RURAL SMALL BUSINESS CAPITAL CREDIT FOR

INVESTORS FILING ON A FISCAL YEAR BASIS

(2)

Total Investment in,

or in conjunction with, the Rural Small Business Capital Company

(3)

Total Credit Available

(Column 2 x 30%)

(4)

Credit Allowable

in 2011 for investments made on or after 1/1/12

Total Credit Allowable in 2011

Carry the credit claimed this year to Form 511CR. If the entire credit is not being claimed this year, complete Part 2 for the subsequent carryover years.

Under penalties of perjury, I declare I have examined this return, including accompanying statements, and to the best of my knowledge and belief it is true, accurate and complete.

Oficer, General Partner or Member of the Rural Small Business Capital Company: ______________________________________ Date: ___________

|

|

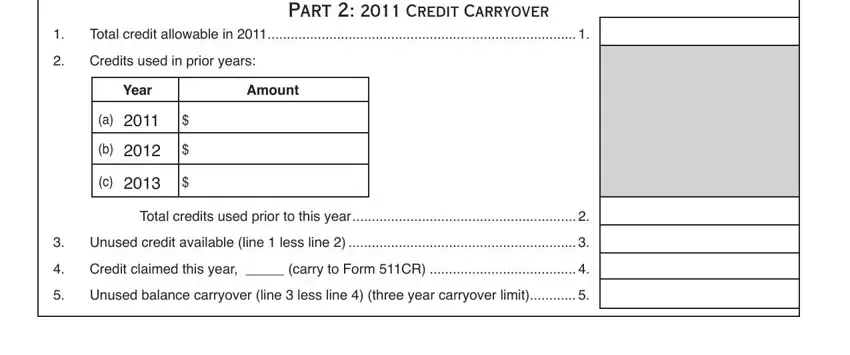

PART 2: 2011 CREDIT CARRYOVER |

1. |

Total credit allowable in 2011 |

................................................................................ 1. |

2. |

Credits used in prior years: |

|

(a)2011 $

(b)2012 $

(c)2013 $

|

Total credits used prior to this year |

2. |

3. |

Unused credit available (line 1 less line 2) |

3. |

4. |

Credit claimed this year, _____ (carry to Form 511CR) |

4. |

5. |

Unused balance carryover (line 3 less line 4) (three year carryover limit) |

5. |

2011 Form 526-A - Page 2

INSTRUCTIONS AND GUIDELINES FOR PREPARING

RURAL SMALL BUSINESS CAPITAL COMPANY REPORT FOR INVESTORS

68 Oklahoma Statutes (OS) Sec. 2357.71-2357.76 and Rule 710:50-15-87

Tax Credit Moratorium

No credit may be claimed for qualiied investments in Oklahoma rural small business ventures during the period of June 1, 2010 through December 31, 2011. No amount of qualiied investment made in a qualiied rural small business capital com- pany which has not been invested in one or more Oklahoma rural small business ventures prior to June 1, 2010 is eligible

for any credit otherwise authorized, and no investment made during the moratorium is eligible for a credit.

Note: Credit Carryover - Credits established before June 1, 2010 are eligible to be claimed under normal carryover provi-

sions if applicable.

Part 1 – Establishing the Credit

Column 1:

List the date(s) the investor invested in, or in conjunction with, the Rural Small Business Capital Company.

Column 2:

List the total amount(s) invested in, or in conjunction with, the Rural Small Business Capital Company. Any funds invested in an Oklahoma Rural Small Business Venture shall be subject to the following requirements:

1.The Oklahoma Rural Small Business Venture must issue its equity securities or subordinated debt instruments in exchange for a qualiied investment within 30 days of the date as of which the investment occurs;

2.The qualiied Rural Small Business Capital Company or any entity making an investment in conjunction with investment by a qualiied Rural Small Business Capital Company must relect the documented qualiied investment in the Oklahoma Rural Small Business Venture as an asset in its accounting system;

3.The qualiied Rural Small Business Capital Company shall not make a qualiied investment in an Oklahoma Small

Business Venture in which it has, at any time, more than 50% ownership, whether directly or indirectly, of the

voting interest entitled to elect the governing board of any Oklahoma Rural Small Business Venture in which a qualiied investment is to be made by the qualiied Rural Small Business Capital Company; and

4.Neither the qualiied Rural Small Business Capital Company nor the Oklahoma Rural Small Business Venture can enter into any agreement, whether formal or informal, written or unwritten, the purpose of which is to control, directly or indirectly, the return of a speciic amount of qualiied investment by the Oklahoma Rural Small Business Venture to the qualiied Rural Small Business Capital Company or the purpose of which is to cause or require the transfer of such speciic amount of qualiied investment to any other entity within ive years of the date the qualiied investment is made available to the Oklahoma Rural Small Business Venture.

Column 3:

Compute the total Credit available. Multiply the igure in column 2 by 30%.

Note: If a pass-through entity is entitled to the credit, the pass-through entity shall allocate such credit to one or more of the shareholders, partners or members of the pass-through entity, provided the total of all credits allocated shall not

exceed the amount of the credit to which the pass-through entity is entitled. The credit may only be claimed for funds borrowed by the pass-through entity to make a qualiied investment if a shareholder, partner or member to whom the credit is allocated has an unlimited and continuing legal obligation to repay the borrowed funds but the allocation may not exceed such shareholder’s, partner’s or member’s pro-rata equity share of the pass-through entity even if the taxpayer’s legal obligation to repay the borrowed funds is in excess of such amount.

Column 4:

List the amount of credit eligible to be claimed this year. The credit for investments made in a Rural Small Business Capi- tal Company may only be claimed for a taxable year during which such company invests funds in an Oklahoma Rural Small Business Venture and the credit shall be allowed only for the amount of the funds invested in such venture. The credit for investments made in conjunction with the Rural Small Business Capital Company may be claimed in the year in which investments were made.

Note: If a pass-through entity is entitled to the credit, the pass-through entity shall provide to each partner, shareholder or member, documentation showing their share of the “total credit allowable in 2011”. This documentation must be provided with the partner’s, shareholder’s or member’s income tax return when their share of the credit is being claimed.

2011 Form 526-A - Page 3

INSTRUCTIONS AND GUIDELINES FOR PREPARING

RURAL SMALL BUSINESS CAPITAL COMPANY REPORT FOR INVESTORS

(Continued)

Credits

There shall be allowed a credit equal to 30% of the amount of a qualiied investment in a qualiied Rural Small Business

Capital Company which is subsequently invested in an Oklahoma Rural Small Business Venture. The credit may only be claimed in the tax year in which the Rural Small Business Capital Company makes the qualiied investment in an Oklaho- ma Rural Small Business Venture if the funds are used in pursuit of a legitimate business purpose of the Oklahoma Rural Small Business Venture consistent with its organizational instrument, bylaws or other agreement responsible for the gov- ernance of the Rural Small Business Venture. If the tax credit exceeds the amount of tax liability, the amount of unused credit may be carried forward for a period not to exceed three years.

There shall also be allowed a credit equal to 30% of the investment invested in Oklahoma Rural Small Business Ventures in conjunction with qualiied investment in such ventures made by a qualiied Rural Small Business Capital Company. To qualify for the credit, qualiied investment shall be:

1.Made by a shareholder or partner of a qualiied Rural Small Business Capital Company that has made a qualiied investment in an Oklahoma Rural Small Business Venture;

2.Invested in the purchase of equity or near-equity in an Oklahoma Rural Small Business Venture;

3.Made under the same terms and conditions as the qualiied investment made by the qualiied Rural Small Business Capital Company; and

4.Limited to the lesser of:

a.200% of any qualiied investment by the taxpayer in the qualiied Rural Small Business Capital Company, or

b.200% of any qualiied investment made by the qualiied Rural Small Business Capital Company in the Okla-

homa Rural Small Business Venture.

If the tax credit exceeds the amount of tax liability, the amount of unused credit may be carried forward for a period not to exceed three years.

The Credit shall be allowed against income tax imposed by section 2355 or the bank “in lieu” tax imposed by section 2370.

No credit will be allowed for qualiied investments made prior to January 1, 2001 or from June 1, 2010 to December 31, 2011, nor for the same qualiied investment for which a Small Business Capital Credit is claimed under section 2357.62 or

2357.63.

Recapture

The Oklahoma Tax Commission (OTC) is authorized to recapture the credit if it inds that the transaction does not meet

the requirements of the Rural Venture Capital Formation Incentive Act.

Reporting Requirement

The Rural Small Business Capital Company must furnish this form to the investor by January 31st of the year following

when the investment becomes eligible for the credit. A copy must be enclosed with the investor’s income tax return if the credit is claimed. If the investor is a partnership, S-Corporation or other pass-through entity, the entity must provide to each partner, shareholder or member, documentation showing their share of the “total credit allowed in 2011”. Documen- tation must be provided with the partner’s, shareholder’s or member’s income tax return when their share of the credit is being claimed.

Part 2 – 2011 Credit Carryover

The credit not used may be carried over, in order, to each of the three years following the year in which the credit was

eligible to be claimed. Complete Part 2 to compute the amount of the 2011 credit carryover to be used in each of the next three subsequent years. Keep a copy of this form to ile with your return for each such year in which the 2011 credit car- ryover is claimed.

Notice

Effective July 1, 2011

Tax credits transferred or allocated must be reported on Oklahoma Tax Commission Form 569. Failure to ile Form 569 will result in the affected credits being denied by the Oklahoma Tax Commission pursuant to 68 OS Sec. 2357.1A-2.