Oregon offers a unique program that is beneficial to business owners and sole proprietors. Form 530 is an Oregon income tax credit that allows for a 20% reduction of Oregon taxable income. This program is available to all businesses in Oregon, regardless of size or location. There are certain eligibility requirements that must be met in order to qualify, so it's important to understand the specifics of the credit before applying. In this blog post, we'll provide an overview of the Form 530 Oregon program and outline the eligibility requirements. We'll also provide tips on how to apply for the credit and what you need to know if you're approved. So, if you're interested in learning more about this program, read on!

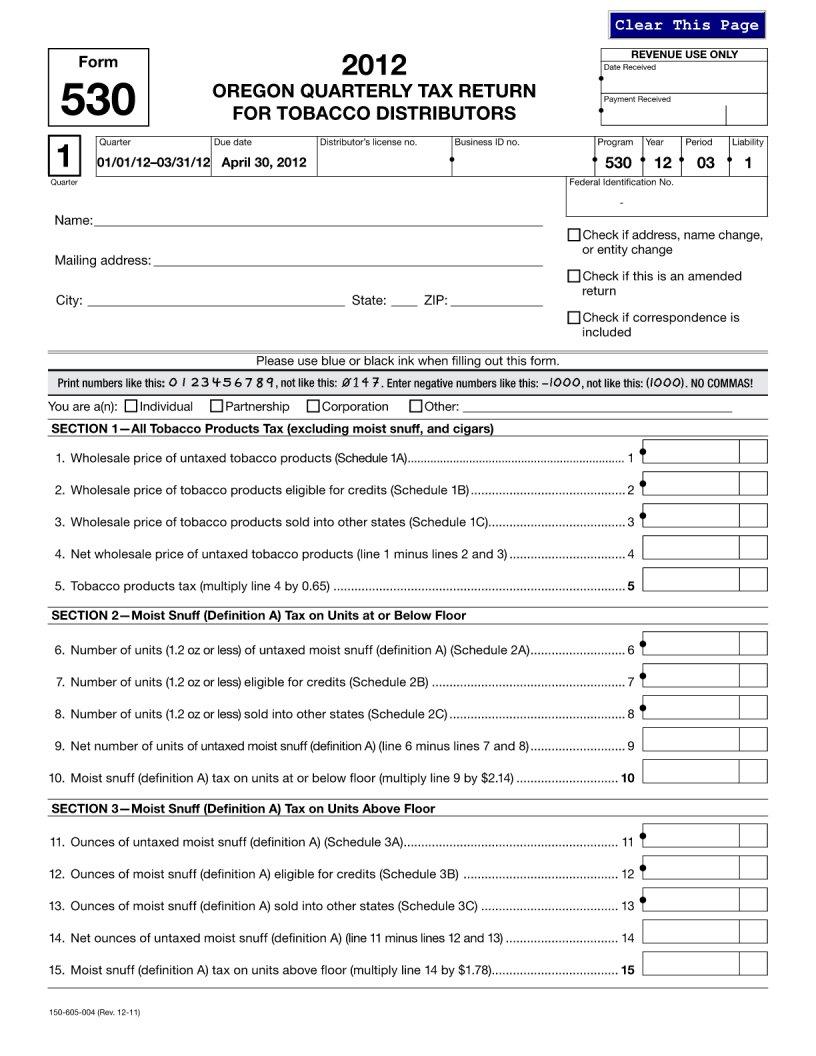

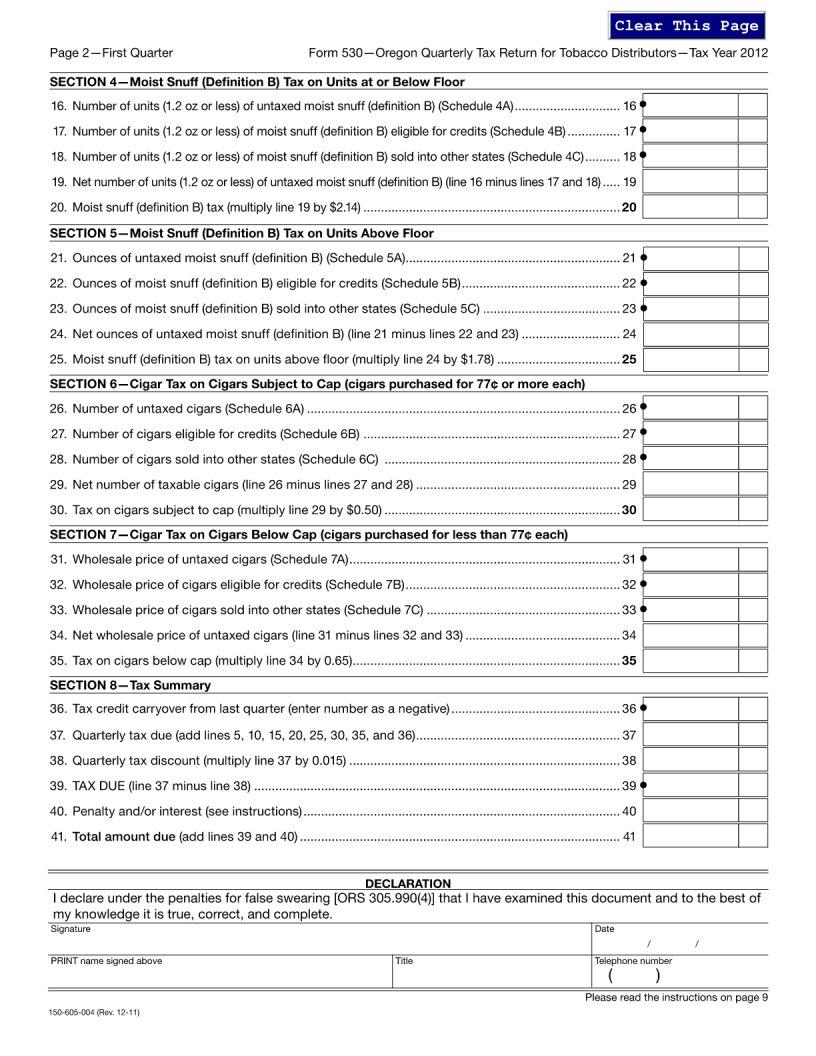

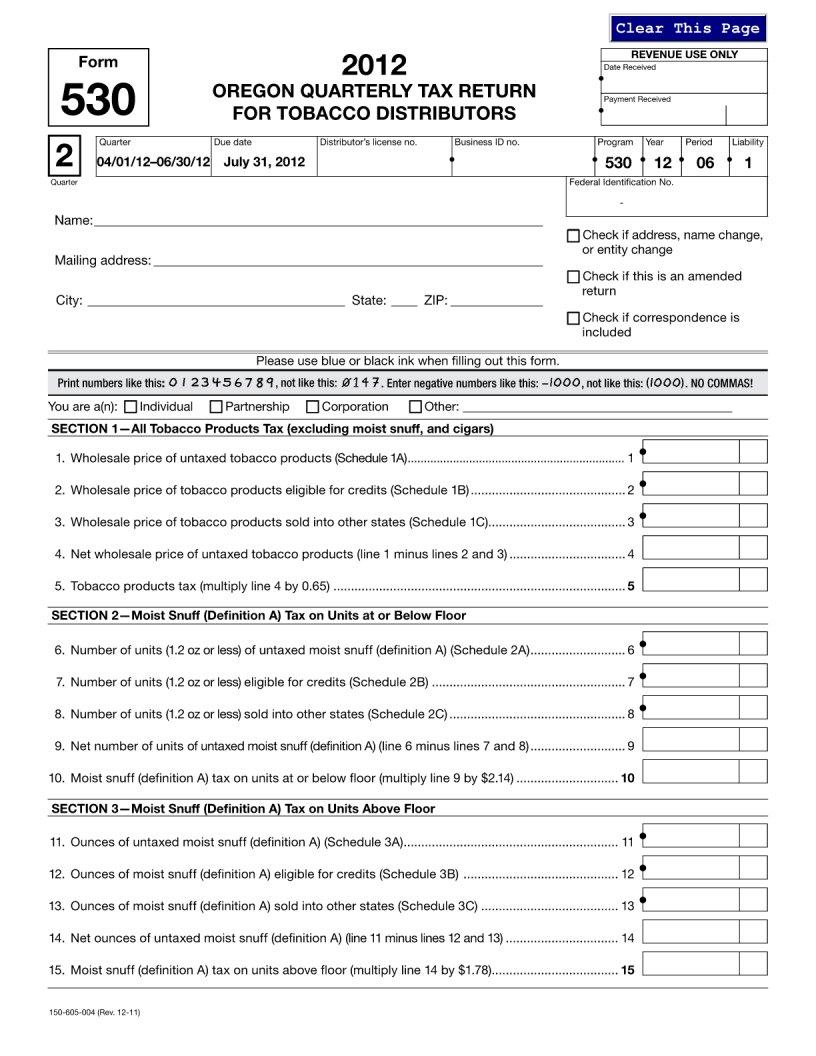

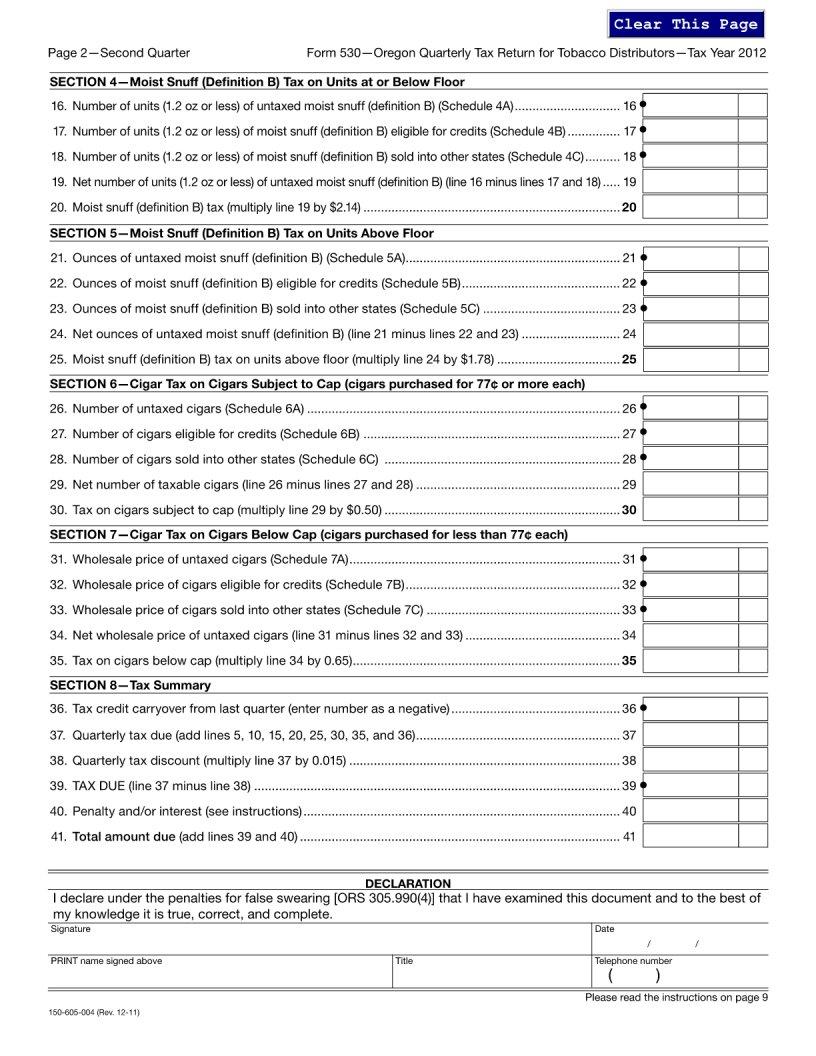

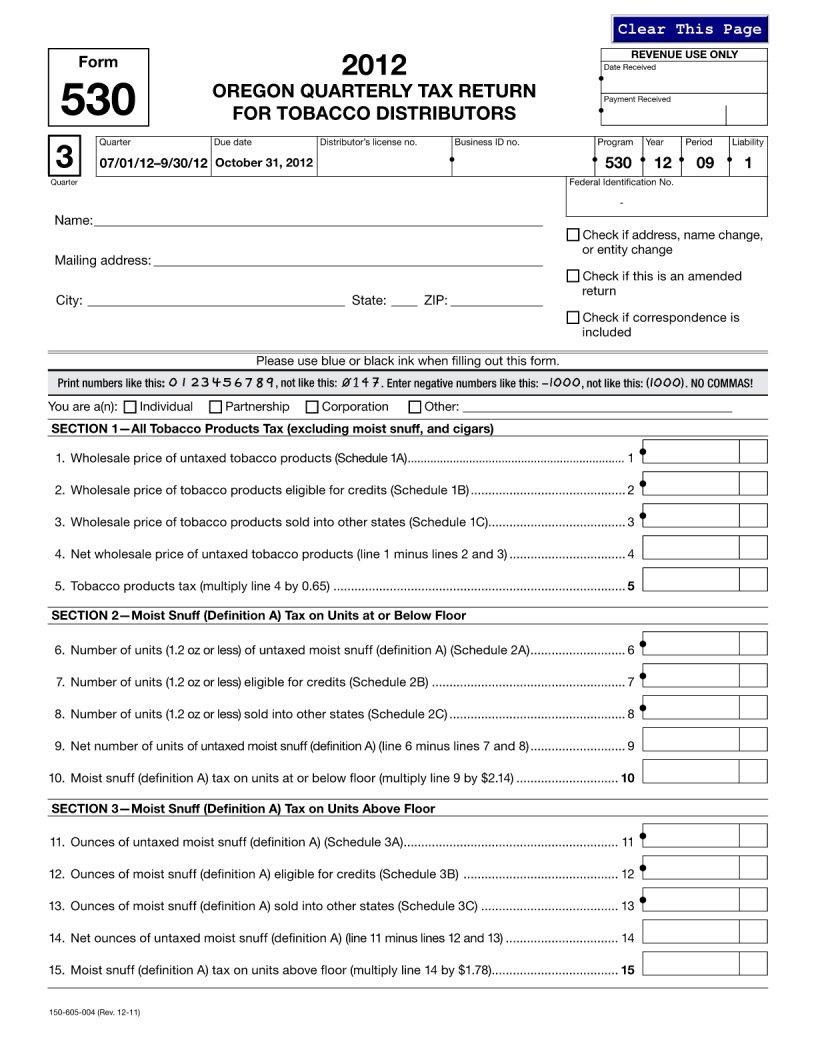

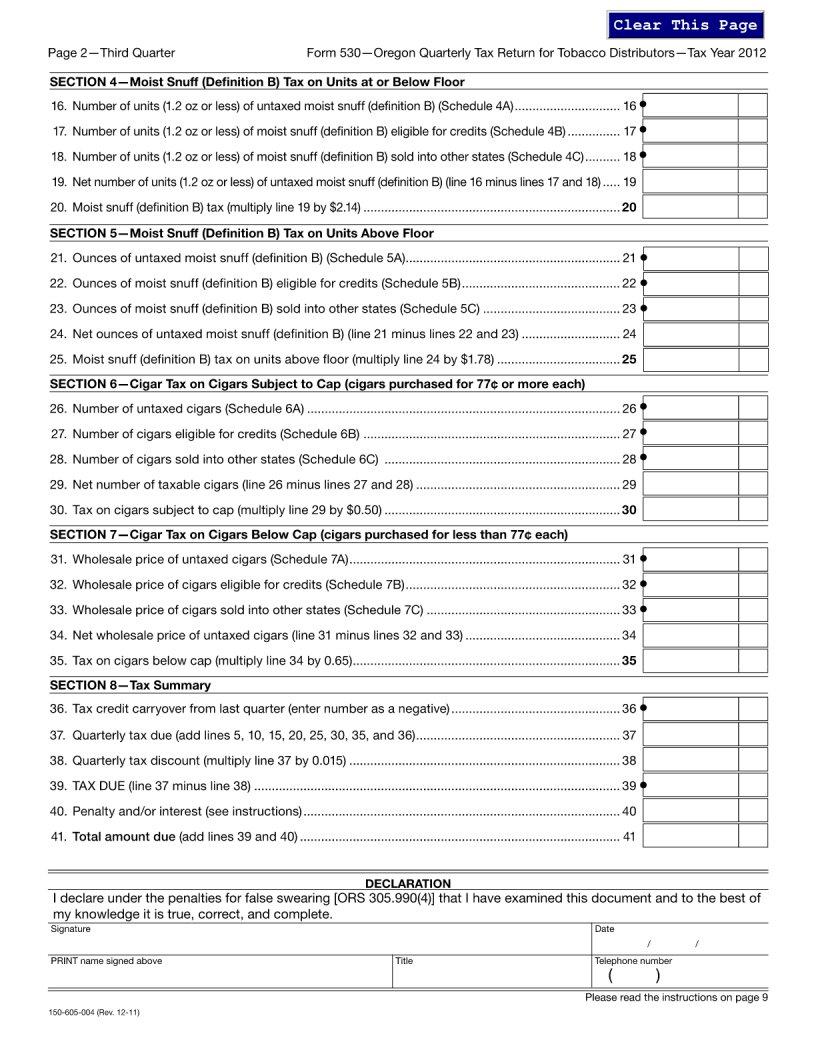

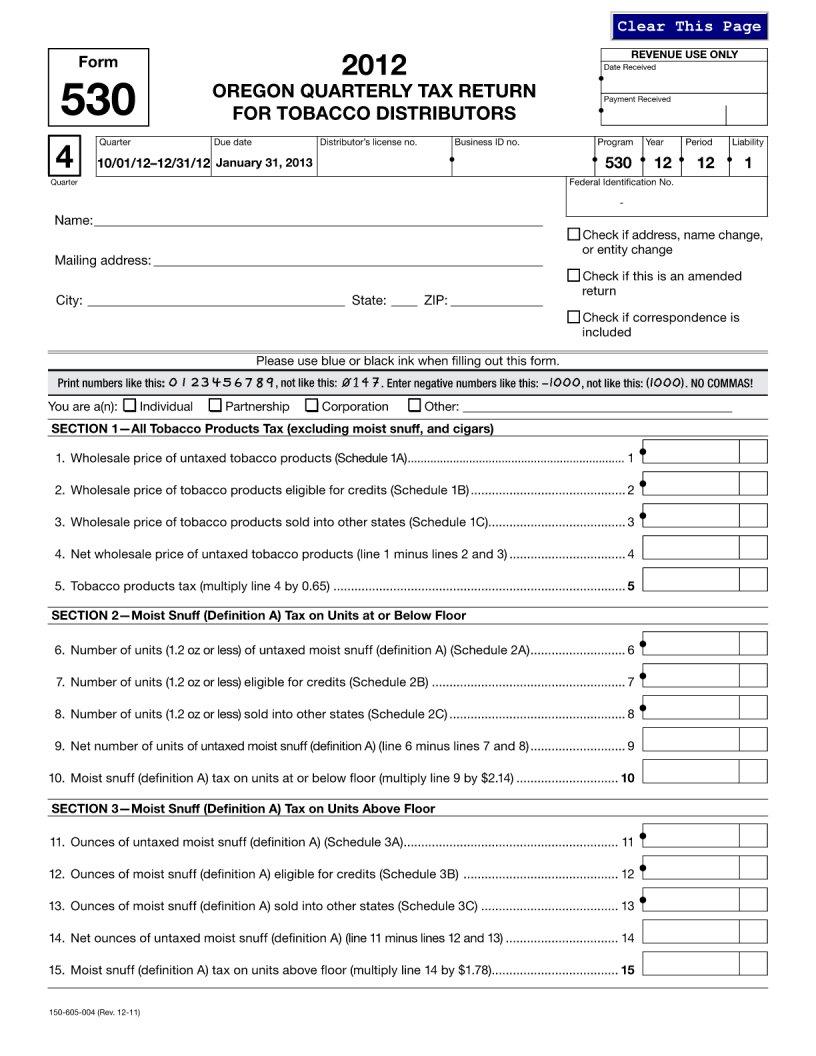

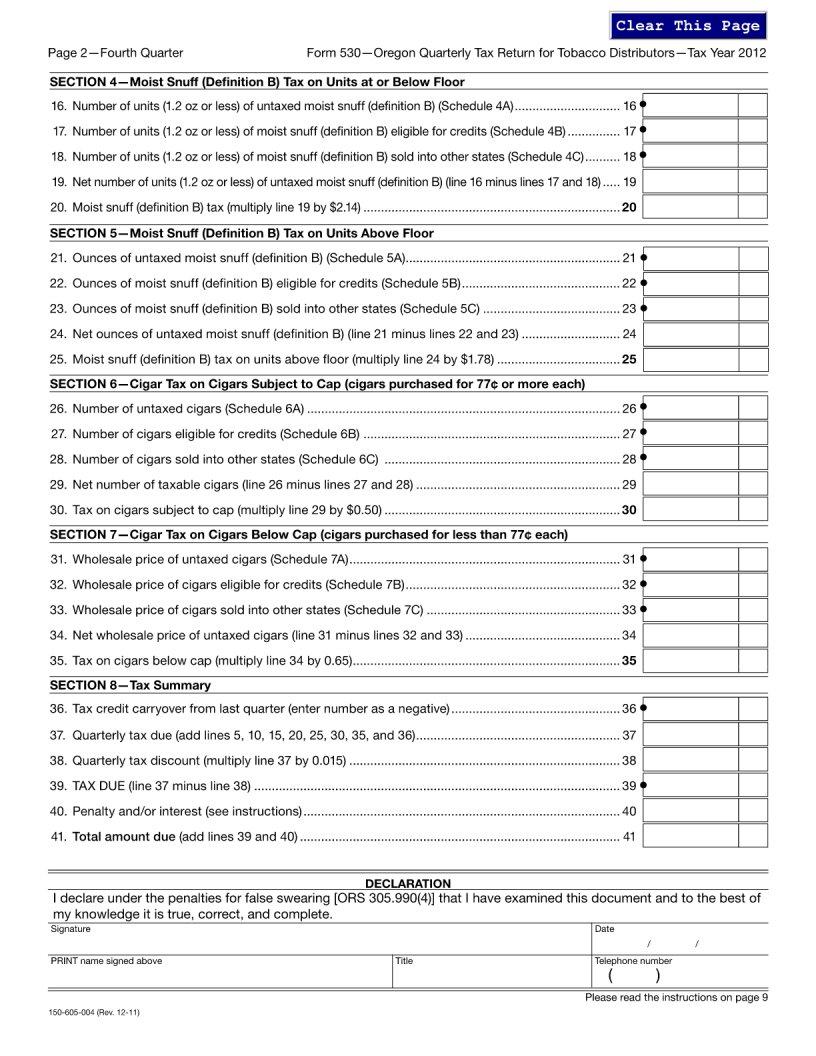

| Question | Answer |

|---|---|

| Form Name | Form 530 Oregon |

| Form Length | 9 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min 15 sec |

| Other names | oregon quarterly tax form, false, 2--Moist, 7--Cigar |