Handling PDF documents online can be simple using our PDF tool. You can fill in 540ez 2019 here with no trouble. To maintain our tool on the forefront of efficiency, we work to put into practice user-driven capabilities and improvements on a regular basis. We're at all times looking for feedback - assist us with revolutionizing the way you work with PDF files. Getting underway is easy! All you have to do is stick to these easy steps down below:

Step 1: Open the form in our editor by clicking the "Get Form Button" at the top of this page.

Step 2: This editor will allow you to customize PDF documents in a variety of ways. Modify it with personalized text, adjust original content, and add a signature - all doable within minutes!

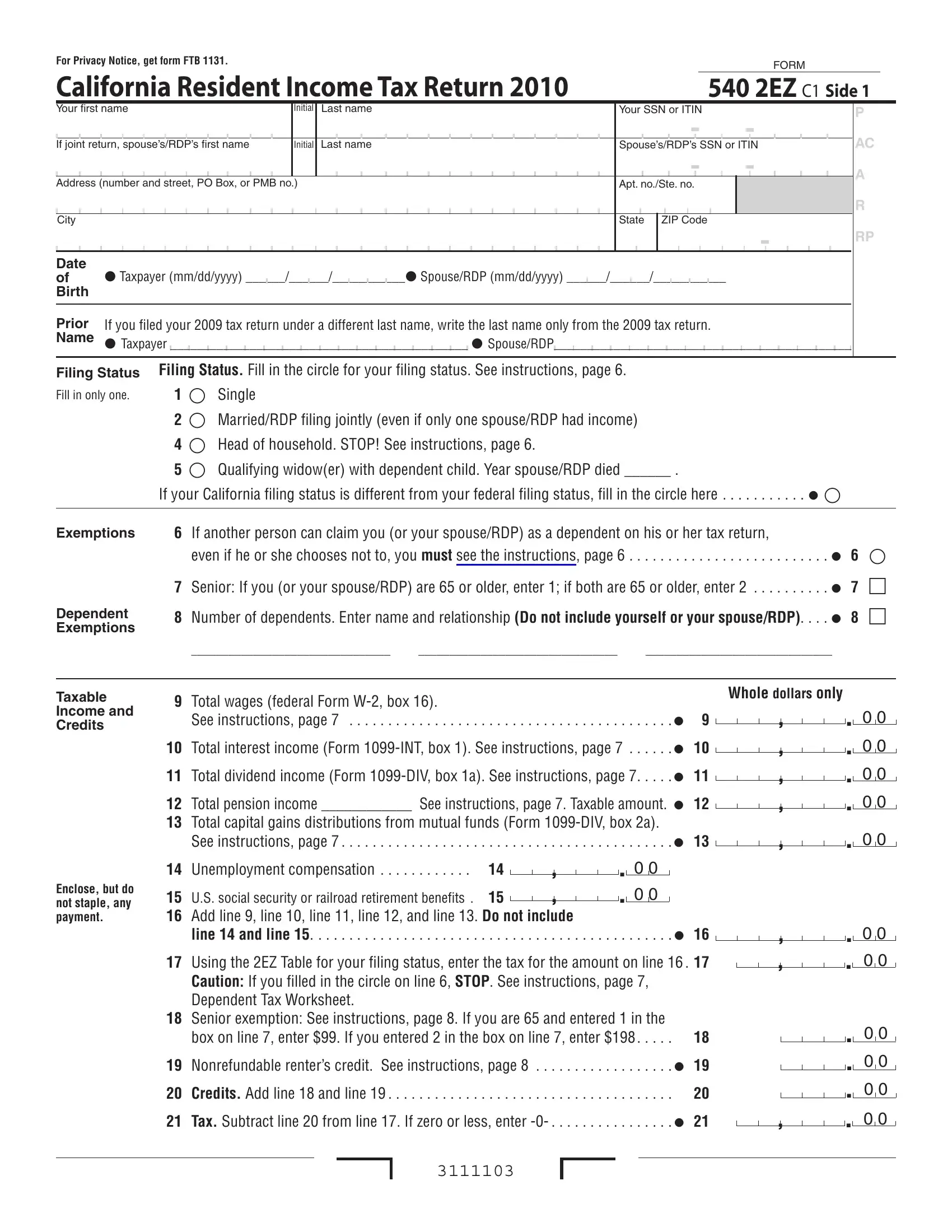

So as to finalize this PDF form, make certain you provide the information you need in every area:

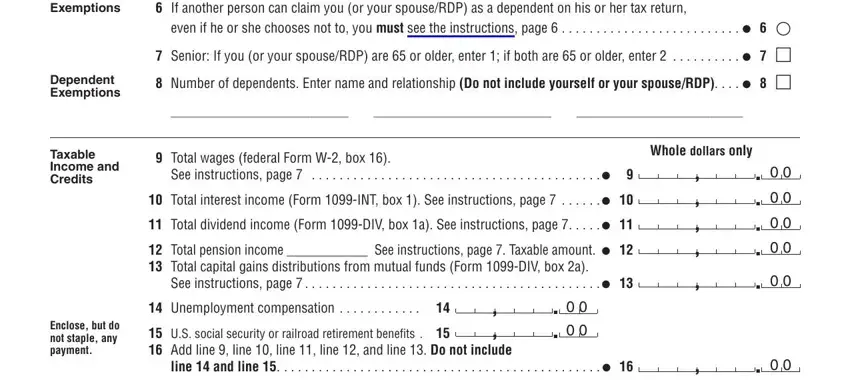

1. Before anything else, when filling in the 540ez 2019, beging with the section containing subsequent fields:

2. Once your current task is complete, take the next step – fill out all of these fields - Exemptions, If another person can claim you, Dependent Exemptions, Taxable Income and Credits, Enclose but do not staple any, even if he or she chooses not to, Total wages federal Form W box , See instructions page , See instructions page , Unemployment compensation , line and line , and Whole dollars only with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

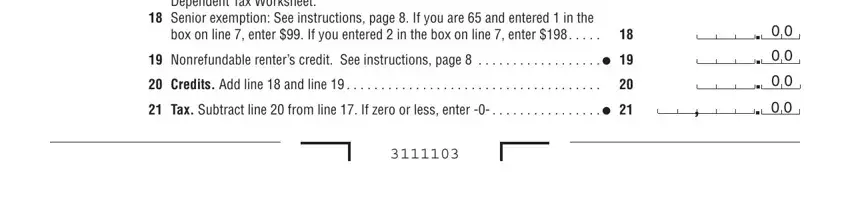

3. Completing Caution If you filled in the circle, Senior exemption See instructions, and box on line enter If you entered is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

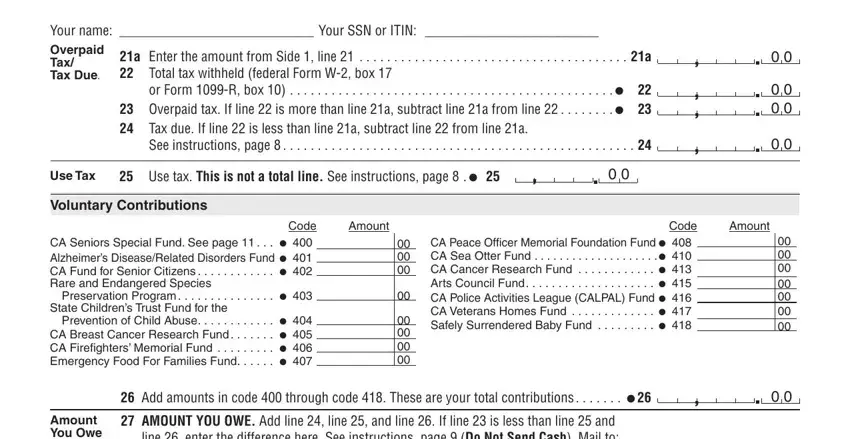

4. This next section requires some additional information. Ensure you complete all the necessary fields - Your name Your SSN or ITIN , a Enter the amount from Side line, or Form R box , See instructions page , Use Tax, Use tax This is not a total line, Voluntary Contributions, Code Amount, CA Seniors Special Fund See page , Code Amount, CA Peace Officer Memorial, Amount You Owe, and Add amounts in code through code - to proceed further in your process!

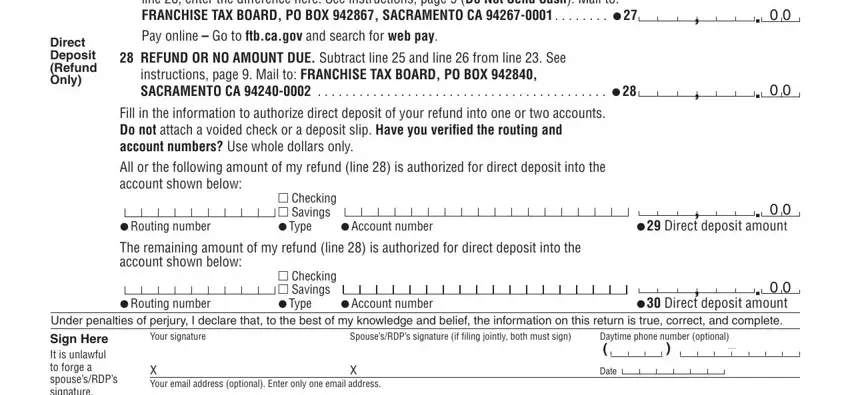

5. This very last notch to complete this PDF form is crucial. You need to fill in the mandatory blank fields, like Amount You Owe, Direct Deposit Refund Only, Add amounts in code through code, REFUND OR NO AMOUNT DUE Subtract, instructions page Mail to, Direct deposit amount, Fill in the information to, m Checking m Savings Type, m Checking m Savings Type, Account number, Direct deposit amount Under, Account number, Sign Here It is unlawful to forge, Your signature, and SpousesRDPs signature if filing, before using the form. Neglecting to accomplish that could result in an unfinished and probably invalid paper!

It is easy to make a mistake while completing your Direct deposit amount, hence you'll want to reread it before you send it in.

Step 3: Make certain the information is accurate and click "Done" to continue further. After setting up afree trial account here, you'll be able to download 540ez 2019 or email it right off. The PDF document will also be readily available from your personal account page with your every modification. FormsPal provides risk-free form editing without data recording or distributing. Rest assured that your details are secure here!