Should you intend to fill out excise, it's not necessary to install any programs - simply try using our online tool. Our tool is continually evolving to provide the best user experience possible, and that's due to our commitment to continual enhancement and listening closely to feedback from customers. In case you are seeking to begin, this is what it takes:

Step 1: Hit the orange "Get Form" button above. It will open up our pdf tool so you could start filling out your form.

Step 2: This tool provides you with the ability to customize your PDF document in various ways. Modify it with customized text, correct what's originally in the document, and put in a signature - all close at hand!

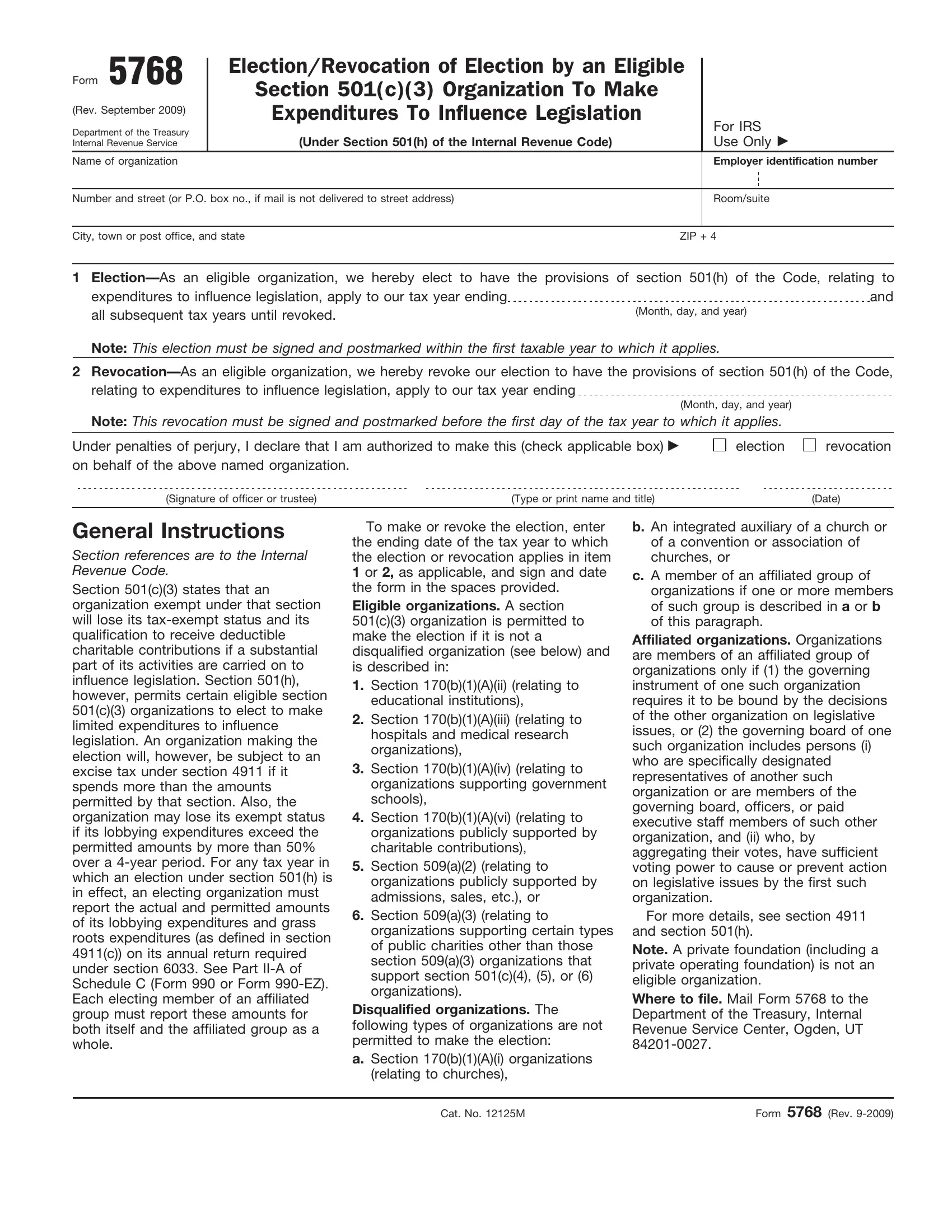

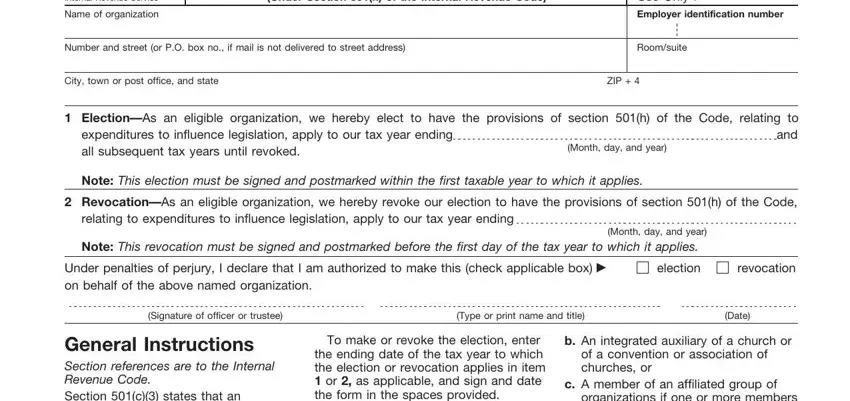

This document will involve some specific details; to ensure accuracy, make sure you bear in mind the suggestions below:

1. The excise necessitates particular details to be inserted. Make sure the next blank fields are finalized:

Step 3: Right after you have reread the information in the fields, just click "Done" to complete your document generation. Acquire your excise as soon as you sign up at FormsPal for a free trial. Conveniently gain access to the pdf form inside your FormsPal cabinet, with any edits and changes automatically preserved! We don't sell or share any details you provide when working with documents at FormsPal.