Are you familiar with Form 712? This is a form filed by certain estate tax payers to claim a credit for certain state death taxes. The purpose of this form is to determine the amount of any such credit that is available and claim it on the income tax return. In order to complete this form, you will need to know the total amount of state death taxes paid and your taxable estate. Let's take a closer look at this form and what it entails.

| Question | Answer |

|---|---|

| Form Name | Form 712 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | K9110170 form 712 from 1992 |

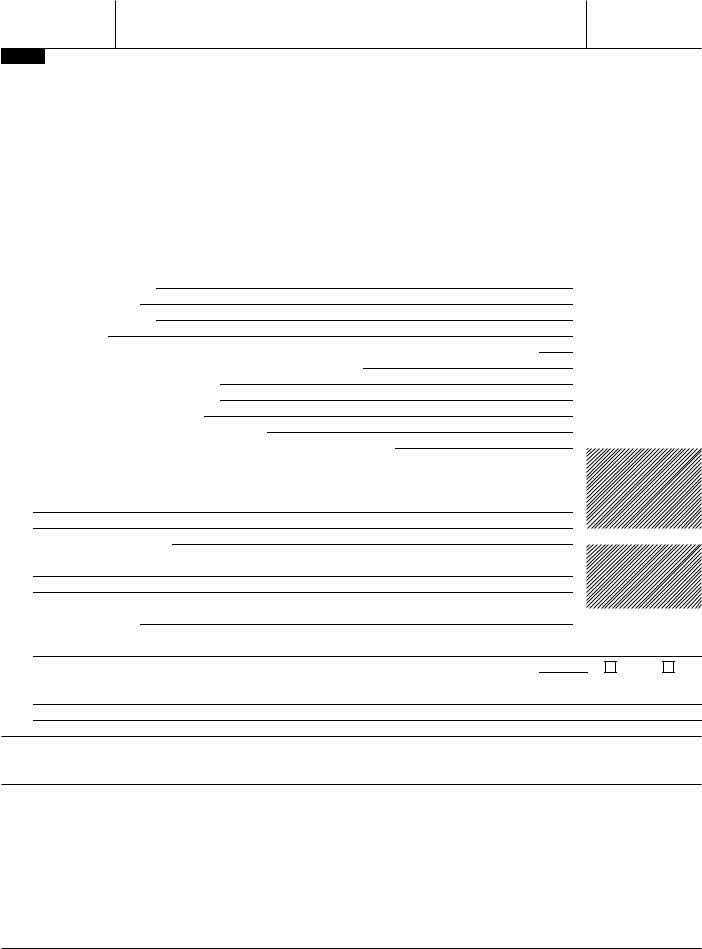

Form 7 1 2

(Rev. November 1991)

Department of the Treasury Internal Revenue Service

Life Insurance Statement

OMB No.

Expires

Part I |

|

|||

1 Decedent’s first name and middle initial |

2 Decedent’s last name |

3 Decedent’s social security number |

4 Date of death |

|

|

|

|

(if known) |

|

|

|

|

|

|

5Name and address of insurance company

6 |

Type of policy |

|

7 |

Policy number |

|

|

|

|

|

|

|

|

|

8 |

Owner’s name. If decedent is not owner, |

9 Date issued |

10 |

Assignor’s name. Please attach |

11 Date assigned |

|

|

please attach copy of application. |

|

|

copy of assignment. |

|

|

|

|

|

|

|

|

|

12 |

Value of the policy at the |

13 Amount of premium (see instructions) |

14 |

Name of beneficiaries |

|

|

|

time of assignment |

|

|

|

|

|

|

|

|

|

|

|

|

15 |

Face amount of policy |

|

|

|

$ |

|

16 |

Indemnity benefits |

|

|

|

$ |

|

17 |

Additional insurance |

|

|

|

$ |

|

18 |

Other benefits |

|

|

|

$ |

|

19 |

Principal of any indebtedness to the company that is deductible in determining net proceeds |

$ |

||||

20 |

Interest on indebtedness (item 19) accrued to date of death |

|

|

$ |

||

21 |

Amount of accumulated dividends |

|

|

|

$ |

|

22 |

Amount of |

|

|

|

$ |

|

23 |

Amount of returned premium |

|

|

|

$ |

|

24 |

Amount of proceeds if payable in one sum |

|

|

$ |

||

25 |

Value of proceeds as of date of death (if not payable in one sum) |

|

$ |

|||

26 |

Policy provisions concerning deferred payments or installments. |

|

|

|

||

|

Note: If other than |

|

||||

|

the insurance policy. |

|

|

|

|

|

27 |

Amount of installments |

|

|

|

$ |

|

28 |

Date of birth, sex, and name of any person the duration of whose life may measure the number of payments. |

|

||||

29 |

Amount applied by the insurance company as a single premium representing the purchase of |

|

||||

|

installment benefits |

|

|

|

$ |

|

30Basis (mortality table and rate of interest) used by insurer in valuing installment benefits.

31 Was the insured the annuitant or beneficiary of any annuity contract issued by the company? |

Yes |

No |

32Names of companies with which decedent carried other policies and amount of such policies if this information is disclosed by your records.

The undersigned officer of the

Signature ▶ |

Title ▶ |

Date of Certification ▶ |

Instructions

Paperwork Reduction Act

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Form |

Recordkeeping |

Preparing the form |

712 |

18 hrs., 25 min. |

18 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form more simple, we would be happy to hear from you. You can write to both the IRS and

the Office of Management and Budget at the addresses listed in the instructions of the tax return with which this form is filed. DO NOT send the tax form to either of these offices. Instead, return it to the executor or representative who requested it.

Statement of

Line

Cat. No. 10170V |

Form 712 (Rev. |

Form 712 (Rev. |

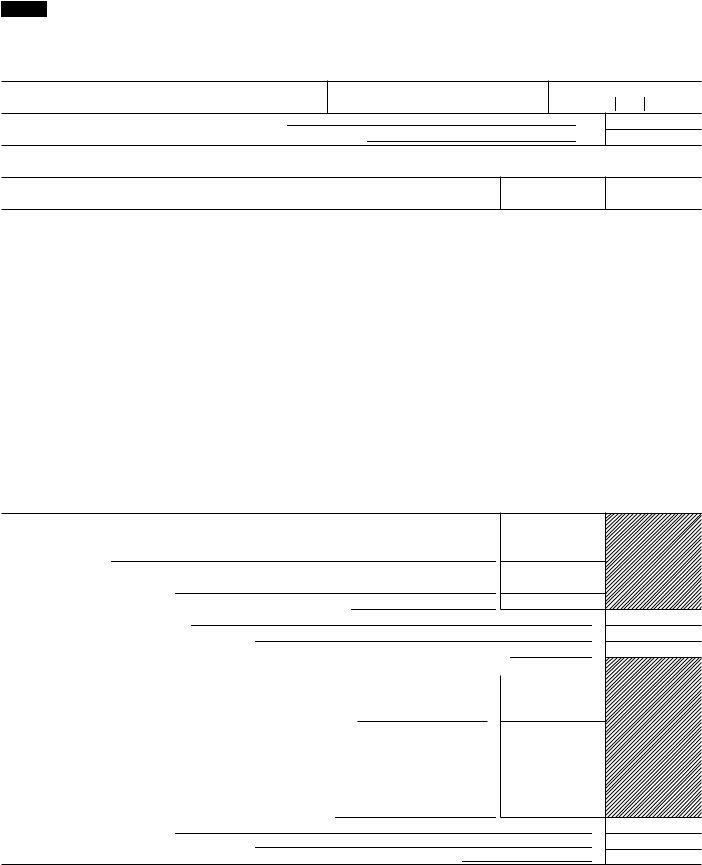

Page 2 |

|

Part II |

Living Insured |

|

|

(File With United States Gift Tax Return, Form 709. May Be Filed With United States Estate Tax |

|

|

Return, Form 706, Where Decedent Owned Insurance on Life of Another) |

|

SECTION

33 First name and middle initial of donor (or decedent)

34Last name

35 Social security number

36 |

Date of gift for which valuation data submitted |

▶ |

37 |

Date of decedent’s death for which valuation data submitted |

▶ |

SECTION

38Name of insured

39Sex

40 Date of birth

41Name and address of insurance company

42 |

Type of policy |

43 Policy number |

|

44 |

Face amount |

45 |

Issue date |

|

|

|

|

|

|

|

|

46 |

Gross premium |

|

|

47 |

Frequency of payment |

||

|

|

|

|

|

|

|

|

48 |

Assignee’s name |

|

|

|

|

49 |

Date assigned |

|

|

|

|

|

|

|

|

50 |

If irrevocable designation of beneficiary made, name of |

51 Sex |

52 |

Date of birth, |

53 |

Date |

|

|

beneficiary |

|

|

|

if known |

|

designated |

|

|

|

|

|

|

|

|

54If other than simple designation, quote in full. (Attach additional sheets if necessary.)

55 If policy is not paid up:

aInterpolated terminal reserve on date of death, assignment, or irrevocable designation of beneficiary

bAdd proportion of gross premium paid beyond date of death, assignment, or irrevocable designation of beneficiary

cAdd adjustment on account of dividends to credit of policy d Total (add lines a, b, and c)

e Outstanding indebtedness against policy

f Net total value of the policy (for gift or estate tax purposes) (subtract line e from line d)

56 If policy is either paid up or a single premium:

a Total cost, on date of death, assignment, or irrevocable designation of beneficiary, of a

any additional

(If a

bAdjustment on account of dividends to credit of policy c Total (add lines a and b)

d Outstanding indebtedness against policy

e Net total value of policy (for gift or estate tax purposes) (subtract line d from line c)

The undersigned officer of the

|

|

Date of |

Signature ▶ |

Title ▶ |

Certification ▶ |