EDI can be filled out online very easily. Simply try FormsPal PDF editor to complete the job fast. To retain our tool on the leading edge of convenience, we aim to put into practice user-driven capabilities and improvements on a regular basis. We're always thankful for any suggestions - play a vital part in revampimg PDF editing. To get the ball rolling, consider these simple steps:

Step 1: Open the PDF inside our tool by hitting the "Get Form Button" at the top of this webpage.

Step 2: When you access the tool, you will notice the document made ready to be completed. In addition to filling in different blank fields, you could also perform many other things with the PDF, particularly writing custom text, modifying the initial textual content, adding graphics, placing your signature to the form, and a lot more.

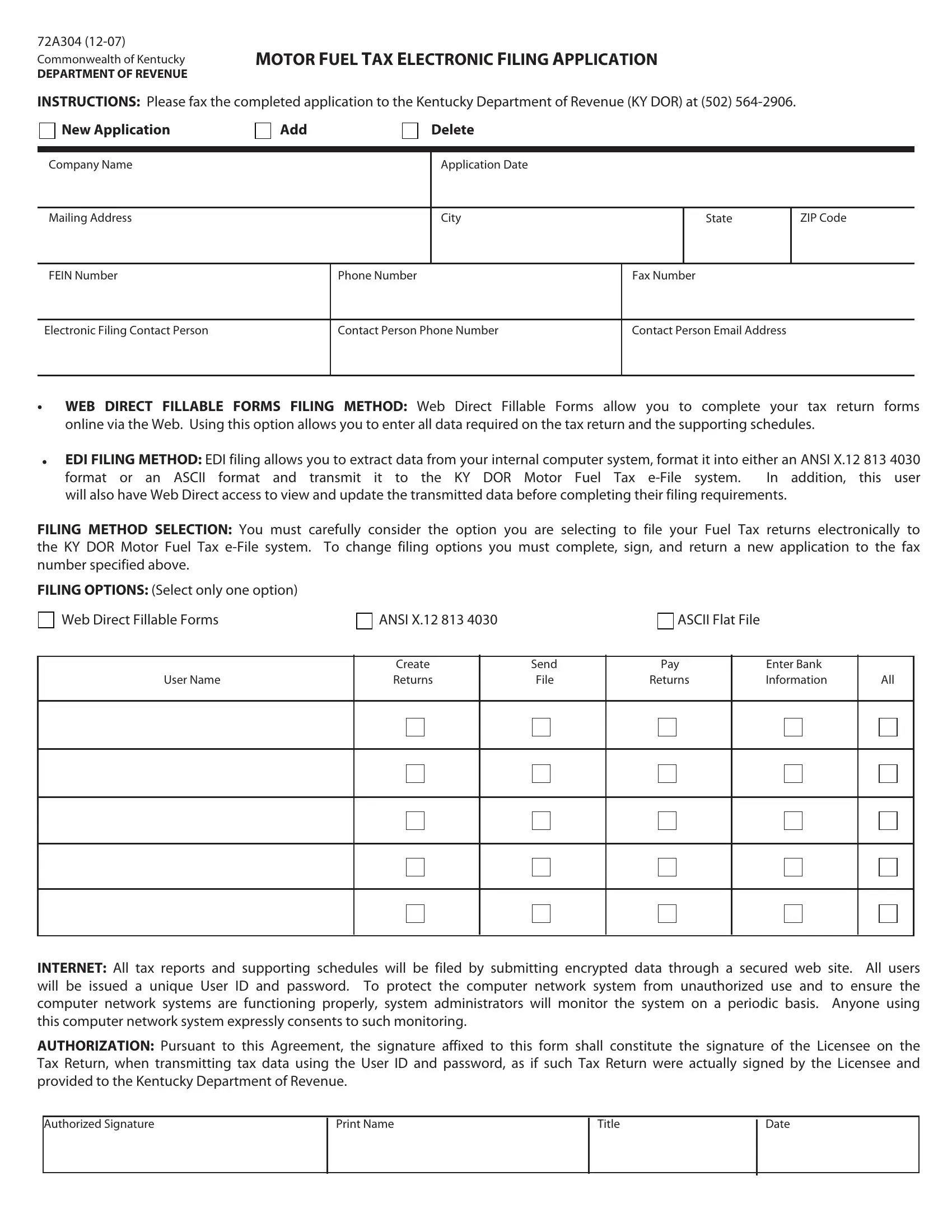

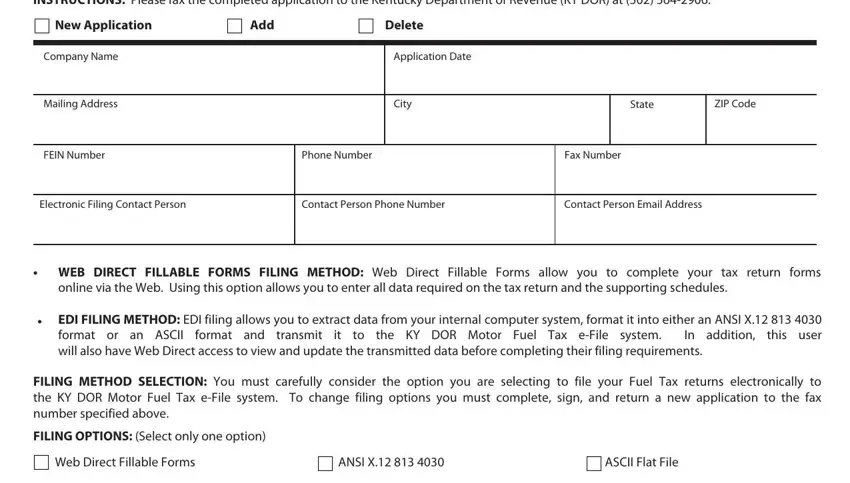

To be able to complete this PDF document, be sure you type in the required details in every blank:

1. The EDI necessitates specific details to be inserted. Ensure that the following blank fields are complete:

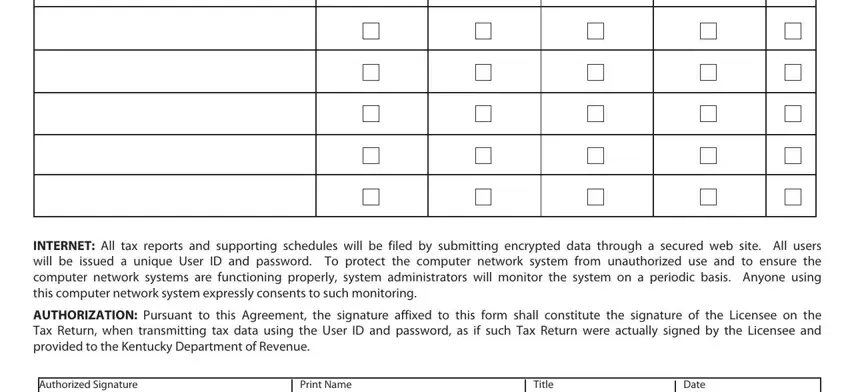

2. Once your current task is complete, take the next step – fill out all of these fields - INTERNET All tax reports and, AUTHORIZATION Pursuant to this, Authorized Signature, Print Name, Title, and Date with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It's easy to make a mistake when completing your Print Name, so ensure that you go through it again prior to deciding to submit it.

3. The next part should be relatively simple, - each one of these fields will have to be completed here.

Step 3: Confirm that your details are correct and click "Done" to complete the process. Right after setting up afree trial account here, you will be able to download EDI or send it through email immediately. The PDF file will also be readily available through your personal account page with your changes. When you use FormsPal, you can easily complete documents without needing to worry about database incidents or entries being distributed. Our secure system makes sure that your private information is stored safe.