If you are a taxpayer who has been affected by a natural disaster, you may be eligible for tax relief. The Internal Revenue Service (IRS) offers several options to help taxpayers impacted by disasters. One such option is Form 8362, which allows taxpayers to partially or fully waive the late filing penalty. To request this form, contact the IRS toll-free at 1-866-562-5227. Talk with an agent about your specific situation and explore all of your available options. With some advance planning, you may be able to reduce the stress that comes with recovering from a natural disaster.

| Question | Answer |

|---|---|

| Form Name | Form 8362 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | CTRC, 15th, EIN, health checkup result |

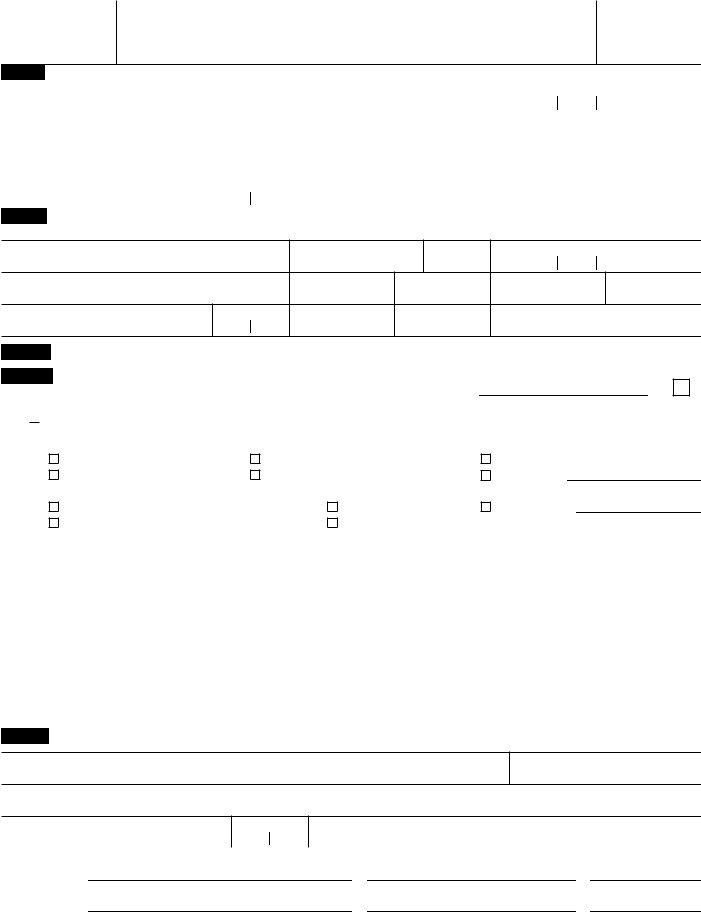

Form 8 3 6 2

(Rev. May 1992)

Department of the Treasury Internal Revenue Service

Currency Transaction Report by Casinos

File a separate Form 8362 for each transaction. Please type or print.

(Complete all applicable

OMB No.

Part I Individual or Organization for Whom This Transaction Was Completed

Individual’s last name |

|

First name |

|

Middle initial |

Social security number |

|

|

|

|

|

|

|

|

Organization’s name |

|

Employer identification number (EIN) |

Passport number |

Country |

||

|

|

|

|

|

|

|

Address (number, street, and apt. or suite no.) |

|

Occupation, profession, or business |

Alien registration number |

Country |

||

|

|

|

|

|

|

|

City |

State |

ZIP code |

Country (if not U.S.) |

Driver’s license (number and state) |

||

|

|

|

|

|

|

|

Part II Identity of Individual Conducting the Transaction (Complete only if an agent conducts a transaction

for the person in Part l)

Last name

First name

Middle initial

Social security number

Address (number, street, and apt. or suite no.)

Passport number

Country

Alien registration number

Country

City

State

ZIP code

Country (if not U.S.)

Driver’s license (number and state)

Part III |

Patron’s Account or Receipt Number ▶ |

|

Part IV |

Description of Transaction |

|

|

If more space is needed, attach a separate schedule and check this box |

▶ |

1Type of transaction. Check the applicable boxes to describe transaction.

a Currency exchange (currency for currency) b CASH IN:

|

(1) |

Deposit (front and safekeeping) |

(3) |

Check purchased (see item 6 below) |

(5) |

Collection on account |

||||

|

(2) |

Chips purchased |

(4) |

Wire transfer of funds |

(6) |

Other cash in |

||||

c |

CASH OUT: |

|

|

|

|

|

|

|

(specify) |

|

|

|

|

|

|

|

|

|

|||

|

(1) |

Withdrawal of deposit (front and safekeeping) |

(3) |

Chips redeemed |

(5) |

Other cash out |

||||

|

(2) |

Check cashed (see item 6 below) |

|

|

|

(4) |

Credit advance |

|

(specify) |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

||||

2 |

Total amount of currency transaction (in |

|

3 |

Amount in item 2 in $100 bills or higher |

4 |

Date of transaction (month, day, and year) |

||||

|

U.S. dollars) |

|

|

|

|

|

|

|

|

|

|

$ |

.00 |

|

|

$ |

|

.00 |

|

|

|

5 If other than U.S. currency is involved, please furnish the following information:

Currency name |

Country |

Total amount of each foreign currency (in U.S. dollars) |

|

|

|

$ |

.00 |

6If a check was involved in this transaction, please furnish the following information (see instructions):

Date of check |

Amount of check (in U.S. dollars) |

Payee of check |

|

|

$ |

.00 |

|

Maker of check |

|

|

Drawee bank and city |

|

|

|

|

Part V Casino Reporting the Financial Transaction

Name

Employer identification number (EIN)

Address (number, street, and apt. or suite no.) where transaction occurred

City

State

ZIP code

Sign |

▶ |

|

|

|

|

▶ |

(Casino employee who handled the transaction) |

(Title) |

(Date) |

||

Here |

|||||

|

|

|

|||

|

|

|

|

||

|

|

(Casino official reviewing and approving the Form 8362) |

(Title) |

(Date) |

|

|

|

|

|

||

For Paperwork Reduction Act Notice, see back of form. |

Cat. No. 62291Z |

Form 8362 (Rev. |

|||

Form 8362 (Rev. |

Page 2 |

General Instructions

Paperwork Reduction Act Notice.—

The requested information is useful in criminal, tax, and regulatory investigations, for instance by directing the Federal Government’s attention to unusual or questionable transactions. Casinos are required to provide the information under 31 CFR 103.22, 103.25, and 103.36.

The time needed to complete this form will vary depending on individual circumstances. The estimated average time is 38 minutes. If you have comments concerning the accuracy of this time estimate or suggestions for making this form more simple, we would be happy to hear from you. You can write to both the Internal Revenue Service, Washington, DC 20224, Attention: IRS Reports Clearance Officer, T:FP; and the Office of Management and Budget, Paperwork Reduction Project

Who Must

Exception. Casinos do not have to file Form 8362 for transactions with domestic banks.

When and Where To

Specific Instructions

Part I

You must complete this part. Record information about patrons and other individuals who conduct transactions in person for their own benefit.

If an agent (see Definitions) conducts a transaction with the casino for a patron or other person, show in Part I the patron’s or other person’s identity and show in Part II the agent’s identity.

Use a passport, alien ID card, or other official document showing nationality to

verify the identity of an alien or nonresident of the United States. Use a driver’s license or other document, normally accepted as identification when cashing checks, to verify the identity of anyone else. Record the information from the document in the appropriate block.

In the address section, enter the permanent street address. If the address is outside the United States, provide the city, province or state, postal code, and the name of the country.

Part II

Complete this part only when an agent (see Definitions) conducts a transaction for a patron or other person.

The identity of the agent must be verified. Use a passport, alien ID card, or other official document showing nationality to verify the identity of an alien or nonresident of the United States. Use a driver’s license or other document, normally accepted as identification when cashing checks, to verify the identity of anyone else.

In the address section, enter the permanent street address of the agent conducting the transaction. If the address is outside the United States, provide the city, province or state, postal code, and the name of the country.

In the social security number block, enter the social security number of the agent conducting the transaction. If the agent has no number, write “ None” in this block.

Part III

If the patron has an account relationship with the casino, enter the account number. If a receipt has been issued for a front or safekeeping deposit, enter the number.

Part IV

If less than a full dollar amount is involved, round that figure to the next higher dollar. For example, if the CASH IN totaled $10,000.05, show the figure as $10,001.00.

Item

Item

Part V

Enter the full legal name of the casino and the street address of the casino, office, or branch where the actual currency transaction was conducted. Enter the casino’s employer identification number (EIN) in the block provided.

Definitions

Domestic

1.A commercial bank or trust company organized under the laws of any state or of the United States;

2.A private bank;

3.A savings and loan association or a building and loan association organized under the laws of any state or of the United States;

4.An insured institution as defined in section 401 of the National Housing Act;

5.A savings bank, industrial bank, or other thrift institution;

6.A credit union organized under the laws of any state or of the United States; and

7.Any other organization chartered under the banking laws of any state and subject to the supervision of the bank supervisory authorities of a state.

Identifying

Transaction in