You could complete ITIN instantly using our PDF editor online. Our team is continuously endeavoring to improve the editor and help it become even better for users with its multiple functions. Unlock an ceaselessly revolutionary experience now - take a look at and find new possibilities as you go! If you're looking to begin, this is what it's going to take:

Step 1: Click on the "Get Form" button above. It'll open up our tool so that you can start filling out your form.

Step 2: When you open the online editor, you'll notice the document all set to be filled in. In addition to filling in various blanks, you may also perform other things with the file, that is putting on your own words, changing the original textual content, inserting illustrations or photos, signing the PDF, and a lot more.

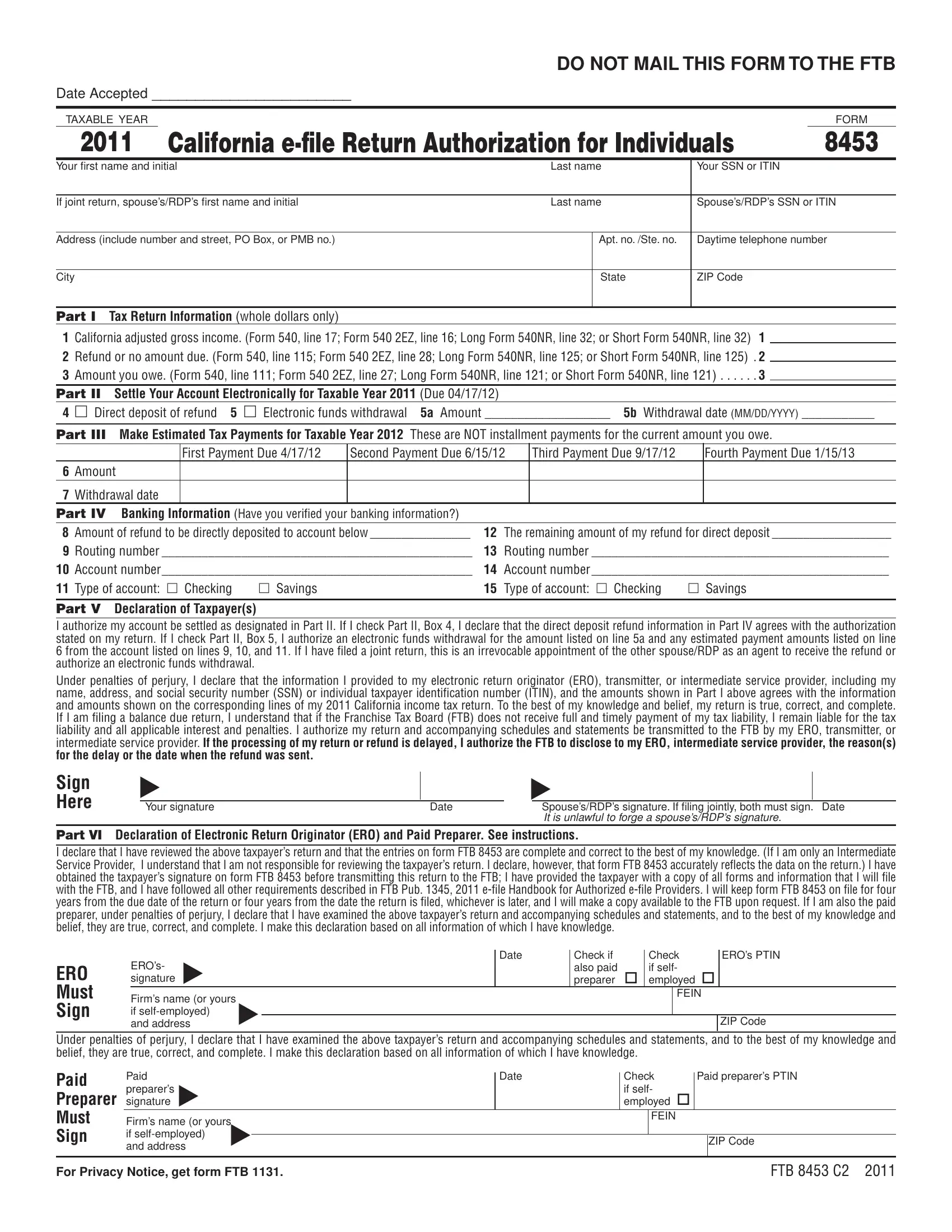

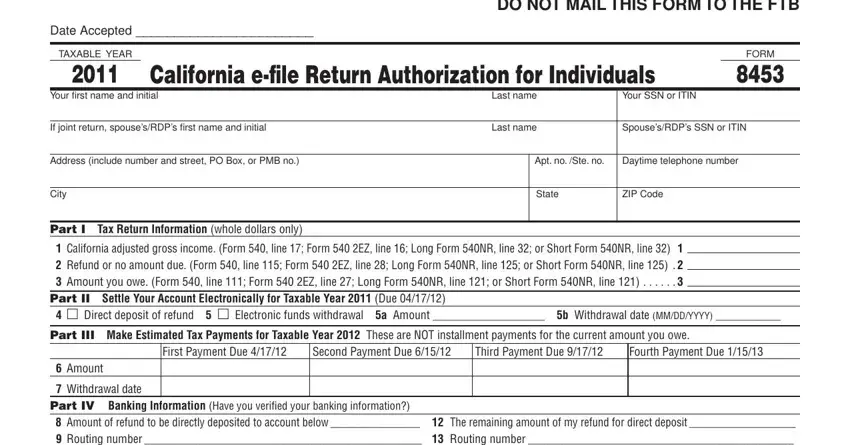

For you to complete this PDF form, make sure you type in the required information in every field:

1. The ITIN usually requires certain details to be inserted. Be sure that the subsequent blank fields are finalized:

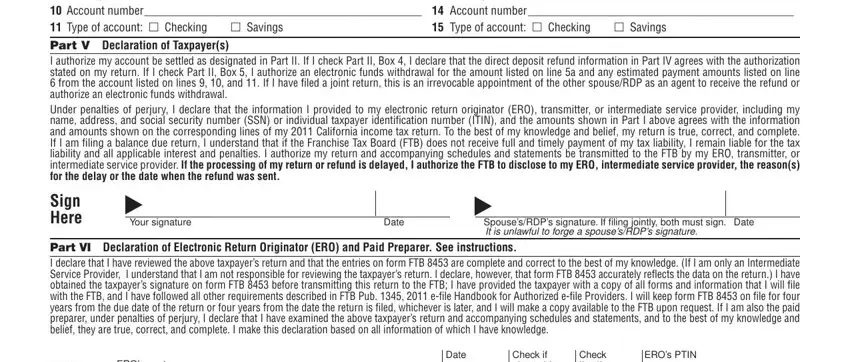

2. The third stage is to complete all of the following blank fields: m Savings, Withdrawal date Part IV Banking, Type of account m Checking, m Savings, Sign Here, Your signature, Date, SpousesRDPs signature If filing, Part VI Declaration of Electronic, EROs signature, Date, Check if also paid preparer, Check if self employed, and EROs PTIN.

In terms of m Savings and EROs PTIN, ensure you double-check them here. Both of these are thought to be the key fields in this form.

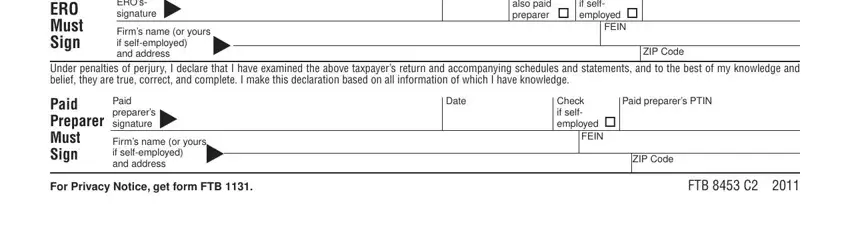

3. Completing ERO Must Sign, EROs signature, Firms name or yours if, Check if also paid preparer, Check if self employed, FEIN, ZIP Code, Under penalties of perjury I, Paid Preparer Must Sign, Paid preparers signature, Firms name or yours if, For Privacy Notice get form FTB, Date, Paid preparers PTIN, and Check if self employed is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Step 3: Once you've glanced through the information in the fields, press "Done" to finalize your form. Right after creating afree trial account here, you'll be able to download ITIN or send it via email directly. The file will also be available in your personal account menu with your changes. FormsPal is invested in the privacy of our users; we always make sure that all personal data used in our system is kept protected.