You are able to prepare 1040A instantly in our PDFinity® online PDF tool. Our tool is consistently evolving to present the very best user experience attainable, and that's due to our resolve for continuous enhancement and listening closely to user feedback. All it requires is a couple of basic steps:

Step 1: Press the "Get Form" button above. It will open up our pdf tool so you could start filling in your form.

Step 2: With this advanced PDF editor, you could accomplish more than merely fill out blank form fields. Try all of the features and make your documents seem great with customized textual content added in, or tweak the original input to excellence - all that comes along with the capability to insert any type of pictures and sign the file off.

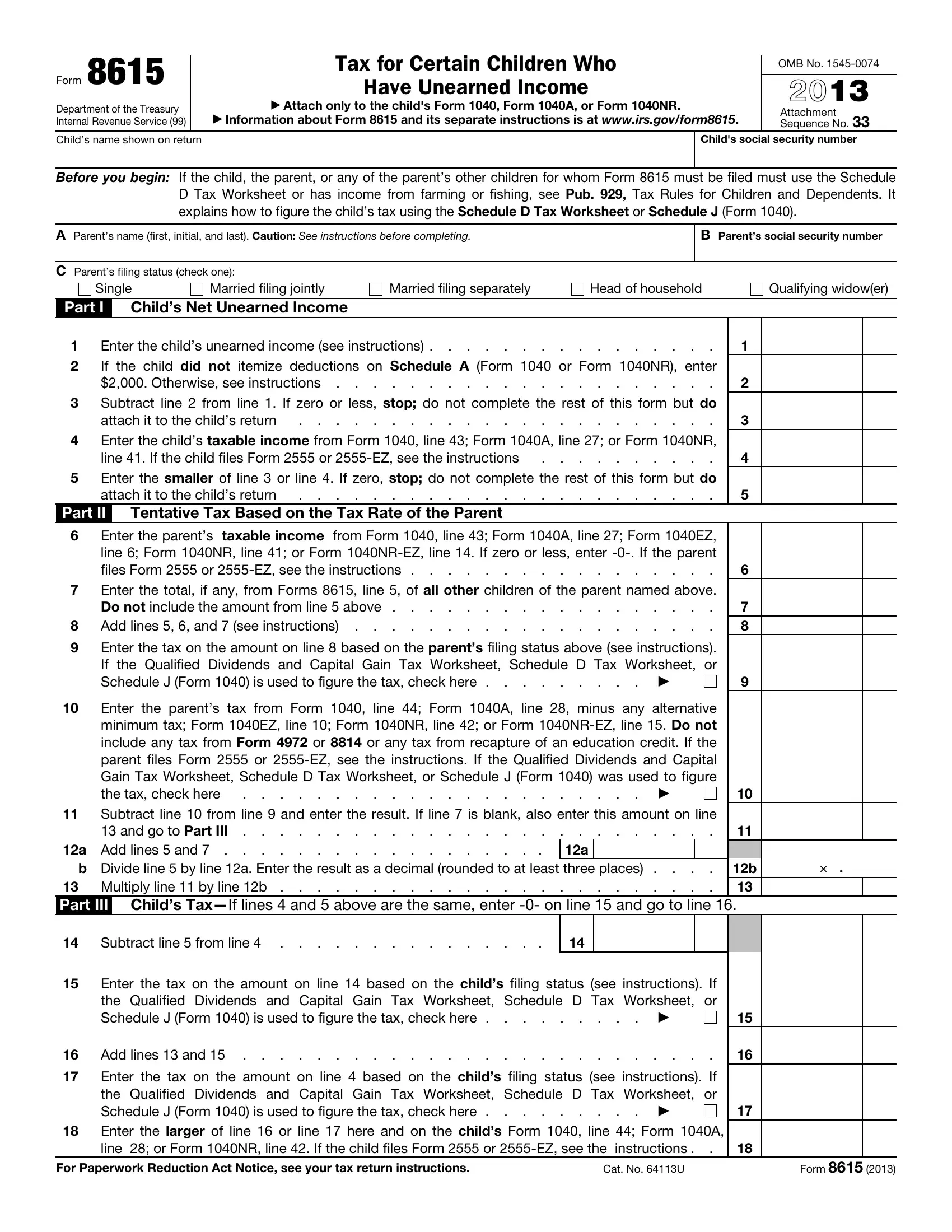

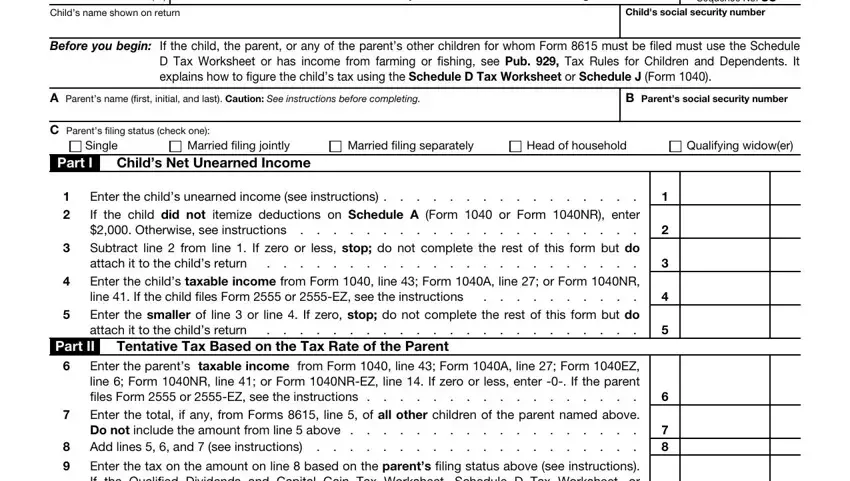

If you want to finalize this document, ensure that you provide the necessary information in every area:

1. Before anything else, when filling in the 1040A, start with the section that contains the following fields:

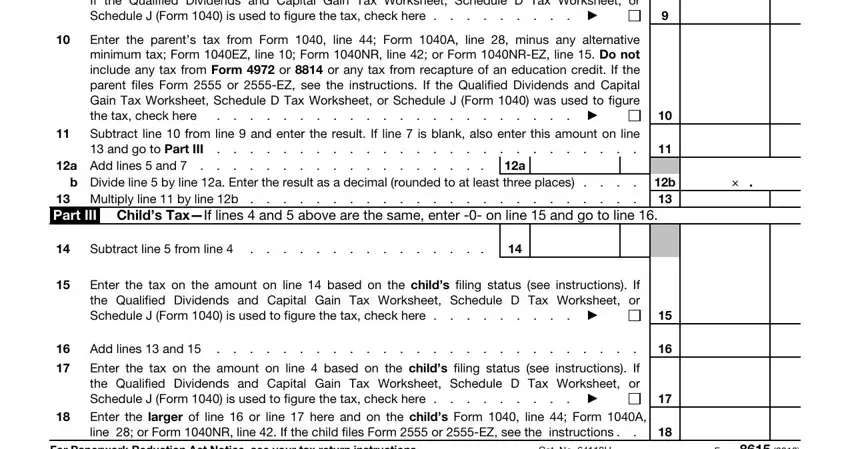

2. Once your current task is complete, take the next step – fill out all of these fields - Enter the tax on the amount on, Enter the parents tax from Form, b Divide line by line a Enter the, Multiply line by line b Part, Subtract line from line, Enter the tax on the amount on, Add lines and, Enter the tax on the amount on, For Paperwork Reduction Act Notice, Cat No U, and Form with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It is possible to make an error when filling out your For Paperwork Reduction Act Notice, consequently make sure you take another look before you'll finalize the form.

Step 3: Prior to addressing the next step, double-check that blank fields are filled in as intended. The moment you think it's all good, click “Done." Get the 1040A the instant you subscribe to a 7-day free trial. Readily gain access to the pdf file from your FormsPal account, with any modifications and changes automatically kept! At FormsPal, we do everything we can to be certain that your details are maintained private.