You can work with form8859 effortlessly with our PDF editor online. FormsPal professional team is ceaselessly working to improve the editor and help it become much faster for clients with its cutting-edge features. Unlock an ceaselessly revolutionary experience today - check out and uncover new opportunities along the way! Should you be looking to get started, this is what it requires:

Step 1: Firstly, access the pdf editor by clicking the "Get Form Button" above on this site.

Step 2: After you launch the PDF editor, you'll see the form made ready to be filled out. Apart from filling out various blank fields, you could also do other things with the form, such as writing custom textual content, editing the initial text, adding illustrations or photos, signing the document, and much more.

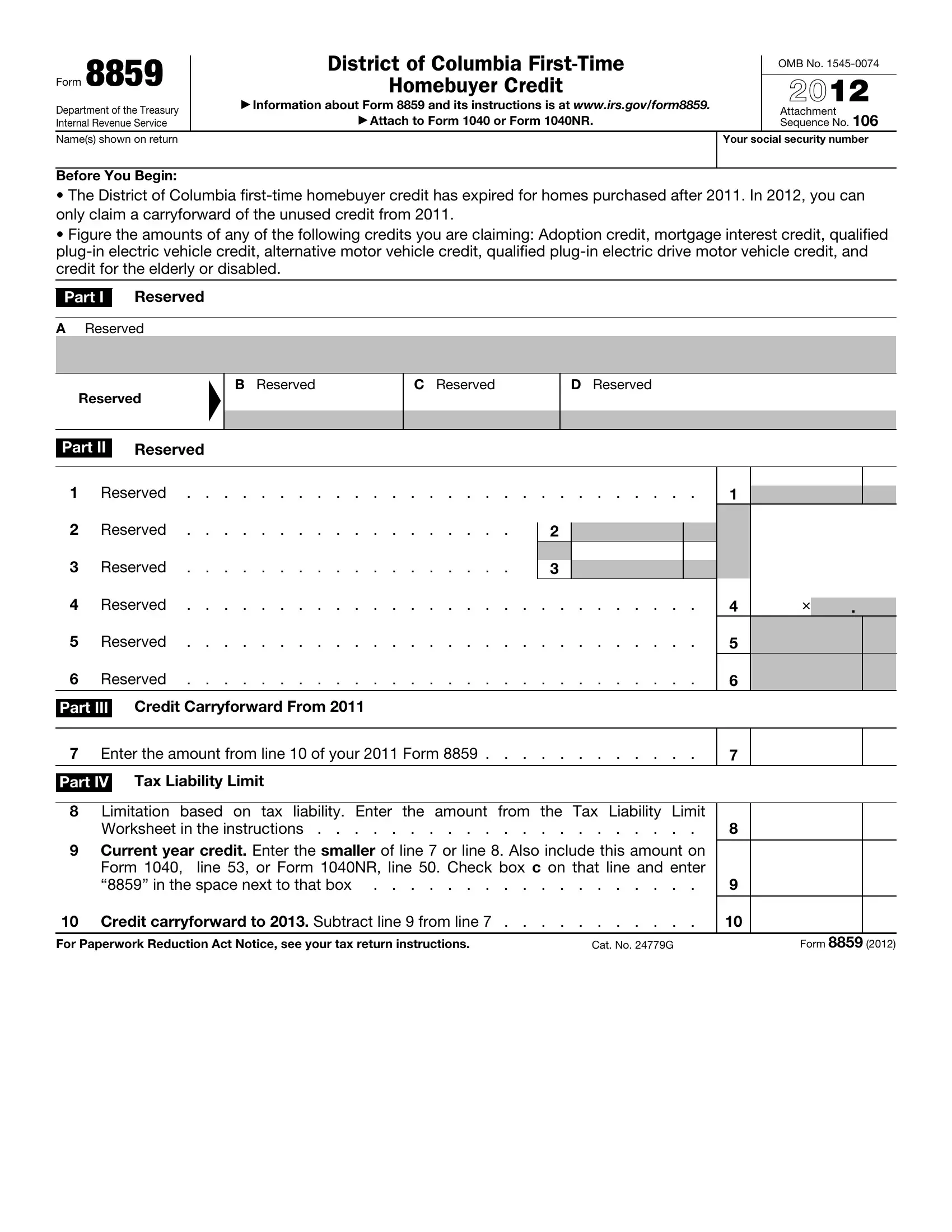

This document will need particular details to be filled in, so make sure you take some time to fill in what is expected:

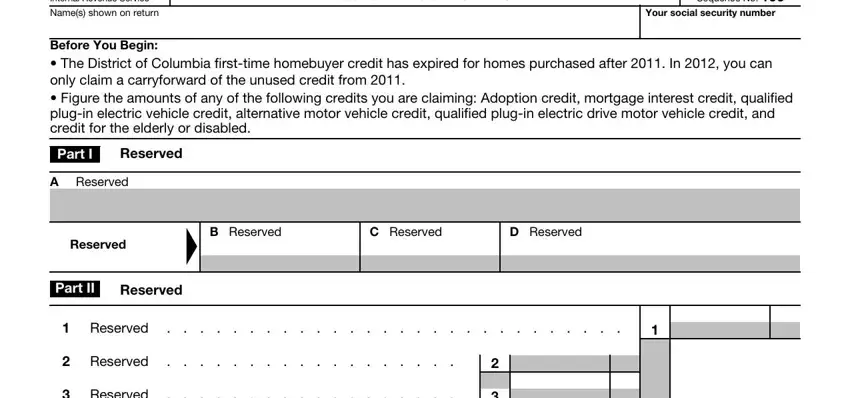

1. The form8859 involves specific details to be entered. Be sure the subsequent blank fields are finalized:

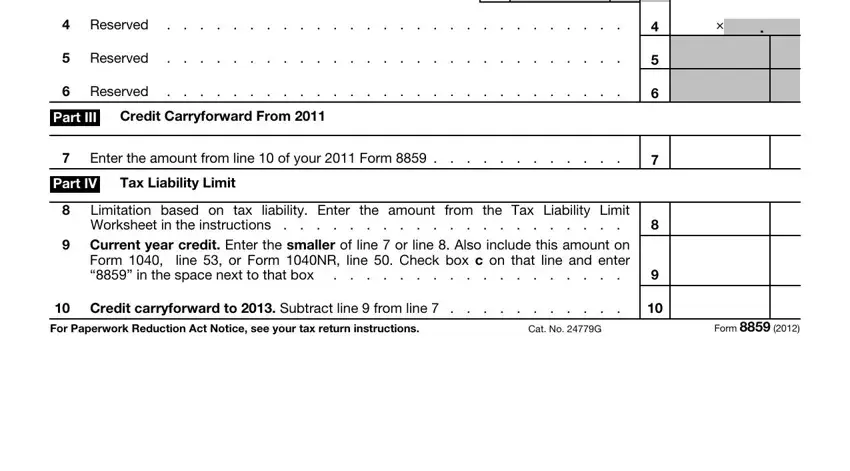

2. Your next part is usually to complete the next few blanks: Reserved, Reserved, Reserved, Part III, Credit Carryforward From, Enter the amount from line of, Part IV, Tax Liability Limit, Limitation based on tax liability, Credit carryforward to Subtract, For Paperwork Reduction Act Notice, Cat No G, and Form.

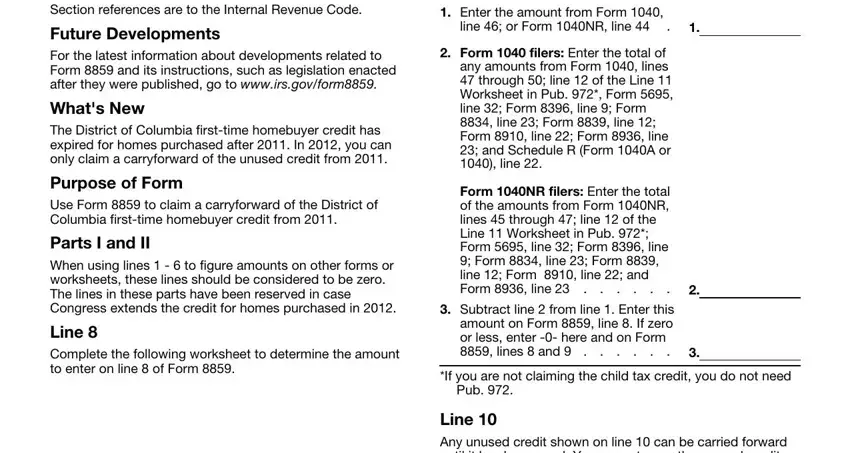

3. Completing General Instructions Section, Future Developments, For the latest information about, Whats New, The District of Columbia firsttime, Purpose of Form, Use Form to claim a carryforward, Parts I and II, When using lines to figure, Line, Complete the following worksheet, Enter the amount from Form line, Form filers Enter the total of, Subtract line from line Enter, and If you are not claiming the child is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

As to When using lines to figure and Enter the amount from Form line, make sure you get them right in this section. Both these are considered the most important ones in this document.

Step 3: Right after you have looked over the information in the file's blanks, press "Done" to finalize your FormsPal process. Create a 7-day free trial option with us and get instant access to form8859 - with all changes preserved and accessible in your personal cabinet. FormsPal is devoted to the personal privacy of our users; we make sure that all information processed by our editor is confidential.