When working in the online tool for PDF editing by FormsPal, you can fill in or alter form 8875 instruction right here. FormsPal professional team is always working to enhance the tool and insure that it is much faster for people with its multiple functions. Take full advantage of the current modern opportunities, and find a myriad of emerging experiences! This is what you would want to do to get started:

Step 1: Simply click on the "Get Form Button" at the top of this site to see our pdf editing tool. There you'll find all that is necessary to work with your file.

Step 2: As soon as you start the editor, you will notice the document made ready to be completed. Besides filling out different blanks, you could also perform many other things with the PDF, such as putting on custom textual content, modifying the original textual content, adding images, affixing your signature to the PDF, and much more.

It will be an easy task to complete the pdf using out helpful guide! Here is what you need to do:

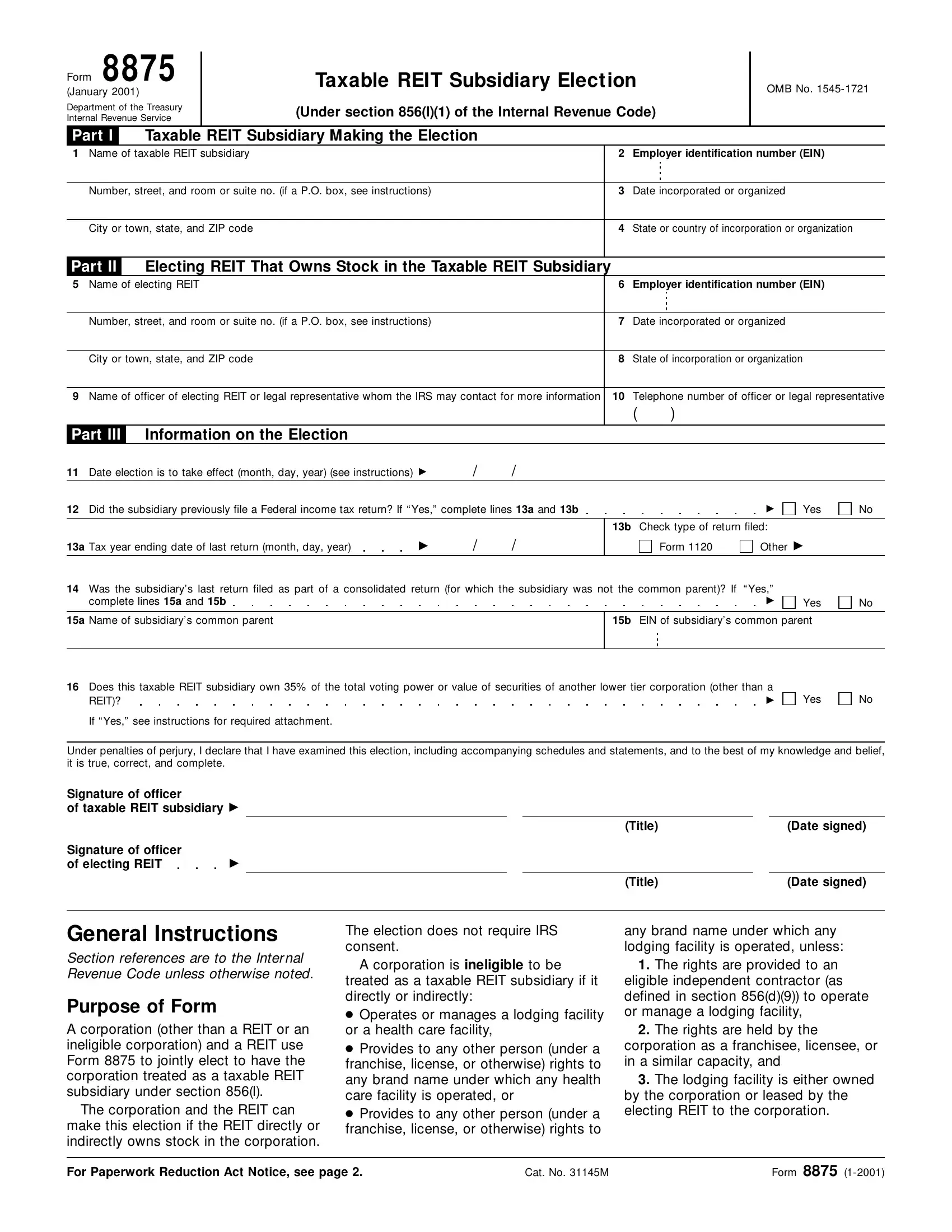

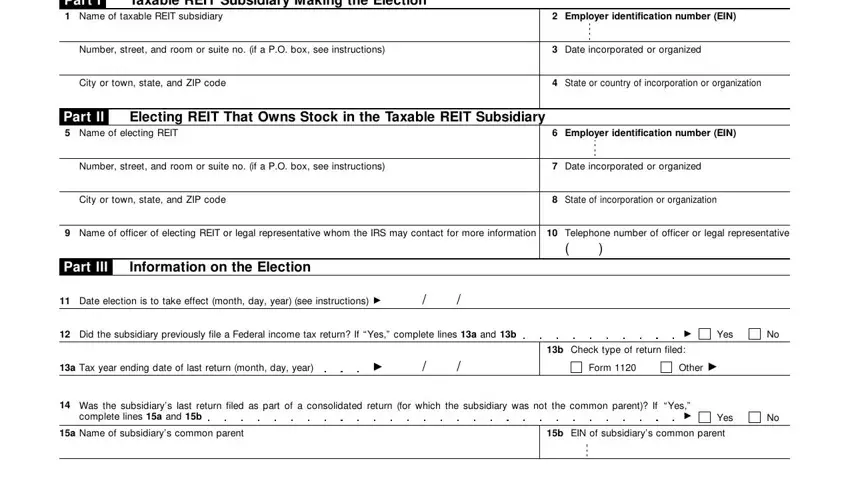

1. You'll want to fill out the form 8875 instruction correctly, so be attentive when filling out the sections containing all of these blanks:

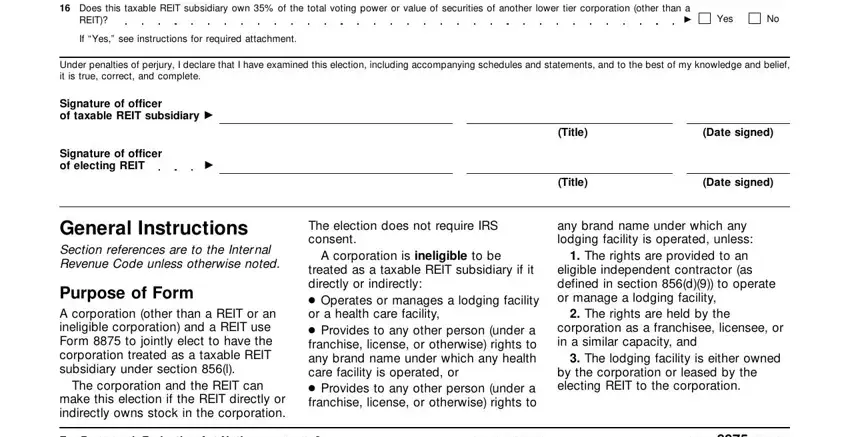

2. Your next part is to submit these fields: Does this taxable REIT subsidiary, Yes, If Yes see instructions for, Under penalties of perjury I, Signature of officer of taxable, Signature of officer of electing, General Instructions Section, Purpose of Form A corporation, The corporation and the REIT can, make this election if the REIT, The election does not require IRS, A corporation is ineligible to be, treated as a taxable REIT, Title, and Title.

People often make some mistakes when completing Purpose of Form A corporation in this area. You should definitely read twice everything you type in here.

Step 3: Confirm that your information is right and press "Done" to continue further. Go for a free trial option with us and get immediate access to form 8875 instruction - download, email, or change in your FormsPal account. We don't share or sell any information that you use whenever working with documents at FormsPal.