Making use of the online tool for PDF editing by FormsPal, it is possible to fill out or modify form 8916 here and now. To make our tool better and simpler to use, we continuously design new features, with our users' feedback in mind. Starting is effortless! All you have to do is follow the following simple steps directly below:

Step 1: Hit the "Get Form" button at the top of this webpage to get into our PDF editor.

Step 2: When you open the PDF editor, you will see the document all set to be completed. Aside from filling in various blanks, you can also do other actions with the file, specifically adding your own words, changing the original text, inserting images, placing your signature to the form, and much more.

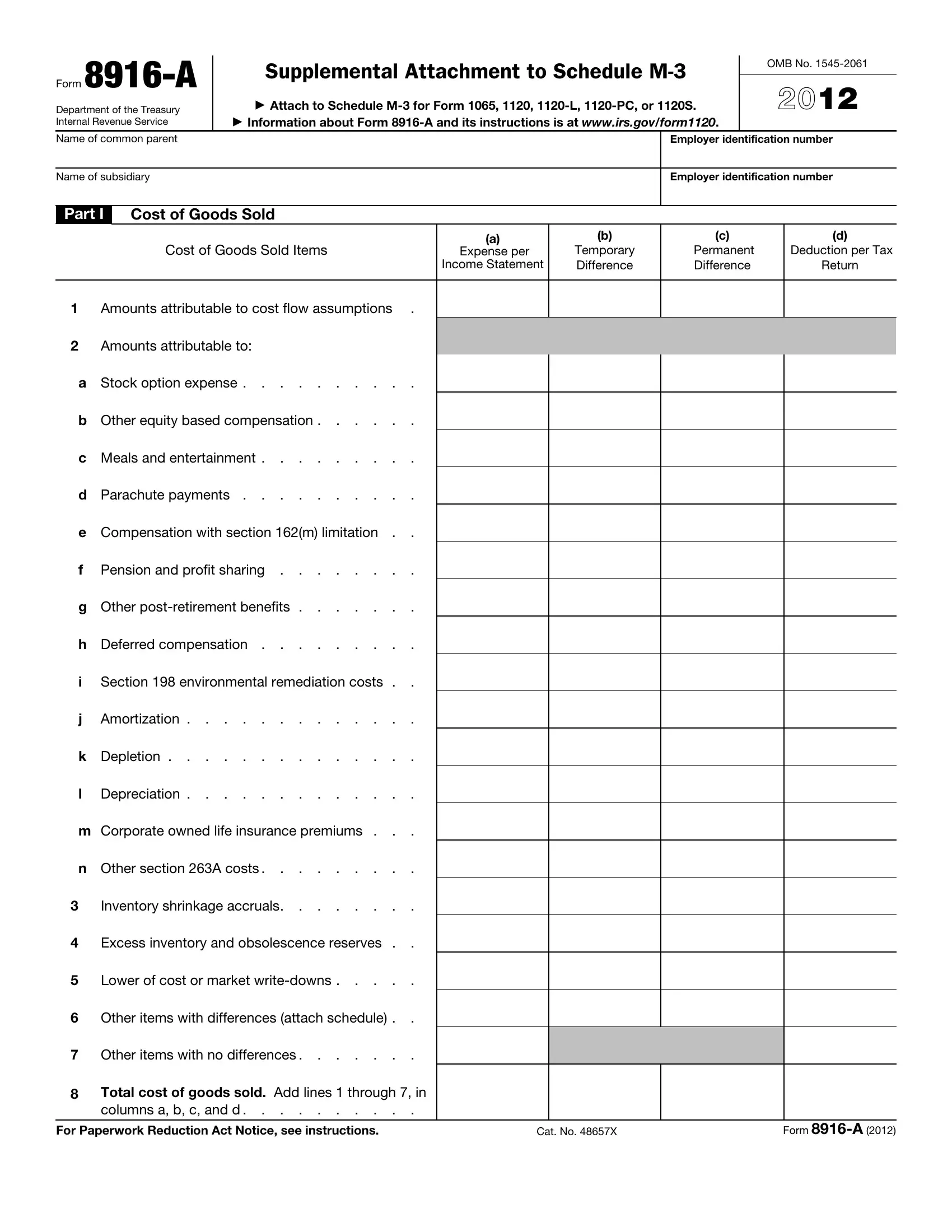

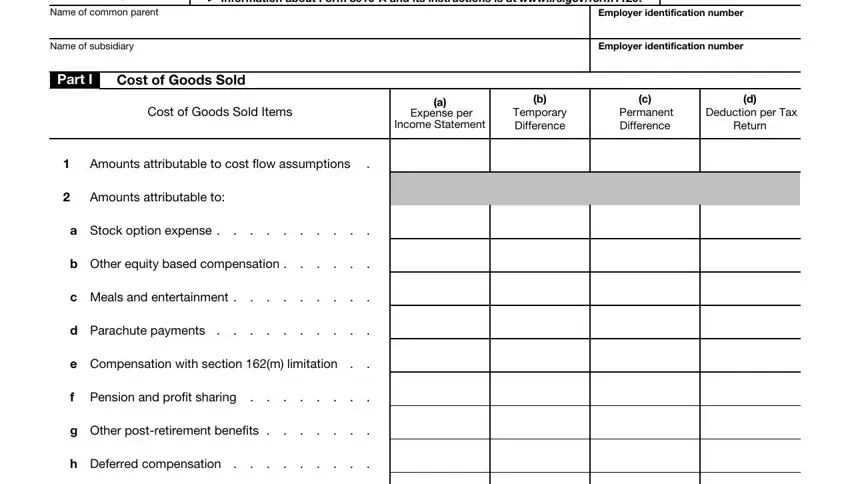

If you want to complete this document, make sure you type in the right information in every single area:

1. To begin with, while completing the form 8916, start in the form section that features the next blank fields:

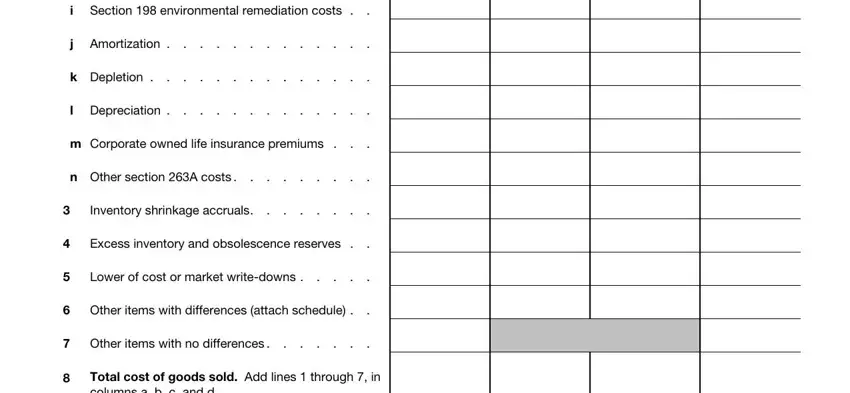

2. Given that the last segment is finished, you're ready include the required specifics in Section environmental remediation, Amortization, k Depletion, l Depreciation, m Corporate owned life insurance, n Other section A costs, Inventory shrinkage accruals, Excess inventory and obsolescence, Lower of cost or market writedowns, Other items with differences, Other items with no differences, and Total cost of goods sold Add lines so you can go further.

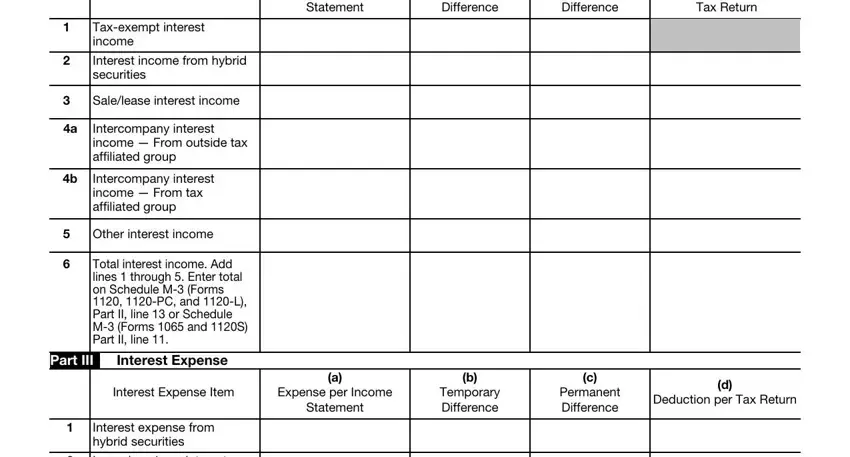

3. This third segment is generally fairly uncomplicated, Statement, Temporary Difference, Permanent Difference, Tax Return, Taxexempt interest income, Interest income from hybrid, Salelease interest income, Intercompany interest income From, Intercompany interest income From, Other interest income, Total interest income Add lines, Part III, Interest Expense, Interest Expense Item, and Expense per Income - all of these form fields will have to be filled out here.

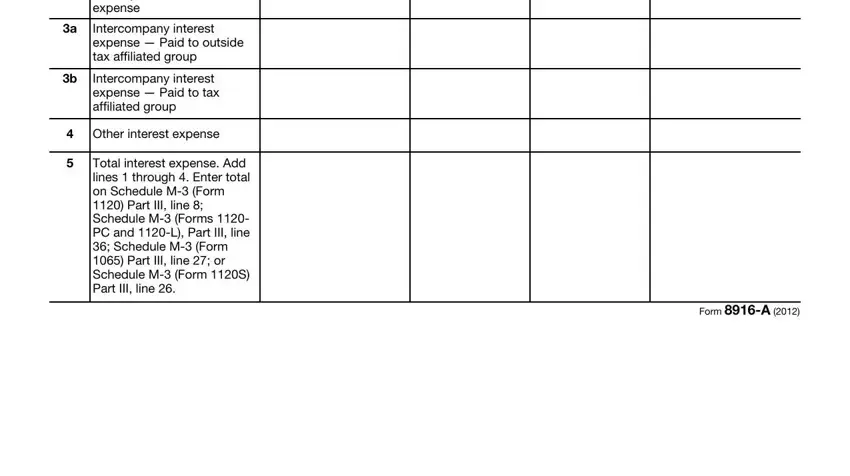

4. This next section requires some additional information. Ensure you complete all the necessary fields - Leasepurchase interest expense, Intercompany interest expense, Intercompany interest expense, Other interest expense, Total interest expense Add lines, and Form A - to proceed further in your process!

Be extremely attentive when filling out Leasepurchase interest expense and Form A, as this is where a lot of people make mistakes.

Step 3: Always make sure that your information is accurate and then click "Done" to continue further. Obtain the form 8916 when you sign up for a 7-day free trial. Conveniently gain access to the pdf file within your FormsPal cabinet, along with any modifications and changes automatically preserved! FormsPal ensures your data privacy with a protected system that never records or distributes any kind of private data involved in the process. You can relax knowing your files are kept protected every time you work with our tools!