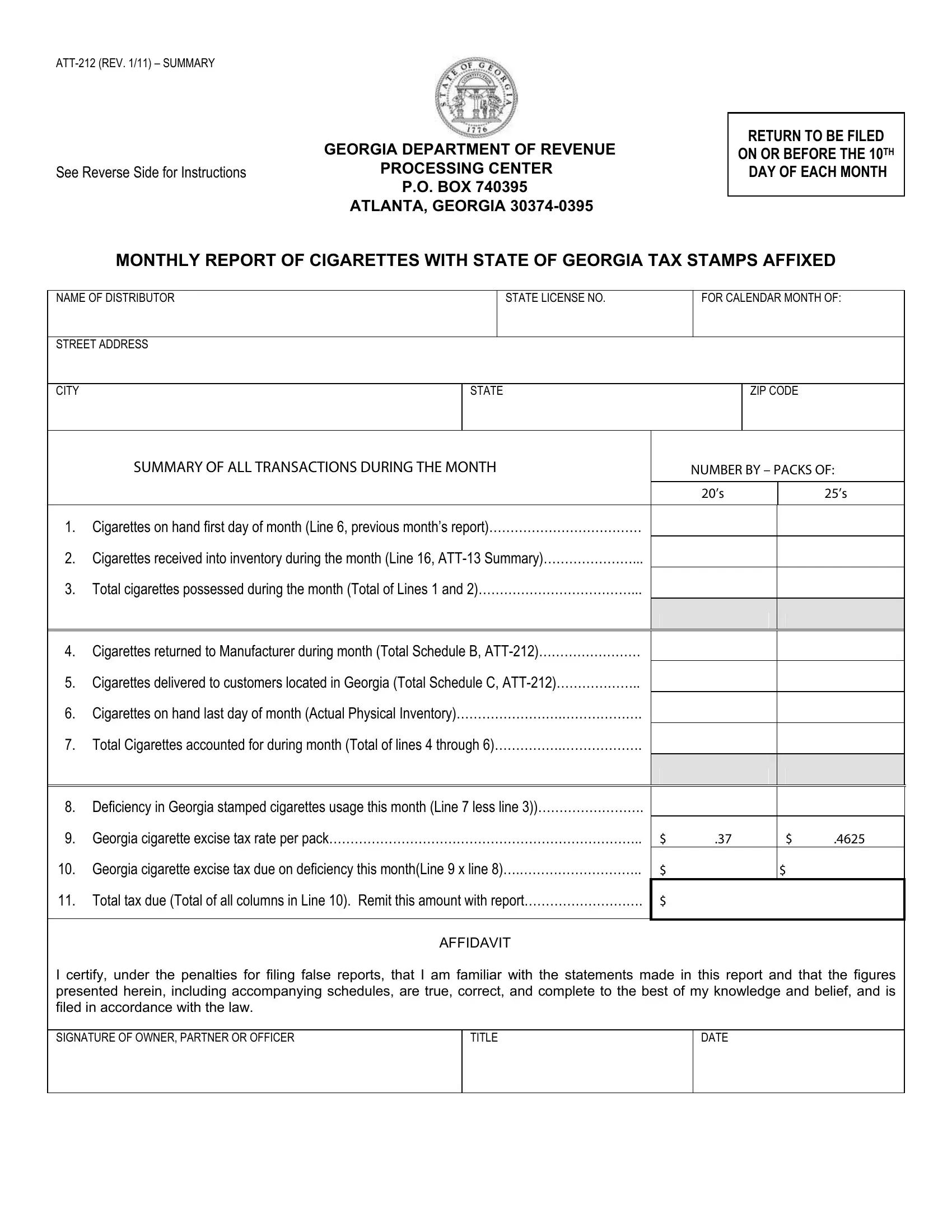

ATT-212 (REV. 1/11) – SUMMARY

GEORGIA DEPARTMENT OF REVENUE

See Reverse Side for InstructionsPROCESSING CENTER

P.O. BOX 740395

ATLANTA, GEORGIA 30374-0395

RETURN TO BE FILED

ON OR BEFORE THE 10TH DAY OF EACH MONTH

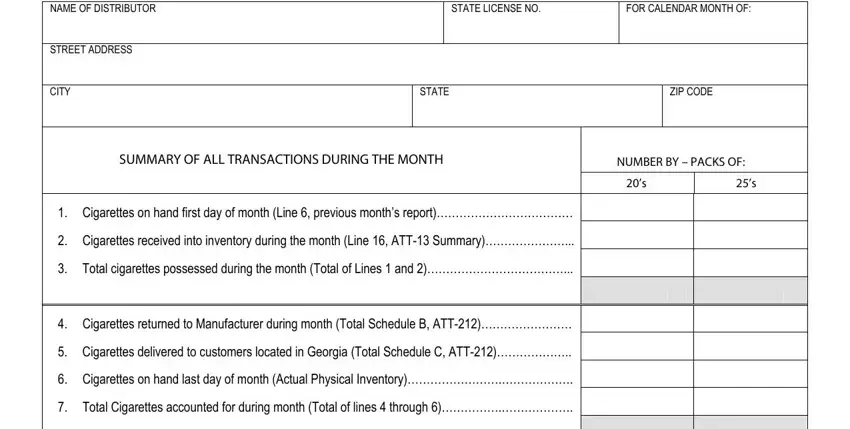

MONTHLY REPORT OF CIGARETTES WITH STATE OF GEORGIA TAX STAMPS AFFIXED

NAME OF DISTRIBUTOR

STREET ADDRESS

CITY

STATE LICENSE NO. |

FOR CALENDAR MONTH OF: |

|

|

SUMMARY OF ALL TRANSACTIONS DURING THE MONTH |

NUMBER BY – PACKS OF: |

|

|

|

|

20’S |

25’S |

|

|

|

1.Cigarettes on hand first day of month (Line 6, previous month’s report)………………………………

2.Cigarettes received into inventory during the month (Line 16, ATT-13 Summary)…………………...

3.Total cigarettes possessed during the month (Total of Lines 1 and 2)………………………………...

4.Cigarettes returned to Manufacturer during month (Total Schedule B, ATT-212)……………………

5.Cigarettes delivered to customers located in Georgia (Total Schedule C, ATT-212)………………..

6.Cigarettes on hand last day of month (Actual Physical Inventory)…………………….……………….

7.Total Cigarettes accounted for during month (Total of lines 4 through 6)…………….……………….

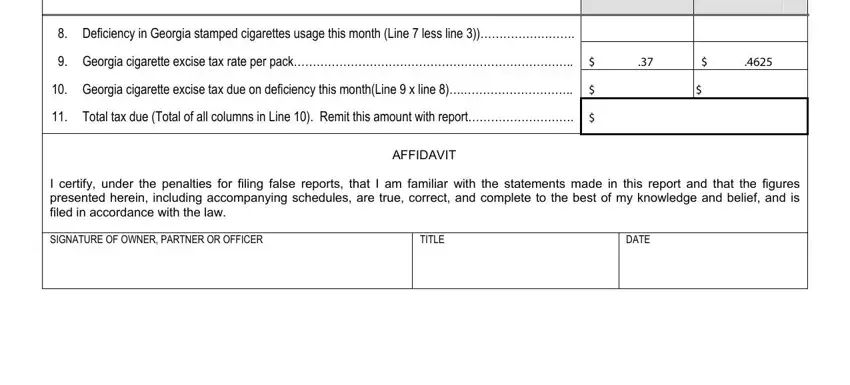

8.Deficiency in Georgia stamped cigarettes usage this month (Line 7 less line 3))…………………….

9. |

Georgia cigarette excise tax rate per pack……………………………………………………………….. |

$ |

.37 |

$ |

.4625 |

10. |

Georgia cigarette excise tax due on deficiency this month(Line 9 x line 8)….……………………….. |

|

$ |

|

$ |

|

11.Total tax due (Total of all columns in Line 10). Remit this amount with report………………………. $

AFFIDAVIT

I certify, under the penalties for filing false reports, that I am familiar with the statements made in this report and that the figures presented herein, including accompanying schedules, are true, correct, and complete to the best of my knowledge and belief, and is filed in accordance with the law.

SIGNATURE OF OWNER, PARTNER OR OFFICER

INSTRUCTIONS

GENERAL INSTRUCTIONS (FORM ATT-212)

Every out-of-state licensed distributor is required to complete a “Monthly Report of Cigarettes with Georgia Tax Stamps Affixed”. This report must be prepared at the same time and filed along with “Wholesale Distributors Cigarette Monthly Report” Form ATT-13.

SPECIFIC INSTRUCTIONS

Line 1 Enter on this line the number of packs, by size, with Georgia tax stamps affixed on hand at the beginning of month.

Line 2 Enter on this line the number of packs, by size, Georgia with tax stamps. To convert the tax value of stamps used during the month as indicated on Line 16, ATT-13 Summary to packs, divide by $.37 for packs of 20’s and by .4625 for packs of 25’s.

Line 3 Enter on this line the results of adding the amounts on lines 1 and 2.

Line 4 Enter on this line the total number of packs, by size, with Georgia tax stamps affixed returned to the manufacturer during the month. This total must be supported by completion of form ATT-212, Schedule B.

Line 5 Enter on this line the number of packs, by size, delivered to retail dealers located in Georgia. This total must be supported by the completion of Form ATT-212, Schedule C.

Line 6 Enter on this line the number of packs, by size, with Georgia tax stamps affixed on hand at end of month. This inventory is required to be a physical inventory, not a book inventory, and must be taken at the same time as the inventory used in completing Form ATT-13 Summary, Line 15.

Line 7 Enter on this line the results of adding the number of packs on lines 4 through 6.

Line 8 Enter on this line the results of subtracting the number of packs on line 3 from the number of packs on line 7. If line 3 is greater than line 7 or there is no difference in these two lines, then this line is to be left blank.

Line 9 This line has been preprinted on the report form giving the tax rate per pack by size.

Line 10 Enter on this line in appropriate columns, the tax due by multiplying the number of packs on line 8 by the tax rate listed on line 9.

Line 11 Enter on this line the total of all columns from line 10. A check for the amount shown on this line must be submitted along with this report .

SPECIAL INSTRUCTIONS

If distributor is located outside the State of Georgia, the distributor must submit an exact copy of the Monthly Cigarette Report filed with the state which the business is located along with this report.

MAILING

Sign and date the original report and mail it with remittance due, originals of the supporting schedules and copies of supporting documents to: Georgia Department of Revenue, Processing Center, P.O. BOX 740395, Atlanta, Georgia 30374-0395 , on or

before the 10th day of the following month for which report is filed. The statutes provide penalties for failure to file this report and pay the tax when due. The duplication of the report and schedules along with all invoices of sales must be retained by licensee for a period of three years.