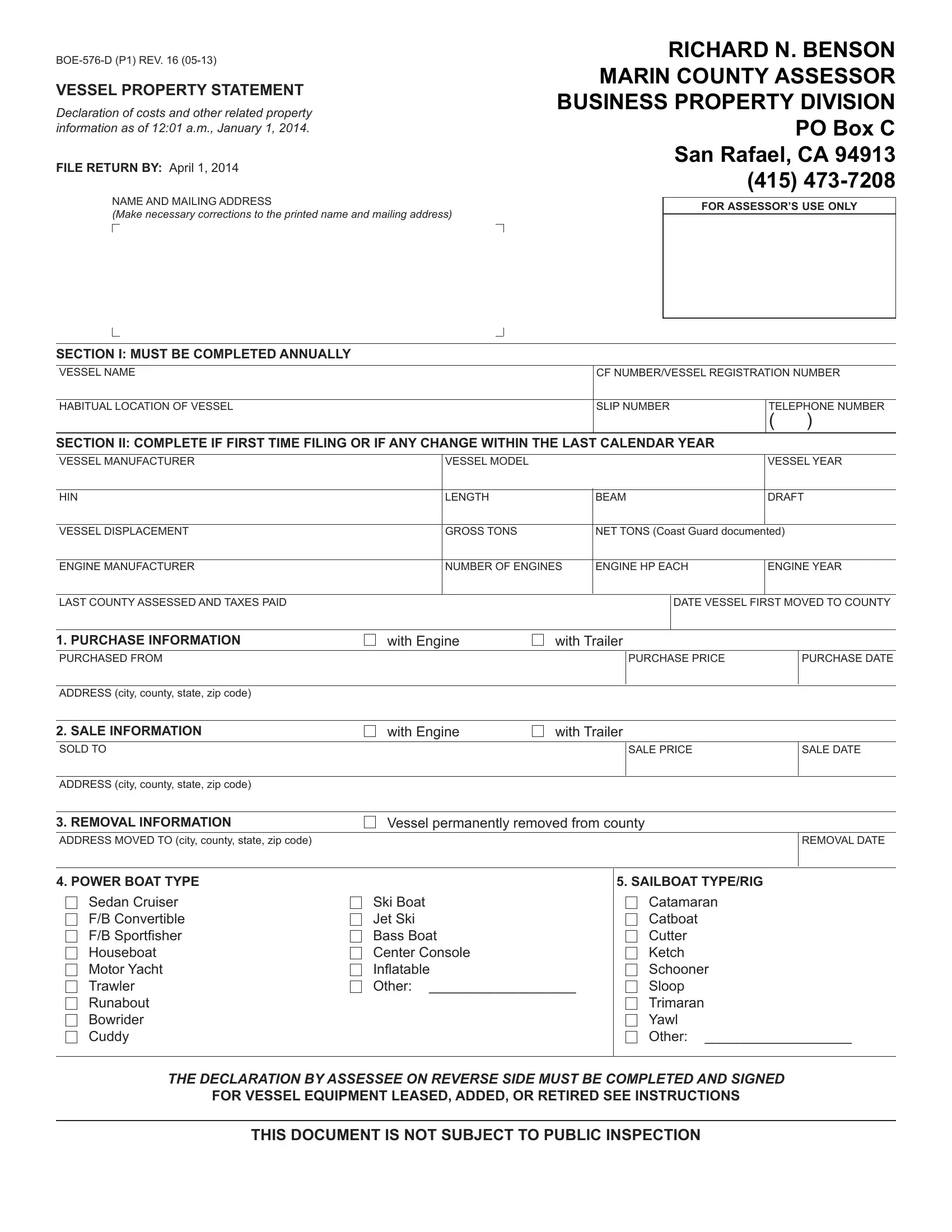

BOE-576-D (P1) REV. 16 (05-13)

VESSEL PROPERTY STATEMENT

Declaration of costs and other related property information as of 12:01 a.m., January 1, 2014.

FILE RETURN BY: April 1, 2014

NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address)

RICHARD N. BENSON MARIN COUNTY ASSESSOR BUSINESS PROPERTY DIVISION PO BOX C SAN RAFAEL, CA 94913 (415) 473-7208

FOR ASSESSOR’S USE ONLY

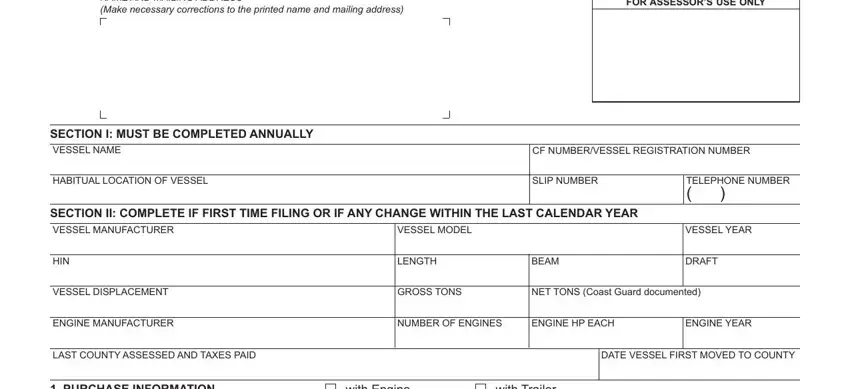

SECTION I: MUST BE COMPLETED ANNUALLY

VESSEL NAME |

|

CF NUMBER/VESSEL REGISTRATION NUMBER |

|

|

|

|

|

HABITUAL LOCATION OF VESSEL |

|

SLIP NUMBER |

TELEPHONE NUMBER |

|

|

|

|

( |

) |

|

|

|

|

|

|

SECTION II: COMPLETE IF FIRST TIME FILING OR IF ANY CHANGE WITHIN THE LAST CALENDAR YEAR |

|

|

|

|

|

|

|

VESSEL MANUFACTURER |

VESSEL MODEL |

|

|

VESSEL YEAR |

|

|

|

|

|

|

HIN |

LENGTH |

BEAM |

DRAFT |

|

|

|

|

|

|

|

VESSEL DISPLACEMENT |

GROSS TONS |

NET TONS (Coast Guard documented) |

|

|

|

|

|

|

ENGINE MANUFACTURER |

NUMBER OF ENGINES |

ENGINE HP EACH |

ENGINE YEAR |

|

|

|

|

|

LAST COUNTY ASSESSED AND TAXES PAID |

|

|

DATE VESSEL FIRST MOVED TO COUNTY |

|

|

|

|

|

|

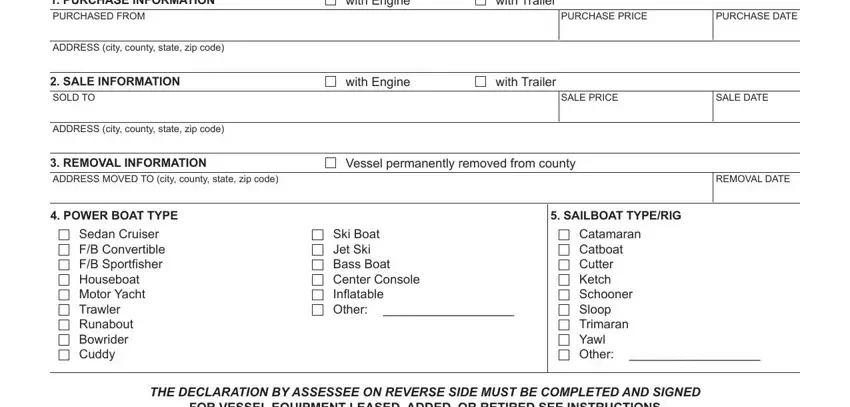

ADDRESS (city, county, state, zip code)

ADDRESS (city, county, state, zip code)

Vessel permanently removed from county

ADDRESS MOVED TO (city, county, state, zip code)

4. POWER BOAT TYPE

Sedan Cruiser

F/B Convertible

F/B Sportisher

Houseboat

Motor Yacht

Trawler

Runabout

Bowrider

Cuddy

Ski Boat

Jet Ski

Bass Boat

Center Console

Inlatable

Other: ___________________

5. SAILBOAT TYPE/RIG

Catamaran

Catboat

Cutter

Ketch

Schooner

Sloop

Trimaran

Yawl

Other: ___________________

THE DECLARATION BY ASSESSEE ON REVERSE SIDE MUST BE COMPLETED AND SIGNED

FOR VESSEL EQUIPMENT LEASED, ADDED, OR RETIRED SEE INSTRUCTIONS

THIS DOCUMENT IS NOT SUBJECT TO PUBLIC INSPECTION

BOE-576-D (P3) REV. 16 (05-13)

OFFICIAL REQUEST

A report on BOE-576-D is required of you by section 441(a) of the Revenue and Taxation Code (Code). The statement must be completed according to the instructions and iled with the Assessor on or before April 1. Failure to ile it on time will compel the Assessor to estimate the value of your property from other information in the assessor’s possession and add a penalty of 10 percent as required by Code section 463.

This statement is not a public document. The information contained herein will be held secret by the Assessor (Code section 451); it can be disclosed only to the district attorney, grand jury, and other agencies speciied in Code section 408. Attached schedules are considered to be part of the statement. In all instances, you must return the original BOE-576-D.

GENERAL INSTRUCTIONS

ADDRESS BLOCK: Make necessary changes to assessee, mailing address, and enter all information that is applicable to your particular vessel.

1.PURCHASE INFORMATION: Enter the total original cost of the vessel as purchased. Include sales tax and all other relevant costs. If the vessel exceeds

27feet in length a copy of your purchase agreement or invoice is required to be submitted with this statement.

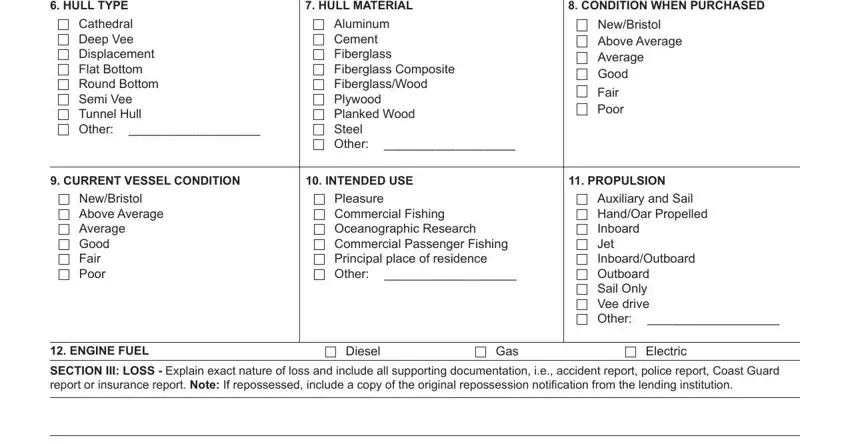

9.CURRENT VESSEL CONDITION: Using the information below, check the line that relects the condition of your vessel:

•NEW/BRISTOL: is a vessel that is new or is maintained in mint or a fashion usually better than factory new — loaded with extras. Turnkey, no commissioning necessary.

•ABOVE AVERAGE: Has had above average care and is equipped with extra electrical and electronic gear. A well-found vessel ready to go.

•AVERAGE: Clean, ready for sale. Attractive inside and out, normally equipped. Mechanically sound, mid-time on mechanicals, and little or no additional work.

•GOOD: Mechanically sound, requiring some interior and exterior cosmetic work. Some mechanicals on the down side of life expectancy.

•FAIR: Cosmetics still show noticeable areas of wear and fading after cleanup. Mechanically sound but deinitely on the down side of life. May require substantial yard work.

•POOR: Vessel needs signiicant amount of structural yard repair. Most mechanicals, electronics, need overhaul or replacement. Cosmetics almost not restorable. Cost of repairs and restoration may exceed market value of the vessel.

10.INTENDED USE - COMMERCIAL FISHING, OCEANOGRAPHIC RESEARCH OR COMMERCIAL PASSENGER FISHING: A vessel may be eligible for a special 4 percent assessment under the provisions of Code section 227 if the boat is engaged exclusively:

•In the taking and possession of ish or other living resource of the sea for commercial purposes.

•In instruction or research studies as an oceanographic research vessel.

•In carrying or transporting seven (7) or more people for commercial passenger ishing purposes and holds a current certiicate of inspection issued by the United States Coast Guard.

If, in your opinion, the vessel meets the above criteria, obtain the BOE-576-E, Afidavit for 4 Percent Assessment of Certain Vessels, from the Assessor and ile on or before February 15.

10.INTENDED USE - OTHER: If you ile a Business Property Statement, or if this vessel is used in connection with any business, trade, or profession located within this County, enter the name and address of the business.

VESSEL EQUIPMENT LEASED, ADDED or RETIRED: If you lease equipment in connection with this vessel’s operation, attach a schedule listing the name and address of the owner and description of the leased property cost if purchased, and annual rent. If you have added or retired equipment from date of acquisition of vessel to last day in December, last year, attach a schedule listing the description of equipment, the date added or retired, and the added or retired equipment’s cost. Explain any major overhaul of the vessel, its engine, or other equipment.

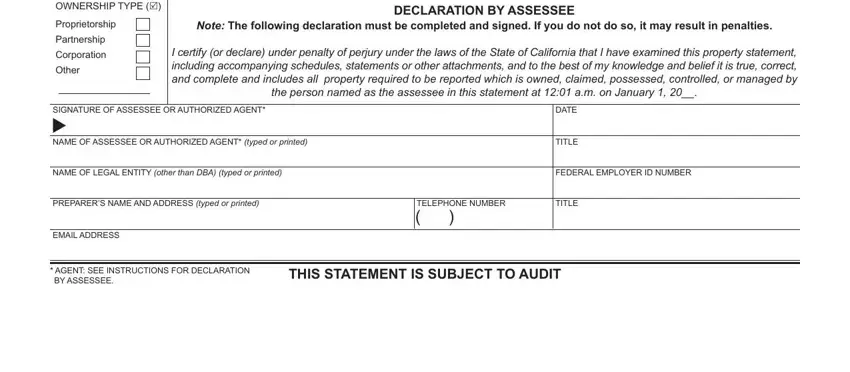

DECLARATION BY ASSESSEE: The law requires that this property statement, regardless of where it is executed, shall be declared to be true under penalty of perjury under the laws of the State of California. The declaration must be signed by the assessee, a duly appointed iduciary, or a person authorized to sign on behalf of the assessee. In the case of a corporation, the declaration must be signed by an oficer or by an employee or agent who has been designated in writing by the board of directors, by name or by title, to sign the declaration on behalf of the corporation. In the case of a partnership, the declaration must be signed by a partner or an authorized employee or agent. In the case of a Limited Liability Company (LLC), the declaration must be signed by an LLC manager, or by a member where there is no manager, or by an employee or agent designated by the LLC manager or by the members to sign on behalf of the LLC.

When signed by an employee or agent, other than a member of the bar, a certiied public accountant, a public accountant, an enrolled agent or a duly appointed iduciary, the assessee’s written authorization of the employee or agent to sign the declaration on behalf of the assessee must be iled with the Assessor. The Assessor may at any time require a person who signs a property statement and who is required to have written authorization to provide proof of authorization.

A property statement that is not signed and executed in accordance with the foregoing instructions is not validly iled. The penalty imposed by Code section 463 for failure to ile is applicable to unsigned property statements.

VETERANS EXEMPTION: To ile a Claim for Veterans’ Exemption on the declared vessel, obtain BOE-261 from the Assessor. The exemption claim must be iled on or before February 15. No such exemption shall apply if (a) the unmarried veteran or unmarried pensioned parent owns property valued at $5,000 or more, (b) a married veteran or married pensioned parent who, together with the spouse, owns property valued at $10,000 or more, or (c) the

unmarried widow or widower of a deceased veteran owns property in excess of $10,000.

HOMEOWNERS EXEMPTION: If the declared vessel is your principal place of residence, and you have not previously iled a Claim for Homeowners’ Property Tax Exemption stating this fact, obtain BOE-266 from the Assessor. The exemption claim must be iled on or before February 15.

ARMED FORCES MEMBERS EXEMPTION: If you are not a resident of the State of California, but are in this state solely by the reason of compliance with military orders, you may declare tax situs elsewhere by iling BOE-261-D, Servicemembers Civil Relief Act Declaration. Obtain the declaration form from the Assessor or from your unit Legal Oficer.

OVER 50 NET TONS EXEMPTION: If your vessel is over 50 net tons burden, certiied and engaged in the transportation of freight or passengers, complete the form and send with a copy of the vessel document and the U.S. Coast Guard or SOLAS certiicate.