Form Cctr 0506 is a document used by the IRS to collect information about taxpayers and their businesses. The form is used to determine potential audit targets, and must be completed by all businesses with gross receipts of $200,000 or more in a taxable year. Completing the form can help business owners avoid potential problems with the IRS, so it is important to understand exactly what is required. This blog post will provide an overview of Form Cctr 0506, including the information it asks for and how to complete it.

| Question | Answer |

|---|---|

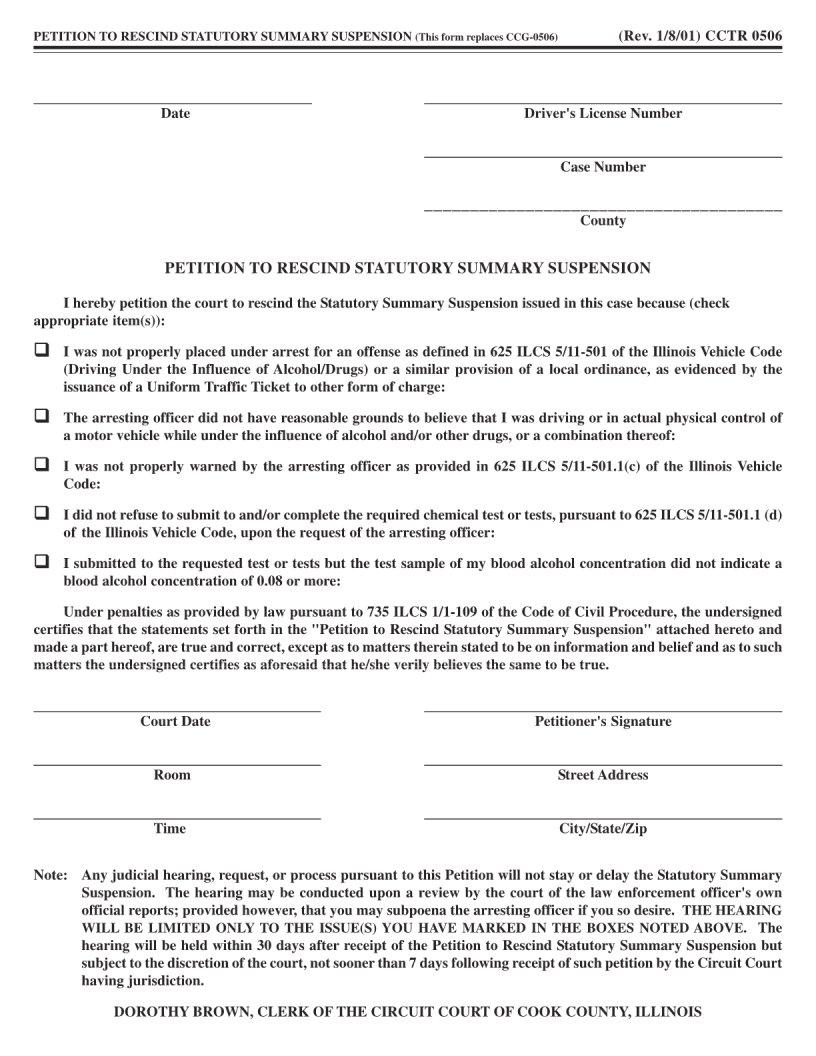

| Form Name | Form Cctr 0506 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | evidenced, ILCS, pursuant, aforesaid |