Each year, businesses and individuals in the United States are required to file a form with the IRS known as 1120U. This form is used to report income and taxes related to that income. The deadline for filing this form is generally in September, so it's important to understand what it is and how to complete it correctly. In this blog post, we'll provide an overview of Form 1120U and explain who needs to file it. We'll also discuss the penalties for not filing on time or completing the form incorrectly. So if you're wondering what Form 1120U is and whether or not you need to file it, keep reading!

| Question | Answer |

|---|---|

| Form Name | Form Ct 1120U |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | ct 1120u ct 1120u instructions form |

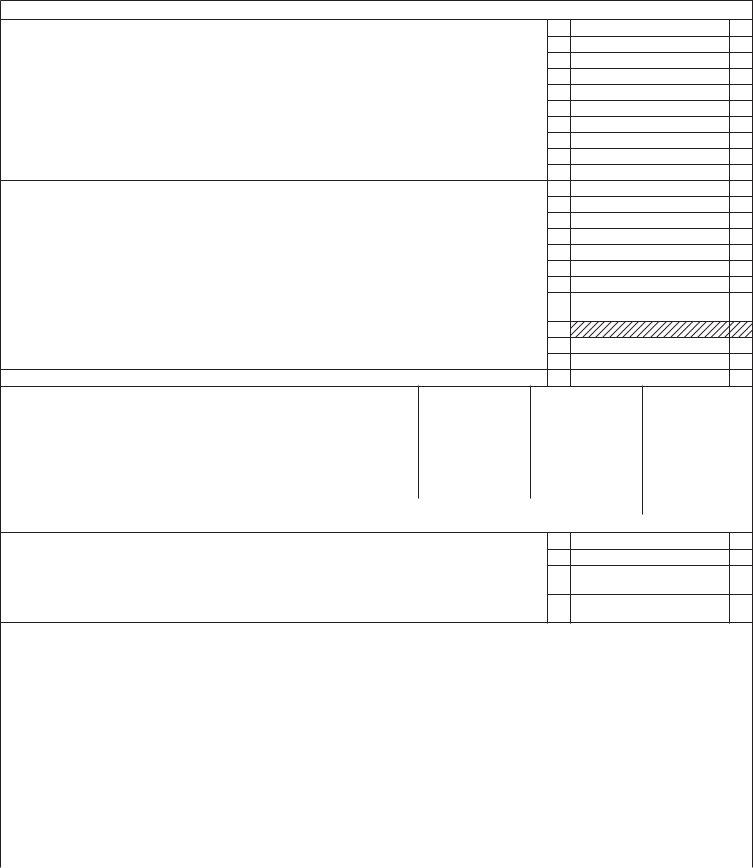

Department of Revenue Services State of Connecticut

(Rev. 12/10)

Form |

2010 |

Unitary Corporation Business Tax Return |

Enter Income Year Beginning ____________________, 2010, and Ending _____________________________________

Total assets |

|

00 |

Name of parent or designated Connecticut parent corporation |

|

|

|

Parent or Designated CT Parent |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Connecticut Tax Registration Number |

|||||

Gross receipts |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|||||

00 |

Address |

number and street |

PO Box |

|

|

|

|

|||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

DRS use only |

|

||

NAICS code: See instructions. |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

– |

– 20 |

||

|

|

|

City or town |

|

State |

ZIP code |

|

|||||||

Audited by |

F O |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

Federal Employer ID Number (FEIN) |

|||||||

Check All Applicable Boxes |

1. Address change |

2. Unitary return status: Final Short period |

|

|

|

|||||||||

|

|

|

|

|||||||||||

3. |

Has any corporation within the group: Dissolved Withdrawn Merged/Reorganized: Enter survivor’s CT Tax Reg # _______________________________ |

|||||||||||||

4. |

Is this the fi rst year this group is fi ling a unitary return? |

Yes (Attach Form |

|

No |

|

|

||||||||

Visit the DRS Taxpayer |

||||||||||||||

5. |

Does any nexus company pay, accrue, or incur interest expenses or intangible expenses, costs, and related |

|

|

|||||||||||

|

|

Service Center (TSC) at |

||||||||||||

|

interest expenses to a related member? |

|

Yes (Attach Form |

|

|

|

No |

|||||||

6. |

Is the unitary group exchanging R & D tax credits? |

Yes (Attach Form |

|

|

|

No |

www.ct.gov/TSC |

|

||||||

7. |

Did the unitary group annualize its estimated tax payments? |

Yes (Attach Form |

|

|

|

No |

to pay this |

|

||||||

8. |

Is any corporation fi ling Form |

|

Yes (Attach Form |

|

|

|

No |

return electronically. |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule of Corporations Included in the Unitary Return IF ADDITIONAL LINES ARE NEEDED, ATTACH A SCHEDULE.

|

Corporation Name |

Nexus |

|

CT Tax Registration Number* |

FEIN |

|

|

With CT () |

|

||||

1. |

Common parent or designated Connecticut parent |

|

|

— ____ |

|

|

2. |

|

|

|

— |

000 |

|

3. |

|

|

|

— |

000 |

|

*CT Tax Registration Number must be included for parent and all affi liates, if applicable.

Minimum Tax Calculation

1. |

. .................................................Enter the total number of corporations included in this unitary return |

1 |

|

|

||||

|

|

|

|

|

|

|

|

|

2. |

Minimum tax: Multiply Line 1 by $250 |

|

2 |

|

00 |

|||

|

|

|

|

|

||||

|

– Attach a Complete Copy of Form 1120 Including all Schedules as Filed With the Internal Revenue Service – |

|||||||

Schedule A – Computation of Tax on Net Income |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

1. |

Net income from Schedule D, Line 22 |

|

1 |

|

00 |

|||

|

|

|

|

|

|

|

|

|

2. |

Apportionment fraction from Form |

2 |

0. |

|

||||

|

|

|

|

|

|

|

|

|

3. |

Connecticut net income: Multiply Line 1 by Line 2 |

|

3 |

|

00 |

|||

|

|

|

|

|

|

|

|

|

4. |

Operating loss carryover: See instructions |

|

4 |

|

00 |

|||

|

|

|

|

|

|

|

|

|

5. |

Income subject to tax: Subtract Line 4 from Line 3 |

|

5 |

|

00 |

|||

|

|

|

|

|

|

|

|

|

6. |

Tax: Multiply Line 5 by 7.5% (.075) |

|

6 |

|

00 |

|||

Schedule B – Computation of Minimum Tax on Capital |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

1. |

Minimum tax base from Schedule E, Line 6, Column C |

|

1 |

|

00 |

|||

|

|

|

|

|

|

|

||

2. |

Apportionment fraction from Form |

2 |

0. |

|

||||

|

|

|

|

|

|

|

|

|

3. |

Multiply Line 1 by Line 2. |

...................................................................................................................... |

|

3 |

|

00 |

||

|

|

|

|

|

|

|

|

|

4. |

Number of months covered by this return |

|

4 |

|

|

|||

|

|

|

|

|

|

|

|

|

5. |

Multiply Line 3 by Line 4. |

Divide the result by 12 |

|

5 |

|

00 |

||

|

|

|

|

|

|

|

|

|

6. |

Tax (3 and 1/10 mills per dollar): Multiply Line 5 by .0031 |

6 |

|

00 |

||||

Schedule C – Computation of Amount Payable |

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

1a. Tax: Enter the greater of Schedule A, Line 6; Schedule B, Line 6; or the minimum tax calculation. |

.... |

1a |

|

00 |

||||

|

|

|

|

|||||

1b. Surtax: If Line 1a is the minimum tax calculation, enter “0.” Otherwise, multiply Line 1a by 10% (.10). 1b |

|

00 |

||||||

|

|

|

|

|

|

|

|

|

1c. |

Recapture of tax credits: See instructions |

|

1c |

|

00 |

|||

. ......1. Total tax: Enter the total of Lines 1a through 1c. If no tax credits claimed, also enter on Line 6 |

|

1 |

|

00 |

||||

|

|

|

|

|

|

|

|

|

2. |

Multiply Line 1 by 30% (0.30) |

|

2 |

|

00 |

|||

|

|

|

|

|

|

|

|

|

3. |

Enter the greater of Line 2 or minimum tax |

|

3 |

|

00 |

|||

|

|

|

|

|

|

|

|

|

4. |

Tax credit limitation: Subtract Line 3 from Line 1 |

|

4 |

|

00 |

|||

|

|

|

|

|

|

|||

5. |

Tax credits from Form |

5 |

|

00 |

||||

|

|

|

|

|

|

|

|

|

6. |

Balance of tax payable: Subtract Line 5 from Line 1 |

|

6 |

|

00 |

|||

|

|

|

|

|

|

|

||

7a. Paid with application for extension from Form |

......................................................................... |

7a |

|

00 |

||||

|

|

|

|

|

|

|||

7b. Paid with estimates from Forms |

7b |

|

00 |

|||||

|

|

|

|

|

|

|

||

7c. Overpayment from prior year |

|

7c |

|

00 |

||||

|

|

|

|

|

|

|

||

7. Tax payments: Enter the total of Lines 7a, 7b, and 7c |

|

7 |

|

00 |

||||

|

|

|

|

|

|

|

|

|

8. |

Balance of tax due (overpaid): Subtract Line 7 from Line 6 |

|

8 |

|

00 |

|||

|

|

|

|

|

|

|

|

|

9. |

Add: Penalty (9a) |

.00 Interest (9b) |

.00 |

.00 |

|

9 |

|

00 |

10. |

Amount to be credited to 2011 estimated tax (10a) |

.00 Refunded (10b) |

.00 |

|

10 |

|

00 |

|

11. |

Balance due with this return: Add Line 8 and Line 9 |

|

11 |

|

00 |

|||

Schedule D – Computation of Net Income

1. |

Federal taxable income (loss) before net operating loss and special deductions ..........................................1 |

00 |

2. |

Interest income wholly exempt from federal tax .............................................................................................2 |

00 |

3. |

Unallowable deduction for corporation tax from Schedule F, Line 4 ..............................................................3 |

00 |

4. |

Interest expenses paid to a related member from Form |

00 |

5. |

Intangible expenses and costs paid to a related member from Form |

00 |

6. |

Federal bonus depreciation: See instructions. ...............................................................................................6 |

00 |

7. |

Cancellation of debt income deferred on IRC §108(i) election statement ......................................................7 |

00 |

8. |

IRC §199 domestic production activities deduction from federal Form 1120, Line 25 ....................................8 |

00 |

9. |

Other: Attach explanation. ..............................................................................................................................9 |

00 |

10. |

Total: Add Lines 1 through 9. ..........................................................................................................................10 |

00 |

11. |

Dividend deduction from Form |

00 |

12. |

Capital loss carryover (if not deducted in computing federal capital gain) .....................................................12 |

00 |

13. |

Capital gain from sale of preserved land ........................................................................................................13 |

00 |

14. |

Federal bonus depreciation recovery from Form |

00 |

15. |

Exceptions to interest add back from Form |

00 |

16. |

Exceptions to interest add back from Form |

00 |

17. |

Exceptions to interest add back from Form |

00 |

18. |

Exceptions to add back of intangible expenses paid to a related member |

|

|

from Form |

00 |

19. |

Reserved for future use ..................................................................................................................................19 |

|

20. |

Other: See instructions. ..................................................................................................................................20 |

00 |

21. |

Total: Add Lines 11 through 20. ......................................................................................................................21 |

00 |

22. |

Net income: Subtract Line 21 from Line 10. Enter here and on Schedule A, Line 1. .....................................22 |

00 |

Schedule E – Computation of Minimum Tax Base |

Column A |

Column B |

Column C |

||||

|

See instructions. |

Beginning of Year |

End of Year |

(Column A plus |

|||

1. |

Capital stock from federal Schedule L, Line 22a and Line 22b |

|

00 |

|

00 |

||

|

|

Column B) |

|||||

2. |

Surplus and undivided profi ts from federal Schedule L, Lines 23, 24, and 25 |

|

00 |

|

00 |

||

|

|

Divided by 2 |

|||||

3. |

Surplus reserves: Attach schedule |

|

00 |

|

00 |

|

|

4. |

Total: Add Lines 1, 2, and 3. Enter average in Column C |

|

00 |

|

00 |

|

00 |

5. |

Holdings of stock of private corporations: Attach schedule. Enter average in Column C. |

|

00 |

|

00 |

|

00 |

6. |

Balance: Subtract Line 5, Column C, from Line 4, Column C. Enter here and on Schedule B, Line 1 |

|

|

00 |

|||

Schedule F – Taxes

1.Connecticut corporation business taxes deducted in the computation of federal taxable income ......................

2.Other taxes: See instructions. .............................................................................................................................

3.Tax on or measured by income or profi ts imposed by other states or political subdivisions deducted in the computation of federal taxable income: Attach schedule. ...................................................................................

4.Total unallowable deduction for corporation business tax purposes: Add Line 1 and Line 3. Enter here and on Schedule D, Line 3. .............................................................................................................................................

1

2

3

4

00

00

00

00

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department of Revenue Services (DRS) is a fine of not more than $5,000, imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

|

Corporate officer’s name (print) |

|

Corporate officer’s signature |

|

|

|

Date |

May DRS contact the preparer |

||

|

|

|

|

|

|

|

|

|

||

Sign Here |

|

|

|

|

|

|

|

|

shown below about this return? |

|

|

|

|

|

|

|

|

|

|

Yes No |

|

|

Title |

|

|

|

Telephone number |

|

||||

Keep a copy |

|

|

|

|

|

( |

) |

|

|

|

of this |

Paid preparer’s name (print) |

|

Paid preparer’s signature |

|

|

|

Date |

Preparer’s SSN or PTIN |

||

return for |

|

|

|

|

|

|

|

|

|

|

your |

|

|

|

|

|

|

|

|

|

|

Firm’s name and address |

|

|

|

FEIN |

|

|

Telephone number |

|||

records. |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

||

Mail return with payment to: |

|

Mail return without payment to: |

Make check payable to: |

|

|

|||||

Department of Revenue Services |

|

Department of Revenue Services |

|

Commissioner of Revenue Services |

|

|||||

State of Connecticut |

|

State of Connecticut |

|

|

|

|

|

|

||

PO Box 2974 |

|

|

PO Box 150406 |

|

|

|

|

|

|

|

Hartford CT |

|

Hartford CT |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Form