In order to file your CT-241 tax form, you will need to gather a number of documents including your social security number and W-2 forms. The CT-241 tax form is used to calculate the amount of taxes that you owe the state of Connecticut. You can use this form to claim exemptions, credits, or deductions. If you have any questions about how to fill out the CT-241 tax form, be sure to consult with a professional accountant. Filing your taxes can be a complex process, but with the right information it can be easy and efficient. Thanks for reading!

| Question | Answer |

|---|---|

| Form Name | Form Ct 241 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | ct241_2008 form ct 241 fill in |

Staple forms here

New York State Department of Taxation and Finance |

|

|

|

|

Claim for Clean Heating Fuel Credit |

|

Tax Law — Section 210.39 |

|

All filers must enter tax period: |

beginning

ending

Name

Employer identification number (EIN)

Attach to Form

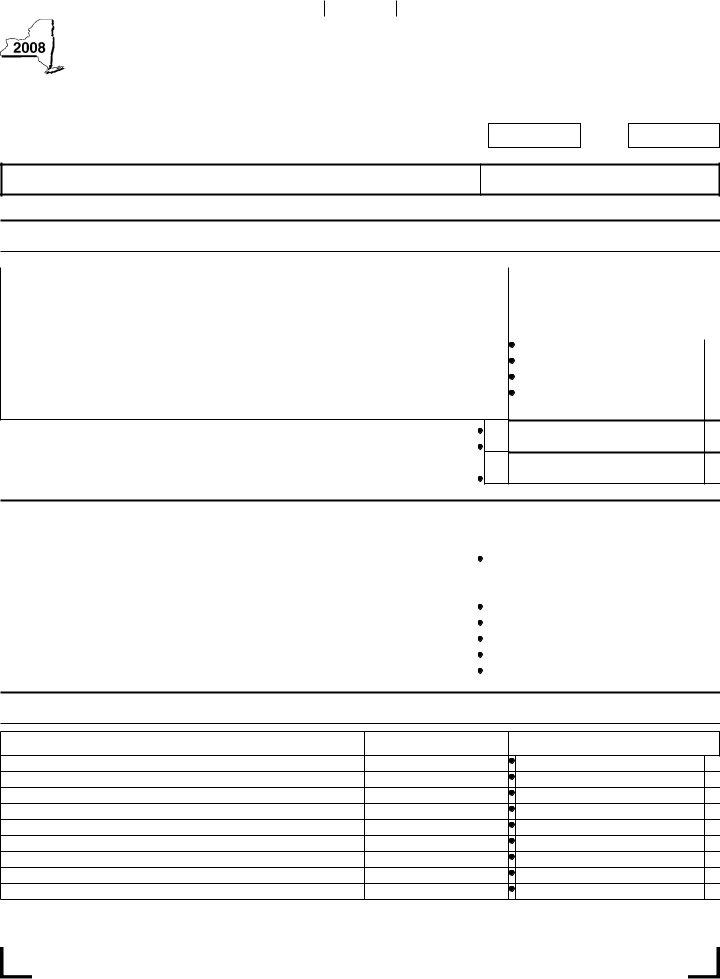

Part 1 — Computation of clean heating fuel credit (see instructions; documentation must be attached)

A |

B |

C |

D |

Purchase date |

Gallons of bioheat |

Percentage of biodiesel |

Multiply column B |

|

eligible for credit |

per gallon of bioheat |

by column C |

|

|

(enter as a decimal, |

|

|

|

not to exceed .2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total from attached sheets, if any.................................................................................................

1 |

Credit amount (total column D amounts) |

1. |

2 |

Clean heating fuel credits passed through from partnership(s) |

2. |

3Total clean heating fuel credit available (add lines 1 and 2; S corporations should transfer this

amount to Form |

3. |

Part 2 — Computation of clean heating fuel credit used, refunded, and credited as an overpayment to next year’s tax (see instructions; New York S corporations do not complete this part)

4 |

Tax due before credits (from Form |

4. |

|

|

5 |

Tax credits claimed before the clean heating fuel credit (see instructions) |

5. |

|

|

6 |

Net tax (subtract line 5 from line 4) |

6. |

|

|

7 |

Tax limitation (from Form |

7. |

|

|

8 |

Tax credit after limitation (subtract line 7 from line 6; if the result is negative, enter 0) |

8. |

|

|

9 |

Clean heating fuel credit to be used this year (enter the lesser of line 3 or line 8) |

9. |

|

|

10 |

Unused clean heating fuel credit (subtract line 9 from line 3) |

10. |

|

|

11 |

Amount of line 10 to be refunded |

11. |

|

|

12 |

Amount to be credited as an overpayment to next year’s tax (subtract line 11 from line 10) |

12. |

|

|

Part 3 — Partnership information (complete only if you entered an amount on line 2; attach additional sheets if necessary)

Name of partnership

Partnership’s EIN

Credit amount allocated

52501080094

Page 2 of 2

Instructions

General information

Tax Law section 210.39 provides for a tax credit for the purchase of bioheat used for space heating or hot water production for residential purposes within New York State. The credit is equal to one cent for each percent of biodiesel per gallon of bioheat purchased on or after July 1, 2006, and before July 1, 2007; and on or after January 1, 2008, and before January 1, 2012. The amount of the credit may not exceed 20 cents per gallon. The credit may not reduce the tax liability to less than either

the tax on the minimum taxable income base or the fixed dollar minimum tax, whichever is greater. Any amount not used in the current tax year may be refunded or credited as an overpayment to the next year’s tax. No interest will be paid on the refund.

Attach documentation showing the date of the purchase, the amount, and the percent of biodiesel in the bioheat purchased by you and claimed on this form. The credit must be claimed for the tax year in which the bioheat is purchased, regardless of when the bioheat is used.

Definitions

Bioheat is a fuel comprised of biodiesel blended with conventional home heating oil, which meets the specifications of the American Society of Testing and Materials designation D 396 or D 975.

Biodiesel is a fuel comprised exclusively of

Residential purposes means any use of a structure, or part of a structure, as a place of abode maintained by or for a person, whether or not owned by such person, on other than a temporary or transient basis. This includes

Corporate partners

If you are a corporate partner, enter on line 2 any pro rata share of the clean heating fuel credits passed through to you from the partnership. Also enter the name, employer identification number, and the share of the credit for each partnership in Part 3.

New York S corporations

New York S corporations will calculate a clean heating fuel credit, however the S corporation may not use the credit against its own tax liability. Instead the credit is passed through to the shareholders to use against their personal income

tax liabilities on their New York State tax returns. New York

S corporations complete only Part 1. Include the line 3 amount on Form

Combined filers

A taxpayer filing as a member of a combined group is allowed to claim the clean heating fuel credit. The clean heating fuel credit is computed on a separate basis, but is applied against the combined tax.

Line instructions

Part 1 — Use a separate line for each purchase of bioheat. Attach additional sheets if necessary.

Column A — Enter the date the bioheat was purchased. If you purchased the bioheat under a plan that requires prepayment for a stipulated number of gallons of bioheat at a fixed price, enter the date of the prepayment as the date of purchase. If you purchased the bioheat through a payment (budget) plan where you make monthly payments to the supplier and the supplier deducts the amount of the sale from your account at the time of delivery, enter the date of delivery as the date of purchase.

Column B — Enter the gallons of bioheat purchased on the date entered in column A. Attach documentation showing the number of gallons purchased and the percentage of biodiesel for each gallon purchased.

If bioheat is purchased for a location that has both business and residential space, but has only one tank for the storage and use of bioheat fuel, the taxpayer must use the following formula to determine the percentage of space used for residential purposes.

Square footage of residential areas |

|

% used for |

||

(excluding common areas) |

|

= |

residential purposes |

|

Total square footage of location |

(rounded to four |

|||

|

||||

(excluding common areas) |

|

decimal places) |

||

For purposes of the formula:

• Hotels,motels,andsimilarlocationsmayclaimasresidential square footage only those units used by the same occupant for more than 90 consecutive days.

• Common area means any area at the premises used without distinction for both residential and business purposes.

To determine the number of gallons eligible for the credit, multiply the percentage by the number of gallons of bioheat purchased.

Column C — Enter the percentage of biodiesel per gallon of bioheat purchased. This percentage will be listed on your receipt preceded by the letter B.

Example: If B5 is shown in the description of the bioheat on your receipt, the bioheat contains 5% biodiesel. In that case, you would enter .05 in column C for that purchase. If the receipt showed B20, the bioheat is 20% biodiesel and you would enter

.2 in column C. The amount entered cannot exceed 20% (.2).

Column D — Add the column D amounts and enter the result on line 1.

Line 2 — Obtain this amount from the partnership(s) allocating this credit to you. Also complete Part 3.

Line 5 — You must apply certain credits before the clean heating fuel credit. Refer to Form

Need help?

Internet access: www.nystax.gov

(for information, forms, and publications) |

|

1 800 |

|

To order forms and publications: |

1 800 |

Corporation Tax Information Center: |

1 888 |

From areas outside the U.S. and |

|

outside Canada: |

(518) |

Text Telephone (TTY) Hotline |

|

(for persons with hearing and |

|

speech disabilities using a TTY): |

1 800 |

52502080094