If you are in the market for a new car, you may have come across some of the newer car safety features that are now available. One such feature is automatic emergency braking. Automatic emergency braking is a system that uses sensors to detect an impending crash and then applies the brakes automatically in order to avoid or minimize the collision. In this blog post, we will explore automatic emergency braking and discuss why it is becoming increasingly popular among drivers. We will also compare automatic emergency braking with other common car safety features so that you can make an informed decision about which one is best for you. Finally, we will provide some tips on how to get the most out of your automatic emergency braking system. Stay safe on the roads!

| Question | Answer |

|---|---|

| Form Name | Form Ct 3 S Att |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | CT-3-S, Originating, 9-A, New_York |

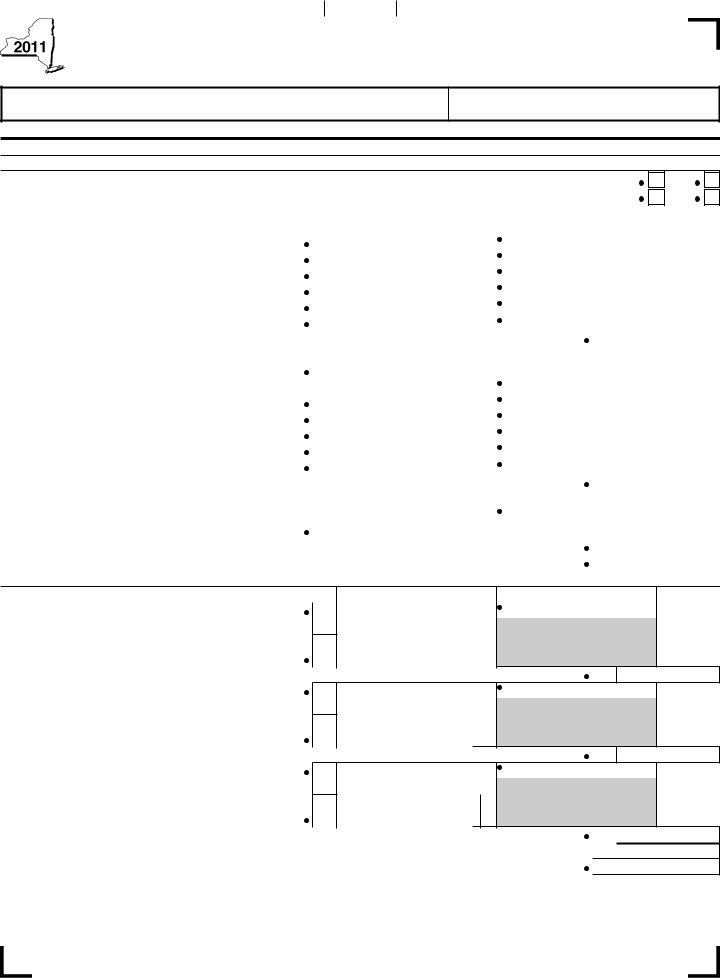

Staple forms here

Attachment to Form

Legal name of corporation

Employer identiication number

Attach to Form

Schedule A — Business allocation percentage (see instructions)

Part 1 — Computation of business allocation percentage (see instructions)

Did you make an election to use fair market value in your property factor? |

|

|

Yes |

No |

|||||||

If this is your irst tax year, are you making the election to use fair market value in your property factor? |

Yes |

No |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Average value of property (see instructions) |

|

A. New York State |

|

B. Everywhere |

|

||||||

1 |

Real estate owned |

1. |

|

|

|

|

|

|

|

|

|

2 |

Real estate rented (attach list) |

|

2. |

|

|

|

|

|

|

|

|

3 |

Inventories owned |

3. |

|

|

|

|

|

|

|

|

|

4 |

Tangible personal property owned |

4. |

|

|

|

|

|

|

|

|

|

5 |

Tangible personal property rented |

5. |

|

|

|

|

|

|

|

|

|

6 |

Total (add lines 1 through 5) |

6. |

|

|

|

|

|

|

|

|

|

7 |

New York State property factor (divide line 6, column A, by line 6, column B) |

|

|

7. |

|

|

% |

||||

Receipts in the regular course of business (see instr.) |

|

|

|

|

|

|

|

|

|

||

8 |

Sales of New York State tangible personal property |

8. |

|

|

|

|

|

|

|

|

|

9 |

All sales of tangible personal property |

9. |

|

|

|

|

|

|

|

|

|

10 |

Services performed |

10. |

|

|

|

|

|

|

|

|

|

11 |

Rentals of property |

11. |

|

|

|

|

|

|

|

|

|

12 |

Royalties |

12. |

|

|

|

|

|

|

|

|

|

13 |

Other business receipts |

13. |

|

|

|

|

|

|

|

|

|

14 |

Total (add lines 8 through 13) |

14. |

|

|

|

|

|

|

|

|

|

15 |

New York State business receipts factor (divide line 14, column A, by line 14, column B; see instructions) |

15. |

|

|

% |

||||||

Payroll (see instructions) |

|

|

|

|

|

|

|

|

|

||

16 |

Total wages and other compensation of employees |

|

|

|

|

|

|

|

|

|

|

|

except general executive oficers |

16. |

|

|

|

|

|

|

|

|

|

17 |

New York State payroll factor (divide line 16, column A, by line 16, column B) |

|

|

17. |

|

|

% |

||||

18 |

Business allocation percentage (see instructions) |

|

|

|

|

|

18. |

|

|

% |

|

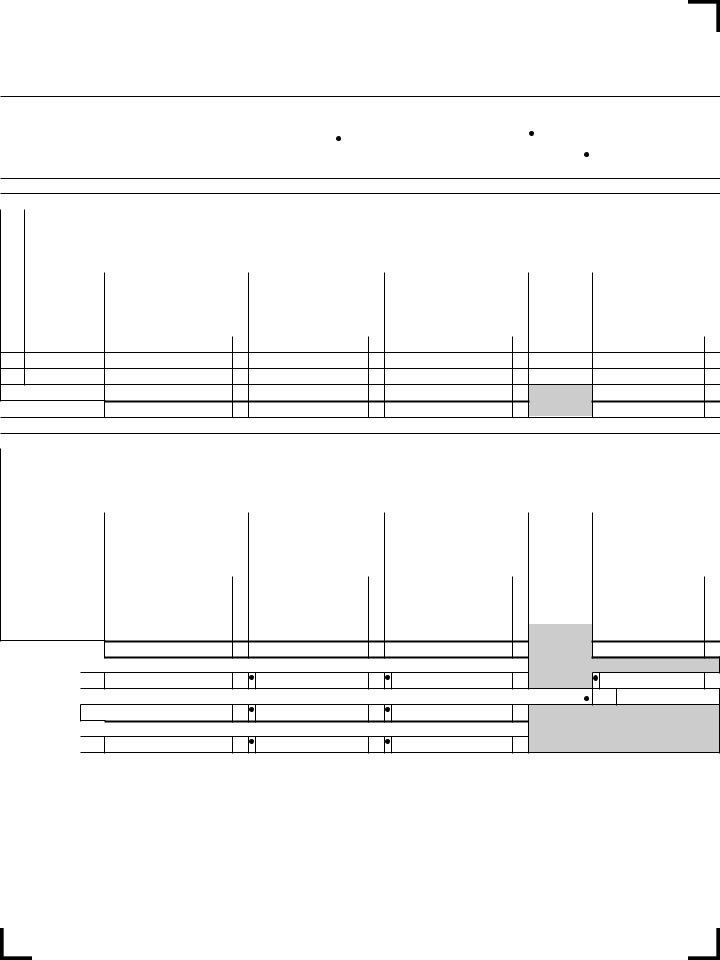

Part 2 — Computation of business allocation percentage for aviation corporations (see instructions) |

|

||||||||||

|

|

|

A. New York State |

|

|

B. Everywhere |

|

|

|

|

|

|

|

|

|

19 |

Revenue aircraft arrivals and departures |

19. |

|

|

|

|

|

20 |

Adjustment per Tax Law, Article |

20. |

|

|

.60 |

|

|

21Adjusted NYS revenue aircraft arrivals and departures

|

(in column A, multiply line 19 by line 20) |

21. |

|

|

|

|

|

22 |

New York percentage (divide line 21, column A, by line 19, column B) |

|

|

|

22. |

||

23 |

Revenue tons handled |

23. |

|

|

|

|

|

24 |

Adjustment per Tax Law section 210.3(a)(7)(A) |

24. |

|

.60 |

|

|

|

25Adjusted NYS revenue tons handled

|

(in column A, multiply line 23 by line 24) |

25. |

|

|

|

|

|

|

|

26 |

New York percentage (divide line 25, column A, by line 23, column B) |

|

|

|

|

26. |

|

||

27 |

Originating revenue |

27. |

|

|

|

|

|

|

|

28 |

Adjustment per Tax Law section 210.3(a)(7)(A) |

28. |

|

.60 |

|

|

|

|

|

29Adjusted NYS originating revenue

|

(in column A, multiply line 27 by line 28) |

29. |

|

|

|

|

30 |

New York percentage (divide line 29, column A, by line 27, column B) |

30. |

||||

31 |

Total (add lines 22, 26, and 30) |

|

|

31. |

||

32 |

Business allocation percentage (divide line 31 by three) |

............................................................................... |

|

|

32. |

|

%

%

%

%

%

44501110094

Page 2 of 2

Part 3 — Computation of business allocation percentage for trucking and railroad corporations (see instructions)

|

|

|

A. New York State |

|

B. Everywhere |

|

||

|

|

|

|

|

|

|

|

|

33 |

Revenue miles (see instructions) |

33. |

|

|

|

|

|

|

34 |

Business allocation percentage (divide line 33, column A, by line 33, column B) |

|

34. |

|

% |

|||

Schedule B — Computation of investment allocation percentage (see instructions)

Section 1 — Corporate and governmental debt instruments (see instructions)

A — Description of investment (identify each item; for each debt instrument, complete columns B through G on the corresponding lines below)

Item |

|

|

Debt instrument description |

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

B |

|

|

|

|

|

|

C |

|

|

|

|

|

|

A |

B |

C |

D |

E |

F |

G |

Item |

Maturity date |

Average value |

Liabilities directly or |

Net average value |

Issuer’s |

Value allocated to |

|

|

indirectly attributable to |

(column C – column D) |

allocation |

New York State |

|

|

|

|

investment capital |

|

% |

(column E × column F) |

|

|

|

|

|

|

|

A

B

C

Amounts from attached list

Totals of Section 1

Section 2 — Corporate stock, stock rights, stock warrants, and stock options (see instructions)

A — Description of investment (identify each investment here; for each investment, complete columns B through G on the corresponding lines below)

Item |

|

|

Investment description |

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

B |

|

|

|

|

|

|

C |

|

|

|

|

|

|

A |

B |

C |

D |

E |

F |

G |

Item |

Number of |

Average value |

Liabilities directly or |

Net average value |

Issuer’s |

Value allocated to |

|

shares |

|

indirectly attributable to |

(column C – column D) |

allocation |

New York State |

|

|

|

investment capital |

|

% |

(column E × column F) |

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

B |

|

|

|

|

|

|

C |

|

|

|

|

|

|

Amounts from attached list

Totals of Section 2

35 Total (add totals of Sections 1 and 2, columns C, D, E, and G)

35.

36 Investment allocation percentage without cash (divide line 35, column G, by line 35, column E) |

36. |

% |

37 Cash (optional) 37.

38Investment capital (add lines 35 and 37, columns C, D, and E).

38.

44502110094