Are you a business owner who is looking to save money on your tax bill? If so, you may be interested in Form Ct 43. This form can help businesses reduce their taxable income, and as a result, save money on their taxes. In this blog post, we will provide an overview of Form Ct 43 and explain how businesses can use it to lower their tax bills. We will also discuss some of the benefits of using this form and outline the steps businesses need to take in order to file it. So if you're looking for ways to save money on your taxes, be sure to read on!

| Question | Answer |

|---|---|

| Form Name | Form Ct 43 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | ct43_2012 claim for special additional mortgage tax credit ct 43 form |

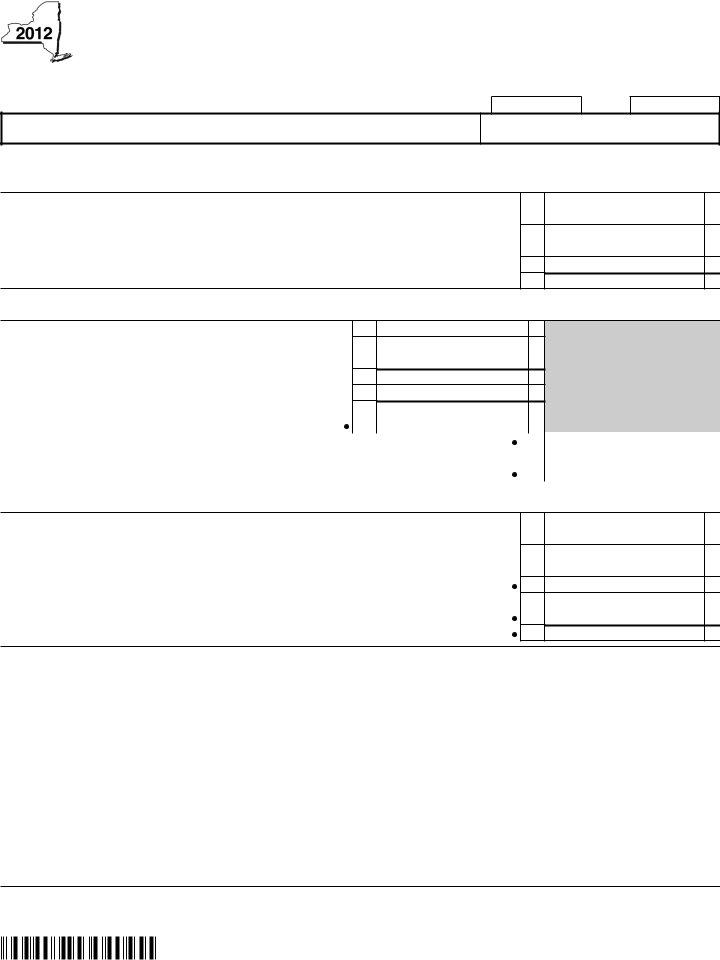

New York State Department of Taxation and Finance

Claim for Special Additional Mortgage Recording Tax Credit

Tax Law – Article 9, Sections 183, 184, 185, and 186 Articles

beginning

All ilers must enter tax period:

ending

Legal name of corporation

Employer identiication number

Read instructions on page 2.

Attach this form to your franchise tax return.

1a Special additional mortgage recording tax due and paid during current tax year that

qualiies for the credit...........................................................................................................

1b Special additional mortgage recording tax due and paid during current year from a low

through entity that qualiies for the credit (see instructions).....................................................

2 Unused special additional mortgage recording tax credit from preceding period ...................

3 Total available tax credit (add lines 1a, 1b, and 2) ......................................................................

1a

1b

2

3

Computation of special additional mortgage recording tax credit used and available to be carried forward

4 |

Tax (see below*) |

4 |

5 Tax credits claimed before the special additional |

|

|

|

mortgage recording tax credit (see instructions) |

5 |

6 |

Subtotal (subtract line 5 from line 4) |

6 |

7 |

Minimum tax (see below**) |

7 |

8Limitation on credit used (subtract line 7 from line 6; if less

than zero, enter 0) |

8 |

|

|

|

9 Special additional mortgage recording tax credit used this period (see instructions) |

9 |

|

|

|

10 Unused special additional mortgage recording tax credit available for carryforward |

10 |

|

|

|

(subtract line 9 from line 3) |

|

|

||

Refund or credit and carryforward of special additional mortgage recording tax credit (Article

11 Amount of recording tax included on lines 1a and 1b for recording of residential |

|

|

|

mortgages only (see instructions) |

11 |

12 Amount of special additional mortgage recording tax credit eligible for refund or credit |

|

|

|

(see instructions) |

12 |

13 |

Balance to be refunded (enter the amount from line 12 to be refunded; see instructions) |

13 |

14 Balance to be credited as an overpayment (enter the amount from line 12 to be credited; |

|

|

|

see instructions) |

14 |

15 |

Amount of carryforward (subtract lines 13 and 14 from line 10) |

15 |

If you iled: |

* Enter on line 4 any net recaptured |

tax credits plus the amount from: |

**Enter on line 7 the minimum tax shown below:

Form |

Line 78 |

amount from |

Form |

Line 77 |

amount from |

Form |

Line 23 |

amount from |

Form |

Schedule A, line 5 |

250 |

Form |

Line 10 |

250 |

Form |

Line 11 |

250 |

Form |

Line 15 |

(see instructions for line 7 on page 2) |

Form |

Line 5 |

250 |

Form |

Line 4 |

75 |

Form |

Line 3 or line 4 |

0 |

Form |

Line 6 |

10 |

Form |

Line 5 |

125 |

450001120094

Page 2 of 2

Instructions

Temporary deferral of certain tax credits

For tax years beginning on or after January 1, 2010, and before

January 1, 2013, if the total amount of certain credits that you may use to reduce your tax or have refunded to you is greater than $2 million, the excess over $2 million must be deferred to, and used or refunded in, tax years beginning on or after January 1, 2013. For more information about

If you are subject to the credit deferral, you must complete all credit

forms without regard to the deferral. However, the credit amount that

is transferred to your tax return to be applied against your tax due

or to be refunded to you may be reduced. Follow the instructions for

amount to be deferred.

General information

You may claim as a credit against your franchise tax certain special

additional mortgage recording tax you paid.

A tax credit is not allowed for the special additional mortgage recording tax paid on residential mortgages (deined below) recorded on or after

May 1, 1987, if the real property is located in Erie County or any of

the counties within the Metropolitan Commuter Transportation District (MCTD). The MCTD includes the counties of New York, Bronx, Queens, Kings, Richmond, Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, and Westchester.

Aresidential mortgage is deined as a mortgage of real property that has been or will be principally improved by one or more structures containing a total of not more than six residential dwelling units, each with its own separate cooking facilities.

For tax periods beginning in and after 1994, New York S corporations

above. Credit earned by the S corporation does not low through to the shareholders to be claimed against their personal income tax liability.

When claiming this credit, you must add back to your entire net income

the amount of the special additional mortgage recording tax used

as a deduction in the computation of federal taxable income. (See

Line instructions

Complete the beginning and ending tax period boxes in the upper right

corner on page 1.

Line

received from each entity.

Line

You must apply certain credits before the special additional mortgage

recording tax credit. Refer to the instructions of your franchise tax return

to determine the order of credits that applies.

Article

If you are included in a combined return, include any amount of tax credit(s), including special additional mortgage recording tax credit(s), being claimed by other members of the combined group that you wish to apply before your special additional mortgage recording tax credit.

Line 7 – Article 33 combined ilers (using Form

Line 9 – Enter the lesser of line 3 or line 8.

If your total credits from all sources are $2 million or less, enter the amount from line 9 on your franchise tax return.

If your total credits from all sources are more than $2 million, you may be subject to the temporary credit deferral. Complete line 9 but do not enter the amount from line 9 on your franchise tax return. See Form

Article

Line

Line 12 – Enter the lesser of line 10 or line 11.

Lines 13 and 14

Include the line 13 amount on Form

Include the line 14 amount on Form

If your total credits from all sources are more than $2 million, you may be subject to the temporary credit deferral. Complete lines 13 and 14 but do not enter the amounts from lines 13 and 14 on your franchise tax return. See Form

Scorporations: If the total credits claimed on lines 13 and 14 exceed

To avoid an unnecessary exchange of funds, we will apply the

refundable portion of the tax credit to any unpaid balance of the

franchise tax and metropolitan transportation business tax (MTA surcharge) and refund the remaining balance.

Need help? and Privacy notiication

See Form

450002120094