Many taxpayers claimed the education tax credit on their returns last year. However, there are some taxpayers who claimed this credit incorrectly. In order to help you claim the education tax credit correctly, here are four tips to follow. Each year, billions of dollars in credits go unclaimed by US taxpayers. Last year alone, over $2 billion in education tax credits were left on the table. So if you’re eligible for this credit, be sure to learn how to claim it properly! These four tips will make claiming the education tax credit a breeze and help ensure that you get the most out of this valuable deduction. Remember – knowledge is power! Be sure to educate yourself about all of the different tax credits and deductions available to you so that you can get the biggest refund possible. For more information on education-related tax breaks, check out our blog post “4 Education Tax Credits That Can Save You Money”. Happy filing!

| Question | Answer |

|---|---|

| Form Name | Form Cte 004C |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | Form CTE 004C extended hours and productivity days time log cte form |

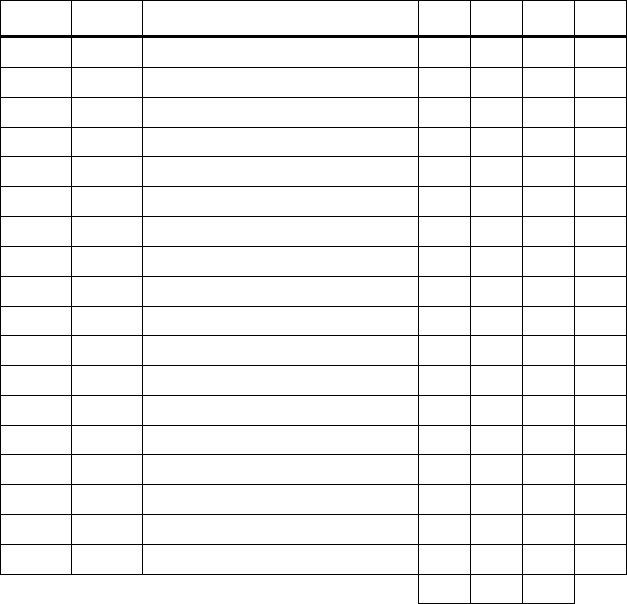

EXTENDED HOURS COMPENSATION AND

PRODUCTIVITY DAYS TIME LOG

CAREER AND TECHNICAL EDUCATION

Name _____________________________________________ Date ______________________________

School ____________________________________________ |

Fiscal/School Year ___________________ |

Date of Activity

Time

Logged

Activity (CTE activities must be prior approved)

Other

CTE

Extended

Hours

Produc-

tivity

Days

Completed (Supervisor Initials)

Totals

Instructor Signature |

CTE Coordinator Signature |

Revised |

FORM |