The IRS Form D-410 is the Application for Advance Ruling on a Taxable Transaction. This form is used to request advance rulings from the IRS on specific transactions or events that may occur in the future. The purpose of this form is to allow taxpayers and tax professionals to obtain guidance from the IRS on how a transaction will be treated for federal income tax purposes. This can help taxpayers avoid any potential surprises when filing their taxes, and ensure that they are complying with all applicable tax laws. If you are considering a transaction that may be subject to federal income tax, it is important to speak with an experienced tax professional about whether you would benefit from seeking an advance ruling from the IRS. The rules and regulations can be complex, and it is important to make sure that you are taking all necessary steps to comply with the law. Contact us today if you have any questions about this process, or would like more information on how we can help you

| Question | Answer |

|---|---|

| Form Name | Form D 410 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | North_Carolina, Rico, D--403, G--600 |

|

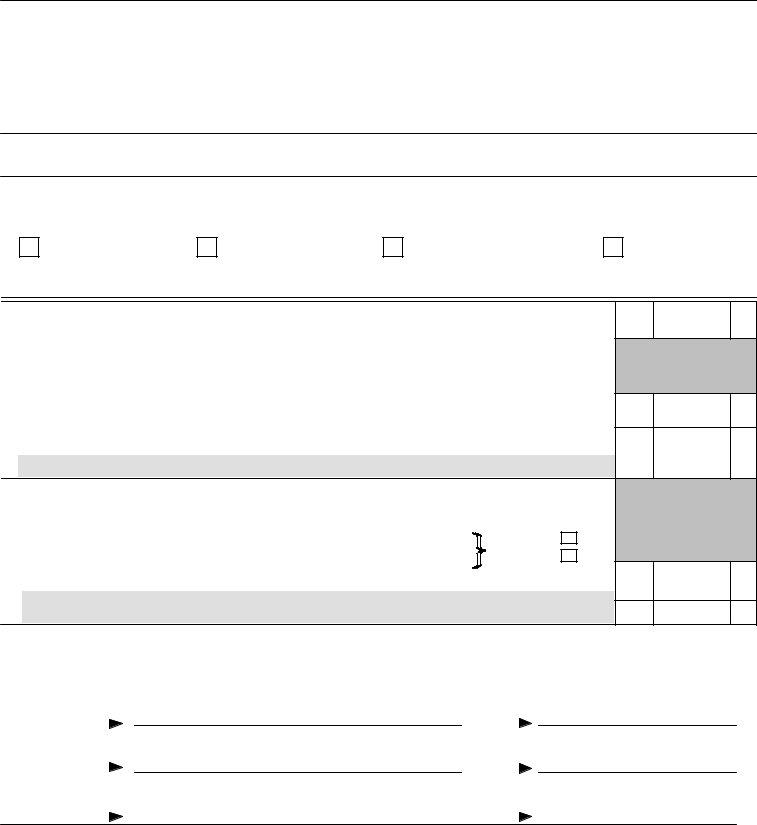

1998 |

|

|

NORTH CAROLINA DEPARTMENT OF REVENUE |

|

FORM |

APPLICATION FOR AUTOMATIC SIX |

|

OF TIME TO FILE STATE INCOME AND/OR GIFT TAX RETURNS |

||

(REV. |

(See back for filing instructions. Be sure to complete all items.) |

Please

Type

or

Your first name and initial (If other than individual, enter complete name on this line) |

Last Name |

Your social security number |

|

|

|

| |

| |

|

|

| |

| |

If joint return, spouse’s first name and initial |

Last Name |

Spouse’s social security number |

|

|

|

| |

| |

|

|

| |

| |

Present home address |

|

Federal Employer Identification No. |

|

|

|

|

|

City, town or post office, state, and zip code |

|

County |

|

|

|

|

|

Important: File this form with the North Carolina Department of Revenue, P. O. Box 25000, Raleigh, N. C.

I hereby apply for an automatic extension of time until October 15, 1999 in which to file the following tax return(s) for calendar year 1998 (or if a fiscal year return, an extension to __________________________________, 19__________, for the tax year beginning

_________________________________,19_________ and ending _____________________________, 19_________).

Individual, Form

Partnership, Form

Estates and Trusts, Form

Gift, Form

Note: If this form is being filed only to extend the time for filing a gift tax return, Form

1. |

Total income tax liability for 1998. This is the amount you expect to enter on |

line 12 of Form |

|

|

|

|

1 |

|

line 10 of Form |

|

|

|

Caution: You MUST enter an amount on line 1 or your extension will be denied. You can estimate |

|

|

|

this amount, but be as exact as you can with the information you have. If we later find |

|

|

|

that your estimate was not reasonable, the extension will be null and void. |

|

|

2. |

Total payments for 1998 (See the instructions) |

. . . . . . . . . . . . . . . . . . . . . |

2 |

3. |

Balance Due (Subtract line 2 from line 1.) If line 2 is more than line 1, enter zero |

|

|

|

|

|

3 |

|

(FOR GIFT TAX ONLY) |

|

|

Only complete line 4 and line 5a (and 5b if applicable) if you are applying for an extension of time to |

|

||

file a gift tax return. Do not include income tax on these lines. (See the instructions.) |

|

|

|

4. |

If you or your spouse expect to file a gift tax return (Form |

Yourself . . |

|

|

generally due by April 15, 1999, see the instructions and check here |

|

|

|

|

Spouse . . |

|

|

|

|

5a |

5a. Enter the amount of gift tax that you are paying with this form |

. . . . . . . . . . . . . . . . . . . . . . |

|

|

b. Enter the amount of gift tax that your spouse is paying with this form |

. . . . . . . . . . . . . . . . . . . . . . |

5b |

|

Signature and Verification

I certify that, to the best of my knowledge, this return is accurate and complete.

00

00

00

00

00

Signature of taxpayer

Date

Signature of spouse

Date

(If filing jointly, BOTH must sign even if only one had income)

Signature of preparer other than taxpayer

Date

Form

Purpose

Use Form

tax returns: Individual, Form

To receive the extra time you MUST:

1.Properly estimate your 1998 tax

liability using the information available to you,

2.Enter your tax liability on line 1 of Form

3.File Form

You are not required to send a payment of the tax you estimate as

due. However, because an extension of time to file the return does not extend the time for paying the tax, it will benefit you to pay as much as you can.

If you already had 2 extra months to file because you were ‘‘out of the country” (explained later) when your return was due, then use this form to ask for an additional 4 months to file.

In lieu of filing Form

Because North Carolina’s automatic extension is for 6 months instead of 4 months as allowed for federal purposes, you are not required to apply for an additional 2 month extension or submit a copy of the application for an additional 2 month extension that you filed with the Internal Revenue Service because you are unable to file your return within the additional 4 months granted automatically for federal purposes.

INSTRUCTIONS

Filing Your Tax Return

You may file the income or gift tax return at any time before the extended due date. But remember, Form

Interest.

Late Payment Penalty.

Late Filing Penalty.

If you do not file the application for extension by the original due date of the return, you are subject to both the 5 percent per month late filing penalty and the 10 percent late payment penalty on the remaining tax due.

Invalid Extensions.

How To Claim Credit For Payments Made With This Form.

If you and your spouse jointly filed Form

If this extension request is filed to extend the time in which to file a partnership return, enter the amount paid on line 11a of Form

Specific Instructions

Name, Address, and Social Security Numbers.

Out of the Country.

Line 2.

Line 4.

Lines 5a and 5b.

Your Signature.

Others Who Can Sign For You.

SAttorneys, CPAs, and enrolled agents, or

SA person in close personal or business relationship to you who is signing because you cannot. There must be a good reason why you cannot sign, such as illness or absence. Attach an explanation to the form.

Important: Do not use this form to request extensions of time for filing corporate income or franchise tax returns.