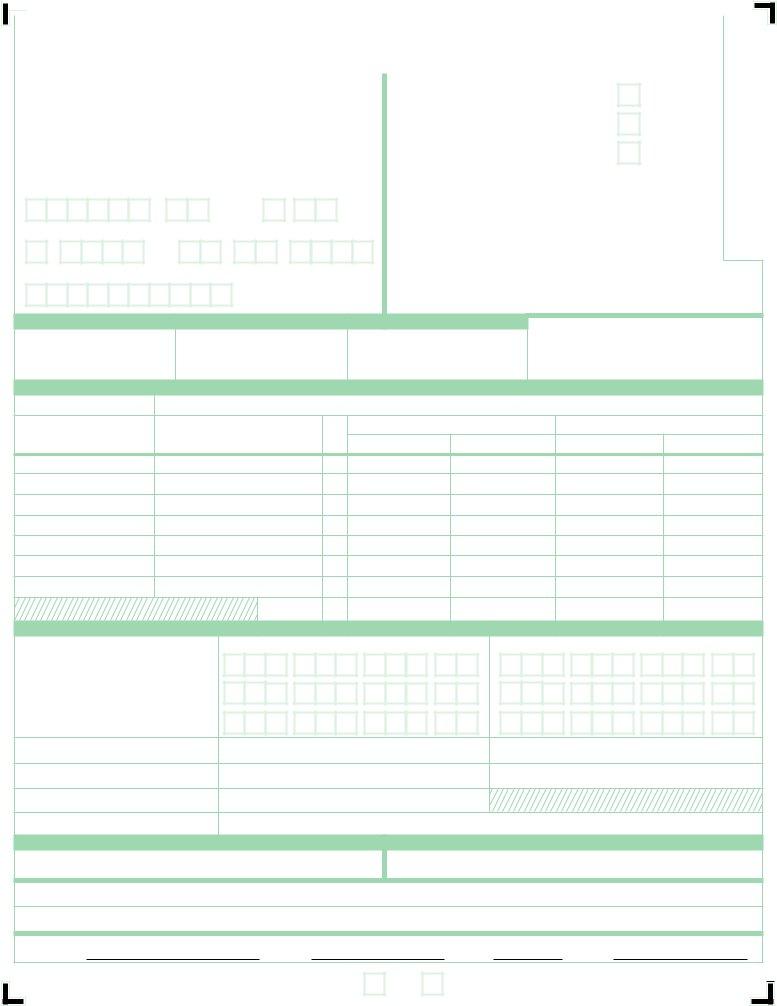

Form Dol 3C is a new form that the Department of Labor released in an effort to streamline the claims process for unemployment benefits. The new form will allow claimants to file their initial claim and any appeals online, making it easier and faster for them to get the benefits they need. In addition, the Department of Labor has also announced a series of changes to the program which should make it easier for businesses to comply with its requirements. These changes are welcome news for businesses and claimants alike, and should help to improve the overall efficiency of the program.

| Question | Answer |

|---|---|

| Form Name | Form Dol 3C |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | corrected gross amount, dol 3c instructions, dol 3c, ga dol correction online |

Electronic Form Processing - DO NOT STAPLE OR SUBMIT COPIES - Use Black InkDOL - 3C

GEORGIA |

|

|

REPORT TO ADD NEW WAGES |

|

*00301* |

|||||||||||||

DEPARTMENT OF LABOR |

|

AND/OR CORRECT REPORTED WAGES |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mail Completed Form To: |

|

|

|

For Department Use Only |

|

|

|

Wage |

||||||||||

|

|

|

|

|

|

Investigation |

||||||||||||

|

|

|

|

|

|

|

|

|||||||||||

GDOL - Employer Accounts, Room 752 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

148 Andrew Young International Blvd., N.E. |

|

|

Date Received |

|

|

|

Supplemental |

|||||||||||

Atlanta, Georgia |

|

|

|

M |

M |

/ |

D |

D |

/ |

Y |

Y |

Y |

Y |

|

|

|||

Phone: (404) |

|

|

|

|

Correction |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Employer Name, Address and |

|

||||||||||||||||

|

|

|

|

|

||||||||||||||

DOL Account Number |

|

Total Tax Rate |

|

|

|

|

||||||||||||

|

- |

|

. |

|

|

|

|

|

|

Qtr / Yr |

End Date |

|

|

|

|

|

|

|

|

Q / Y Y Y Y |

M M / D D / Y Y Y Y |

|

|

|

|

|

|||

Federal I.D. Number |

|

|

|

|

|

|

|

|

|

|

|

|

SECTION B |

|

|

|

PLEASE INCLUDE YOUR DOL |

||

|

|

|

|

||||||

|

|

|

|

ACCOUNT NUMBER ON ALL CHECKS |

|||||

Total Reportable Gross Wages |

|

Taxable Wages |

|

||||||

|

|

|

|

|

|||||

|

|

|

|

|

|

|

AND CORRESPONDENCE |

||

|

|

|

|

SECTION C |

|

|

|

|

|

|

|

|

Individual Quarterly Wages Reported And Corrected |

|

|

|

|||

|

Social Security No. |

Employee’s Full Name |

Pages |

Total Reportable Gross Wages |

|

Taxable Wages |

|||

|

Reported |

Corrected |

Reported |

Corrected |

|||||

|

|

|

|

||||||

|

|

|

Totals |

|

|

|

|

|

|

|

|

|

|

SECTION D |

|

|

|

|

|

|

|

|

|

Increase |

|

|

Decrease |

|

|

1. |

Total Reportable Gross Wage |

|

, |

, |

. |

|

, |

, |

. |

|

Corrections |

|

|||||||

2. |

, |

, |

. |

|

, |

, |

. |

||

3. |

Taxable Wage Corrections |

, |

, |

. |

|

, |

, |

. |

|

4. |

Contribution Tax on Corrections |

|

|

|

|

|

|

|

|

5. |

Admin Assessment on Corrections |

|

|

|

|

|

|

|

|

6. |

Interest on Lines 4 & 5 |

|

|

|

|

|

|

|

|

7. |

Additional Tax or Credit Due |

|

|

|

|

|

|

|

|

|

|

|

|

SECTION E |

|

|

|

|

|

Corrected Summary of Total Reportable Gross Wages |

|

Corrected Summary of Taxable Wages |

|

|

|||||

Explanation |

|

|

|

|

|

|

|

|

|

Submitted By |

|

Title |

|

Date |

Phone |

( |

) |

||

Page |

of |

DOL - 3C

INSTRUCTIONS FOR COMPLETING FORM

“REPORT TO ADD NEW WAGES AND/OR CORRECT REPORTED WAGES”

The form is designed to: (1) correct previously reported wages and/or (2) report wages of individuals who were omitted from the original Employer’s Quarterly Tax and Wage Report, Form

SECTION A

Enter the DOL Account Number, Total Tax Rate (Contribution plus Administrative Assessment), quarter and

SECTION B

Enter the amounts as originally reported on lines 2, 3 & 4 of the Employer’s Quarterly Tax and Wage Report, Form

SECTION C

Enter the following information:

•9 digit Social Security Number(s)

•Full Last Name(s) and Full First Name(s) of any employee(s) omitted or incorrectly reported on the original report

•Total reportable gross wages reported for the employee(s) and the corrected amount of total reportable gross wages

•Taxable wages as originally reported and the corrected amount of taxable wages

Add

•All entries in the Total Reportable Gross Wages Reported column and enter total

•All entries in the Total Reportable Gross Wages Corrected column and enter total

•All entries in the Taxable Wages Reported column and enter total

•All entries in the Taxable Wages Corrected column and enter total

If more than one form is submitted for the same quarter, each form should include the totals for that form only.

SECTION D

Line 1: Enter the difference between the reported Total Reportable Gross Wages and the corrected Total Reportable Gross Wages from

Section C as either an increase or decrease, if applicable.

Line 2: Enter the difference in the Corrected

Section B as either an increase or decrease, if applicable.

Line 3: Enter the difference between the Total Taxable Wages from Section B and the corrected Total Taxable Wages from Section C as either an increase or decrease, if applicable.

Line 4: Multiply the Taxable Wage amounts in the increase and/or decrease column on Line 3 by the contributory tax rate for the quarter.

Line 5: Multiply the Taxable Wage amounts in the increase and/or decrease column on Line 3 by the administrative assessment tax rate

for the quarter.

Line 6: Multiply the total tax due (Lines 4 +5 increase column only) by one and

month calculated from the due date until paid. Interest is not applicable on the tax amount in the decrease column.

Line 7: Enter the total of the increase column for Lines 4 through 6, minus the total of the decrease columns for Lines 4 and 5. If the total relects an increase in tax due, submit payment to Georgia Department of Labor. If paying by check, please include your Georgia DOL Account Number on your check. A decrease may result in a credit to your account.

SECTION E

To adjust total reportable gross wages, the amount of increase should be added to the amount entered in Item 2 in Section B or the amount of decrease should be subtracted from Item 2 in Section B. The result of the addition or subtraction should be entered as Cor- rected Summary of Total Reportable Gross Wages.

To adjust taxable wages, the amount of increase should be added to the amount entered in Item 4 in Section B or the amount of decrease should be subtracted from Item 4 in Section B. The result of the addition or subtraction should be entered as Corrected Summary of Tax-

able Wages.

Enter your explanation of the adjustment in the space provided.

Enter your Name on the “Submitted By” line, Title, Date, and Telephone Number and return as indicated on the front of the form.