In order to file your 2016 tax return, you will need the Form F 40059, which is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. This form allows you to request an automatic six-month extension of time to file your return, from the original due date of April 18th until October 17th. The form can be filed online or by mail, and must be received by the IRS no later than midnight on the due date in order to be valid. If you are expecting a refund, you do not need to file this form - your refund will be automatically processed once your return is filed. However, if you owe taxes, it is important to note that an extension of time to file does not mean an extension of time to pay - any taxes owed must still be paid by the original due date. For more information on extensions and how to file them, please visit the IRS website.

| Question | Answer |

|---|---|

| Form Name | Form F 40059 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | F40059 tefap eligibility form wisconsin |

DEPARTMENT OF HEALTH SERVICES |

STATE OF WISCONSIN |

Division of Public Health |

Wisconsin Statutes, s. 46.03 |

P.L. |

THE EMERGENCY FOOD ASSISTANCE PROGRAM (TEFAP) ELIGIBILITY CERTIFICATION

PLEASE PRINT |

Participation in TEFAP is voluntary. Personally identifiable information collected is required for participation and will be used for that purpose only. |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

Participant Name – Last |

|

First |

|

MI |

|

Telephone Number |

Proxy Name (if applicable) |

|

Proxy Authorization Dates |

|

|

|

|

|

|

|

|

|

|

From |

to |

Street Address/Unit or Apartment Number |

|

|

|

City |

|

Zip Code |

County |

|

||

|

|

|

|

|

|

|||||

A. Are you receiving FoodShare (formerly known as Food |

B. Have you applied for FoodShare? |

C. Would you like information about |

FOR OFFICE USE ONLY |

|||||||

Stamps) or do you have a Quest card? |

|

|

|

|

FoodShare? |

|

FoodShare Information Given |

|||

Yes |

No (See box B) |

|

Yes |

No (See box C) |

Yes |

No |

Date: |

|

||

|

|

|

|

|

|

|

|

|

|

|

I certify with my signature that:

My household monthly gross income does not exceed established limits on this form;

I will use the federal commodities received for household consumption only; and

I release the USDA/FNS, the State of Wisconsin, and any agency or person distributing federal commodities from any liability resulting from receipt of this food.

I understand that making a false certification may result in my having to reimburse the State for the value of food improperly issued to me, and may subject me to criminal prosecution under State and Federal law.

Reasonable accommodations may be requested to participate in this program.

MAXIMUM MONTHLY GROSS INCOME FOR RECEIPT OF TEFAP COMMODITIES

|

|

|

|

|

|

|

|

|

|

|

Household |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly |

$1,771 |

$2,391 |

$3,011 |

$3,631 |

$4,250 |

$4,870 |

$5,490 |

$6,110 |

$6,729 |

$7,349 |

|

|

|

|

|

|

|

|

|

|

|

*Annual |

$21,257 |

28,694 |

36,131 |

43,568 |

51,005 |

58,442 |

65,879 |

73,316 |

80,753 |

88,190 |

|

|

|

|

|

|

|

|

|

|

|

For each additional household member, add $7,437 for Annual Income or $620 for Monthly Income

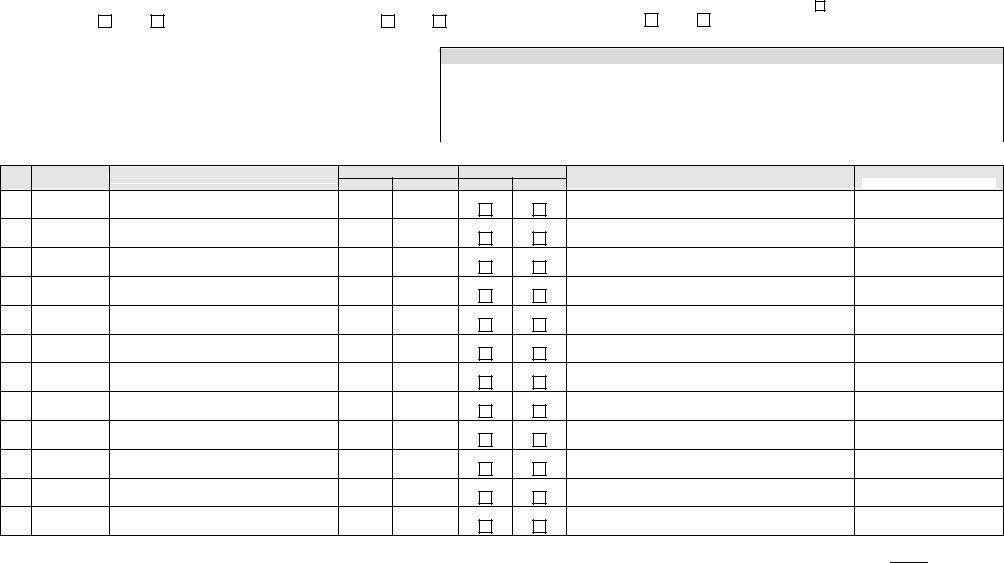

DATE |

RECIPIENT OR PROXY SIGNATURE |

FAMILY SIZE |

ADDRESS VERIFIED |

NAMES OF ALL HOUSEHOLD MEMBERS |

WHAT OTHER TYPES OF |

|||

ADULTS |

CHILDREN |

YES |

NO |

(PLEASE INCLUDE DATE OF BIRTH AFTER EACH NAME) |

ASSISTANCE ARE NEEDED? |

|||

|

||||||||

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

Pantry: |

|

Address: |

|

EFO: |

|

Date: |

*Annual Income is to be used for seasonal and migrant workers. |

This institution is an equal opportunity provider. |