If you're like most Americans, you probably have health insurance through your employer. But what happens if you lose your job- can you still afford to see a doctor? The answer is likely yes, if you contribute to a Health Savings Account (HSA). HSAs are tax-advantaged savings accounts that allow people to save money for medical expenses. Contributions to HSAs are tax deductible, and the funds can be used to cover medical expenses at any time. In addition, HSAs offer tax-free growth and withdrawals for qualifying medical expenses. If you're looking for a way to save money on healthcare costs, an HSA is a great option. Check with your employer or bank about opening an HSA today!

| Question | Answer |

|---|---|

| Form Name | Form Hsa 014 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | HSA_Distributio n_Request_Form location of millenium trust co in st paul mn form |

Fax: 630.472.5970

Email: mtc.hsa@mtrustcompany.com

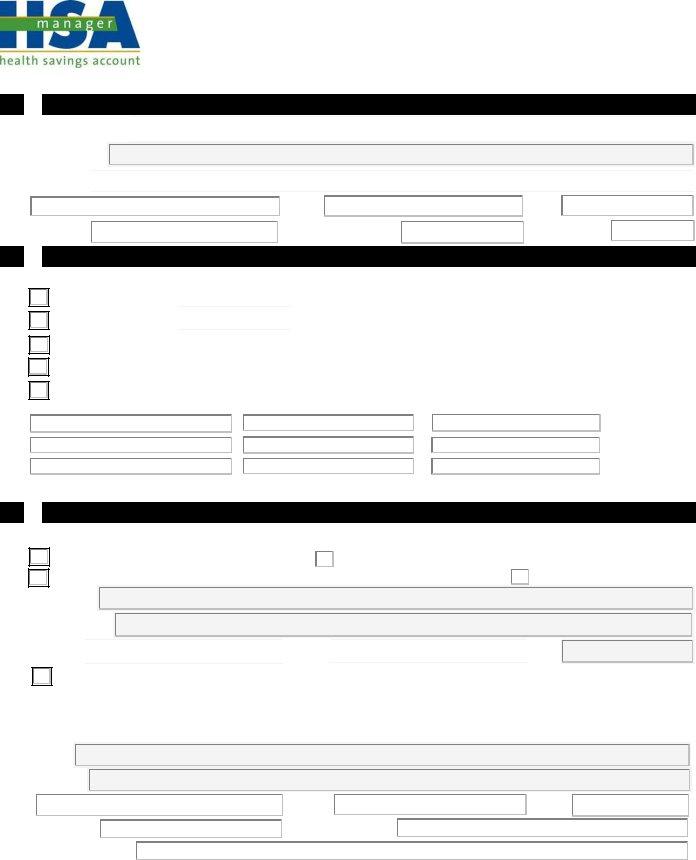

A ACCOUNT INFORMATION

DISTRIBUTION REQUEST FORM

Account Holder Name: HSA Account No.:

Home Address:

City: |

|

|

State: |

|

|

Zip: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Telephone No.: |

|

Social Security No.: |

|

Date of Birth: |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B METHOD OF DISTRIBUTION

Please select one:

Total distribution of my entire account and close account.

Partial distribution of $ (Tell us what to sell in “OTHER” if insufficient cash.) Excess contribution (Please complete Section D.)

OTHER: (e.g. name of asset, number of shares, tell us if the asset should be sold or

Asset Name |

|

No. Shares/Dollar Amt. |

|

Sell or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(All distributions will be reported to the IRS on Form

C PAYMENT DELIVERY

Checks will be sent to you via U.S. Mail unless overnight delivery is requested.

Mail a check to the home address of record. |

|

Overnight Delivery |

|

|

|

|

|

|

|

|

|

Mail a check to the following address (Signature Guarantee Required - Section E.) |

|

Overnight Delivery |

|||

|

|

|

|

|

|

Payee:

Address:

City: State: Zip:

Wire funds - Please complete banking information below. (Signature Guarantee required - Section E.)

A $25 wire fee applies. Please ensure the accuracy of your financial institution’s wire instructions. If a wire is rejected due to the incorrect wire instructions, an additional $25 will be charged.

Banking Information:

Bank Name:

Bank Address:

City: |

|

|

|

State: |

|

|

Zip: |

|

|

|

|

|

|

|

|

|

|

ABA Routing No.: |

|

|

Bank Account No.: |

|

|

|

||

|

|

|

|

|

|

|

|

|

Name on Bank Account: |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Please continue to page two to complete this form.

HSA MANAGER DISTRIBUTION REQUEST, Page 2 of 2

D EXCESS CONTRIBUTION

Excess contributions for: (Indicate year)

$ Excess Contribution Amount: Must be withdrawn by IRS tax filing deadline, including extensions,

and indicated on your tax return for the year the contribution was made.

$ |

|

Excess Earnings Removed: Income earned on contribution must be included as “Other |

|

|

Income” on your tax return for the year the earnings are withdrawn. |

|

|

Please apply the Excess Contribution Amount to /yr contribution.

Generally, you must pay a 6% excise tax on contributions. See IRS Form 5329 to figure the excise tax, if necessary.

E RECIPIENT’S ACKNOWLEDGEMENT AND SIGNATURE

Applicable fees are payable in accordance with the Custodial Agreement and will be deducted from the account unless you remit the amount due.

Please make the

[Signature Guarantee Stamp Here]

Account Holder Signature

Date:

(An original Signature Guarantee is required if funds are sent by wire, OR if funds are to be sent to an address other than the address of record, OR if the proceeds are to be sent to a beneficiary due to death. Forms received without the Signature Guarantee will be returned.)

Please return all forms to:

Millennium Trust Company

Attn: HSA Manager

2001 Spring Road, Suite 700

Oak Brook Il 60523

A Signature Guarantee may be obtained from an authorized officer at a brokerage firm, bank or other financial institution. Certification by a notary public is not a substitute for a Signature Guarantee.