Are you looking for an easy way to organize and store your loan documents? If so, exploring the hud 1a fillable form can be an ideal solution. With this specific form, individuals and families who are in need of financing or partaking in a real estate transaction have access to organized federal-regulated forms that will help them track organization and progress throughout their process. Keep reading as we dive into exactly what the HUD 1A fillable form is all about, how it's used and more!

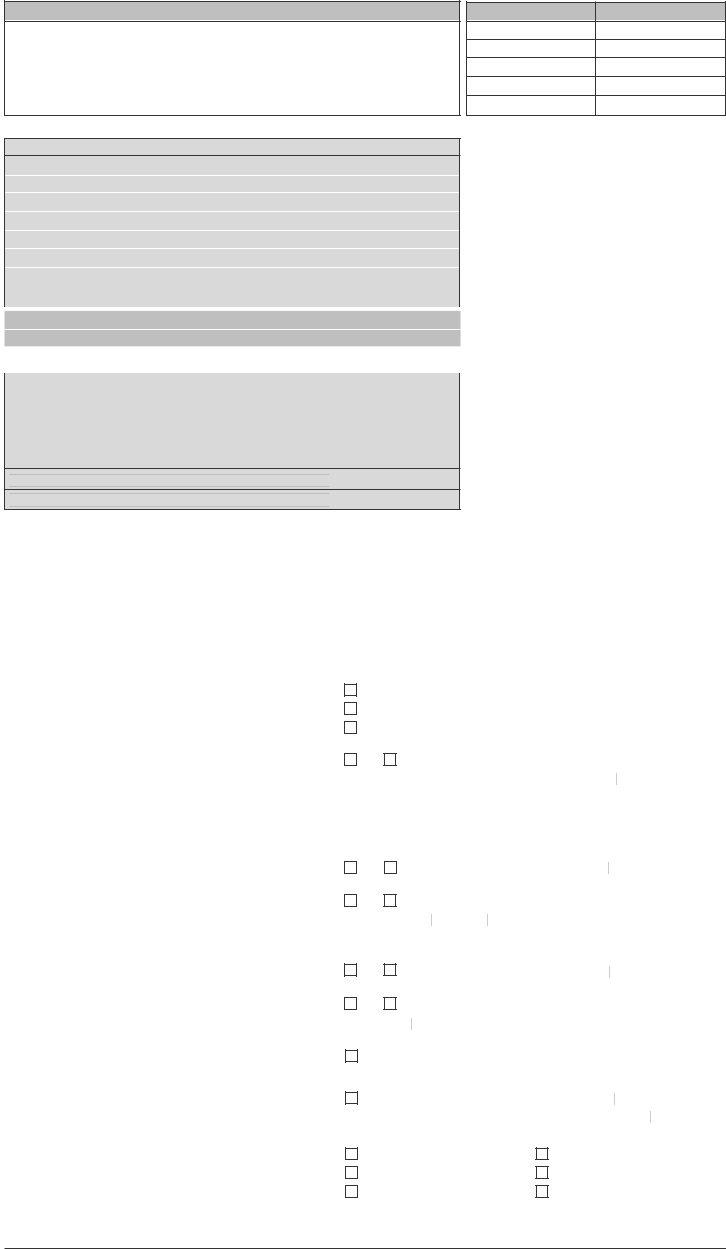

| Question | Answer |

|---|---|

| Form Name | Hud 1A Fillable Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | fillable settlement statement, form hud 1a, sample hud settlement statement, fillable form settlement |

OMB Approval No.

Settlement Statement

Optional Form for Transactions without Sellers

Name and Address of Borrower: |

|

|

|

|

Name and Address of Lender: |

|

||||

|

|

|

|

|

|

|

|

|||

Property Location: (if different from above) |

|

|

|

Settlement Agent: |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Place of Settlement: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan Number: |

|

|

|

|

|

Settlement Date: |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

L. Settlement Charges |

|

|

|

|

|

|

|

M. Disbursements to Others |

|

|

|

|

|

|

|

|

|

|

|

||

800. |

Items Payable in Connection with Loan |

|

|

|

|

|

1501. |

|

||

801. |

Our origination charge |

|

|

|

|

(from GFE #1) $ |

|

|

|

|

|

|

|

|

|

||||||

802. |

Your credit or charge (points) for the specific interest rate chosen (from GFE #2) $ |

|

1502. |

|

||||||

|

|

|

|

|

|

|

|

|

||

803. |

Your adjusted origination charges |

|

|

|

(from GFE A) |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

804. |

Appraisal fee to |

|

|

|

|

(from GFE #3) |

|

1503. |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

805. |

Credit report to |

|

|

|

|

(from GFE #3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

806. |

Tax service to |

|

|

|

|

(from GFE #3) |

|

1504. |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

807. |

Flood certification |

|

|

|

|

(from GFE #3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

808. |

|

|

|

|

|

|

|

|

1505. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

900. |

Items Required by Lender to Be Paid in Advance |

|

|

|

|

|

||||

901. |

Daily interest charges from |

|

to |

@ $ |

/day |

(from GFE #10) |

|

1506. |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||

902. |

Mortgage insurance premium |

for |

months to |

(from GFE #3) |

|

|

|

|||

|

|

|

|

|

|

|

|

|

||

903. |

Homeowner’s insurance |

|

for |

years to |

(from GFE #11) |

|

1507. |

|

||

|

|

|

|

|

|

|

|

|

|

|

904. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1000. |

Reserves Deposited with Lender |

|

|

|

|

|

|

1508. |

|

|

|

|

|

|

|

|

|

|

|||

1001. |

Initial deposit for your escrow account |

|

|

(from GFE #9) |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

1002. |

Homeowner’s insurance |

months @ $ |

|

per month |

$ |

|

|

1509 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1003. |

Mortgage insurance |

months @ $ |

|

per month |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1004. |

Property taxes |

months @ $ |

|

per month |

$ |

|

|

1510. |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

1005. |

|

months @ $ |

|

per month |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1006. |

|

months @ $ |

|

per month |

$ |

|

|

1511. |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

1007. |

Aggregate Adjustment |

|

|

|

|

|

|

|

||

1100. |

Title Charges |

|

|

|

|

|

|

|

1512. |

|

|

|

|

|

|

|

|

|

|

||

1101. |

Title services and lender’s title insurance |

|

|

(from GFE #4) |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

1102. |

Settlement or closing fee |

|

|

|

|

$ |

|

|

1513. |

|

|

|

|

|

|

|

|

|

|

|

|

1103. |

Owner’s title insurance |

|

|

|

|

(from GFE #5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1104. |

Lender’s title insurance |

|

|

|

|

$ |

|

|

1514. |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

1105. |

Lender’s title policy limit $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1106. |

Owner’s title policy limit $ |

|

|

|

|

|

|

|

1515. |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||||

1107. |

Agent’s portion of the total title insurance premium |

$ |

|

|

|

|

||||

|

|

|

|

|

|

|

||||

1108. |

Underwriter’s portion of the total title insurance premium |

$ |

|

|

1520. Total Disbursed |

|

||||

|

|

|

|

|

|

|

|

|

(enter on line 1603) |

|

1200. |

Government Recording and Transfer Charges |

|

|

|

|

|

||||

|

|

|

|

|

|

|||||

1201. |

Government recording charges |

|

|

|

(from GFE #7) |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

1202. |

Deed $ |

Mortgage $ |

|

Releases $ |

|

|

|

N. Net Settlement |

|

|

1203. |

Transfer taxes |

|

|

|

|

(from GFE #8) |

|

1600. Loan Amount |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

1204. |

City/County tax/stamps |

Deed $ |

|

|

Mortgage $ |

|

|

|

1601. Plus Cash/Check from Borrower |

$ |

|

|

|

|

|

|

|

|

|

|

|

1205. |

State tax/stamps |

Deed $ |

|

|

Mortgage $ |

|

|

|

1602. Minus Total Settlement Charges |

$ |

1206. |

|

|

|

|

|

|

|

|

(line 1400) |

|

|

|

|

|

|

|

|

|

|

|

|

1300. |

Additional Settlement Charges |

|

|

|

|

|

|

1603. Minus Total Disbursements |

$ |

|

|

|

|

|

|

|

to Others (line 1520) |

|

|||

1301. |

Required services that you can shop for |

|

|

(from GFE #6) |

|

1604. Equals Total Disbursements |

$ |

|||

|

|

|

to Borrower |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

1302. |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

(after expiration of any applicable |

|

||

1303. |

|

|

|

|

|

$ |

|

|

rescission period required by law) |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

1304. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1305. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1400. |

Total Settlement Charges (enter on line 1602, Section N) |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

The Public Reporting Burden for this collection of information is estimated at 35 minutes per response for collecting, reviewing, and reporting the data. This agency may not collect this information, and you are not required to complete this form, unless it displays a currently valid OMB control number. No confidentiality is assured; this disclosure is mandatory. This is designed to provide the parties to a RESPA covered transaction with information during the settlement process.

Previous editions are obsolete |

Page 1 of 2 |

Comparison of Good Faith Estimate (GFE) and

Charges That Cannot Increase |

||

Our origination charge |

# 801 |

|

Your credit or charge (points) for the specific interest rate chosen # |

802 |

|

Your adjusted origination charges |

# |

803 |

Transfer taxes |

#1203 |

|

|

|

|

Good Faith Estimate

Charges That in Total Cannot Increase More Than 10%

|

Government recording charges |

# 1201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#1201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#1201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#1201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#1201 |

|

|

|

|

|

|

|

|

|

|

|

#1201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#1201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#____ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

Increase between GFE and |

|||

|

|

|

|

|

|

|

Charges That Can Change |

|

|

|

|

|

|

|

|

|

|

|

Initial deposit for your escrow account |

#1001 |

|

|

|

|

|

|

|

|

|

|

Daily interest charges |

# 901 |

$ |

2 /day |

|

|

|

|

|

|

|

|

Homeowner’s insurance |

# 903 |

|

|

|

|

|

|

|

|

|

|

|

|

#1201 |

|

|

#1201

#1201

Good Faith Estimate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$123456 |

or |

% |

|

|

|

|

|

Good Faith Estimate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan Terms

Your initial loan amount is |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your loan term is |

|

|

|

|

|

|

|

|

|

years |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your initial interest rate is |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your initial monthly amount owed for principal, interest, and |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

includes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

and any mortgage insurance is |

|

|

|

|

|

Principal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

Mortgage Insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Can your interest rate rise? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

No. |

|

|

Yes, it can rise to a maximum of |

XXX |

%. The first change will be |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

on [ |

DATEDATE] |

and can change again every [ |

DATEDATE] after |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

[DATEDATE] |

. Every change date, your interest rate can increase or decrease |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

by |

XXX |

%. Over the life of the loan, your interest rate is guaranteed to never be |

||||||||||||||||||||||||||||||||||||||

|

lower than |

|

% or higher than |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

XXX |

XXX |

%. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Even if you make payments on time, can your loan balance rise? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No. |

|

|

Yes, it can rise to a maximum of $[ |

AMOUNT]. |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Even if you make payments on time, can your monthly |

|

|

|

|

|

No. |

|

|

Yes, the first increase can be on |

|

|

|

|

|

|

and the monthly amount |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

amount owed for principal, interest, and mortgage insurance rise? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

owed can rise to $[ |

DATEDATE |

]. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

The maximum it can ever rise to is $ |

[DATEDATE] |

. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Does your loan have a prepayment penalty? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

No. |

|

|

Yes, your maximum prepayment penalty is $[ |

AMOUNT |

. |

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Does your loan have a balloon payment? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No. |

|

|

Yes, you have a balloon payment of $[ |

AMOUNT] |

due in |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

XXX |

years on [DATEDATE |

]. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total monthly amount owed including escrow account payments |

|

|

|

|

|

You do not have a monthly escrow payment for items, such as property |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

taxes and homeowner’s insurance. You must pay these items directly yourself. |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

You have an additional monthly escrow payment of $[AMOUNT] |

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

that results in a total initial monthly amount owed of $[ |

AMOUNT]. This includes |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

principal, interest, any mortgage insurance and any items checked below: |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

Property taxes |

|

|

Homeowner’s insurance |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

Flood insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: If you have any questions about the Settlement Charges and Loan Terms listed on this form, please contact your lender.

Previous editions are obsolete |

Page 2 of 2 |