You can complete Form It 201 X effortlessly with the help of our PDF editor online. Our editor is constantly evolving to give the best user experience achievable, and that's because of our resolve for constant enhancement and listening closely to user comments. To get the process started, consider these basic steps:

Step 1: Simply hit the "Get Form Button" above on this site to access our pdf file editor. There you will find everything that is needed to fill out your file.

Step 2: With our handy PDF file editor, you may do more than just complete blanks. Express yourself and make your docs appear professional with custom textual content added, or modify the original input to perfection - all that comes along with an ability to add stunning photos and sign it off.

This form will require particular data to be entered, so you must take your time to enter exactly what is expected:

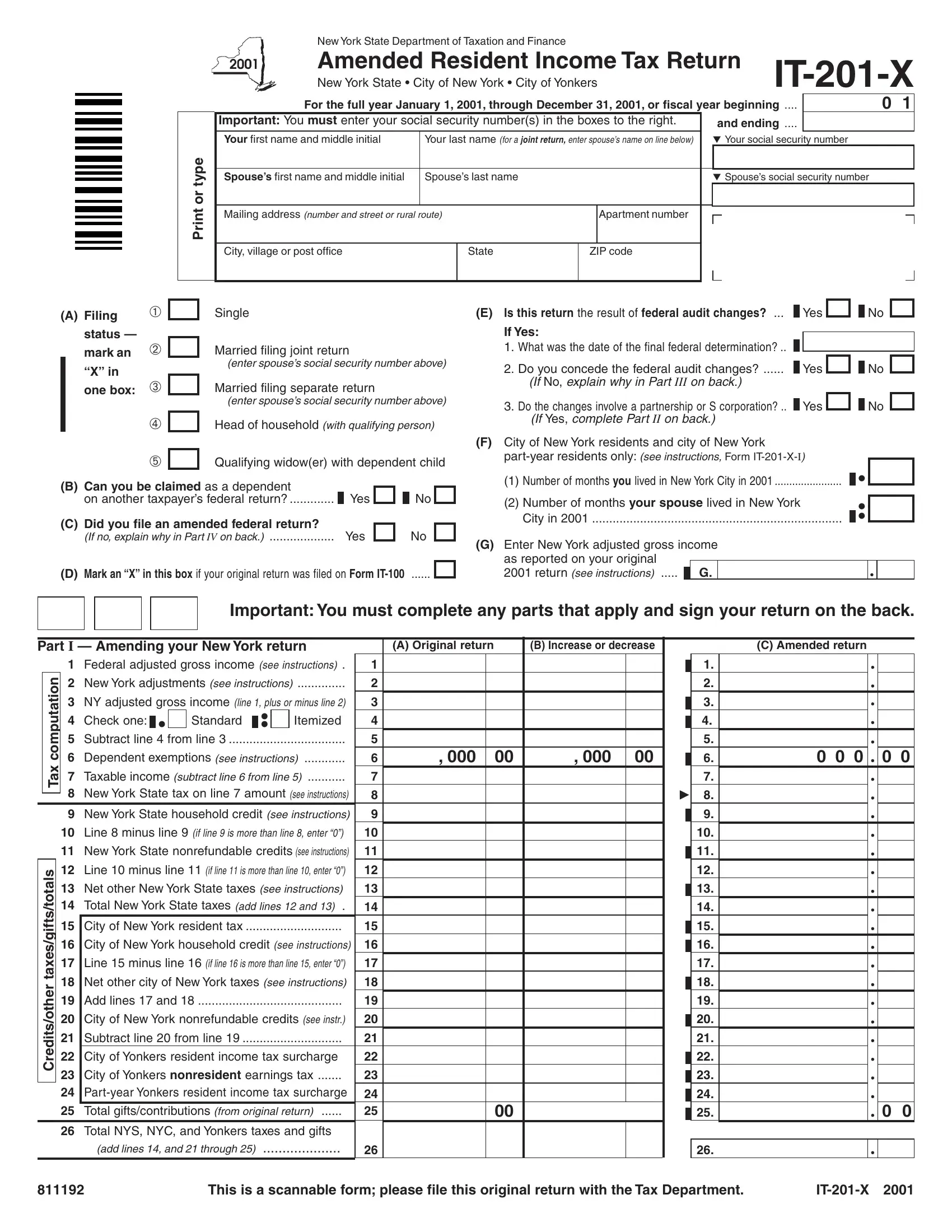

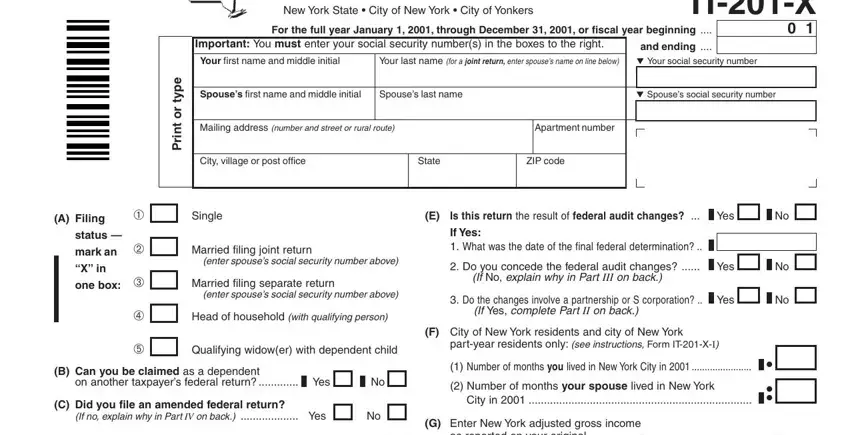

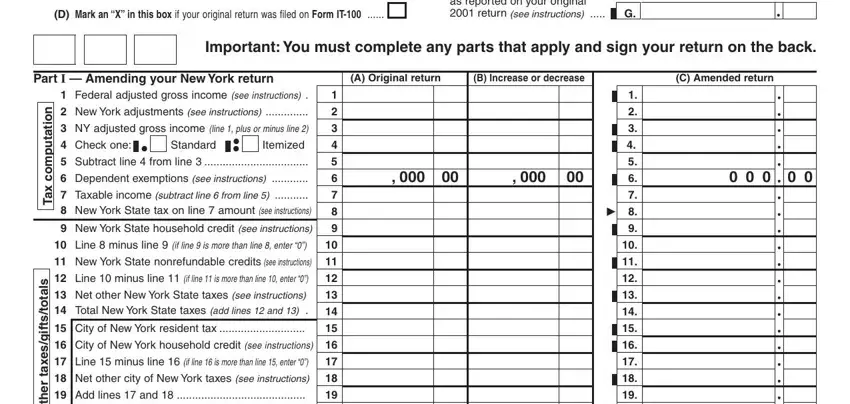

1. You will need to complete the Form It 201 X correctly, so be mindful when filling in the areas including these specific fields:

2. Immediately after this array of blank fields is done, proceed to enter the applicable details in all these: D Mark an X in this box if your, as reported on your original, Important You must complete any, Part I Amending your New York, A Original return, B Increase or decrease, C Amended return, n o i t a t u p m o c, x a T, Federal adjusted gross income see, New York adjustments see, NY adjusted gross income line, Standard, cid cid, and Itemized.

People often get some things incorrect when completing Important You must complete any in this section. Ensure you go over everything you enter right here.

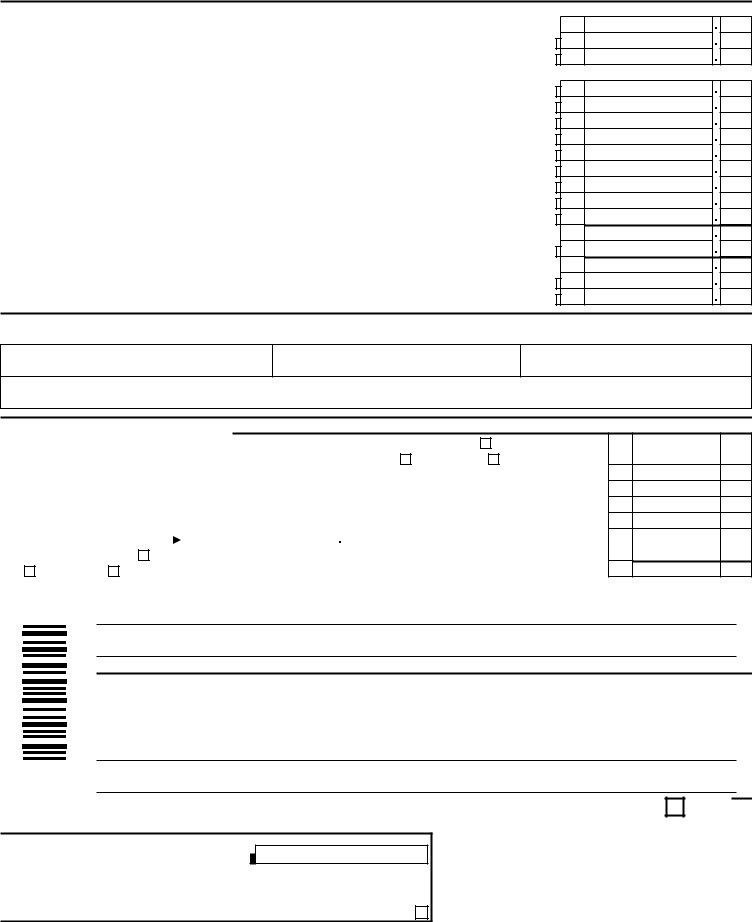

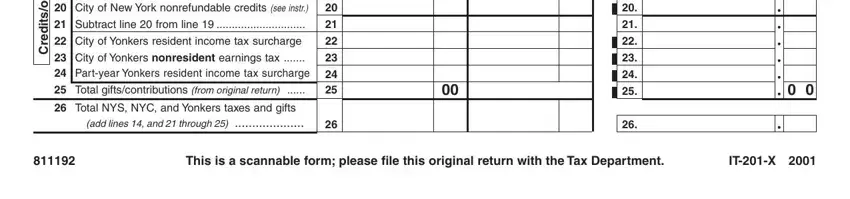

3. Completing s l a t o t s t f i g s e x a t, City of New York nonrefundable, Subtract line from line, City of Yonkers resident income, City of Yonkers nonresident, Total giftscontributions from, Total NYS NYC and Yonkers taxes, add lines and through, This is a scannable form please, and ITX is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

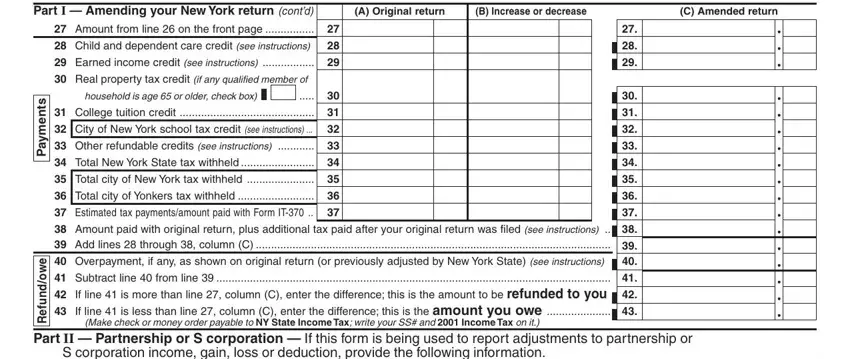

4. The next subsection needs your information in the subsequent areas: Part I Amending your New York, A Original return, B Increase or decrease, C Amended return, Amount from line on the front, Child and dependent care credit, Earned income credit see, Real property tax credit if any, household is age or older check, College tuition credit, City of New York school tax, Other refundable credits see, Total New York State tax withheld, Total city of New York tax, and Total city of Yonkers tax. Just remember to give all of the requested information to move further.

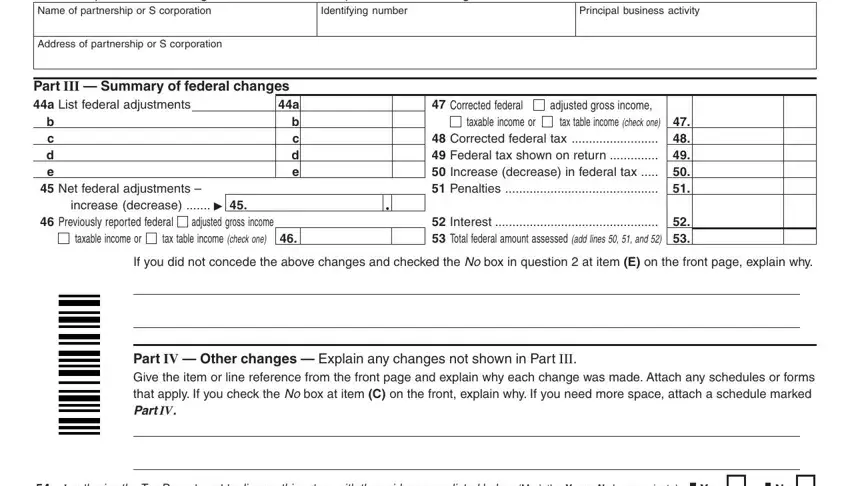

5. This document has to be finished with this segment. Here you can find a detailed list of blank fields that must be completed with correct details to allow your form usage to be accomplished: S corporation income gain loss or, Name of partnership or S, Identifying number, Principal business activity, Address of partnership or S, Part III Summary of federal, a b c d e, b c d e, Net federal adjustments, increase decrease, Previously reported federal, adjusted gross income, taxable income or, tax table income check one, and Corrected federal.

Step 3: Revise all the information you have typed into the blanks and press the "Done" button. After registering afree trial account here, you'll be able to download Form It 201 X or email it immediately. The form will also be at your disposal through your personal account with your every single modification. FormsPal guarantees secure document editing without data record-keeping or sharing. Feel at ease knowing that your information is safe with us!